1/ Thread: $SPOT Deep Dive

80 pg. slide deck here 👉🏼 patient-capital.de/s/SPOT.pdf

In this thread I'll walk you through my assumptions for the bear, base and bull case for Spotify.

The deck has seven chapters, starting with "SPOT AT A GLANCE".

80 pg. slide deck here 👉🏼 patient-capital.de/s/SPOT.pdf

In this thread I'll walk you through my assumptions for the bear, base and bull case for Spotify.

The deck has seven chapters, starting with "SPOT AT A GLANCE".

2/

With 172m paid subs and 381m MAUs $SPOT is the clear leader in music streaming (35% ms). SPOT is 2x the size of its nearest competitor $AAPL in terms of paid subs and has 2x the user engagement.

But so far SPOT never turned a full year profit + the stock dropped sharply TTM.

With 172m paid subs and 381m MAUs $SPOT is the clear leader in music streaming (35% ms). SPOT is 2x the size of its nearest competitor $AAPL in terms of paid subs and has 2x the user engagement.

But so far SPOT never turned a full year profit + the stock dropped sharply TTM.

3/

In music, $SPOT has to pay out ~2/3 of rev to rightsholders, its supplier base is highly concentrated (top 4 labels account for 78% of all streams).

To loosen the labels’ grip on economics, SPOT pushes into podcast adverts with 45-50% gross margin potential vs. 30% in music.

In music, $SPOT has to pay out ~2/3 of rev to rightsholders, its supplier base is highly concentrated (top 4 labels account for 78% of all streams).

To loosen the labels’ grip on economics, SPOT pushes into podcast adverts with 45-50% gross margin potential vs. 30% in music.

4/

How does $SPOT try to differentiate from $APPL or $AMZN in music streaming? Since each DSP boasts roughly the same music catalogue (commodity), DSPs' value shifts from aggregation to discovery.

SPOT is superior in discovery/UX/personalization which drives faster MAU growth.

How does $SPOT try to differentiate from $APPL or $AMZN in music streaming? Since each DSP boasts roughly the same music catalogue (commodity), DSPs' value shifts from aggregation to discovery.

SPOT is superior in discovery/UX/personalization which drives faster MAU growth.

5/

“INDUSTRY BACKGROUND”:To understand SPOT’s growing importance to the recorded music industry, one has to remember how piracy (#Napster, Kazaa) was crushing the record labels from 2000-2014.

#Streaming revived this shrinking industry and made it grow high single digit again.

“INDUSTRY BACKGROUND”:To understand SPOT’s growing importance to the recorded music industry, one has to remember how piracy (#Napster, Kazaa) was crushing the record labels from 2000-2014.

#Streaming revived this shrinking industry and made it grow high single digit again.

