0/ Is fear of a stablecoin depeg warranted?

In today’s Delphi Daily, we examined the narratives around MIM and UST that have been circulating Twitter.

We also analyzed @looksrareNFT compared to @opensea for volume, daily users, and average volume per user.

For more 🧵👇

In today’s Delphi Daily, we examined the narratives around MIM and UST that have been circulating Twitter.

We also analyzed @looksrareNFT compared to @opensea for volume, daily users, and average volume per user.

For more 🧵👇

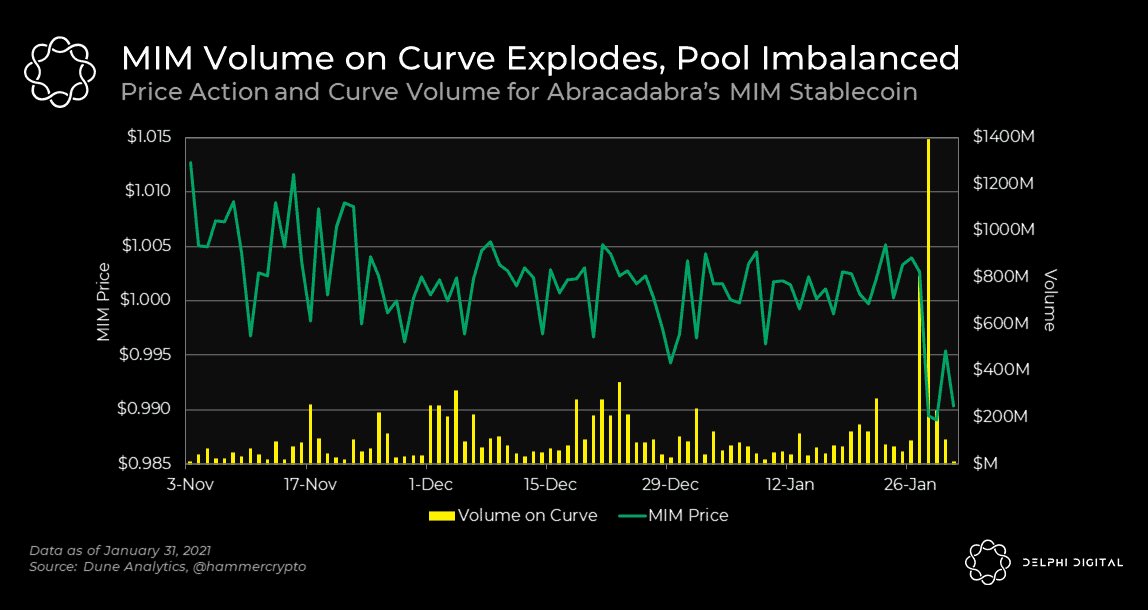

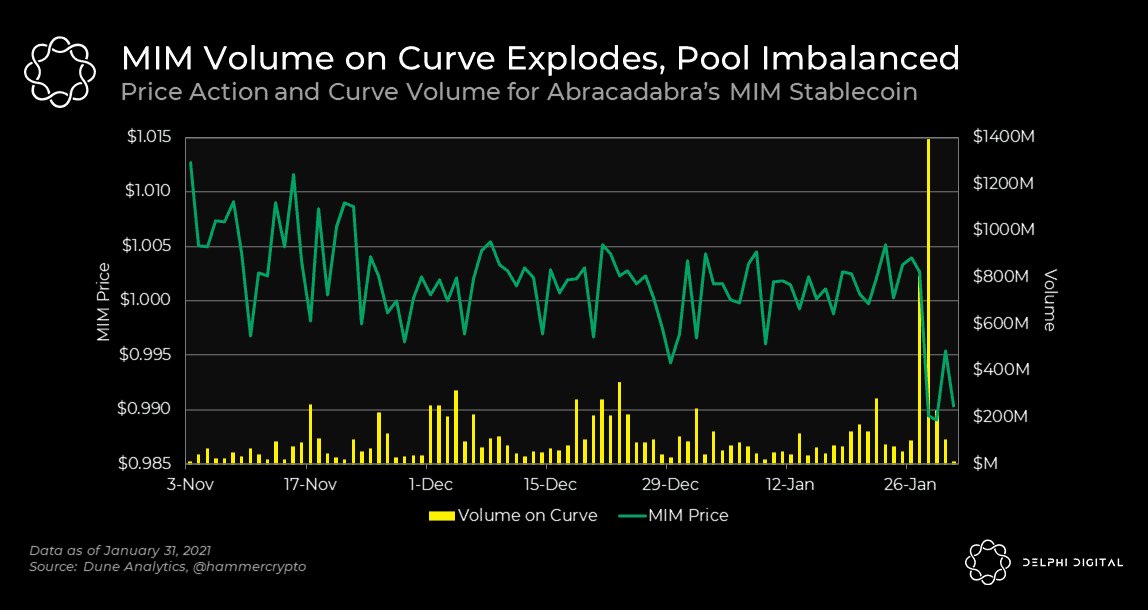

1/ MIM, the native stablecoin of Abracadabra, has been weathering a storm as of late.

MIM briefly broke its peg but recovered quite quickly.

