Good morning! Hope you have a great Lunar New Year and happy Tet! I did even if it was uneventful. First year as a mom and giving out lots of li xi. Now, back to our regular programming of daily reminder of brent 92.8/barrel and markets completely priced out negative rates in EUR

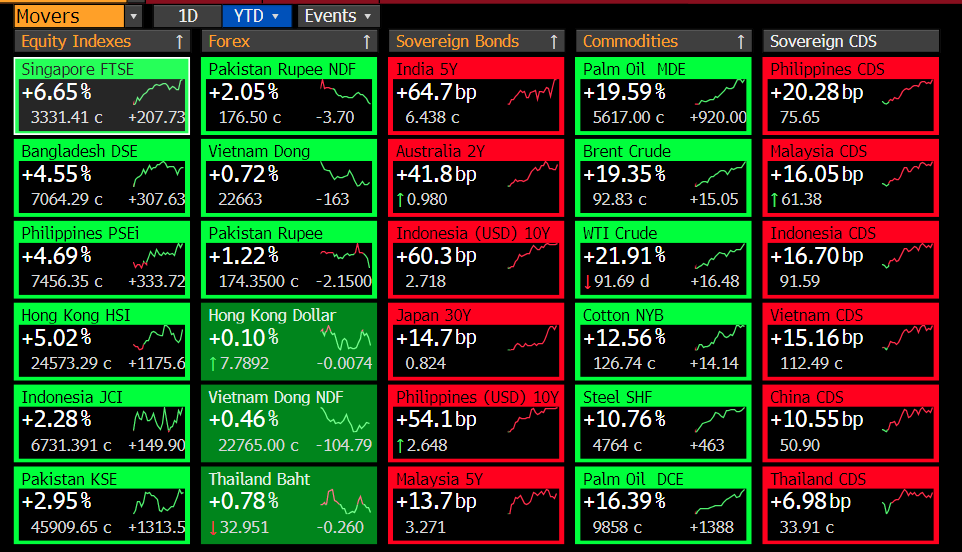

Let me put this another way, Brent crude is +19.35% so far this year and other commodities like palm oil is up too.

I hope u listened when I said you should fear inflation more than Omicron. The Scandinavians have decided that pandemic is over.

Anyway, let's stay w/ inflation.

I hope u listened when I said you should fear inflation more than Omicron. The Scandinavians have decided that pandemic is over.

Anyway, let's stay w/ inflation.

Let's look at global rates - what do you see? Or shall I say it differently, what don't you see?

NEGATIVE EUROPEAN RATES, esp BUND.

Ok, why? Inflation! I told you, central banks DO NOT PROMISE YOU A ROSE GARDEN. Christine changed her tune when CPI hit 5.1%.

So did JPO at 7%

NEGATIVE EUROPEAN RATES, esp BUND.

Ok, why? Inflation! I told you, central banks DO NOT PROMISE YOU A ROSE GARDEN. Christine changed her tune when CPI hit 5.1%.

So did JPO at 7%

Let's stick with inflation again. We have US CPI out at 930pm HKT on 10 Feb and markets expect US inflation, wait for it, to INCREASE, to 7.3%YoY and core to rise to 5.9%, yes, that excludes oil and food. So everything higher!

What will Jerome Powell do?

What will Jerome Powell do?

Markets, by that I mean the bond market, are fretting this CPI release. Why? It's pricing in 50bps hike for March and for 2022 141bps.

