Strategy for buying $LUNA and $ETH cheaper than market price:

Let's look at Kujira Orca and how you can buy other people's liquidated assets.

2 strategies:

1) How to buy $LUNA / $ETH at a 10% discount

2) Buy $LUNA / $ETH at a 10% discount and make an arbitrage

/THREAD

Let's look at Kujira Orca and how you can buy other people's liquidated assets.

2 strategies:

1) How to buy $LUNA / $ETH at a 10% discount

2) Buy $LUNA / $ETH at a 10% discount and make an arbitrage

/THREAD

Let's deep dive into Kujira Orca (@TeamKujira) and see why the DAO is a DeFi-protocol that both benefits the users and the Terra Ecosystem.

Kujira Orca is a protocol that is built on Terra to protect the $UST-peg and consequently the price of $LUNA.

/1

Kujira Orca is a protocol that is built on Terra to protect the $UST-peg and consequently the price of $LUNA.

/1

A bi-effect of this is that we (the users) can snag cheap $LUNA or $ETH.

So what is it, and how does it work?

First of all, Terra is built around Anchor Protocol (the savings protocol where you can get 19,5% APY).

To understand Kujira, we have to understand Anchor Protocol

/2

So what is it, and how does it work?

First of all, Terra is built around Anchor Protocol (the savings protocol where you can get 19,5% APY).

To understand Kujira, we have to understand Anchor Protocol

/2

I've written a lot of threads about Anchor and their savings products, but what I haven't mentioned too often is that you can borrow $UST by using your $LUNA or $ETH as collateral.

Why is this important for Kujira? You'll get the answer soon. Hang on, anon.

/3

Why is this important for Kujira? You'll get the answer soon. Hang on, anon.

/3

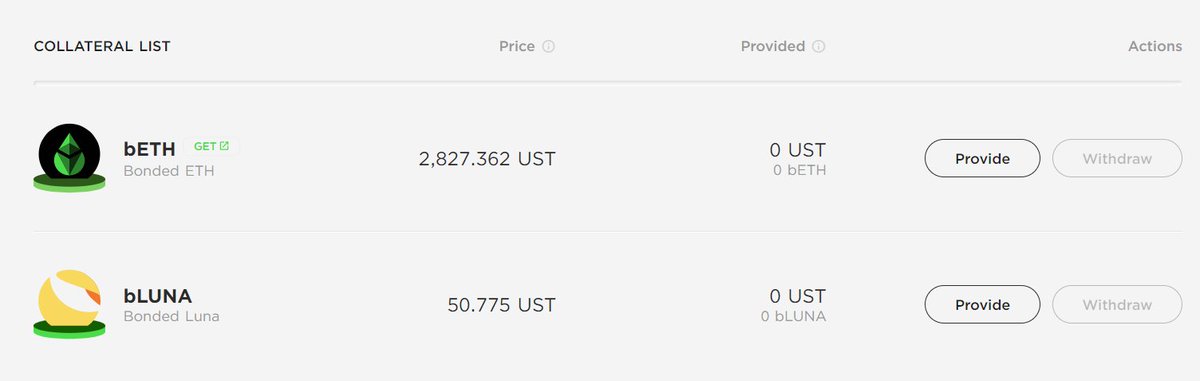

Let's look at how the borrowing on Anchor works first:

1) Go to: app.anchorprotocol.com/borrow

You will see that you have 2 different assets: bLUNA (bonded LUNA) and bETH (bonded ETH).

Why bonded? bAssets are liquid, tokenized representations of staked (bonded) assets...

4/

1) Go to: app.anchorprotocol.com/borrow

You will see that you have 2 different assets: bLUNA (bonded LUNA) and bETH (bonded ETH).

Why bonded? bAssets are liquid, tokenized representations of staked (bonded) assets...

4/

in a PoS (proof-of-stake) blockchain.

bAssets are 1:1 with the original assets' price.

2) Provide (deposit) eg. 100 bLUNA to Anchor Protocol

3) After that you may borrow a maximum of 50% of the current collateral value in $UST.

/5

bAssets are 1:1 with the original assets' price.