6/

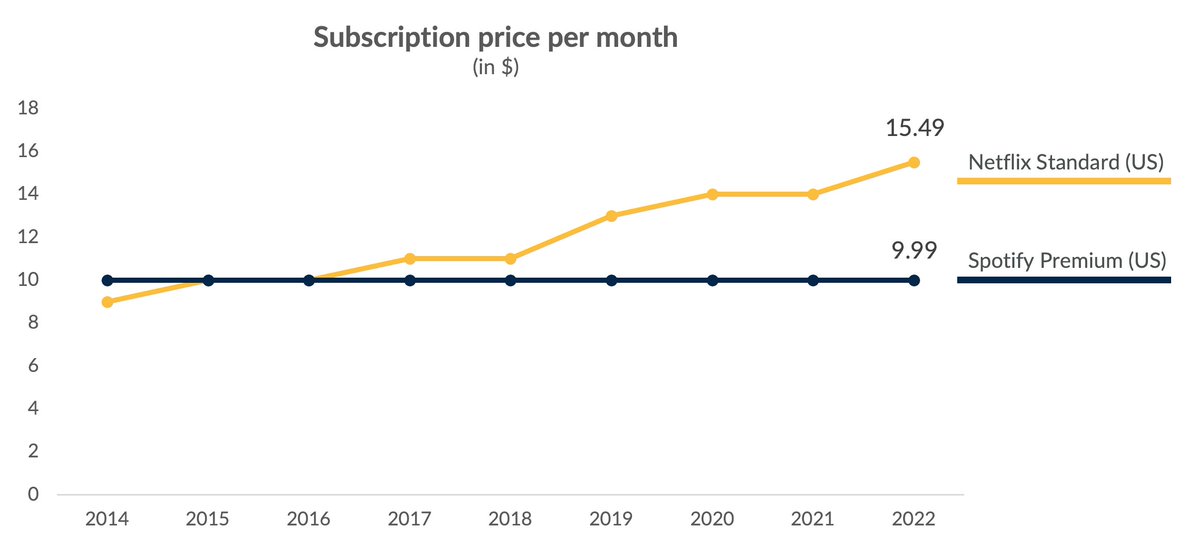

Having the world’s entire music catalogue in your pocket for $9.99/month (35% cheaper than $NFLX) is a clear bargain

Yet, with 443m industrywide paid subscribers only 10% of all payment enabled smartphones are penetrated so far.

The industry could grow to >1 bn paid subs LT

Having the world’s entire music catalogue in your pocket for $9.99/month (35% cheaper than $NFLX) is a clear bargain

Yet, with 443m industrywide paid subscribers only 10% of all payment enabled smartphones are penetrated so far.

The industry could grow to >1 bn paid subs LT

7/

“COMPANY BACKGROUND”: SPOT was founded 2006 by swedish tech entrepreneur @eldsjal and @MartinLorentzon. Ek – at this point 23 yrs old – sold his adtech co Advertigo to Lorentzon’s affiliate marketing network Tradedoubler before for $2m.

Lorentzon got rich through TD's IPO.

“COMPANY BACKGROUND”: SPOT was founded 2006 by swedish tech entrepreneur @eldsjal and @MartinLorentzon. Ek – at this point 23 yrs old – sold his adtech co Advertigo to Lorentzon’s affiliate marketing network Tradedoubler before for $2m.

Lorentzon got rich through TD's IPO.

8/

$SPOT has an engineering driven culture/runs thousands of experiments. Co has a bets board, resources go to #1 bet first, #2 bet afterwards etc

"If you're slow, you better be right most of the time. If you're fast, you can test/iterate more, creating a culture of innovation"

$SPOT has an engineering driven culture/runs thousands of experiments. Co has a bets board, resources go to #1 bet first, #2 bet afterwards etc

"If you're slow, you better be right most of the time. If you're fast, you can test/iterate more, creating a culture of innovation"

9/

“MUSIC ROYALTIES 101”: The music industry knows two separate core intellectual property rights: the song (controlled by publishers) vs. the sound recording (controlled by record labels).

Whenever music is played or streamed, rightsholders are entitled to receive royalties.

“MUSIC ROYALTIES 101”: The music industry knows two separate core intellectual property rights: the song (controlled by publishers) vs. the sound recording (controlled by record labels).

Whenever music is played or streamed, rightsholders are entitled to receive royalties.

10/

Four findings:

1. in live music labels don’t have to be paid (the song is used, master recording isn’t)

2. rights owners are often obliged to license radio stations

3. US radio stations only pay for the song rights

4. artists make the majority of $$$ from live touring

Four findings:

1. in live music labels don’t have to be paid (the song is used, master recording isn’t)

2. rights owners are often obliged to license radio stations

3. US radio stations only pay for the song rights

4. artists make the majority of $$$ from live touring

11/

Music publishing ($6.0 bn) is a fraction of the $21.6 bn global recorded music industry (labels), mostly because producing/studio time/equipment has more costs and value than writing a song on a piece of paper.

30% of publishing revenue comes from music streaming DSPs.

Music publishing ($6.0 bn) is a fraction of the $21.6 bn global recorded music industry (labels), mostly because producing/studio time/equipment has more costs and value than writing a song on a piece of paper.

