🇮🇳 Economic Survey for 2021-22 released.

👇Detailed thread of 440 page survey.!🧵

Some very interesting data points 📚

RT for reach🗣️

👇Detailed thread of 440 page survey.!🧵

Some very interesting data points 📚

RT for reach🗣️

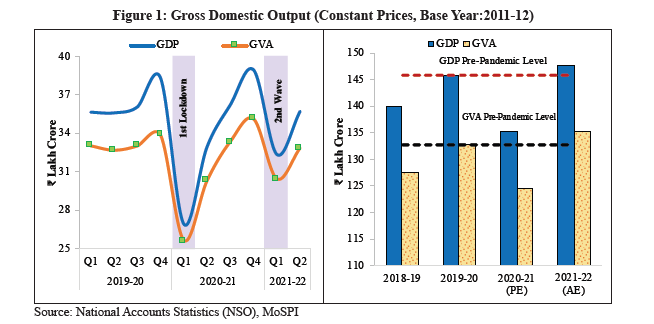

> Indian economy is expected to witness real GDP

expansion of 9.2% in 2021-22.

> Agriculture and allied sectors have been the least impacted by the pandemic and the sector is expected to grow by 3.9%

> GVA of Industry (including mining and

construction) will rise by 11.8%.

expansion of 9.2% in 2021-22.

> Agriculture and allied sectors have been the least impacted by the pandemic and the sector is expected to grow by 3.9%

> GVA of Industry (including mining and

construction) will rise by 11.8%.

> Indian economy is in a good position to witness GDP growth of 8.0-8.5% in 2022-23.

> Foreign exchange reserves at US$ 634 bn on 31st Dec 2021. This is equivalent to 13.2 months of merchandise imports & is higher than the country’s external debt

> India’s CPI inflation at 5.6%

> Foreign exchange reserves at US$ 634 bn on 31st Dec 2021. This is equivalent to 13.2 months of merchandise imports & is higher than the country’s external debt

> India’s CPI inflation at 5.6%

> Economic output surpasses pre-covid levels.

> Agricultural sector was the least impacted by the pandemic-related disruptions.

> Revival in the Indian residential real market in 2021 in terms of growth in sales, prices and new

launches.

> Agricultural sector was the least impacted by the pandemic-related disruptions.

> Revival in the Indian residential real market in 2021 in terms of growth in sales, prices and new

launches.

> Purchasing Managers’ Index-Manufacturing has

remained in the expansionary zone (i.e. over 50).

> Index of Industrial Production (IIP) and Core Industry indices have both followed a similar pattern.

> Segments like Travel, Trade and Hotels are yet to

fully recover.

remained in the expansionary zone (i.e. over 50).

> Index of Industrial Production (IIP) and Core Industry indices have both followed a similar pattern.

> Segments like Travel, Trade and Hotels are yet to

fully recover.

> Hotel occupancy rate has recovered substantially,

reaching 56-58% in October 2021, from 30-32% in April 2021.

> Boom in software & IT-enabled services exports even as earnings from tourism have declined sharply.

> Government consumption is estimated to grow by a strong 7.6%

reaching 56-58% in October 2021, from 30-32% in April 2021.

> Boom in software & IT-enabled services exports even as earnings from tourism have declined sharply.

> Government consumption is estimated to grow by a strong 7.6%

> Gross Fixed Capital Formation (GFCF) is expected to see strong growth of 15 per cent in 2021-22.

> Recovery is most significant in exports followed by government consumption and gross fixed capital

formation. However, an equally strong recovery was seen in imports.

> Recovery is most significant in exports followed by government consumption and gross fixed capital

formation. However, an equally strong recovery was seen in imports.

> Investment to GDP ratio to 29.6% in 2021-22, the highest in seven years.

> Private investment recovery is still at a nascent stage, there are many signals which indicate that India is poised for stronger investment.

> Investor sentiment in manufacturing at all time high.

> Private investment recovery is still at a nascent stage, there are many signals which indicate that India is poised for stronger investment.

> Investor sentiment in manufacturing at all time high.

> Exports - Merchandise exports have been above US$ 30 billion for eight consecutive months.

> India’s total exports are expected to grow by

16.5% in 2021-22 surpassing pre-pandemic levels.

> Imports are expected to grow by 29.4%.