The stablecoin’s main source of liquidity is Curve’s MIM-3CRV pool, now composed of 90.51% MIM and 9.49% 3CRV, hardly a healthy ratio.

MIM briefly broke its peg but recovered quite quickly.

The stablecoin’s main source of liquidity is Curve’s MIM-3CRV pool, now composed of 90.51% MIM and 9.49% 3CRV, hardly a healthy ratio.

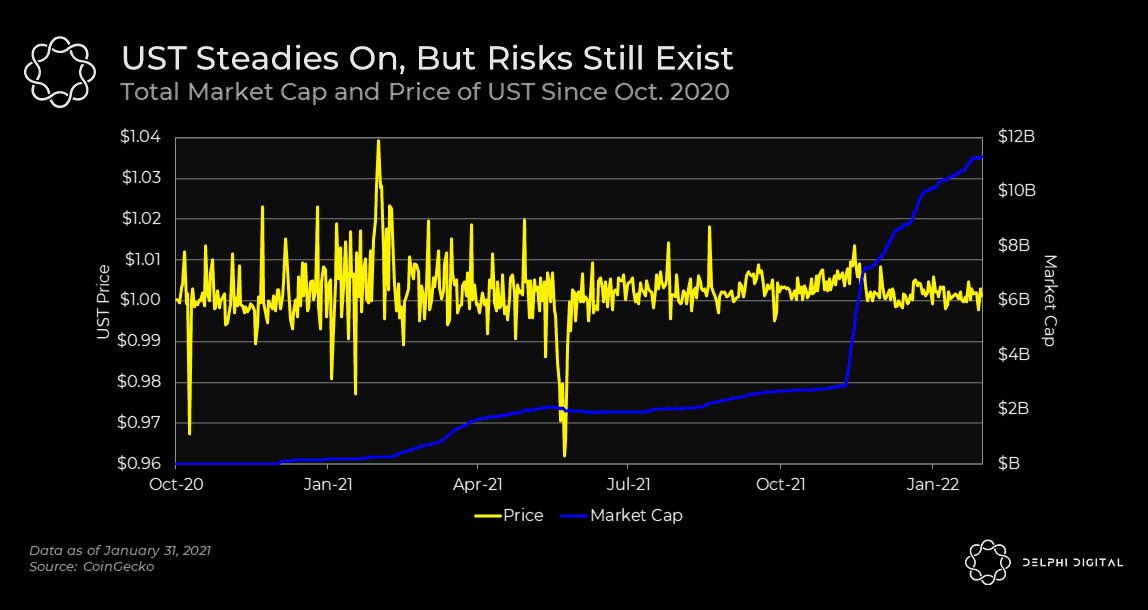

2/ The fear around MIM unwinding sparked discussion across Twitter of a potential UST depeg. But is this warranted?

Over the initial period of contagion, UST’s price never dropped below $0.995.

UST has deep liquidity and lively arbitrageurs who can ensure the peg remains sticky

Over the initial period of contagion, UST’s price never dropped below $0.995.