30% of publishing revenue comes from music streaming DSPs.

12/

62% of recorded music industry ($21.6 bn) comes from streaming. Labels receive ~55% of all DSPs’ streaming revenue vs. 10-15% for publishers.

Labels act as VCs, pay cash advances for exclusive ownership of the artists’ future master recordings with unknown hit/CF potential.

62% of recorded music industry ($21.6 bn) comes from streaming. Labels receive ~55% of all DSPs’ streaming revenue vs. 10-15% for publishers.

Labels act as VCs, pay cash advances for exclusive ownership of the artists’ future master recordings with unknown hit/CF potential.

13/

If you want to learn more on royalties,may I refer you to @SleepwellCap sleepwell.substack.com/p/music-stream…, who explains the subject in a way more enjoyable fashion than I did.

Spoiler: in his post he’ll touch upon how much more $$$ Indie Taylor Swift could make vs. Major Label Taylor

If you want to learn more on royalties,may I refer you to @SleepwellCap sleepwell.substack.com/p/music-stream…, who explains the subject in a way more enjoyable fashion than I did.

Spoiler: in his post he’ll touch upon how much more $$$ Indie Taylor Swift could make vs. Major Label Taylor

14/

@benthompson of Stratechery once said that “the value of tech companies is often inversely proportional to the value of the publishers”.

To understand why labels can extract so much value from $SPOT it's important to realize how valuable e.g. the #1 label $UMG (32% ms) is.

@benthompson of Stratechery once said that “the value of tech companies is often inversely proportional to the value of the publishers”.

To understand why labels can extract so much value from $SPOT it's important to realize how valuable e.g. the #1 label $UMG (32% ms) is.

15/

"A PIVOT IN STRATEGY: AUDIO > MUSIC": to solve the gross margin problem in the core biz, Daniel Ek declared that all audio — not just music — will be the future of $SPOT.

A high priority is reaching the #1 position in podcast consumption (achieved in 60+ countries incl US).

"A PIVOT IN STRATEGY: AUDIO > MUSIC": to solve the gross margin problem in the core biz, Daniel Ek declared that all audio — not just music — will be the future of $SPOT.

A high priority is reaching the #1 position in podcast consumption (achieved in 60+ countries incl US).

16/

Podcast monetization at industrywide 3-4 cents per consumption hour is still in its infancy.

Compared to time spent, podcasts are 10X underpriced vs. other media.

With better targeting and call-to-action cards, dynamic podcast ads should close that gap meaningfully LT.

Podcast monetization at industrywide 3-4 cents per consumption hour is still in its infancy.

Compared to time spent, podcasts are 10X underpriced vs. other media.

With better targeting and call-to-action cards, dynamic podcast ads should close that gap meaningfully LT.

17/

With the Spotify Audience Network $SPOT tries to replicate what $GOOGL built with AdSense for small publishers.

The crucial building block for GOOG's network business was acquiring #DoubleClick in 07 (for 2x(!) the price of #YouTube).

For SPOT the key was buying #Megaphone

With the Spotify Audience Network $SPOT tries to replicate what $GOOGL built with AdSense for small publishers.

The crucial building block for GOOG's network business was acquiring #DoubleClick in 07 (for 2x(!) the price of #YouTube).

For SPOT the key was buying #Megaphone

18/

With Megaphone I expect $SPOT brought in €150-200m in podcast revenue in FY21.

This business is growing +200% organically vs. $ACAST +87% and 30%+ industrywide growth (according to IAB).

It's evident: the leading players in Dynamic Ad Insertion (DAI) rapidly take share.

With Megaphone I expect $SPOT brought in €150-200m in podcast revenue in FY21.

This business is growing +200% organically vs. $ACAST +87% and 30%+ industrywide growth (according to IAB).

It's evident: the leading players in Dynamic Ad Insertion (DAI) rapidly take share.

