Terra Degen Yield strategy V2

I've done some tweaks and found a way to increase the Anchor Protocol rate from 19,5% APY to 50-140% APY on $UST.

No $MIM. No Degenbox.

Let's do an example with $15K to illustrate how it works.

/THREAD

I've done some tweaks and found a way to increase the Anchor Protocol rate from 19,5% APY to 50-140% APY on $UST.

No $MIM. No Degenbox.

Let's do an example with $15K to illustrate how it works.

/THREAD

I just want to start this thread by saying that nothing in DeFi is risk-free.

What I post is investment ideas and not financial advice. Always do your own research.

And if you try this strategy, try with a very small amount the first time so you understand how it works.

1/

What I post is investment ideas and not financial advice. Always do your own research.

And if you try this strategy, try with a very small amount the first time so you understand how it works.

1/

This is an active strategy, which means that you should monitor it daily.

Most often you don't have to do something, but you should always keep an eye on strategies with higher risk.

/2

Most often you don't have to do something, but you should always keep an eye on strategies with higher risk.

/2

Also, I know some of you are worried about Anchor Protocol and the sustainability of the 19,5% APY.

Read my take on it here:

/3

Read my take on it here:

https://twitter.com/Route2FI/status/1487079648609640456

/3

If you want to know more about the Terra Degen Yield Strategy you can see an earlier thread I've made about it here where I showed how to go from 19,5% APY to 40% APY with Anchor Protocol.

Read the thread here:

/4

Read the thread here:

https://twitter.com/Route2FI/status/1473626708314136585

/4

Okay, let's go.

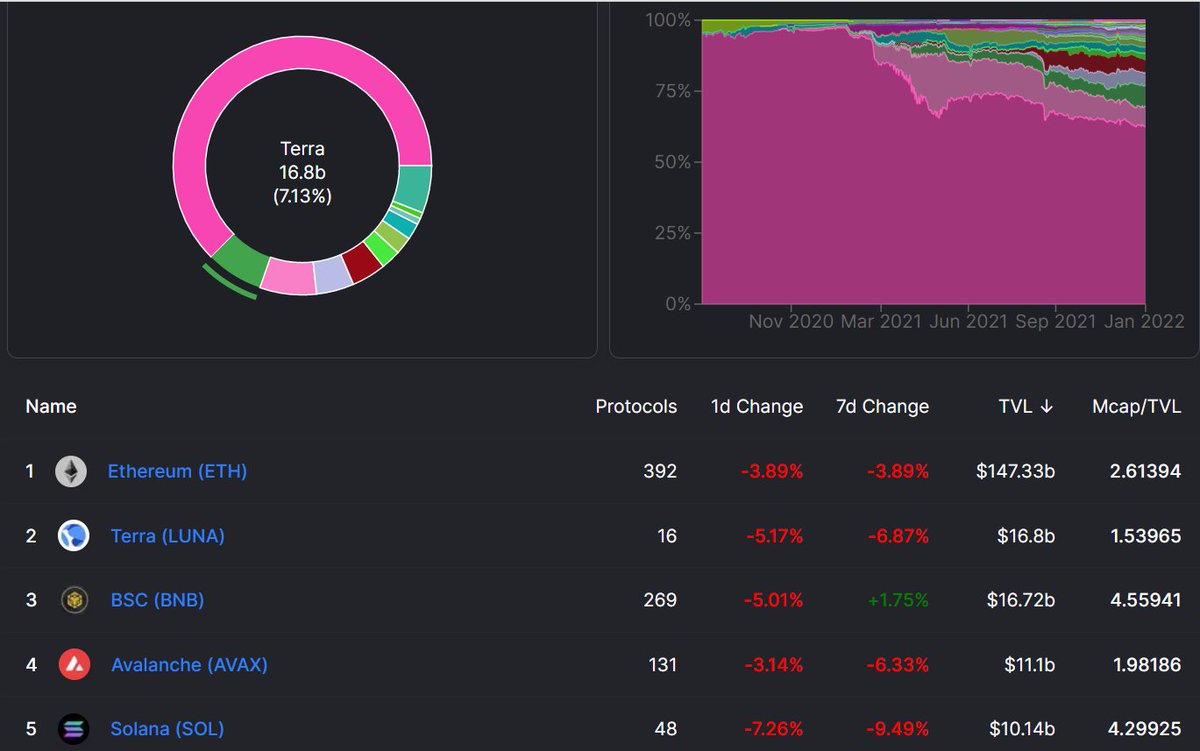

What we're going to do is to use @mirror_protocol to borrow an mAsset, sell it at Terraswap and deposit the money in @anchor_protocol.

