ok, it's started. if you're interested in Facebook accountability, you don't want to miss this. Judge already just told the plaintiffs to "file a motion for sanctions" because "Facebook's discovery conduct has been sanctionable." More coming... /1

https://twitter.com/jason_kint/status/1491932839880933384

holy $%&!, Judge has already said he thinks the partners at Gibson Dunn should also be sanctioned. "The plaintiffs should be rewarded all costs and plaintiffs fees on the discovery issues which Facebook has been stonewalling." /2

(note to press, if you cover Facebook and you're not watching this hearing, I am sorry. I tried to warn you). /3

Judge just once again invited plaintiffs to file for sanctions and said if the plaintiffs choose not to also sanction the partners at their law firm then he'll want to know why not. /4

mark zuckerberg, sheryl sandberg, their board and leadership team owe Sandeep Solankin who is taking one for the team on their multiyear cover-up. He's up now. /5

Judge told Solanki he has to attend all status conferences, he's required to attend all mediation sessions with Special Master, and to make a final decision on FB's behalf in all mediation sessions. If he needs to run anything up the flagpole then the flagpole needs to attend. /6

Judge also said not only does every person above Solanki required for a decision need to be in attendance but if Facebook doesn't make a decision at the session then Facebook will be sanctioned. If it changes after the session, Facebook will also be sanctioned. Brutal. /7

Judge: "Anything else we can discuss today? Because this case is going to get moving...it's been moving too slow... starting today, I will hear any appeals from the Special Master...this case is gong to be moving a lot faster." /8

Facebook's legal team has to turn over all documents from the App Developer Investigation within 21 days. And within all discovery, any doubts, should be turned over to the plaintiffs. /9

Court also said to take any depositions now. It's Facebook's fault that things have been delayed. And if the plaintiffs need to depose anyone twice from Facebook then they'll be able to do that. /10

OK, it's ended. I've never seen a company and it's very top lawyers/firm get scorched by a Judge like that one. I suggested popcorn but in all honesty I didn't expect the show to be that good. Anyone else who watched please feel free to share your observations. /11

I'll add this older thread to end if anyone wants to dive deeper on this case and its importance. Ultimately it gets to the heart of the entire timeline (part of a shareholder suit in Delaware, too) and testimony to Congress (hence the role of @aoc). /12

https://twitter.com/jason_kint/status/1473172762311237633?s=20&t=WKzFFEnk9nNjjGYOaE7Jpw

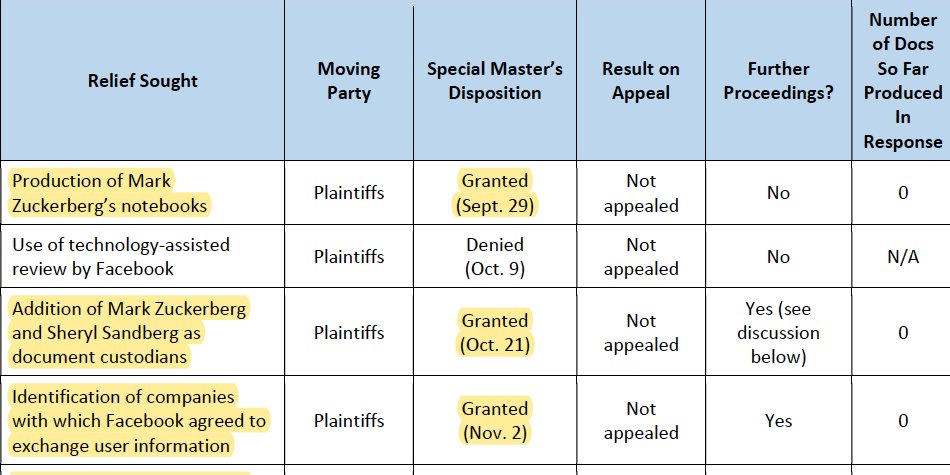

Also adding this to the end as it gets a little deeper into the Sandberg and Zuckerberg discovery ordered from Jan 1, 2007 to Dec 31, 2019.

https://twitter.com/jason_kint/status/1484322614923255810?s=20&t=9oZ3h_5TYIN36nek7J4u0w

Orders posted. "The Court invited the plaintiffs to file a motion for sanctions against defendants and their attorneys regarding their conduct throughout the discovery process. Motions for Sanctions due by 2/24/2022. The 15 page limit for motions is waived for this motion." /13

Also this new denial from the Special Master compelling Facebook to turn over the "Facebook Secret Sauce" Report including all iterations of it. /14

It’s worth adding in addition to Facebook leadership, Gibson Dunn all being likely uncomfortable with tonight’s hearing, I expect people at Stroz Friedberg and FTI Consulting also must be super uncomfortable as all of the docs from their “investigations” are due in 21 days. /15

• • •

Missing some Tweet in this thread? You can try to

force a refresh