Changing dynamics of Indian QSR(Quick Service Restaurants) Industry!!

A🧵 to understand India's QSR Industry which is the largest contributor to Indian Food Service sector!!

Like and retweet for maximum reach

#qsr #dominosindia #Mcdonalds #BurgerKing

A🧵 to understand India's QSR Industry which is the largest contributor to Indian Food Service sector!!

Like and retweet for maximum reach

#qsr #dominosindia #Mcdonalds #BurgerKing

Indian food service industry : 4.2 Tr ($58 Bn)

Expected Growth(upto 2025) : 9% 6.5 Tr by Fy25

Organized player growing faster than industry, their expected growth rate : 15%

Contribution of Organised player inc to 38% in fy20 from 29% in fy15.

Expected to go 50% in fy25

Expected Growth(upto 2025) : 9% 6.5 Tr by Fy25

Organized player growing faster than industry, their expected growth rate : 15%

Contribution of Organised player inc to 38% in fy20 from 29% in fy15.

Expected to go 50% in fy25

In the food sector, QSR and CDR (Casual Dining Restaurants) expected to see highest CAGR of 23% & 19% by fy25.

QSR also expected to see their market share in food industry to reach 54% from existing 47%.

QSR also expected to see their market share in food industry to reach 54% from existing 47%.

Now let's take a deep dive into the the changing landscape of Indian QSR Industry!!

Changing lifestyle of millennials

Frequency of eating out in Mumbai is 12 times per month, much below its benchmark Asian city at 20 per month

Changing lifestyle of millennials

Frequency of eating out in Mumbai is 12 times per month, much below its benchmark Asian city at 20 per month

Increasing population

62% of India's population are in 15-60 yr age bracket and 30% of population is under the age of 15 yr, which is much lower than China and other developed nation.

62% of India's population are in 15-60 yr age bracket and 30% of population is under the age of 15 yr, which is much lower than China and other developed nation.

Rising Middle Class of India

Middle class of India also reached to 350Mn in fy20 from 160Mn in fy11. Which is the target customer base for the qsr players.They seek better service and experience & that drive consumption.

Middle class of India also reached to 350Mn in fy20 from 160Mn in fy11. Which is the target customer base for the qsr players.They seek better service and experience & that drive consumption.

Closure of 30-40% the restaurant

Closure of unorganised players due to covid-19 leads to further customer acquisition for organised players like Domino's, McDonald's etc.

Closure of unorganised players due to covid-19 leads to further customer acquisition for organised players like Domino's, McDonald's etc.

Increase Availability of Retail Space

After huge success of food court in malls, QSR players moved to offices, high streets, hospitals etc.

more than 2m sq ft of Retail Space was estimated to be added to the Food sector in the top seven cities

After huge success of food court in malls, QSR players moved to offices, high streets, hospitals etc.

more than 2m sq ft of Retail Space was estimated to be added to the Food sector in the top seven cities

Food Delivery & Food Tech

2 Type of Biz Model:

Restaurant-to-Consumer(Order on Rest. App or website)

Platform-to-Consumer(Order on 3rd party app & delivery by them also)

2 Type of Biz Model:

Restaurant-to-Consumer(Order on Rest. App or website)

Platform-to-Consumer(Order on 3rd party app & delivery by them also)

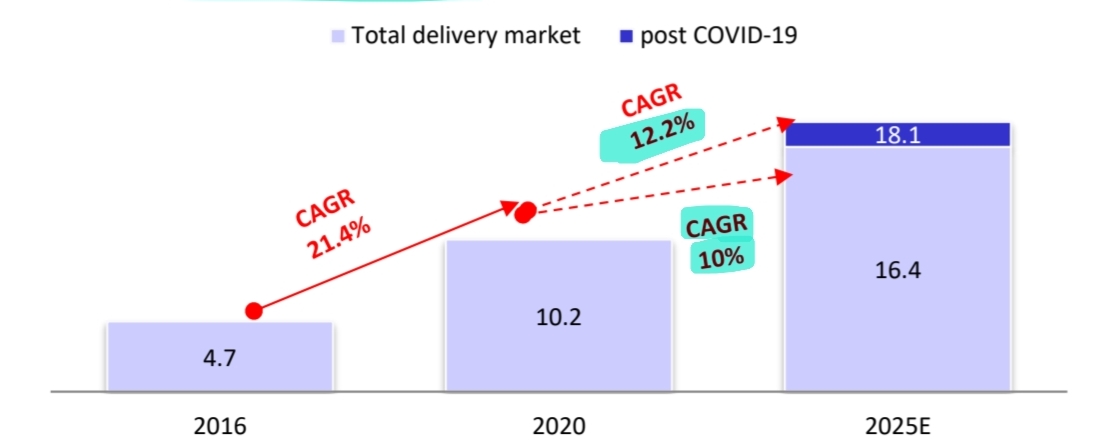

India's food Delivery market expected to grow at 12.2% to 18bn by fy25 from pre-covid estimate of 10% due to cons preference of Delivery over dine-in.

Increased focus on takeaway by QSR players due to better unit economics

Prior to covid majority of sales down via dine-in mode, but post covid, QSR players also increased their focus towards delivery due to lower space Requirements and increasing throughput.

Prior to covid majority of sales down via dine-in mode, but post covid, QSR players also increased their focus towards delivery due to lower space Requirements and increasing throughput.

Like earlier an average pizza hut outlet require 2500-3000 sq ft but now the company expanding with small format store with 600-1200 sq ft. Which lead to lower capex, lower rental, increased customer reach and topline and ultimately higher RoCE.

Wider use of Technology

Recently Devyani International (operator of KFC and Pizza hut) acquired an Australian AI player, Dragontail system, a kitchen order management and delivery technology company in Aus$ 93.5 Mn in Cash.

In every space now, technology is changing the scale.

Recently Devyani International (operator of KFC and Pizza hut) acquired an Australian AI player, Dragontail system, a kitchen order management and delivery technology company in Aus$ 93.5 Mn in Cash.

In every space now, technology is changing the scale.

Accelerated store Expansion by Organised player

Closure of several restaurants increased supply of real estate and improved industry dynamics due to delivery and tech, Organised player like Domino's(Jubi) and McD (Westlife) increasing network guidance from 2k to 3k & 800 to 1k.

Closure of several restaurants increased supply of real estate and improved industry dynamics due to delivery and tech, Organised player like Domino's(Jubi) and McD (Westlife) increasing network guidance from 2k to 3k & 800 to 1k.

These are multiple factors that are changing the dynamics of the QSR sector of India.

Src- MOSL

Now Tell us,

In Which QSR company you are investing or already invested?

Src- MOSL

Now Tell us,

In Which QSR company you are investing or already invested?

Detailed Analysis on QSR Industry

Industry Size & Oppertunity

Factors changing the dynamics of QSR Space

Small Format Stores and Technology changing the Industry

How Loss Making QSR companies becoming profitable?

#QSR

#Zomato

#Mcdonalds

#Dominos

#Bking

Industry Size & Oppertunity

Factors changing the dynamics of QSR Space

Small Format Stores and Technology changing the Industry

How Loss Making QSR companies becoming profitable?

#QSR

#Zomato

#Mcdonalds

#Dominos

#Bking

• • •

Missing some Tweet in this thread? You can try to

force a refresh