By repeating this several times (looping), we will end up with almost 4x the amount we started with.

/5

What we're going to do is to use @mirror_protocol to borrow an mAsset, sell it at Terraswap and deposit the money in @anchor_protocol.

By repeating this several times (looping), we will end up with almost 4x the amount we started with.

/5

In the Terra Degen Yield Strategy V2 we're going to use a different asset than what we did in V1.

In the V1 we ended up with 2x the amount of money. This time we end up with almost 4x.

And we're not going to use mSLV. This time we're going to use mKO (Coca Cola).

/6

In the V1 we ended up with 2x the amount of money. This time we end up with almost 4x.

And we're not going to use mSLV. This time we're going to use mKO (Coca Cola).

/6

Let's go through this step-by-step:

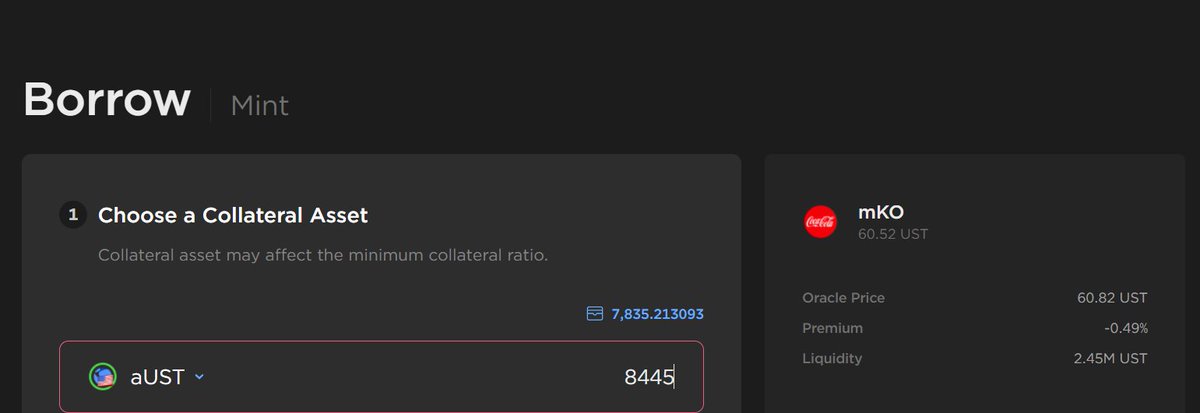

Step 1) Deposit $10,000 UST in Anchor Protocol (equals 8,445 aUST)

Step 2) Go to Mirror Protocol Borrow mirrorprotocol.app/#/borrow#borrow and find mKO (see screenshot below)

/7

Step 1) Deposit $10,000 UST in Anchor Protocol (equals 8,445 aUST)

Step 2) Go to Mirror Protocol Borrow mirrorprotocol.app/#/borrow#borrow and find mKO (see screenshot below)