2) Provide (deposit) eg. 100 bLUNA to Anchor Protocol

3) After that you may borrow a maximum of 50% of the current collateral value in $UST.

/5

From the screenshot below we see that the current price of bLUNA is $50.77.

Since we have 100 bLUNA it means our collateral value is: 100 x 50.77 = $5,077.

50% of that is $2,539 (this is what we maximum can borrow).

/6

Since we have 100 bLUNA it means our collateral value is: 100 x 50.77 = $5,077.

50% of that is $2,539 (this is what we maximum can borrow).

/6

4) Let's say we borrow 50% which equals $2,539 UST.

What is the risk?

At the moment the liquidation threshold is at 60% which means that if our collateral decreases from $2,539 to $2,031 we will be flagged for liquidation (100-60)/100 x 5,077 = $2,031.

/7

What is the risk?

At the moment the liquidation threshold is at 60% which means that if our collateral decreases from $2,539 to $2,031 we will be flagged for liquidation (100-60)/100 x 5,077 = $2,031.

/7

For this to happen the price of bLUNA has to decrease from $50,77 to $40,61.

However, it's worth mentioning that the LTV most likely will increase to 80% soon. You can read more about this here:

app.anchorprotocol.com/poll/15

But for now, let's use 60% LTV.

/8

However, it's worth mentioning that the LTV most likely will increase to 80% soon. You can read more about this here:

app.anchorprotocol.com/poll/15

But for now, let's use 60% LTV.

/8

5) Okay, let's now pretend that the price of $LUNA hits $40 and your bLUNA is in danger of being liquidated from Anchor Protocol to repay the loan.

So they need to find buyers for the bLUNA collateral.

/9

So they need to find buyers for the bLUNA collateral.

/9

6) Instead of letting bLUNA out on the open market, bLUNA is "sent" to Kujira Orca where people like you and me can bid on these liquidations.

First of all, why would be bother buying bLUNA or bETH at Kujira instead of buying it at the spot market?

10/

First of all, why would be bother buying bLUNA or bETH at Kujira instead of buying it at the spot market?

10/

The buyer of the collateral needs an incentive as well.

So Anchor Protocol is willing to sell bLUNA / bETH at a discount to the market value to trigger people to buy it immediately.

The size of the discount (premium) depends on what people are willing to pay.

/11

So Anchor Protocol is willing to sell bLUNA / bETH at a discount to the market value to trigger people to buy it immediately.

The size of the discount (premium) depends on what people are willing to pay.

/11

This is where Kujira Orca comes into the picture.

Now that we understand the basics, it's about time to see how the protocol works and how we can profit from it.

/12

Now that we understand the basics, it's about time to see how the protocol works and how we can profit from it.

/12

At Kujira, they believe that everyone deserves to be a whale.

"Be a killer whale and beat the bots at their own game."

Kujira Orca is a platform that enables any user to bid on collateral liquidated with any amount of UST you'd like.

/13

"Be a killer whale and beat the bots at their own game."

Kujira Orca is a platform that enables any user to bid on collateral liquidated with any amount of UST you'd like.

/13

How can you earn money with Kujira Orca?

On Kujira, you place bids to buy the liquidated collateral (bLUNA or bETH) for a discount of 0-30%.

The liquidated collateral will be sold at the lowest discount (0%) first, then...

14/

On Kujira, you place bids to buy the liquidated collateral (bLUNA or bETH) for a discount of 0-30%.

The liquidated collateral will be sold at the lowest discount (0%) first, then...

14/

going all the way up to 30% until all the necessary collateral has been liquidated.

Is it likely to get a 30% discount?

Probably not. Let's see why.

/15

Is it likely to get a 30% discount?

Probably not. Let's see why.

