I’ve owed you all the next benchmarking thread for a while… here we go!

Now that we’ve been through benchmarking, let’s look at a “live” example of a hotel deal – how would I use this to see if a deal is worth chasing? Thanks to a member of the #ReTwit crew for offering up a hotel – I’ve anonymized so it shouldn’t be recognizable.

First let’s take a look at performance in 2019 and 2020. Worth noting – the hotel underwent an addition in 2019, so it’s a particularly tough historical data set to use! Also, some funky project-specific things we’ll ignore for now (e.g., no property taxes) to protect anonymity

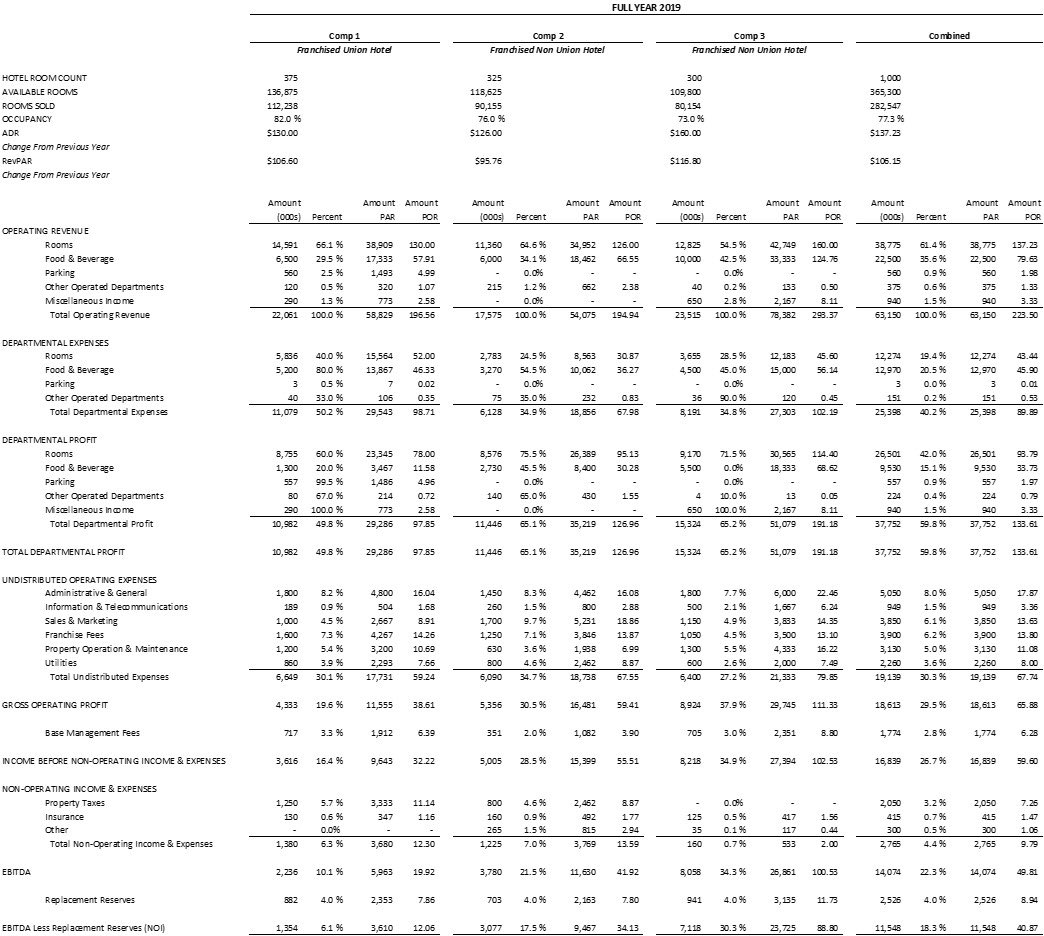

Now, to operating comps. In an analysis like this I’d typically use comps from my portfolio; these are based on real hotels, but not real hotels. Now I can get a good idea of how my operating team should do. I like to list each comp and to blend them – there’s times I’d use each