/7

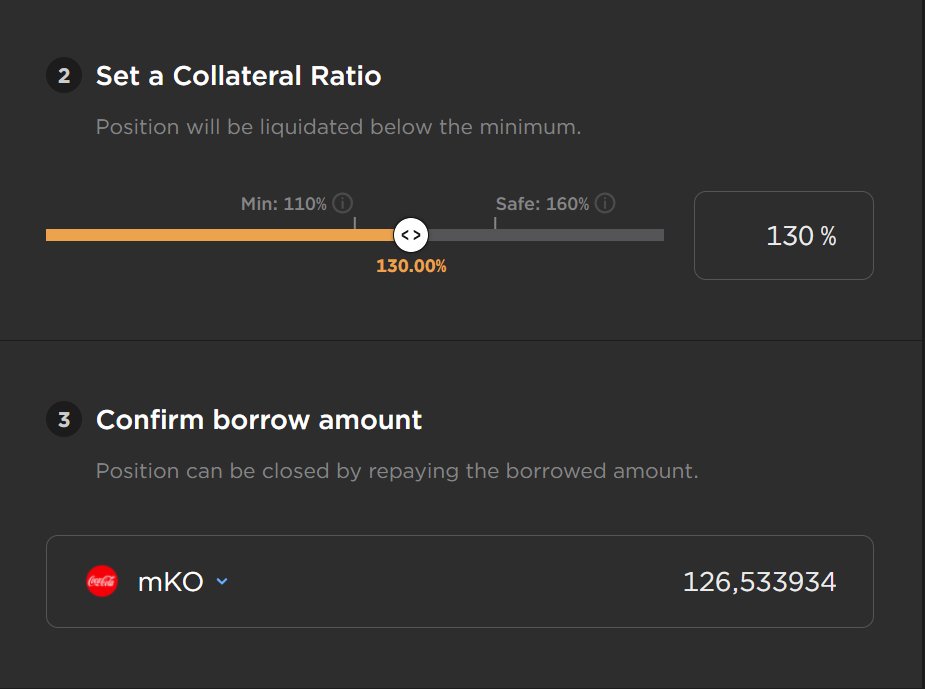

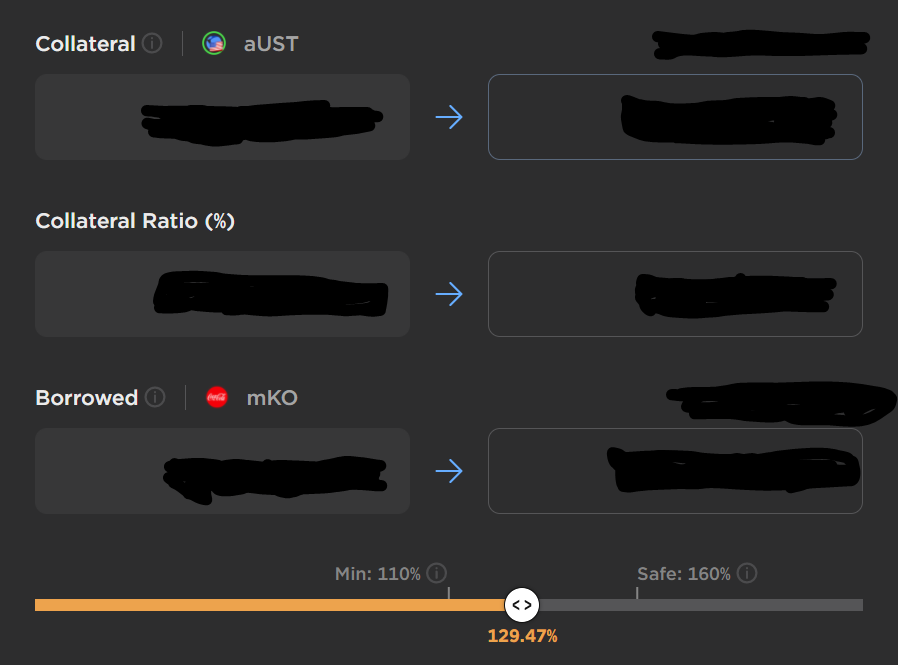

Step 3) Write in 8,445 aUST as your collateral asset

Step 4) Set collateral ratio to 130%

Step 5) This lets you borrow 126,53 mKO

Just to explain a little bit more about the collateral ratio.

In Terra Degen Yield Strategy V1 where we use mSLV as a collateral we had to...

/8

Step 4) Set collateral ratio to 130%

Step 5) This lets you borrow 126,53 mKO

Just to explain a little bit more about the collateral ratio.