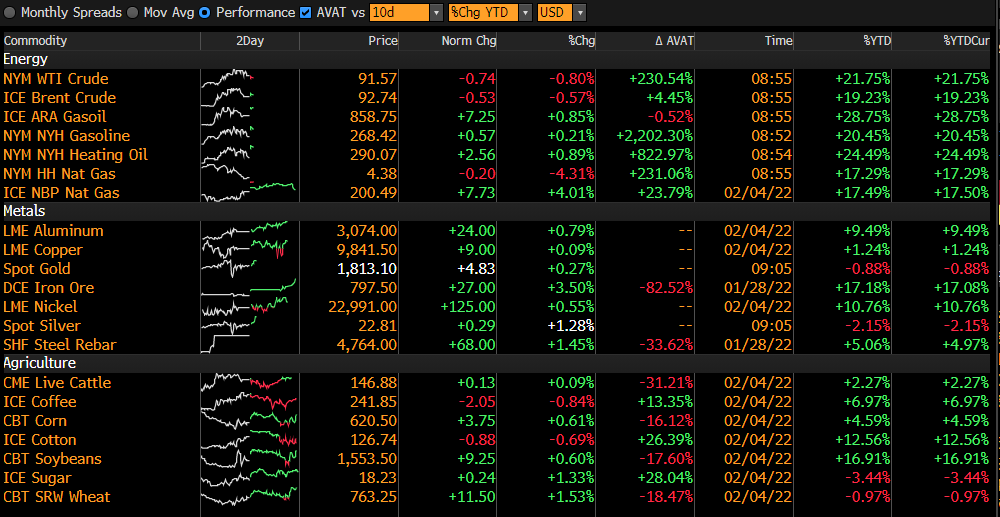

That's a lot. A lot of hikes. If we stick w/ our topic du jour, which is inflation, then what do u it will do if COMMODITY PRICES ARE UP.

That's a lot. A lot of hikes. If we stick w/ our topic du jour, which is inflation, then what do u it will do if COMMODITY PRICES ARE UP.

Should u fear inflation or Omicron? If you listen to me, then you should focus on the former not the latter. I went on every outlet that I could to beat the drum that Southeast Asia isn't going to lockdown & persist w/ endemic.

Commodity prices UP ytd! Should u fear inflation?

Commodity prices UP ytd! Should u fear inflation?

People spent a lot of effort on how high natural gas, oil etc are. But let's not forget that OTHER COMMODITIES, whether agriculture or metals, are UP!

Look at palm oil. It's up and good for Malaysia as Indonesia limits exports but BAD FOR THE WORLD & by that I mean consumers.

Look at palm oil. It's up and good for Malaysia as Indonesia limits exports but BAD FOR THE WORLD & by that I mean consumers.

Palm oil is used in everything that it's up! Do you think Unilever isn't going to raise prices?

You bet it will. If everyone raises prices, then prices get raised further as when wages go up, well, well well.

Stops being transitory and starts being pretty real.

JPO gets it.

You bet it will. If everyone raises prices, then prices get raised further as when wages go up, well, well well.

Stops being transitory and starts being pretty real.

JPO gets it.

While commodity prices are on the rise, China PMIs just show that the economy is slowing down in Q1 2022 with the composite for both state and Caixin PMIs weakening.

Monetary policy divergence between the Fed and China or rest of the world vs China where zero-Covid remains.

Monetary policy divergence between the Fed and China or rest of the world vs China where zero-Covid remains.

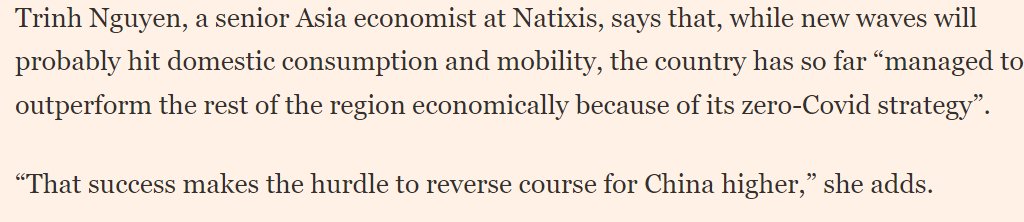

Why China is sticking to zero-Covid even if it weakens its growth, as in consumption?

“Zero-Covid success makes the hurdle to reverse course for China higher,” @Trinhnomics adds @NatixisResearch @natixis

ft.com/content/0e6914…

“Zero-Covid success makes the hurdle to reverse course for China higher,” @Trinhnomics adds @NatixisResearch @natixis

ft.com/content/0e6914…

• • •

Missing some Tweet in this thread? You can try to

force a refresh