Oil I gave a $75 and $100 target when it was $35.

$TWI was $1.50 when I was pounding the table to buy.

$JILL was another 8 multiple.

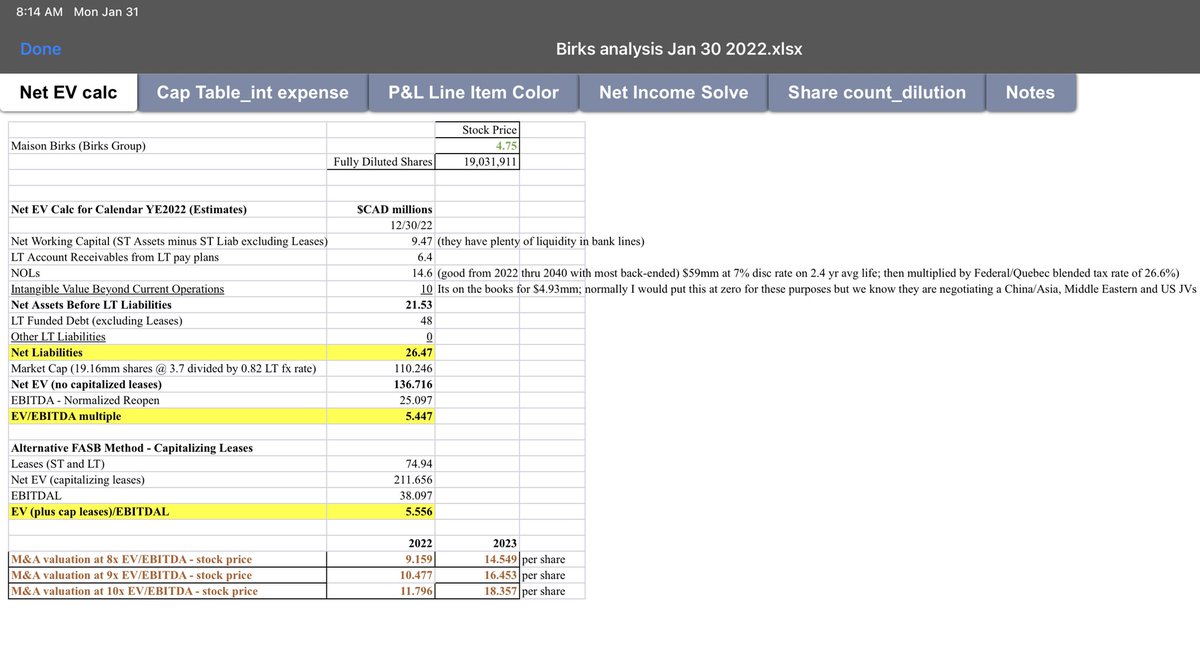

Now my top position $BGI is time to run again. Here is the breakdown:

BGI was a great performer last year. But the stock was so beaten down a

$TWI was $1.50 when I was pounding the table to buy.

$JILL was another 8 multiple.

Now my top position $BGI is time to run again. Here is the breakdown:

BGI was a great performer last year. But the stock was so beaten down a

https://twitter.com/amlivemon/status/1372844775506857985

year ago that it is still cheap now. We have it earning $0.79 in calendar 2022 and $1.40 in calendar 2023. So at $4.75/share its trading at a 6 p/e for 2022 and 3.4 p/e for 2023. EBITDA multiples are 5.4x for 2022 and 3.4x in 2023.

Like many formerly distressed equities the

Like many formerly distressed equities the

earnings leverage from operational turnaround, deleveraging, and tax loss carry forwards are especially rewarding for investors. Because of Canada being so lock-down focused in 2021, $BGI is only just starting to show what it can do. Most US retailers are in the opposite

position - having already had their run.

Also, remember that $BGI was remodeling its stores in calendar 2019 (pre-Covid) and so that is not a normal base year to compare off. As such our 2022 and 2023 revenues estimates are really not aggressive at all. We are not counting on

Also, remember that $BGI was remodeling its stores in calendar 2019 (pre-Covid) and so that is not a normal base year to compare off. As such our 2022 and 2023 revenues estimates are really not aggressive at all. We are not counting on

the jewelry boom that swept the US during reopening in 2021. In fact, with Birks having already reported its holiday sales we have a very good feel for the 2022 results at this juncture.

The top-line is solid and has more risk to the upside, but the real story is the expected

The top-line is solid and has more risk to the upside, but the real story is the expected

profitability rebound driven by its long-awaited full roll-out of its Birks branded jewlery. The in-house manufactured product has multiples of the gross margin that 3rd party sales have and this category has grown its SKUs to a point where it will be the dominant profit

contributor going forward. The category is currently comping 2021 sales in the mid-20s. It is capable of even more as we get back to a post-pandemic world.

BGI has been rock solid during the market sell-off and there is a small cohort of buyers who have a long view of the

BGI has been rock solid during the market sell-off and there is a small cohort of buyers who have a long view of the

company’s prospects and expect to make multiples on their money. Management/family shareholders have not been selling despite the stock’s run last year. Share float remains small and short sellers - which were a problem last year during the lock-down periods - have largely

given up.

While we do not expect the family owners to agree to an M&A the business would be worth $14-20/share on public comps. Instead we expect 2 years of rapid deleveraging and the announcement of further growth initiatives for Birks branded jewelry outside of Canada.

While we do not expect the family owners to agree to an M&A the business would be worth $14-20/share on public comps. Instead we expect 2 years of rapid deleveraging and the announcement of further growth initiatives for Birks branded jewelry outside of Canada.

• • •

Missing some Tweet in this thread? You can try to

force a refresh