UST has deep liquidity and lively arbitrageurs who can ensure the peg remains sticky

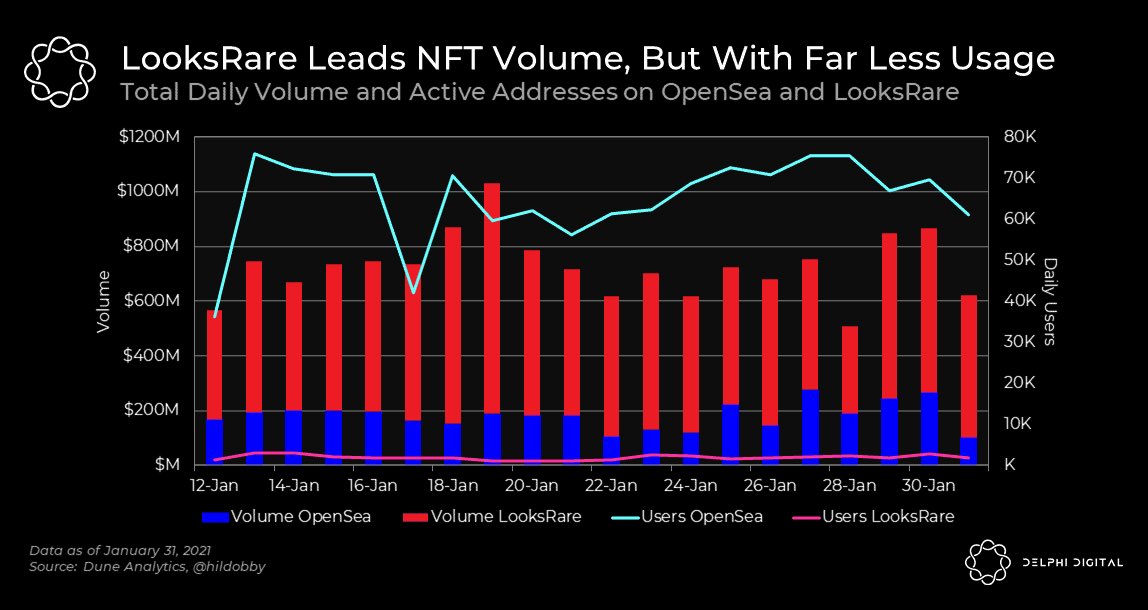

3/ Since its launch, @LooksRareNFT has a roughly 70% volume share versus OpenSea.

However, @OpenSea is accounting for 97% of daily active addresses between the two.

LooksRare has built an incentive mechanism that promotes artificial volumes to prop up its numbers.

However, @OpenSea is accounting for 97% of daily active addresses between the two.

LooksRare has built an incentive mechanism that promotes artificial volumes to prop up its numbers.