In Terra Degen Yield Strategy V1 where we use mSLV as a collateral we had to...

/8

put down a minimum of 150% as a collateral.

But with mKO you only need 110%, which means that the strategy is much more effective in terms of borrowing.

That's why I choose 130% as my preferred collateral value in this strategy.

/9

But with mKO you only need 110%, which means that the strategy is much more effective in terms of borrowing.

That's why I choose 130% as my preferred collateral value in this strategy.

/9

About the 130%, we're coming back to this later in the thread where I talk about risks.

Step 6) Go to app.terraswap.io/swap and sell your 126,53 mKO to $UST. You should get 7,588 UST.

Step 7) Deposit 7,588 UST in Anchor ( 6,408 aUST).

/10

Step 6) Go to app.terraswap.io/swap and sell your 126,53 mKO to $UST. You should get 7,588 UST.

Step 7) Deposit 7,588 UST in Anchor ( 6,408 aUST).

/10

Step 8) Go to Mirror. Borrow mKO with 6,408 aUST and 130% collateral ratio. You should get 96,05 mKO.

Step 9) Sell at Terraswap for 5,768 UST. Then deposit at Anchor. Go to Mirror...

Step 10) Repeat this over and over again until you don't have more funds.

/11

Step 9) Sell at Terraswap for 5,768 UST. Then deposit at Anchor. Go to Mirror...

Step 10) Repeat this over and over again until you don't have more funds.

/11

If you started this strategy by putting $10K into Anchor you should end up with this number of $UST and mKO shares:

$UST: 10K + 7,58K + 5,76K + 4,36K + 3,3K + 2,5K + 1,89K + 1,44K + 1,09K + 0,82K + 0,62K + 0,47K + 0,35K + 0,27K =

40,4K UST (4x leverage)

/12

$UST: 10K + 7,58K + 5,76K + 4,36K + 3,3K + 2,5K + 1,89K + 1,44K + 1,09K + 0,82K + 0,62K + 0,47K + 0,35K + 0,27K =

40,4K UST (4x leverage)

/12

mKO: 126,53 + 96,05 + 72,76 + 55,12 + 41,76 + 31,63 + 23,96 + 18,15 + 13,75 + 10,42 + 7,89 + 5,98 + 4,53 + 3,43 =

511,96 mKO

This sounded complex, right? It's actually much easier once you first do it.

/13

511,96 mKO

This sounded complex, right? It's actually much easier once you first do it.

/13

Secondly, if you already have a lot of money in Anchor Protocol but only want to try the strategy as if you had $10K, then it's much better to just borrow 511,96 mKO directly, and sell it on Terraswap in two steps (easier) and you will save fees.

/14

/14

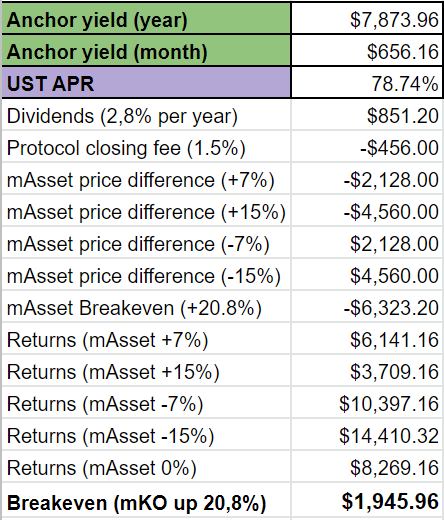

The returns for running this strategy:

Let me explain the figure above.

What we want to compare with is the normal return from Anchor Protocol which is 19,5% APY.

I've not included 15 UST gas fees in total to open these positions, but I've included the 1,5% closing fee.

/15

Let me explain the figure above.

What we want to compare with is the normal return from Anchor Protocol which is 19,5% APY.

I've not included 15 UST gas fees in total to open these positions, but I've included the 1,5% closing fee.

/15

By looping our aUST and mKO several times we end up with a 4x leverage and an effective APY of 82,69% if mKO stays flat (in other words the return of Coca Cola is 0% from the date you borrowed the asset).

