Macro narrative on $BGI

Slowing growth in the US is the dominant narrative. It remains to be seen if we will get inflationary 1Q-2Q data before we get to inflation falling. But there is no debate on growth dropping despite a lagging strong Jobs print in January/Dec.

$BGI – a

Slowing growth in the US is the dominant narrative. It remains to be seen if we will get inflationary 1Q-2Q data before we get to inflation falling. But there is no debate on growth dropping despite a lagging strong Jobs print in January/Dec.

$BGI – a

deep value small cap does well in lower growth/lower inflation (worst overall market environment) as has been demonstrated this month. The fact it has an oil and gold angle makes it far more robust than most other value plays. The only things outperforming it are classic

defensive sectors (Utes, Staples) and O&G.

BGI can take off in an oil surge given the Canadian economy (and stock market) correlations to oil & gas as well as higher global rates.

BGI can also take off in a gold surge which is triggered by US asset (stocks and bonds)

BGI can take off in an oil surge given the Canadian economy (and stock market) correlations to oil & gas as well as higher global rates.

BGI can also take off in a gold surge which is triggered by US asset (stocks and bonds)

underperformance for the first time in over a decade.

BGI will not do as well (on a relative basis) if oil falls sharply and US stocks and bonds rebound however it would still have the strong Canadian economy to provide support. It would outperform all of the currently favored

BGI will not do as well (on a relative basis) if oil falls sharply and US stocks and bonds rebound however it would still have the strong Canadian economy to provide support. It would outperform all of the currently favored

sectors in such a scenario.

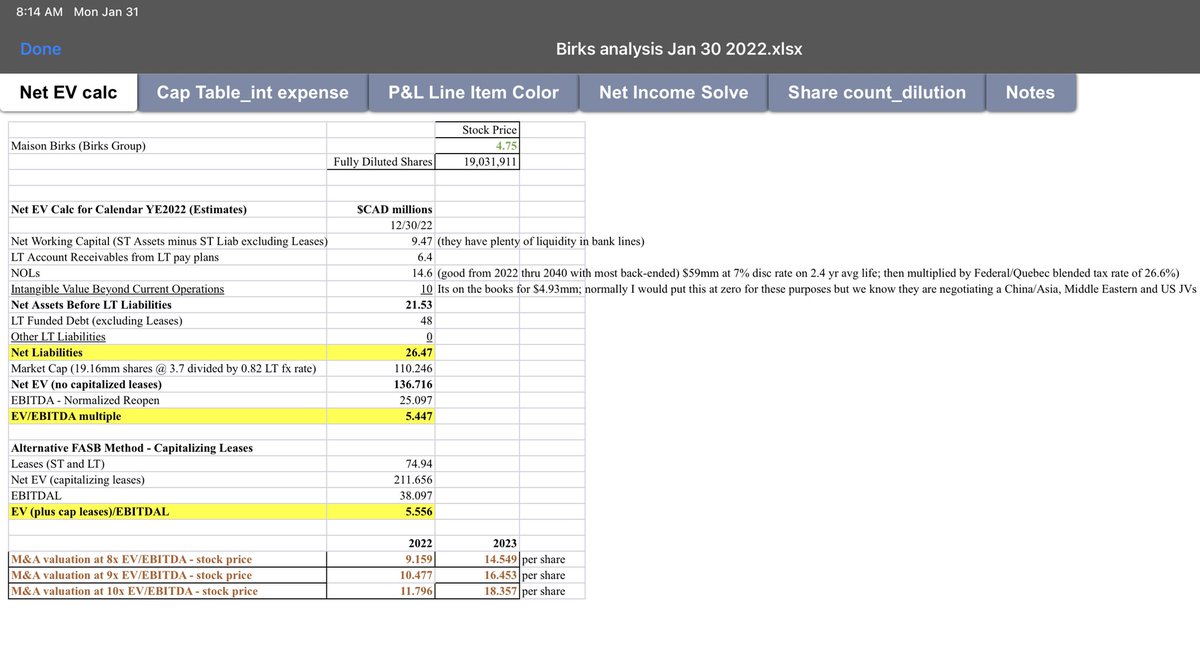

BGI has at least 18 months of gold and platinum inventory. This will lower margin risks near-term and is a strong part of the argument for deep value in the stock at current 3-5x EBITDA multiples. The gross margin story (Birks in-house branded

BGI has at least 18 months of gold and platinum inventory. This will lower margin risks near-term and is a strong part of the argument for deep value in the stock at current 3-5x EBITDA multiples. The gross margin story (Birks in-house branded

jewelry) is by far the most key aspect to watch in the stock in 2022-2023.

$USD is also important consideration. We are bearish on USD after the next 2 months (where we are slightly bullish on more Fed fear). US election season means we are going to see some sort of stabilizing

$USD is also important consideration. We are bearish on USD after the next 2 months (where we are slightly bullish on more Fed fear). US election season means we are going to see some sort of stabilizing

response by late April from the Fed or stimulus.

If USD were to go parabolic it would obviously cause major problems in global markets. However, look at Birks during the current sizeable USD run. Its deep value has protected it. It is not part of any index, etc. Furthermore,

If USD were to go parabolic it would obviously cause major problems in global markets. However, look at Birks during the current sizeable USD run. Its deep value has protected it. It is not part of any index, etc. Furthermore,

a very toxic USD run will ignite gold demand in our view.

We would not expect BGI to outperform gold miners but history has shown that jewelry (esp luxury Jewelry) is the next best category to own in a gold bull market.

It goes without saying that BGI would thrive in a major

We would not expect BGI to outperform gold miners but history has shown that jewelry (esp luxury Jewelry) is the next best category to own in a gold bull market.

It goes without saying that BGI would thrive in a major

USD down move.

In our view BGI looks fine in all macro scenarios except for perhaps an oil collapse. This leaves the issue of lock-downs in Canada as the main “macro/political” threat. This issue has plagued the company and short-circuited several break-out rally attempts.

In our view BGI looks fine in all macro scenarios except for perhaps an oil collapse. This leaves the issue of lock-downs in Canada as the main “macro/political” threat. This issue has plagued the company and short-circuited several break-out rally attempts.

We profess no edge in calling for an end to lock-downs in Canada and leave it to the reader to make their own judgement on whether we are in store for continued lock-downs in 2022.

• • •

Missing some Tweet in this thread? You can try to

force a refresh