2021 Q4 update on global monetary base. Only money supply that economically compares with #bitcoins. Lots of updates this quarter. New currencies. New info. New brand! This is quarterly update #15.

2/ We now have the globe's top 50 fiat currencies included in this research, sourced directly from their central banks. You won't find this info anywhere else. Also we look at historical basic money stocks (i.e. gold & silver). Layer in #bitcoins and we cover it all.

3/ We are updating the brand as well around this research, something a long-time coming. Check out porkopolis.io. In addition to the Crypto Voices podcast, we will be doing frequent video streams of this data and much more long-scale economic charts under the PE brand.

4/ It's important to keep tracking real data like this, because it follows the money to the core of the system. Many like to say central banks run the printing presses into the ground. But how much do they really? What does it all mean?

5/ The effort is to paint a true monetary landscape across the globe. Also understand 'unit-upon-unit' growth of each currency, and compare them. We're looking at the dollars, euros, and yen we're all familiar with, but also 47 more currencies.

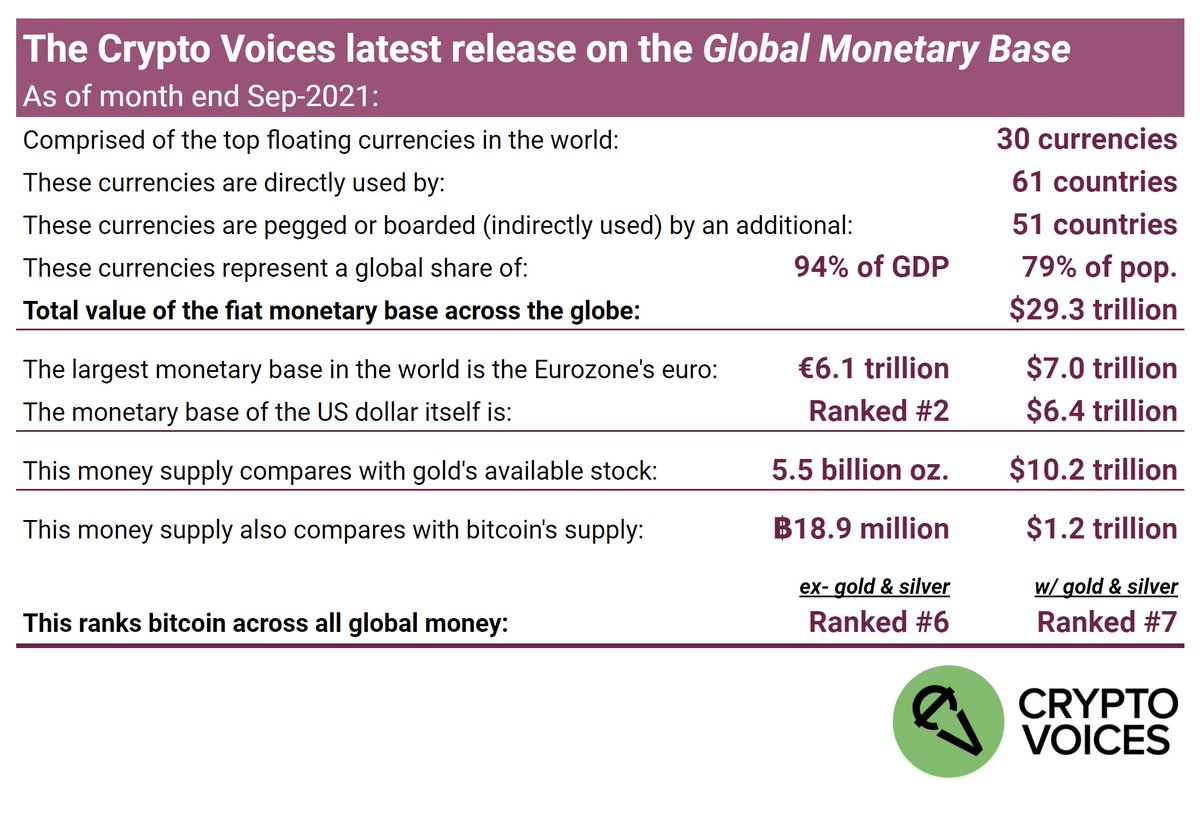

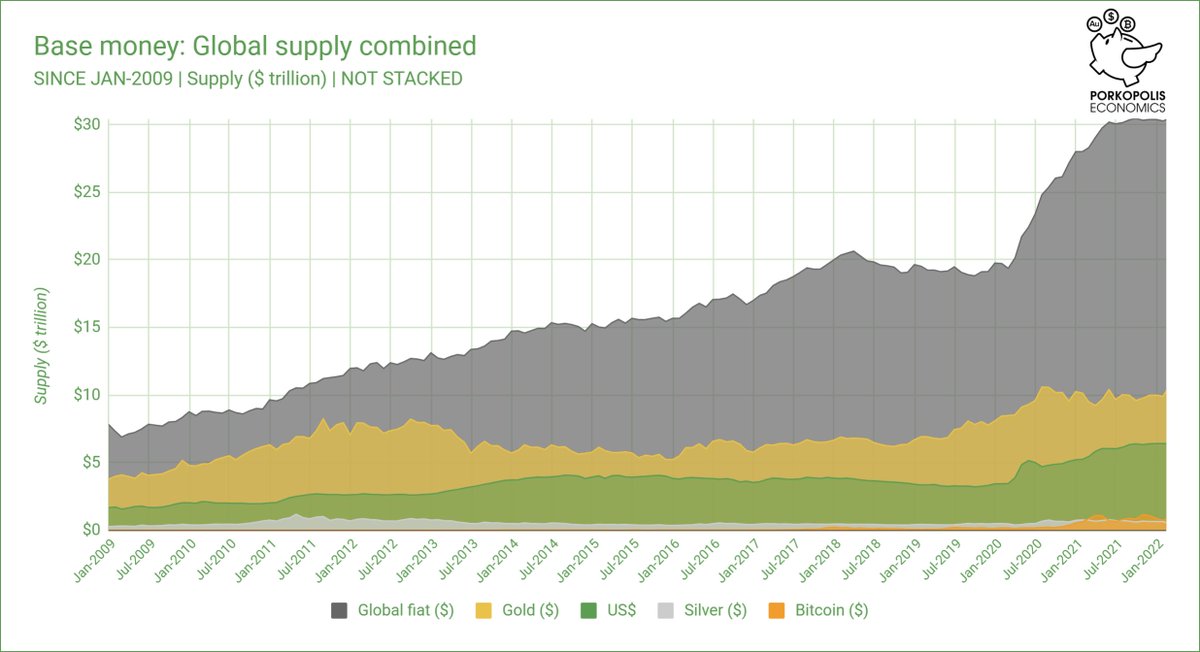

6/ Brass tacks. Fiat basic money globally valued at equivalent of $30.4 trillion. Gold at $10.3 trillion. Bitcoin at $0.8 trillion. Silver at $0.6 trillion.