/15

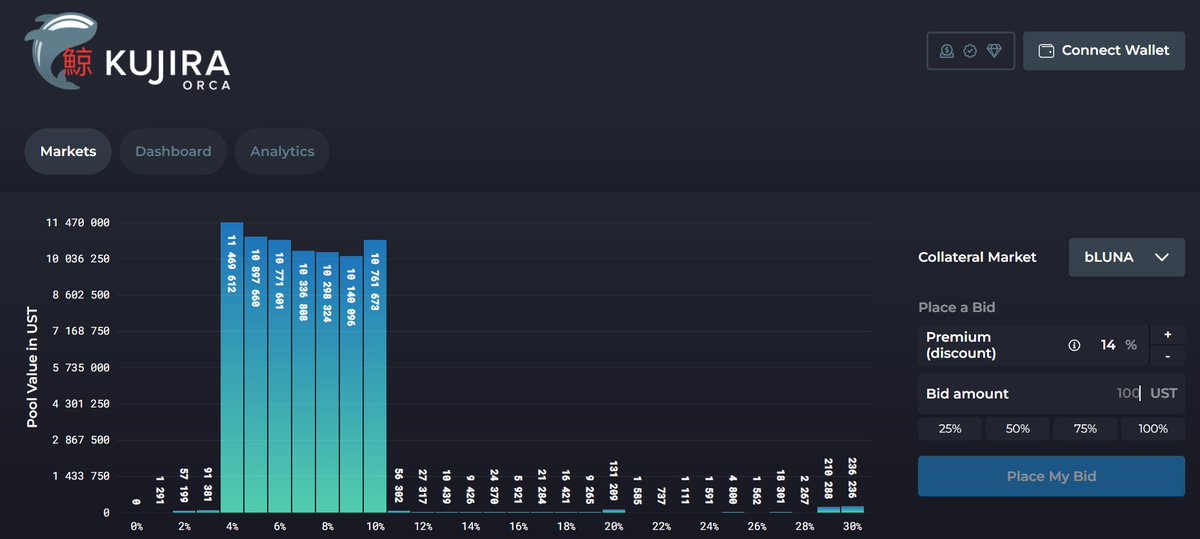

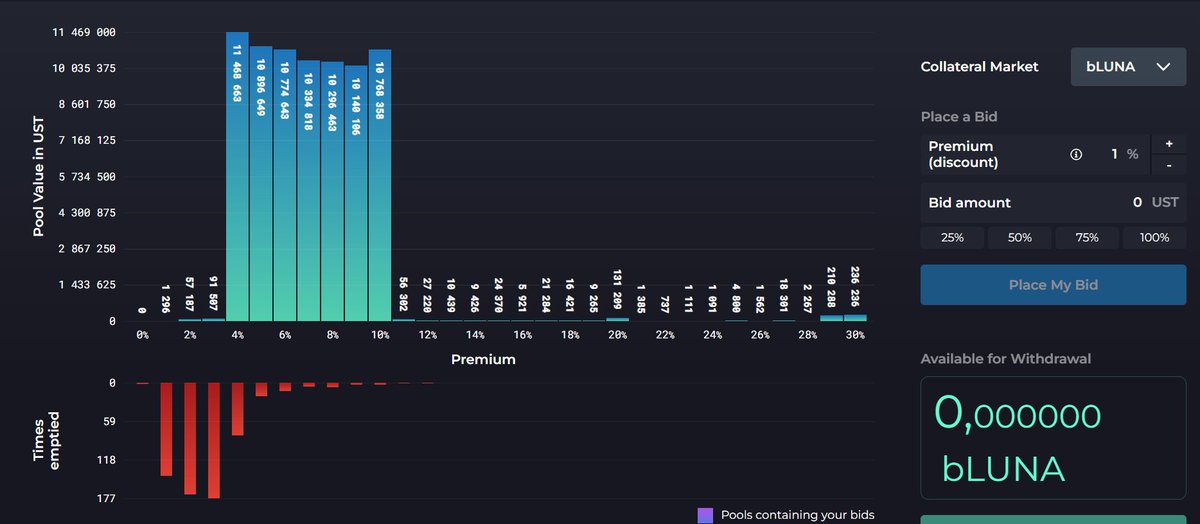

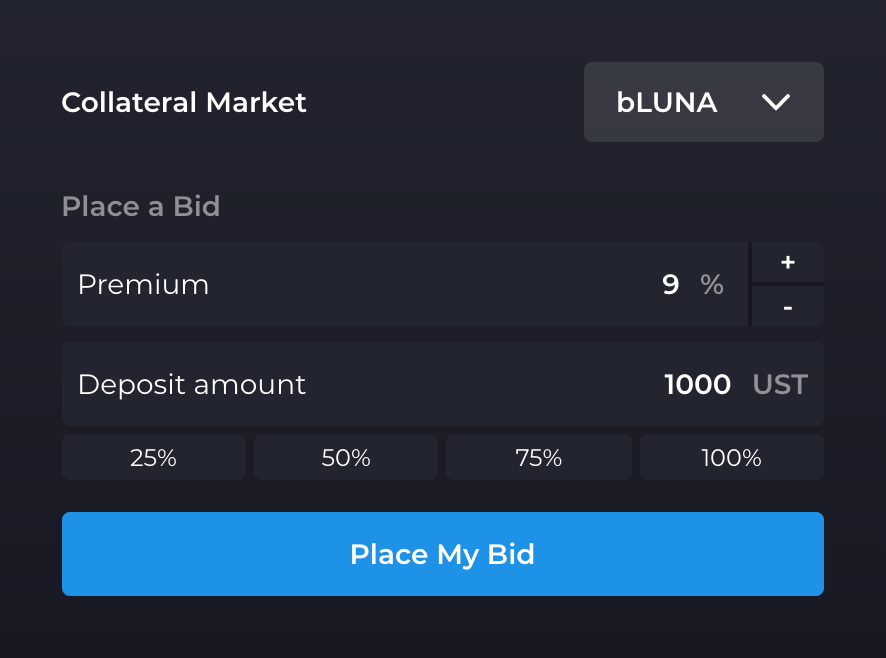

Look at the figure below.

The blue/green pillars show people's bids from 0-30% premium (meaning how much cheaper than the spot price they're willing to pay for bLUNA).

You can see that there are most bids between 4-10% premium.

Why?

/16

The blue/green pillars show people's bids from 0-30% premium (meaning how much cheaper than the spot price they're willing to pay for bLUNA).

You can see that there are most bids between 4-10% premium.

Why?

/16

As I mentioned, the liquidated collateral will be sold at the lowest discount (0%) first, then going all the way up to 30% until all the necessary collateral has been liquidated

In other words, the people with the 1% premium bid will be filled before all the 2% premium bids

/17

In other words, the people with the 1% premium bid will be filled before all the 2% premium bids

/17

The 2% bids will be filled before all the 3% bids, etc.

Right now there are $11,4M UST bids at 4% on bLUNA and $10.8M bids at 5%.

So $11.4M UST in bLUNA needs to be bought from Kujira at 4% before people can get a 5% premium.

/18

Right now there are $11,4M UST bids at 4% on bLUNA and $10.8M bids at 5%.

So $11.4M UST in bLUNA needs to be bought from Kujira at 4% before people can get a 5% premium.

/18

Also, can you see the red bars?

That's the number of times the pools have been emptied (all liquidations have been filled).

The higher the premium, the less likely is it that your bid gets filled. You would probably need a serious bear market for that.

/19

That's the number of times the pools have been emptied (all liquidations have been filled).

The higher the premium, the less likely is it that your bid gets filled. You would probably need a serious bear market for that.