/16

/16

If Coca Cola increases by 15% per year, your return would be $3,709 which equals a 37% return on your $10K.

Almost double of what you could get in Anchor even if Coca Cola is up 15%.

Very good!

/17

Almost double of what you could get in Anchor even if Coca Cola is up 15%.

Very good!

/17

Breakeven is if mKO goes up 20,8%.

Then you would be equally good by having your money in Anchor Protocol.

If Cola is up more than that, obviously you would lose money compared to having them in Anchor Protocol.

/18

Then you would be equally good by having your money in Anchor Protocol.

If Cola is up more than that, obviously you would lose money compared to having them in Anchor Protocol.

/18

On the flip-side, if Cola goes down 7% your return would be 103%. And if Cola is down 15% your return would be 144%.

$KO pays dividends which is great for our short strategy.

At the moment $KO pays out $0.42 per share 4 times per year.

/19

$KO pays dividends which is great for our short strategy.

At the moment $KO pays out $0.42 per share 4 times per year.

/19

This means that the $KO price will be $0.42 lower every quarter (equals a 0.7% free short). The current price of mKO is $60.

/20

/20

Liquidation: You have a collateral ratio of 130%, and a liquidation at 110% which means that you will be liquidated if mKO (Cola) increases by 15% in value in one day.

If mKO goes down in value, your collateral ratio gets healthier (good).

/21

If mKO goes down in value, your collateral ratio gets healthier (good).

/21

If you want to be a little safer you can set the collateral ratio to 160%.

With a collateral ratio of 130% it is very important that you monitor it daily to see if $KO doesn't go up more than 15% in one day.

A good thing is that your collateral ratio should be...

/22

With a collateral ratio of 130% it is very important that you monitor it daily to see if $KO doesn't go up more than 15% in one day.

A good thing is that your collateral ratio should be...

/22

healthier as time goes. Because your collateral (aUST) increases by 19,5% per year.

So if you started with 130% collateral, your ratio should be 149,5% one year later (if Cola returns 0%). If Cola returns 19,5% too then your collateral ratio is still 130%.

/23

So if you started with 130% collateral, your ratio should be 149,5% one year later (if Cola returns 0%). If Cola returns 19,5% too then your collateral ratio is still 130%.

/23

Also, remember we started our strategy with $15K, but we've only used $10K?

That is because in case your collateral value is decreasing, you could at any time use your $5K to refill the collateral.

You do this at My page --> Manage (see screenshot below).

(cont. below)

/24

That is because in case your collateral value is decreasing, you could at any time use your $5K to refill the collateral.

You do this at My page --> Manage (see screenshot below).

(cont. below)

/24

Right now my personal collateral value is 129,5%, so if I wanted to increase it I could just put in some aUST (the $5K UST from Anchor that I haven't used to anything yet).

Couldn’t you just have a 200% collateral ratio of 160% on mKO to make it safer? Yes, you could.

/25

Couldn’t you just have a 200% collateral ratio of 160% on mKO to make it safer? Yes, you could.

/25

But the lower your collateral ratio, the lower the APY.

This is an active strategy that you have to monitor daily.

Do you really need the extra $5K? No. You could use all your $15K.

But at least you need to have cash on the side in case you have to refill your short.

/26

This is an active strategy that you have to monitor daily.

Do you really need the extra $5K? No. You could use all your $15K.

But at least you need to have cash on the side in case you have to refill your short.

/26

Oracle price risk:

mKO gets their price from oracles. What if the oracle shows the wrong price and that leads to a liquidation of your asset.

I don't think this will happen, but it should anyway be listed as a risk.

/27

mKO gets their price from oracles. What if the oracle shows the wrong price and that leads to a liquidation of your asset.

I don't think this will happen, but it should anyway be listed as a risk.

/27

Anchor Protocol risk:

If the APY of Anchor gets lower, then the yield will get lower in this strategy too.

Smart contract risk and peg-risk:

This could happen with any DeFi protocol.

Read more about these two risks here:

/28

If the APY of Anchor gets lower, then the yield will get lower in this strategy too.

