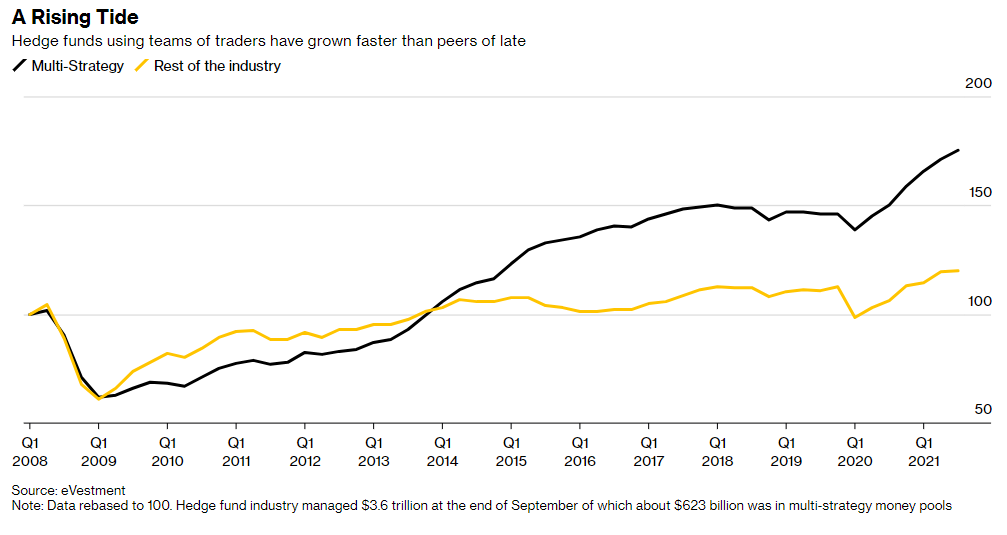

Intersting Bloomberg piece on multi-strat hedge funds and institutional allocators.

"Clients increasingly willing to pay high fees to gain access to... scores of traders who can be easily replaced. A stark contrast to old business model: Launch a fund, call the shots, profit."

"Clients increasingly willing to pay high fees to gain access to... scores of traders who can be easily replaced. A stark contrast to old business model: Launch a fund, call the shots, profit."

What do a lot of institutional allocators want? Steady returns. No blow-up risk. A risk profile that matches that of the allocator seat where upside is limited.

Similar dynamic in private equity and credit. Deploy large checks in brand names that have a portfolio of strategies = efficient due diligence. Trade fees for protection from the brand. Power law kicks in and the rich get richer.

https://twitter.com/maybebullish/status/1488300875974164484

Plight of the emerging manager.

“My strategy is not wild. I left because it was not a place for me." Onorino says raising capital is “almost mission impossible.”

“My strategy is not wild. I left because it was not a place for me." Onorino says raising capital is “almost mission impossible.”

“You’re seeing a lot of those people who try and I give them credit for trying and hanging their shingle. In some cases, they’re going to get paid more being in a place like this than even starting their own businesses.”

bloomberg.com/news/features/…

bloomberg.com/news/features/…

"Multi-strats have a low tolerance for underperformance. Those who start losing in high single digits or over extend their risk can have their assets cut at best, and at worst can be fired on the spot"

"This emphasis on rigor appeals to pension funds, foundations and endowments that have gravitated toward HFs, often without the resources to closely track what each manager’s doing. Why get on the rollercoaster with a rockstar?"

"There are only two ways to make money in business. One is to bundle, the other is to unbundle."

Ugh, linked the wrong tweet re PE🙄

https://twitter.com/bedouincap/status/1488266690211160065?t=lkvluIaQ7fdfvWh7gSG9Wg&s=19

• • •

Missing some Tweet in this thread? You can try to

force a refresh