> India’s total exports are expected to grow by

16.5% in 2021-22 surpassing pre-pandemic levels.

> Imports are expected to grow by 29.4%.

> Current account recording a modest deficit of 0.2 per cent of GDP in the first half.

> India opted for "Barbell Strategy" - safety-nets to cushion the impact on vulnerable sections of society/business, with a flexible policy response based on Bayesian updating of information

> India opted for "Barbell Strategy" - safety-nets to cushion the impact on vulnerable sections of society/business, with a flexible policy response based on Bayesian updating of information

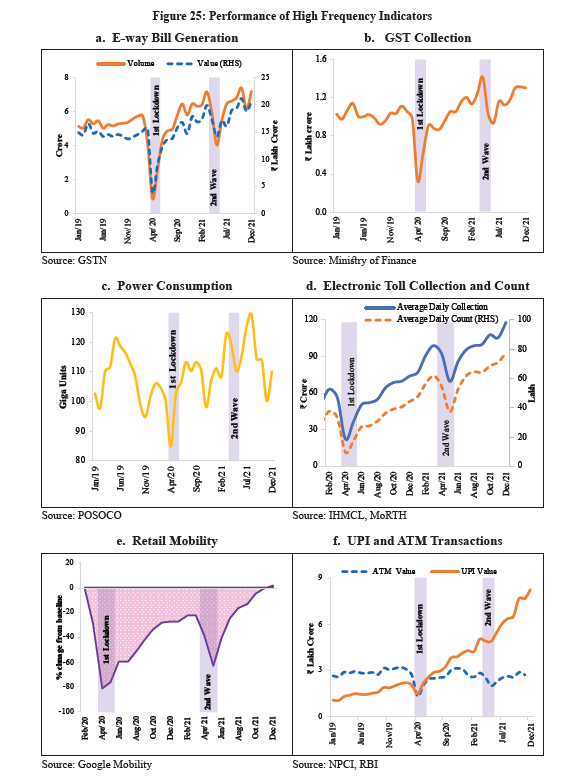

> Decisions taken based on High Frequency Indicators (80 indicators) such as GST collections, power consumption, mobility indicators, digital payments, satellite photographs etc

> India - 4th largest foreign exchange reserves holder in the world after China, Japan & Switzerland

> India - 4th largest foreign exchange reserves holder in the world after China, Japan & Switzerland

> The gross monthly GST collections have crossed ` 1 lakh crore consistently since July 2021.

> The fiscal deficit for April-November 2021 has been contained at 46.2% of Budget Estimates (BE)

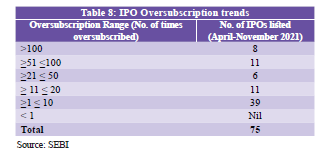

> 89,066 crore was raised via 75 IPO issues in April-

November 2021.

> The fiscal deficit for April-November 2021 has been contained at 46.2% of Budget Estimates (BE)

> 89,066 crore was raised via 75 IPO issues in April-

November 2021.

> GNPA ratio of SCBs decreased from 7.5%

at end-September 2020 to 6.9% at end-September 2021. NNPA ratio of SCBs also declined from 6% at end of 2017-18 to 2.2%

> Freight prices on major global sea routes have observed an upward trend.

at end-September 2020 to 6.9% at end-September 2021. NNPA ratio of SCBs also declined from 6% at end of 2017-18 to 2.2%

> Freight prices on major global sea routes have observed an upward trend.

> Fisc deficit under control based on the receipts and exp from April to Nov 2021.

> Indirect tax receipts have registered a YoY growth of 38.6% in the first eight months.

> Gross GST collections, Centre and States

taken together, were `10.74 lakh crore during Apr to Dec 2021

> Indirect tax receipts have registered a YoY growth of 38.6% in the first eight months.

> Gross GST collections, Centre and States

taken together, were `10.74 lakh crore during Apr to Dec 2021

> Disinvestment target was 1.75 lac crs. Govt was able to mobilise only Rs 9330 crs so far.

> Total expenditure of the Government increased by 8.8% during April to Nov 2021 and stood at 59.6% of Budget Estimate.

> Expenditure on major subsidies stood at

` 2.31 lakh crore.

> Total expenditure of the Government increased by 8.8% during April to Nov 2021 and stood at 59.6% of Budget Estimate.