Smart contract risk and peg-risk:

This could happen with any DeFi protocol.

Read more about these two risks here:

https://twitter.com/Route2FI/status/1442835907372060681?s=20&t=IOQXD6sugMZrkvNhhSJ2Ew

/28

Liquidity:

Mirror Protocol has a total TVL of $630M. Doing strategies on this site is probably not something you want to do with $1M+.

For the mKO stock the total liquidity is $2.5M. The reason why I mention liquidity is that when you're buying/selling...

/29

Mirror Protocol has a total TVL of $630M. Doing strategies on this site is probably not something you want to do with $1M+.

For the mKO stock the total liquidity is $2.5M. The reason why I mention liquidity is that when you're buying/selling...

/29

a mAsset you will get unfavorable prices with big money.

Premium:

If you want to hedge you could eventually buy back some Cola shares when the prices are lower.

Or you could do a delta-neutral strategy by going long on Mirror/Spectrum.

/30

Premium:

If you want to hedge you could eventually buy back some Cola shares when the prices are lower.

Or you could do a delta-neutral strategy by going long on Mirror/Spectrum.

/30

If you want to learn more about how you do that, check out this thread:

/31

https://twitter.com/Route2FI/status/1454519452888969220

/31

How do you close the positions?

Before you even try this strategy you should know that there is a 1,5% closing fee.

I've also included that in the calculations. You should also estimate 10-20 UST in closing fees.

Step 1) You go to My page --> Manage --> Close

/32

Before you even try this strategy you should know that there is a 1,5% closing fee.

I've also included that in the calculations. You should also estimate 10-20 UST in closing fees.

Step 1) You go to My page --> Manage --> Close

/32

Step 2) You have to buy the number of mKO that you've borrowed

Step 3) For us, that's 511,96 mKO. So we go to trade and buy the correct number of mKO:

mirrorprotocol.app/#/trade

/33

Step 3) For us, that's 511,96 mKO. So we go to trade and buy the correct number of mKO:

mirrorprotocol.app/#/trade

/33

Step 4) You will see that the price of mKO will be higher/lower compared to when you borrowed it.

That's because $KO is a real stock that has movements in the stock market from Monday to Friday every week.

This also explains why you can end up...

/34

That's because $KO is a real stock that has movements in the stock market from Monday to Friday every week.

This also explains why you can end up...

/34

earning 144% from this strategy, or why you can end up losing money.

However, I don't think Coca Cola will increase more than 20,8% on average per year.

It's a value stock after all.

/35

However, I don't think Coca Cola will increase more than 20,8% on average per year.

It's a value stock after all.

/35

Step 5) When you've bought 511,96 mKO, go to My page --> Manage --> Close

Did you find this strategy complex?

Fear not, @rebel_defi has made a Youtube video that explains the thought process behind Mirror strategies very well step by step:

/36

Did you find this strategy complex?

Fear not, @rebel_defi has made a Youtube video that explains the thought process behind Mirror strategies very well step by step:

/36

Also a huge credit to @DrCle4n that was the first to write about degen Mirror strategies, see his write-up here:

medium.com/@Cle4ncuts/cle…

/37

medium.com/@Cle4ncuts/cle…

/37

Also a huge thanks to @Bryguydefi who mentioned mKO

I hope you learned something new in this thread.

Follow me on @route2fi if you want to learn more about DeFi, and crypto in general.

I also have a free newsletter, which you can subscribe to here: getrevue.co/profile/route2…

/38

I hope you learned something new in this thread.

Follow me on @route2fi if you want to learn more about DeFi, and crypto in general.

I also have a free newsletter, which you can subscribe to here: getrevue.co/profile/route2…

/38

If you liked this thread, I would love it if you could share it by retweeting the first tweet:

Thank you!

/39

https://twitter.com/Route2FI/status/1488557950423732225?s=20&t=8nb8dE9cpMCT9j7K0H1fTg

Thank you!

/39

• • •

Missing some Tweet in this thread? You can try to

force a refresh