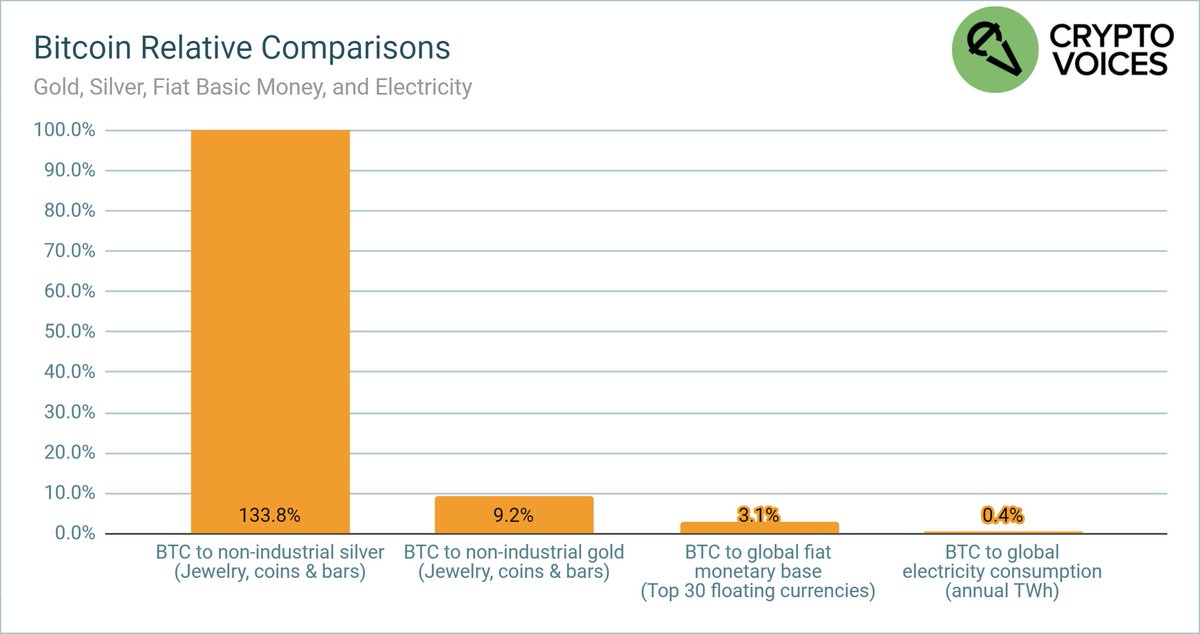

7/ Here's another way to look at #Bitcoin against its peers. Gold, silver, fiat basic cash, and thanks to the good people at @CambridgeAltFin, vs. global electricity (~125 TWh / 23,000 TWh). Note #Bitcoin accretes well faster against money than electricity consumption.

8/ Gold & silver is basic money of the past. Government fiat cash is basic money today. It comprises both physical cash 🤜and🤛 a digital cash component. Bitcoin may be base money of the future. Before we show the charts, it's important to clarify exactly what basic money is.

9/ Everyone looking to value Bitcoin always jumps to the 'narrow' or 'broad' money supplies (M1/M2/M3). This is incorrect. The reason is those money supplies represent 'claims' on something else. What is that something else? The answer... is the basic money supply.

10/ Fiat basic cash today includes both physical (notes & coins) and digital (bank reserves at the central bank) components. Think of the digital part as the 'account' each bank holds with its central bank. This & only this money supply compares economically with 21 million BTC.

11/ Why? Because that's the end of the line. It's 🤜final🤛…settlement, in either system. There's no deeper level you can go to in the current financial system than the monetary base, and there's no deeper level you can go to in the Bitcoin system than on-chain bitcoins.

12/ This is why all the Visa/Mastercard comparisons, TPS, etc. lose the plot. #Bitcoin is basic money that settles globally, in 10 minutes. In the fiat system, credit/debit cards, etc. are higher-level monetary 🤜claims🤛 issued by banks. It's different stuff, not basic money.

13/ Another mistake often made when comparing bitcoins to the analog monetary world is looking at a simple chart like US M1, or Eurozone M2. Besides again being incorrect on the M1/M2/M3 comparison, this method is inadequate because Bitcoin is global, and those... are not.

14/ We can't simply look at one or two nation states' base money supplies to gauge any kind of market depth. The sample must be global. We've done that here: the top 50 currencies in the world. This is how basic monetary media issued by governments looks since 1970.

16/ These top 50 currencies in fact cover 97% of global GDP across 80 countries. As well, an additional 49 countries either use one of these 50 directly (no separate legal tender), or are legally pegged to one or fixed via currency board.

17/ More on the above image. It's ordered by GDP per currency bloc (as well as the table coming up). Talk about Pareto's distribution: The top 5 currencies in the world comprise 84% of this chart by value. The balance goes to the next 45 currencies.

18/ Let's look again at the global basic cash curve since 1970, but this time see how the split shakes out between physical, versus digital basic money. Note how bank reserves (the digital printing press) drastically increased its overall % from the 2008 financial slide.

19/ Final point on fiat cash. The monetary base is in fact a graph of the money monopoly today; meaning, it is the source of the printing press, and only central banks control this. If you're curious where to find it, the answer is simple: the balance sheet of each central bank.

20/ Now let's look at gold. Central banks still hold gold, but it no longer acts as basic money. This chart is delineated between all-time gold mined, gold that's readily available (jewelry + bullion but ex-industrial), and estimated gold in bullion (coin & bars or 'monetary').