19/

"Long term, I believe at the very least, [advertising] should be 20% of our revenues, but it might possibly be a lot more than that, 30%, 40% even, over the next 5 to 10 years.” – Daniel Ek

Podcast ads have 45-50% gross margin potential compared to 30% for the core biz.

"Long term, I believe at the very least, [advertising] should be 20% of our revenues, but it might possibly be a lot more than that, 30%, 40% even, over the next 5 to 10 years.” – Daniel Ek

Podcast ads have 45-50% gross margin potential compared to 30% for the core biz.

20/

"Financials and thoughts on valuation": with first insights into Marquee and podcast ad sales initiatives $SPOT upped its financial long-term targets in 21.

- rev growth: 20%+

- gross margin: 30-40%

- EBIT margin: 10%+

- FCF: pos.

In my opinion rev target seems demanding.

"Financials and thoughts on valuation": with first insights into Marquee and podcast ad sales initiatives $SPOT upped its financial long-term targets in 21.

- rev growth: 20%+

- gross margin: 30-40%

- EBIT margin: 10%+

- FCF: pos.

In my opinion rev target seems demanding.

21/

To get close to their revenue targets and offset geo mix, $SPOT will have to raise prices in mature markets where market share is high.

At $9.99 SPOT is 35% cheaper than $NFLX standard ($15.49).

LT SPOT could be priced at $20 (incl more O&Es, meditation, audiobooks, live).

To get close to their revenue targets and offset geo mix, $SPOT will have to raise prices in mature markets where market share is high.

At $9.99 SPOT is 35% cheaper than $NFLX standard ($15.49).

LT SPOT could be priced at $20 (incl more O&Es, meditation, audiobooks, live).

22/

I rarely encounter a stock, where investors derive such a wide range of different fair values.

SPOT’s LT value depends on how one judges:

- its podcast strategy

- core music margin pathway/2SMP

- subscriber growth

Here's the issue: these are all really hard to predict.

I rarely encounter a stock, where investors derive such a wide range of different fair values.

SPOT’s LT value depends on how one judges:

- its podcast strategy

- core music margin pathway/2SMP

- subscriber growth

Here's the issue: these are all really hard to predict.

23/

Wildcard I: $SPOT could push more into social after #ByteDance's Resso made social functions (sharing, commenting) front and center of their UX.

Wildcard II: SPOT could co against #Clubhouse with Greenroom and leverage SPOT's +400m MAUs to become the standard for live chat.

Wildcard I: $SPOT could push more into social after #ByteDance's Resso made social functions (sharing, commenting) front and center of their UX.

Wildcard II: SPOT could co against #Clubhouse with Greenroom and leverage SPOT's +400m MAUs to become the standard for live chat.

24/

"CONCLUSION": I think the Street still sees $SPOT as a MAU growth story, when in fact it’s more and more shifting to a monetization story of 400+m users.

As a sentiment check, what do you think will drive the stock narrative for SPOT over the coming quarters?:

"CONCLUSION": I think the Street still sees $SPOT as a MAU growth story, when in fact it’s more and more shifting to a monetization story of 400+m users.

As a sentiment check, what do you think will drive the stock narrative for SPOT over the coming quarters?:

25/End

Full deck 80 pg.: patient-capital.de/s/SPOT.pdf

What else can I recommend from #FinTwit on $SPOT?:

- @SleepwellCap, @TSOH_Investing and @YHamiltonBlog: high quality write-ups (Substack)

- @Find_Me_Value: detailed slide deck (12 pg. free trial)

Thanks if you made it this far!

Full deck 80 pg.: patient-capital.de/s/SPOT.pdf

What else can I recommend from #FinTwit on $SPOT?:

- @SleepwellCap, @TSOH_Investing and @YHamiltonBlog: high quality write-ups (Substack)

- @Find_Me_Value: detailed slide deck (12 pg. free trial)

Thanks if you made it this far!

• • •

Missing some Tweet in this thread? You can try to

force a refresh