The Jan. number for EA inflation of 5.1% was a significant surprise against the average of market forecasts of 4.4%. One month outcome is, of course, not enough to justify an immediate substantial revision of projections, but a preliminary rethinking is warranted, 1/14

The expected base effect, related to oil and energy prices commanding inflation, did not materialise in Jan. The oil price went beyond a mere recovery from the 2020 sharp decline, with Brent already over $90. Gas prices instability reflected geopolitics 2/

Germany hastily opted to dismantle its nuclear power plants to go heavily into natural gas, pushing Europe in the same direction, becoming progressively dependent on Russia, an untrustworthy supplier. Europe even built excessive import capacity 3\

The very recent drop in natural gas prices in Europe happened after the US promised to find sufficient supply for Europe in case of further tensions with Russia over Ukraine. This may change, and surely, energy prices will determine the course of inflation this year. 4\

If energy prices don´t decrease soon, the natural delay of several months for primary prices to influence wholesale and retail prices implies that inflation will stay for longer persistently high. For policy decisions, though, other factors have to be considered.5\

A high degree of uncertainty prevails now. The ongoing worldwide deceleration of growth will impact energy imports and their prices. The IMF just reduced growth predictions by 0.4 p.p for the EA and 1.2 p.p. for the US. Ukraine tensions may abate, etc.. 6\

The ECB has it more difficult than other CBs, as EA inflation has been determined so far by supply shocks and not by big increases in aggregate demand or wages. In the absence of visible second-round effects, monetary policy must react cautiously. It´s different for the FED.6\

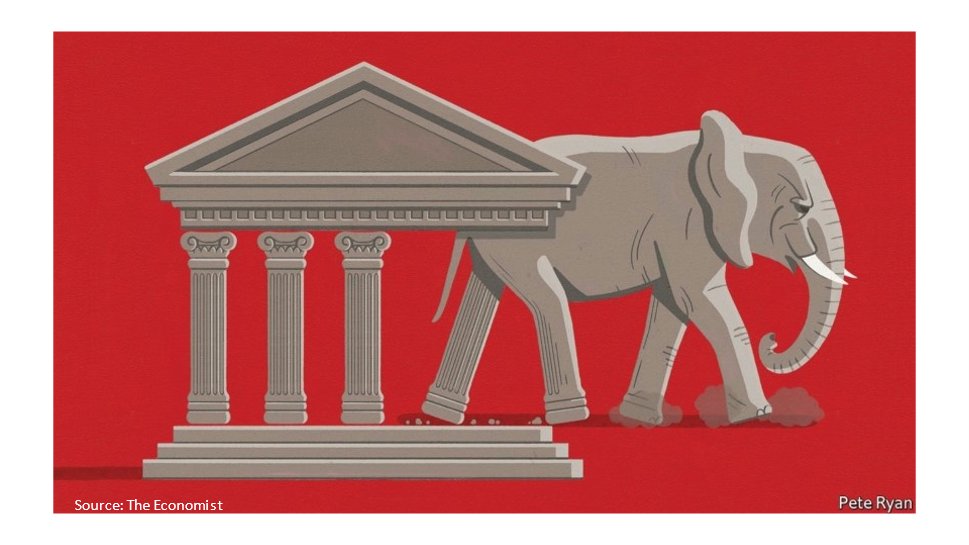

Yesterday, the ECB kept its policy instruments on hold but opening the door to all possibilities led to a quite hawkish reading by the markets. However, the ECB has formal commitments and substantive reasons that justify acting cautiously. 7\

First, there is a commitment to sequencing securities purchases and rate moves, with purchases to end shortly before changing interest rates. Yesterday it confirmed the sequencing and the plan to purchase € 270 bn until the end of the year. 8\

So, to contemplate policy rates moves, it should start by accelerating but keep to some degree the gradual winding down of QE. Moving rates soon and ending at the same time all purchases would not be prudent as it would risk instability. 9\

The second formal commitment is the forward guidance on interest rates, approved last July and reaffirmed by the ECB President yesterday. The three well-known criteria will have to be met, and they imply projections for 2033/2024 at 2% or higher. Still not certain.10\

The substantive reasons to act cautiously are the high uncertainty (already addressed) and the different nature of the inflation dynamics in the EA. The dependency on energy and supply shocks may change if those drivers abate later in the year. No one knows either way but... 11\

The possibility exists of a sharp change, and if the happens, strong policy action early on will not change the course of inflation this year, but it would unnecessarily aggravate the ongoing growth deceleration when the EA recovery is not yet complete (see chart) 12\

The present trade-offs are not easy to navigate. No one really knows how events will develop in the next few months, let alone the next few years. As W. Brainard said long ago (1967), facing uncertainty in the models and projections, policy should “do less”. 13\

However, Central Banks must be forward-looking and therefore must use models and projections, adding, of course, some judgement. As Alan Blinder (1998) wrote, “looking out the window”, seeing the temperature, and deciding, is a very bad strategy for monetary policy. 14\14.

• • •

Missing some Tweet in this thread? You can try to

force a refresh