> Expenditure on major subsidies stood at

` 2.31 lakh crore.

> Fisc Deficit target of 6.8 per cent of GDP (15.07 lac cr deficit) for 2021-22 achievable.

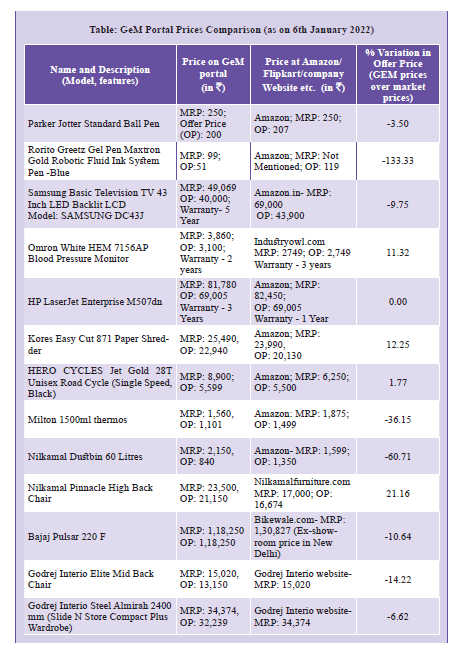

> Government e-Marketplace (GeM) - has resulted in a substantial reduction in prices in comparison to the rates used earlier, with average prices falling by at least 15-20 per cent.

> Government e-Marketplace (GeM) - has resulted in a substantial reduction in prices in comparison to the rates used earlier, with average prices falling by at least 15-20 per cent.

> Out of an ambitious export target of US$ 400 billion set for 2021-22, India has already attained more than 75 per cent of it by exporting goods worth US$ 301.4 billion.

> 40 per cent of India’s exports is still accounted to only seven countries.

> 40 per cent of India’s exports is still accounted to only seven countries.

> USA (18.4%) remained the top export destination followed by UAE (6.6%) and China (5.9%). Belgium has replaced Malaysia and entered into the top ten

> Computer services exports continue to be the largest exported service constituting about 49% of total services exports.

> Computer services exports continue to be the largest exported service constituting about 49% of total services exports.

> Gold imports registered sharp rise to US$ 33.2 billion from US$ 12.3.

> Crude petroleum imports more than doubled to US$ 73.3 bn.

> China (15.5%), UAE (7.3%) and USA were the top import sources for India.

> Crude petroleum imports more than doubled to US$ 73.3 bn.

> China (15.5%), UAE (7.3%) and USA were the top import sources for India.

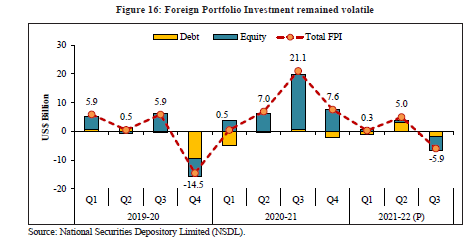

> FPI flows remained volatile due to global uncertainties relating to US monetary policy normalisation, rising global energy prices, fear of new variants of COVID-19 and strong inflationary pressures.

> The repo rate which currently stands at 4% is lowest in the last decade

> The repo rate which currently stands at 4% is lowest in the last decade

> The yields on 10-year G sec which had reached 8.2 per cent on 26th September 2018 reduced substantially to reach 5.75 per cent in June 2020. It has since then increased to stand at 6.45 per cent as on 31st December 2021

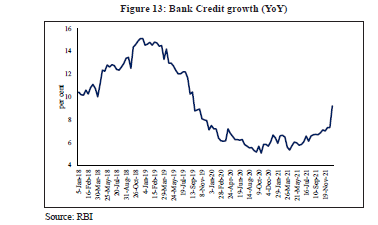

> Bank credit growth picking up sharply to 9.2% in Dec.

> Bank credit growth picking up sharply to 9.2% in Dec.

> In December alone 4.6 billion transactions worth `8.26 lakh crore were carried out by UPI.

> Total assets of NBFCs increased from `36.37 lakh crore in September 2020 to `42.05 lakh crore in September 2021, resulting in YoY growth of 15.61%

> Total assets of NBFCs increased from `36.37 lakh crore in September 2020 to `42.05 lakh crore in September 2021, resulting in YoY growth of 15.61%

> IPO subscriptions & MSCI Composition trends in image.