21/ Now silver. 55 billion ounces of the stuff has been mined throughout humanity. Same as gold, we include 3 categories: 'all-time' mine production, 'available' estimates (i.e. not lost to industry), and 'monetary' estimates (bullion). Since 1970, this is silver.

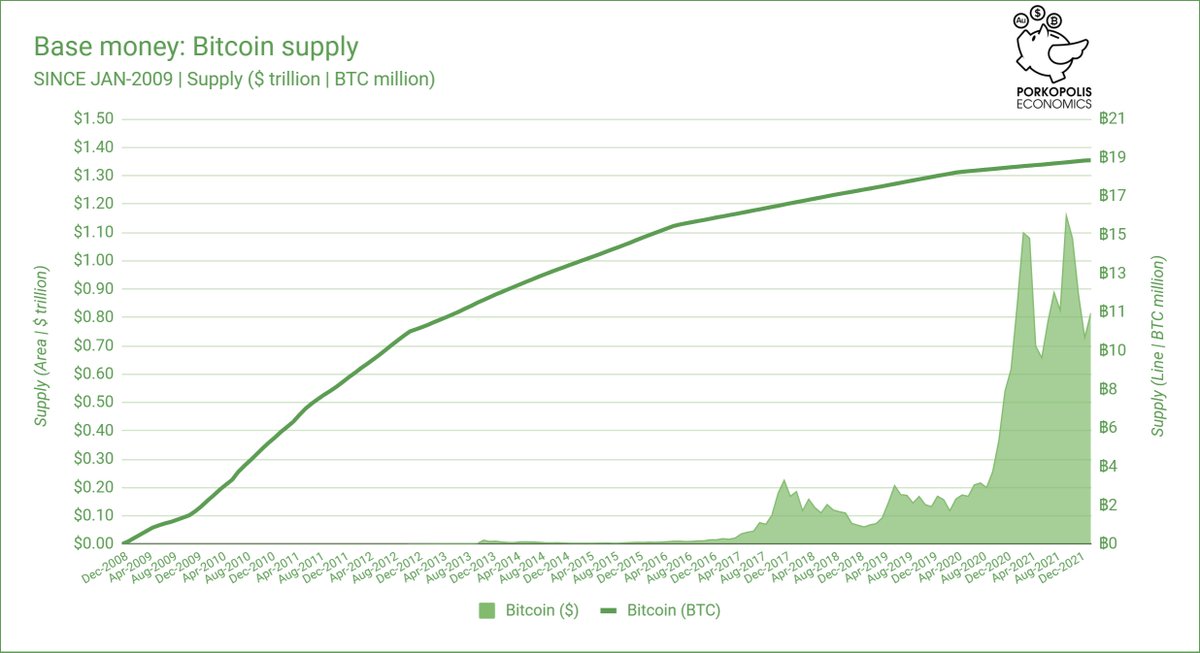

22/ And finally Bitcoin. Bitcoins are limited by the protocol to an eventual 21 million in supply by ~2141, and with each day it seems that bitcoins could circulate as basic money of the future: a deep & balanced final settlement money supply. Here's its global supply curve.