/19

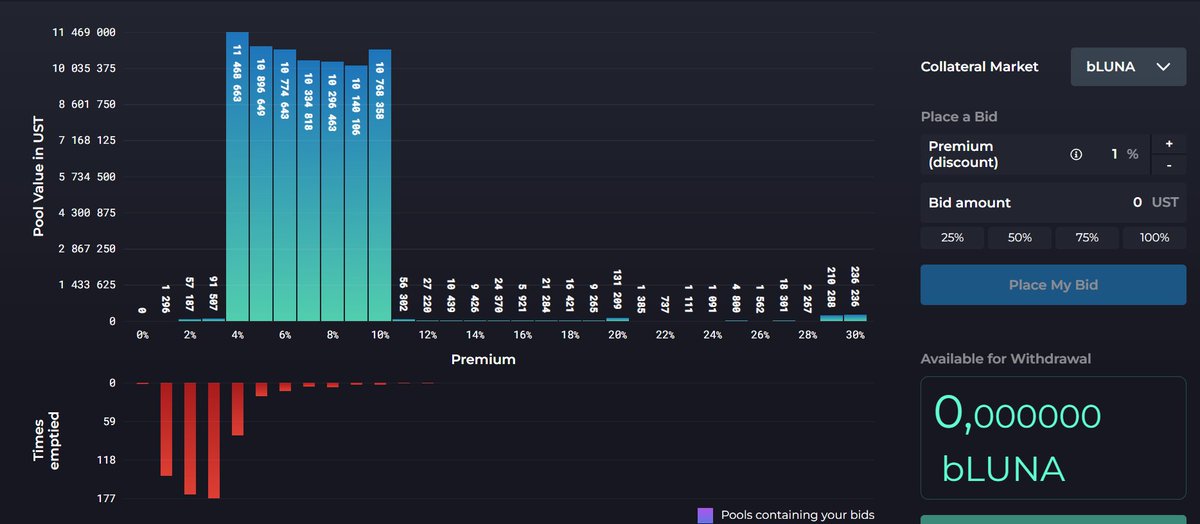

Enough theory, let's see how we can get some cheap bLUNA or bETH:

1) Go to: orca.kujira.app and connect your wallet

2) Let's say you wanted to bid $1,000 UST on bLUNA with a 9% premium.

However, there is no minimum bid, so try it with $10 if you'd like.

/20

1) Go to: orca.kujira.app and connect your wallet

2) Let's say you wanted to bid $1,000 UST on bLUNA with a 9% premium.

However, there is no minimum bid, so try it with $10 if you'd like.

/20

3) Click the button "place my bid"

4) After you've placed the bid you have to wait 10 minutes and then press "activate bid". Why? To prevent bots from abusing the system.

5) Then you just have to wait until someone is liquidated.

/21

4) After you've placed the bid you have to wait 10 minutes and then press "activate bid". Why? To prevent bots from abusing the system.

5) Then you just have to wait until someone is liquidated.

/21

Liquidations are likely when the asset prices fall, or when borrowers have high LTV.

What's the opportunity cost of having UST sitting in Kujira Orca waiting for bids to get filled?

Well, you could have your money in Anchor Protocol instead earn 19,5% for you.

/22

What's the opportunity cost of having UST sitting in Kujira Orca waiting for bids to get filled?

Well, you could have your money in Anchor Protocol instead earn 19,5% for you.

/22

But the good thing is that Kujira Orca has thought about this too, very soon you may be able to use your aUST to bid with.

As you probably already know, aUST increases in value (yield-bearing-asset).

Kujira caps 4%, so you should make 15% APY if you're bidding with aUST.

/23

As you probably already know, aUST increases in value (yield-bearing-asset).

Kujira caps 4%, so you should make 15% APY if you're bidding with aUST.

/23

6) After your bid gets filled you can withdraw your bLUNA or bETH to your wallet.

Simply click on the green Withdraw button, confirm the transaction on your wallet, and the bASSET will be removed from Orca and placed in your wallet.

/24

Simply click on the green Withdraw button, confirm the transaction on your wallet, and the bASSET will be removed from Orca and placed in your wallet.

/24

7) You can at any time see what your average discount (premium) you've bought for at Kujira Orca.

It's also worth mentioning that there is a 1% withdrawal fee.

If you instead pay in $KUJI tokens the fee is 50% less.

/25

It's also worth mentioning that there is a 1% withdrawal fee.

If you instead pay in $KUJI tokens the fee is 50% less.

/25

This is interesting, for who wants to lose bLUNA or bETH? A great incentive for holding the $KUJI token.

In the first tweet, I talked about 2 strategies

nr. 1: buy bLUNA or bETH at a 10% discount (this is basically what we've done above step-by-step).

/26

In the first tweet, I talked about 2 strategies

nr. 1: buy bLUNA or bETH at a 10% discount (this is basically what we've done above step-by-step).

