As a prop trader since 2006 with 150 inhouse full time traders our Edge always was transaction cost, technology and access to information using Bloomberg and other terminals. That is now available to everyone.

Still 99 percent people loosing money. Why ?

Thread 1/n

Still 99 percent people loosing money. Why ?

Thread 1/n

1. Most of them have no idea why they are partcipating in the market? They start with trading and if loss in position, become investor or they start with investing and seeing the small profit they become trader.

First thing First Know yourself. Use this:

First thing First Know yourself. Use this:

2. Secondly people spend too much time looking at the trading terminal. And now with terminal on mobile phones, its even worst. The color changes around bid and ask always excites human mind and invites to trade more. Its like any other vice. Try trading without these.

3. People are most of the time focus on profit. No one is looking at loss. Loss is not just loss from trade. It also includes the transaction cost. Typical mistake people make is believing that discount broking is zero transaction cost. There are many other cost involved.

4. Inability to book loss is the biggest problem. Mostly people are in denial mode about the market when it is falling. Its not unnatural to behave like this. We all are build to be optimistic and we love prices going up. But the real men in market book loss, if they are wrong.

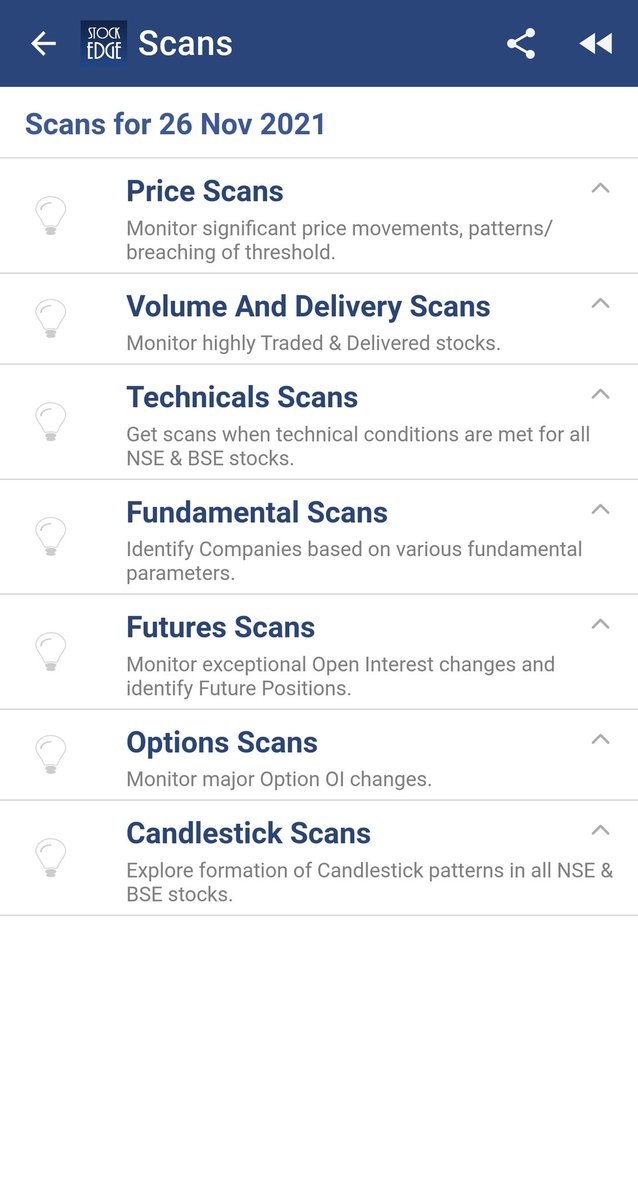

5. Over dependency on free resources and not willing to pay for value added products that can give edge. All major prop firms in India will have Bloomberg terminal. We are not idiots paying 1.5 lac a month to them. Today there are platforms like @mystockedge etc giving you power.

6. Not sharpening own mind and grossly following/copying others. This is worst of all. No one can make money for you.Everyone is here to make their money.Even if you want to go to heaven you will have to die first. No one can do on your behalf. Follow people who want you to grow.

7. Trading without any strategy. Even if you trade based on the color of shirt of business news channel anchor, that's also a strategy. But that has to be vetted via backtesting and also front testing. Also strategy will evolve over a period of time. Some may become redundant.

8. Poor risk appetite. For me risk appetite is not how much capital you have with the broker. For me its the additional capital you may have to add, if you incur loss. If you don't have buffer capital to add in a not so favorable situation,you are stuck. Money management is key.

9. Poor understanding of basics and weak core. Any big tower will always have a solid foundation. Least number of participants are spending time on building that foundation. It takes 2 years to build that. We have created @elearnmarkets for exactly that purpose.

10. Last but not the least, poor belief in one's ability. Generally we all are short of confidence. You need small small achievements and reforcement in yourself to make you a motivated human being.

This is how I do it:

Hope you liked it.

This is how I do it:

Hope you liked it.

• • •

Missing some Tweet in this thread? You can try to

force a refresh