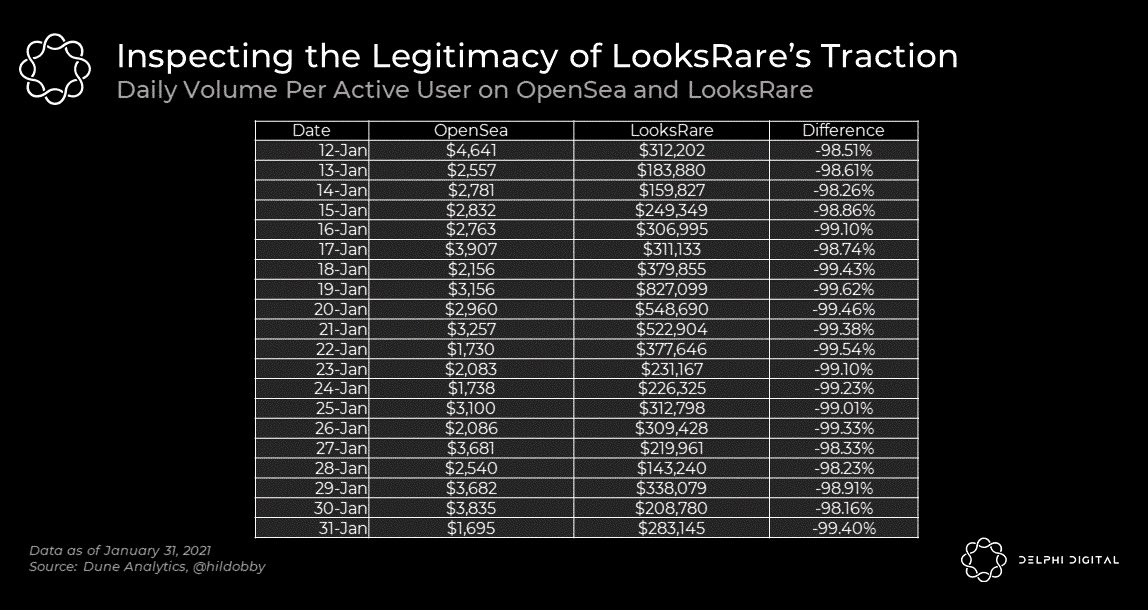

4/ When it comes to real usage, one of the best metrics is average volume per user.

It’s clear that LooksRare is dominated by wash-trading whales moving NFTs.

OpenSea’s numbers are far more realistic, and the lack of any native reward only makes their data more believable.

It’s clear that LooksRare is dominated by wash-trading whales moving NFTs.

OpenSea’s numbers are far more realistic, and the lack of any native reward only makes their data more believable.

5/ Tweets of the day!

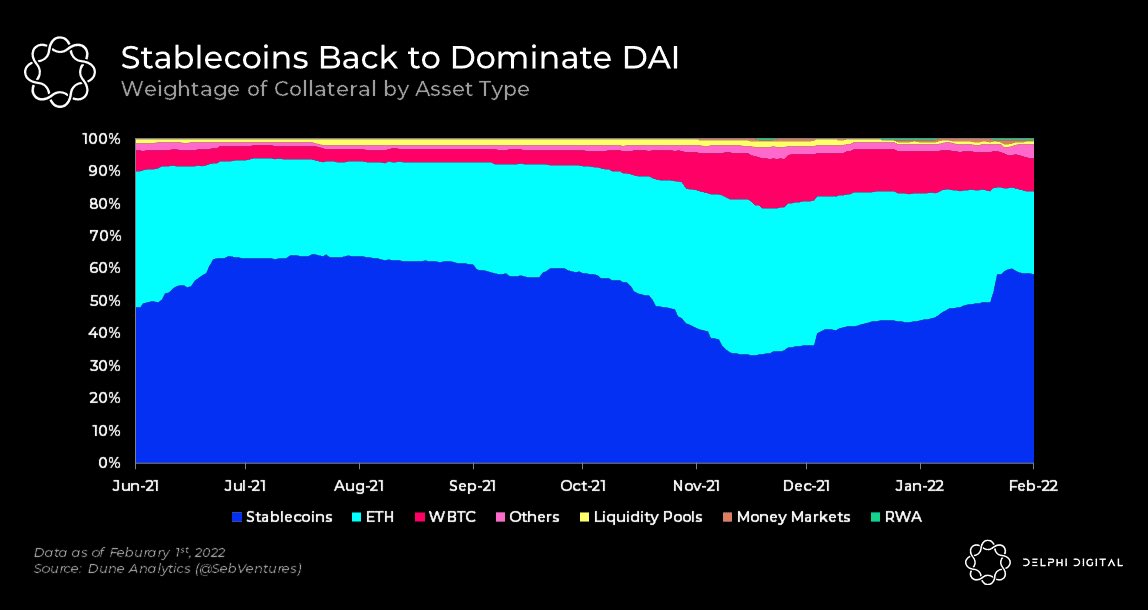

Over-collateralization isn’t the end-all solution to stablecoin pegs

Over-collateralization isn’t the end-all solution to stablecoin pegs

https://twitter.com/spreekaway/status/1487872355015745541

9/ Crypto moves fast. Delphi has you covered. Sign up here to get Delphi's free daily newsletter delivered right to your inbox every weekday

delphidigital.io/daily/

delphidigital.io/daily/

• • •

Missing some Tweet in this thread? You can try to

force a refresh