/26

If the price of bLUNA is 50,77 and you buy it for a 10% discount, you paid $45,69 per bLUNA.

And when you withdraw you have to pay an extra 1% meaning that you actually recieve 45,23 per bLUNA (9%).

/27

And when you withdraw you have to pay an extra 1% meaning that you actually recieve 45,23 per bLUNA (9%).

/27

nr. 2: Buy bLUNA or bETH at a 10% discount and make an arbitrage:

You basically follow the procedure above step-by-step, but this time you want to sell your bLUNA or bETH to the market price immediately afterward.

/28

You basically follow the procedure above step-by-step, but this time you want to sell your bLUNA or bETH to the market price immediately afterward.

/28

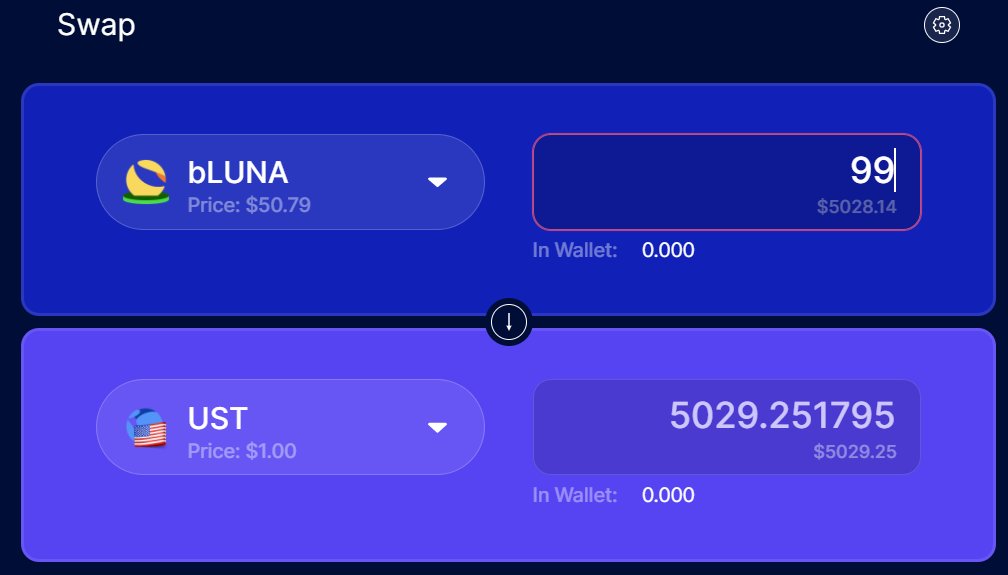

Let's look at this:

1) Example: you just bought 100 bLUNA at a 10% discount on Kujira. You paid $4,569.

You withdraw from Kujira to your Terra wallet and pay a 1% fee.

You now have 99 bLUNA in your wallet (worth 99 x 50,77 = $5,026).

/29

1) Example: you just bought 100 bLUNA at a 10% discount on Kujira. You paid $4,569.

You withdraw from Kujira to your Terra wallet and pay a 1% fee.

You now have 99 bLUNA in your wallet (worth 99 x 50,77 = $5,026).

/29

2) We want to sell our bLUNA to UST so we have to do it on either Astroport, Terraswap, or Loop.

Example from Astroport below.

/30

Example from Astroport below.

/30

3) You use also the bot "Arbie" to see where you can get the best price for your bLUNA:

web.telegram.org/z/#5058934221

/31

web.telegram.org/z/#5058934221

/31

4) From time to time you may see that you can get a worse conversion rate for your bLUNA, in other words, it's not 1:1.

What you have to do then is to accept that you'll lose another 1% in spread and end up with a little less.

/32

What you have to do then is to accept that you'll lose another 1% in spread and end up with a little less.

/32

5) Or you could burn your bLUNA to LUNA here: app.anchorprotocol.com/basset/bluna/b…

Then you can be 100% sure that you get as many bLUNA as LUNA (1:1), and you can sell your Luna to market price.