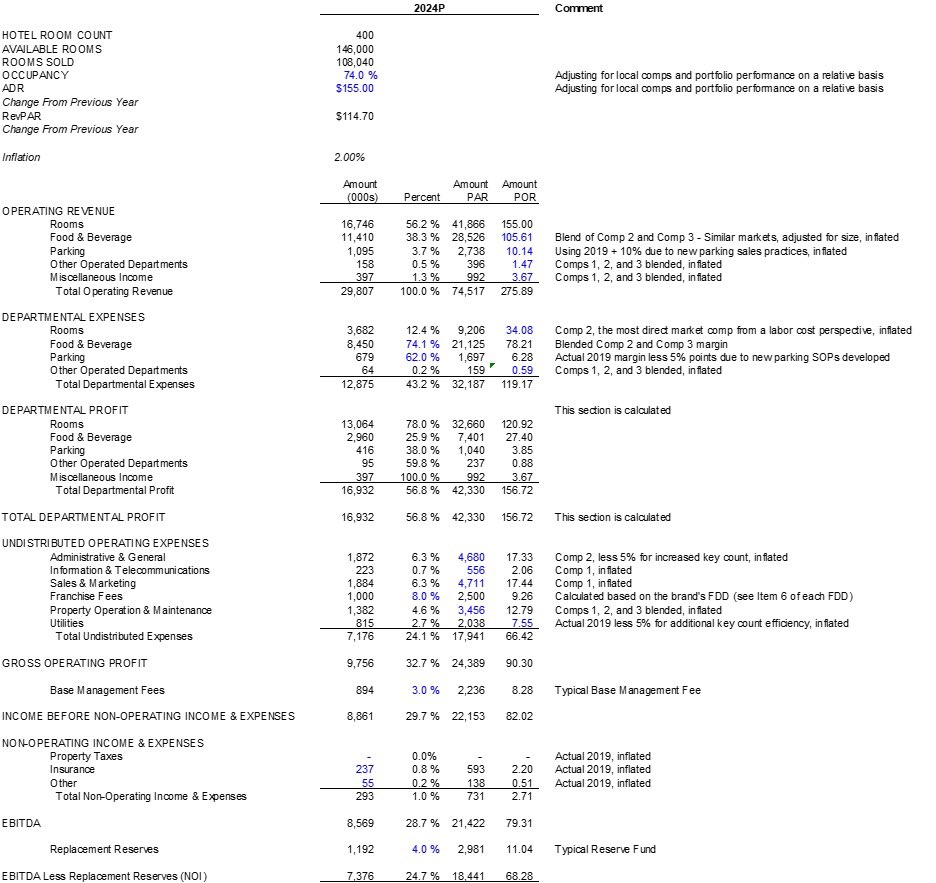

Let’s go! Time to answer the Q, “how should we do if we buy it?”. For now, 0 capital value add (e.g., no renovation), just change in mgmt. Also, I’m using a stabilized year here – coming out of COVID, we’re still looking at a couple year ramp to prior levels, so I’m assuming 2024

Now to the “why”

We’ll do an entire thread on comping Occupancy and ADR, so let’s just say for now, “my revenue management and marketing is better, so I can do better”.

We’ll do an entire thread on comping Occupancy and ADR, so let’s just say for now, “my revenue management and marketing is better, so I can do better”.

F+B Revenue – Comps 2 and 3 are in similar types of markets with similar sized banquet facilities. Parking – Generally will do what it’s done, but I’ve built a better mousetrap of monetizing parking… may be underselling it here. Other & Misc – it’s small, who cares at this point

Expenses! As we discussed, Rooms is variable per occupied room & heavy labor. Comp 2 (non-union in similar labor market) is the best bet here. F+B is complicated, & I’m not yet to the point where I’ll do detailed by outlet, so we’ll blend Comps 2 & 3 (what we used for revenues)

Other – Again, who cares. Gets us to our departmental profit – 56.8% vs historical 56.7%. Hm. Not a ton of margin improvement! But, $16.9MM vs $13.1MM is a pretty material change. Driving revenue really does matter!

Overhead! Admin & General historically has been quite lean – I’ll likely add some cost here to help drive performance. The cost varies by room count, not occupancy, and so we’ll use Comp 2 (non-union labor) but decrease per key to account for economies of scale

Info & Telecom is also a per-key basis, and I’ve got a method of delivering these services more inexpensively than most, because I can buy across a larger portfolio. Using an internal comp closest to the same size

Sales & Marketing. Similar to A&G, historically lean. I’ll add dollars here for more staff – and likely redeploy existing spend – to improve top line. A pretty profitable trade if done correctly. Franchise Fees I’ll just use the Franchise Disclosure Document to get actuals

Property Ops & Maintenance has historically been way underfunded, but that’s because a renovation was happening and then COVID hit. Need to get this to a more normalized amount

Utilities are hyper local to market and building, so I tend to use historicals. Because keys were added, I’ve added a touch of efficiency

Base Management Fees and Reserve Fund Contributions are normalized, and Property Taxes / Insurance / Other are per historicals – for now

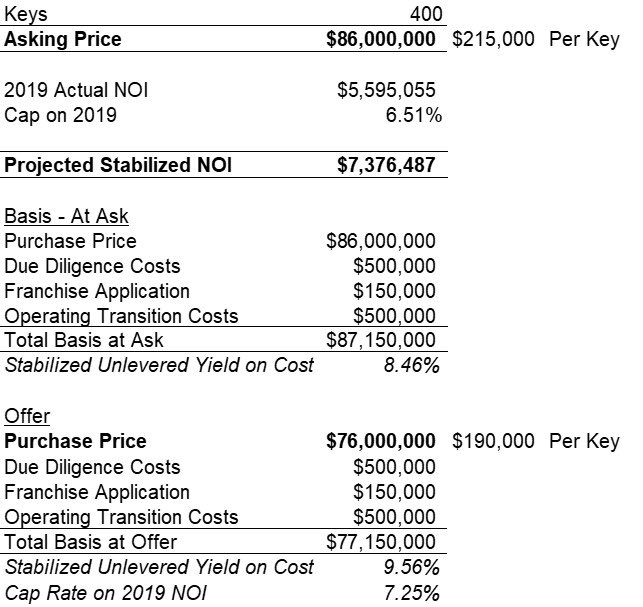

Looking at this, we think we can increase NOI from $5.6MM in 2019 to $7.4MM in 2024 through only management changes and room addition absorption. But which is it? Well, its both, and we know that because NOI / key is increasing from $15.9K to $18.4K

So, what does this mean for a potential investment? Seller is asking $215K per key, or $86MM. A 6.5% cap on 2019, but 2019’s a tough comparison year because of the renovation. At ask, my stabilized UYOC is ~8.5%, which is a bit low for me – I’m not BREIT

I’d like to be closer to a 9.5%, because I think I can sell for a 7% - 7.5%. That puts me at a $190K per key / $76MM number, which is also a 7.25% Cap on 2019… funny how those things work sometimes.

• • •

Missing some Tweet in this thread? You can try to

force a refresh