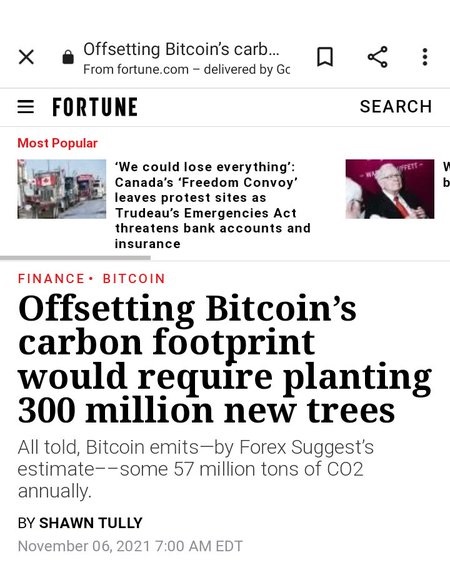

300 million trees sounds like a lot and makes for a good headline, until one takes into account the fact that with ~3 trillion trees on that planet, that's just a 0.01% increase in the number of trees.

science.org/content/articl…

#math ¯\_(ツ)_/¯

science.org/content/articl…

#math ¯\_(ツ)_/¯

Getting rich doesn't involve freaking out about every $5 expenditure.

Improving the environment doesn't involve freaking out about every 0.1% or 0.01% use of energy, especially for useful purposes.

It's about the big picture.

lynalden.com/bitcoin-energy/

Improving the environment doesn't involve freaking out about every 0.1% or 0.01% use of energy, especially for useful purposes.

It's about the big picture.

lynalden.com/bitcoin-energy/

A 2-week luxury holiday can be offset by planting 400 trees. If ten million people do that, that's 4 billion trees.

A couple of lattes per day per person equals 13 trees per year. If a billion people do that, that's 13 billion trees.

fortune.com/2021/10/30/pla…

A couple of lattes per day per person equals 13 trees per year. If a billion people do that, that's 13 billion trees.

fortune.com/2021/10/30/pla…

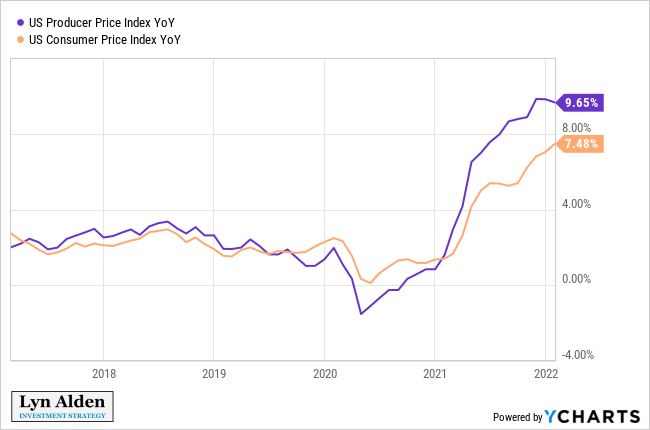

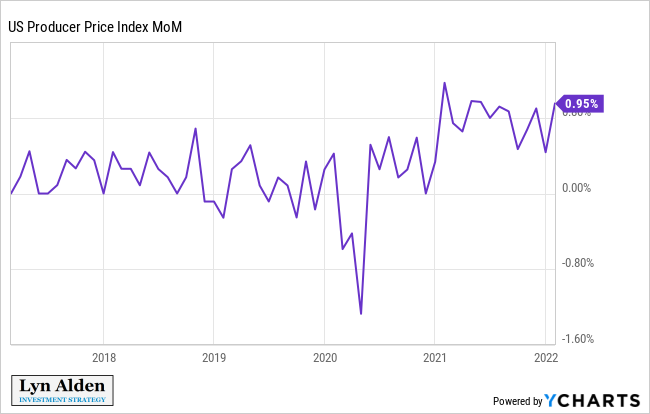

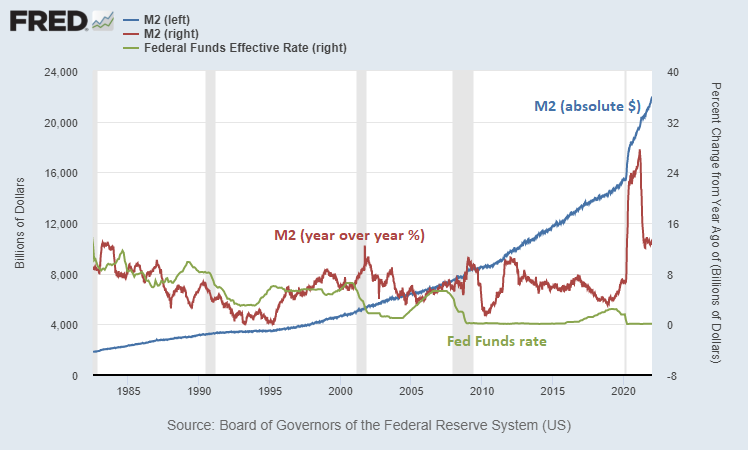

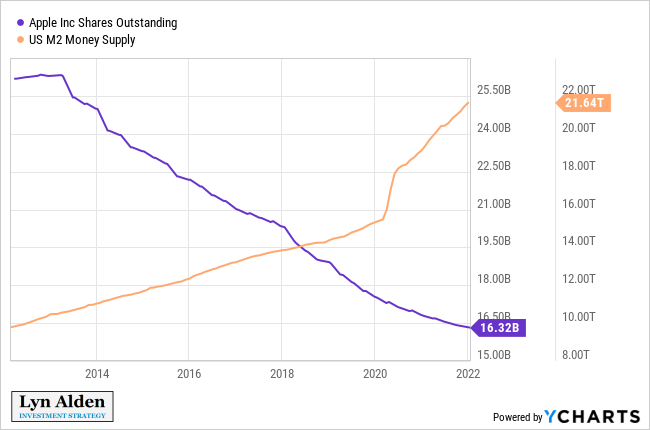

The current global monetary paradigm involves maintaining interest rates below the inflation rate, to discourage savings and incentivize investment and consumption.

It's about keeping people on a carefully-maintained treadmill of economic damage, if thought of in a certain way.

It's about keeping people on a carefully-maintained treadmill of economic damage, if thought of in a certain way.

The idea of stateless money and liability-free property freaks a lot of people out, so they throw environmental concerns at it regardless of whether the math makes sense or not.

I'm pro environment, but bitcoin is not my environmental concern. Quite the contrary.

I'm pro environment, but bitcoin is not my environmental concern. Quite the contrary.

• • •

Missing some Tweet in this thread? You can try to

force a refresh