The drawback: you have to wait 21 days

33/

Then you can be 100% sure that you get as many bLUNA as LUNA (1:1), and you can sell your Luna to market price.

The drawback: you have to wait 21 days

33/

Example of what you can do when the market is red:

/34

https://twitter.com/Route2FI/status/1475776951474348037

/34

Liquidations are likely when the asset prices fall, or when borrowers have high LTV.

This is why you should be very conservative when borrowing using crypto as collateral.

With high-volatility assets, chances of liquidation are quite high if your LTV is high.

/35

This is why you should be very conservative when borrowing using crypto as collateral.

With high-volatility assets, chances of liquidation are quite high if your LTV is high.

/35

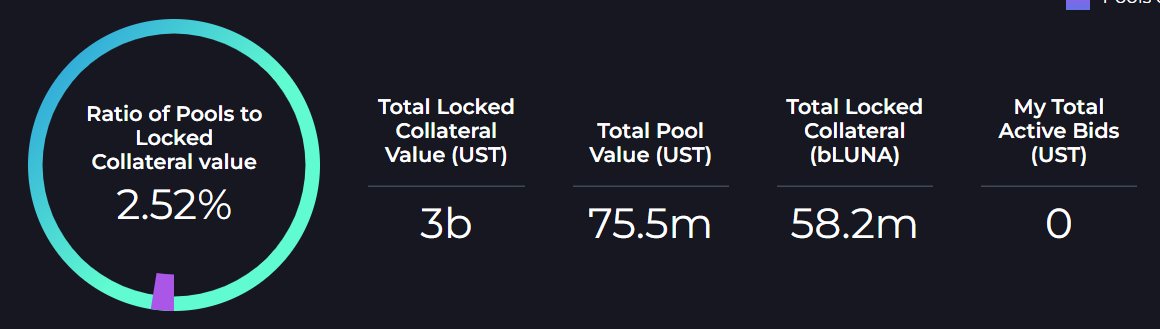

The more people that use Kujira Orca, the smaller the opportunity to get discounted assets is likely to be.

The good news though is that the pool size (total amount of people looking to buy discounted assets) is only 2,5% of the total collateral Anchor Protocol has.

/36

The good news though is that the pool size (total amount of people looking to buy discounted assets) is only 2,5% of the total collateral Anchor Protocol has.

/36

If you want to read more about the tokenomics for the $KUJI token I recommend you to check out this thread:

/37

https://twitter.com/FishMarketAcad/status/1476669500309135360

/37

@shivsakhuja also made a great thread about Kujira Orca here:

/39

https://twitter.com/shivsakhuja/status/1468635676660748293

/39

If you want access to the premium dashboard on Kujira you have to stake 300 $KUJI tokens or more.

The benefits are that you can see your real-time effective APY, tools to plan your bidding strategy to earn the most %, and historical pool data.

/40

The benefits are that you can see your real-time effective APY, tools to plan your bidding strategy to earn the most %, and historical pool data.

/40

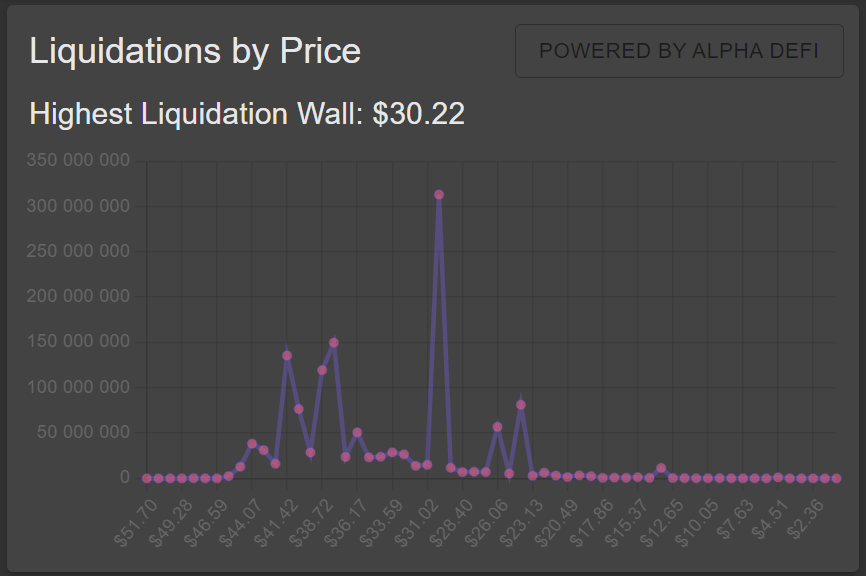

I'm not staking $KUJI myself, instead, I am using some free tools that I like.