> Indvl Investor participation in markets have increased.

> The net Assets Under Management (AUM) of mutual fund industry rose by 24.4% to `37.3 lakh crore at the end of November 2021.

> Indvl Investor participation in markets have increased.

> The net Assets Under Management (AUM) of mutual fund industry rose by 24.4% to `37.3 lakh crore at the end of November 2021.

> Insurance penetration was 2.71% in 2001 and has steadily increased to 4.2% in 2020. US has the highest penetration at 12%. Avg Global is 3.3%

> Status of Corporate Insolvency Resolution Process (CIRPs) as on 30th Sept (in image).

> Status of Corporate Insolvency Resolution Process (CIRPs) as on 30th Sept (in image).

> India progressed further on achieving the Sustainable Development Goals (SDGs). India’s overall score on the NITI Aayog SDG India Index & Dashboard 2020- 21 improved to 66 from 60 in 2019-20.

> Capacity Utilisation at 60% (down from 69.4%).

> Capacity Utilisation at 60% (down from 69.4%).

> One Nation One Ration Card progress - the facility of national/inter-State portability is enabled in 34 States covering nearly 75 cr beneficiaries (94.3 % of total target)

> The Government set 20% ethanol blending target for mixing ethanol with petrol to be achieved by 2025.

> The Government set 20% ethanol blending target for mixing ethanol with petrol to be achieved by 2025.

> Capital expenditure for the Indian Railways has been substantially increased - Rs. 45,980 crores during 2009-14 to budgeted Rs. 215,058 crores in 2021-22.

> Coal is the most important and abundant fossil fuel in India and accounts for 55% of the country’s energy need.

> Coal is the most important and abundant fossil fuel in India and accounts for 55% of the country’s energy need.

> Despite the push for renewables, as per the Draft National Energy Policy of Niti Aayog, the demand for coal is expected to remain in the range of 1.3-1.5 Billion Tonnes by 2030.

> 28 coal mines have been successfully auctioned. Auction process for 88 coal mines is underway.

> 28 coal mines have been successfully auctioned. Auction process for 88 coal mines is underway.

> It is estimated that over the period of five years, the PLI Scheme for Textiles will lead to fresh investment of Rs.19,000 crs, cumulative turnover of over Rs.3 lakh crs, create additional employment opportunities of more than 7.5 lakh jobs in this sector.

> In order to achieve the GDP of $5 trillion by 2024-25, India needs to spend about $1.4 trillion over these years on infrastructure

> The domestic traffic in India has more than doubled from around 61 million in 2013-14 to around 137 million in 2019-20.

> The domestic traffic in India has more than doubled from around 61 million in 2013-14 to around 137 million in 2019-20.

> During April-November 2021, Indian railways carried over 185.1 crore domestic passengers

> India presence in global services exports, ranks in top ten services exporter countries with its share in world commercial services exports increasing from 3.4 % in 2019 to 4.1 % in 2020

> India presence in global services exports, ranks in top ten services exporter countries with its share in world commercial services exports increasing from 3.4 % in 2019 to 4.1 % in 2020

> The number of patents filed in India has gone up from 39,400 in 2010-11 to 58,502 in 2020-21. The average pendency for final decision in acquiring patents in India is 42 months as of 2020.

> The number of patents granted in China, USA, stood at 5.30 lakh & 3.52 lakh for 2020.

> The number of patents granted in China, USA, stood at 5.30 lakh & 3.52 lakh for 2020.

> India’s ranking in Global Innovation Index has climbed 35 ranks, from 81st in 2015-16 to 46th in 2021.

> Gross enrolment ratio in higher education recorded at 27.1 percent in 2019-20, was slightly higher from 26.3 percent in 2018-19.

> Gross enrolment ratio in higher education recorded at 27.1 percent in 2019-20, was slightly higher from 26.3 percent in 2018-19.

> From 1 startup in space sector in 2012 to 101 startups in 2021, the sector has grown rapidly. India accounts for only about 2 per cent of the space economy, much behind the major players – USA and China.

THAT'S IT.! Thanks for reading.!

THAT'S IT.! Thanks for reading.!

@threadreaderapp UNROLL.!

• • •

Missing some Tweet in this thread? You can try to

force a refresh