1) Free Willy: terratoolbox.com/freewilly

In Free Willy I can check what people's liquidation levels are at for the moment. You can see that there is a big liquidation wall at...

/41

1) Free Willy: terratoolbox.com/freewilly

In Free Willy I can check what people's liquidation levels are at for the moment. You can see that there is a big liquidation wall at...

/41

approx. $30 with a worth of $300M. Also two walls at $41 and $38 on approx. $150M each.

It's worth mentioning that most of this liquidity will move downwards if the $LUNA price goes down.

Why?

Because most people log into Anchor Protocol and reduce their...

/42

It's worth mentioning that most of this liquidity will move downwards if the $LUNA price goes down.

Why?

Because most people log into Anchor Protocol and reduce their...

/42

borrow rate when the prices go down.

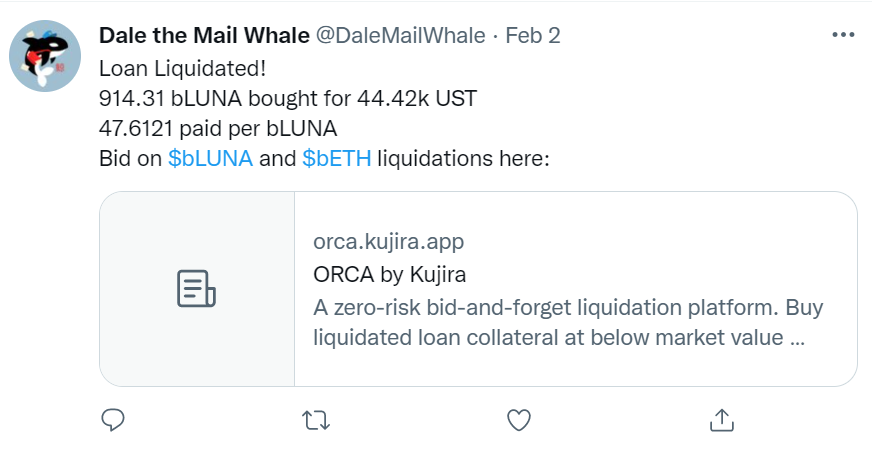

2) Liquidation stats from Dale The Mail Whale: twitter.com/DaleMailWhale

/43

2) Liquidation stats from Dale The Mail Whale: twitter.com/DaleMailWhale

/43

Personally, I use a combination of strategy 1 and 2. I stack both bLUNA and bETH, but I also enjoy doing some arbitrage trades.

/44

/44

About the risk level: Medium/Low

Risks include smart contract risk (both Anchor and Kujira Orca) and peg-risk.

It is a higher risk than Anchor alone because you're now reliant on two smart contracts instead of one.

/45

Risks include smart contract risk (both Anchor and Kujira Orca) and peg-risk.

It is a higher risk than Anchor alone because you're now reliant on two smart contracts instead of one.

/45

That was it, I hope I answered most questions, and if not feel free to comment below.

I also have a free newsletter where I break down DeFi protocols and crypto in an easy way.

Subscribe here and follow me on Twitter at @Route2FI:

getrevue.co/profile/route2…

/46

I also have a free newsletter where I break down DeFi protocols and crypto in an easy way.

Subscribe here and follow me on Twitter at @Route2FI:

getrevue.co/profile/route2…

/46

If you liked this thread, I would love it if you could share it with others by retweeting the first tweet

👇

/47

👇

https://twitter.com/Route2FI/status/1489643360298094597

/47

• • •

Missing some Tweet in this thread? You can try to

force a refresh