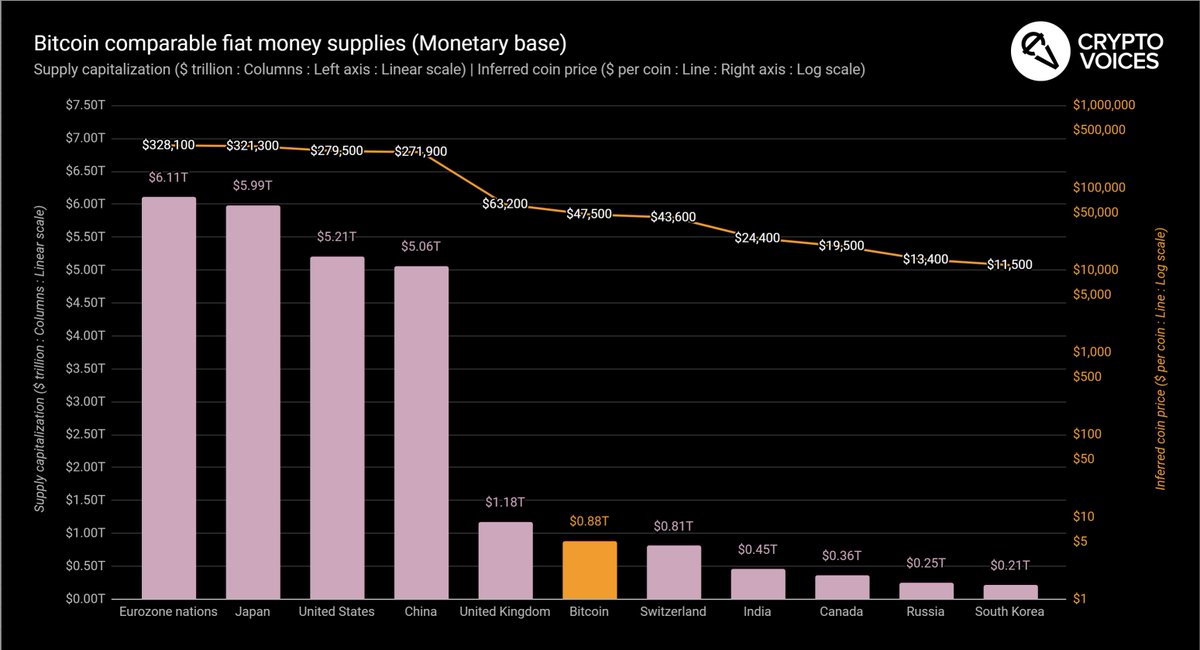

23/ And now we'll put them altogether. Global fiat cash, 'available' gold, 'available' silver, and bitcoins, today. Without further commentary, note that the Bitcoin system is the 6th largest money in the world, and the 7th largest money if gold included.

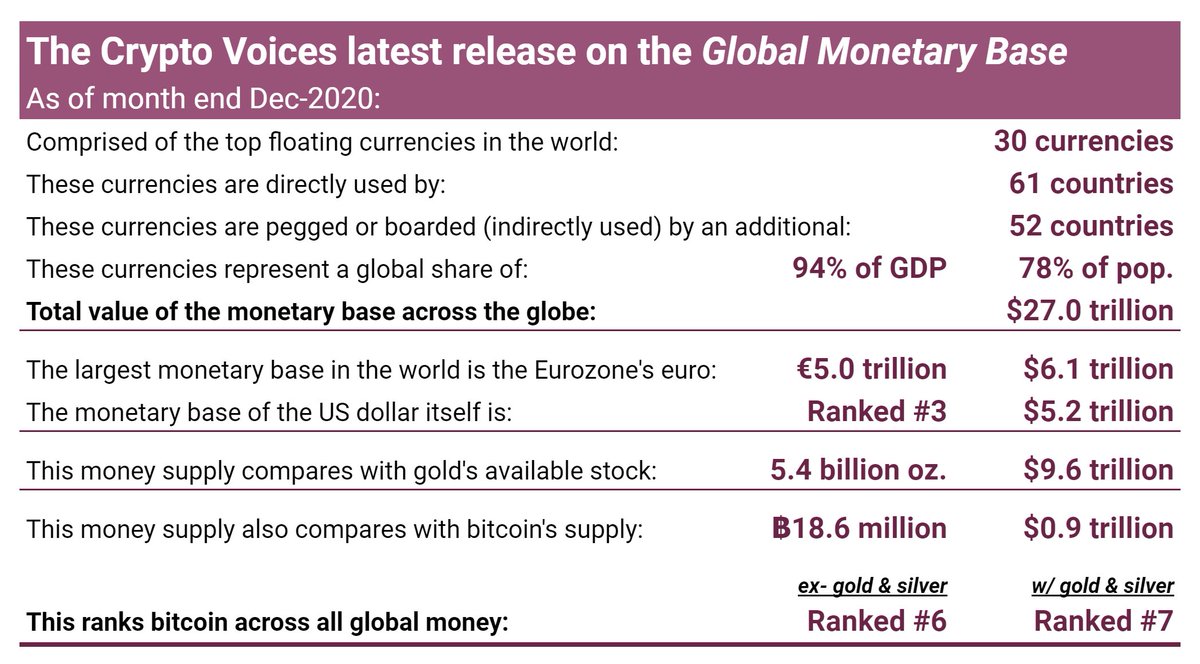

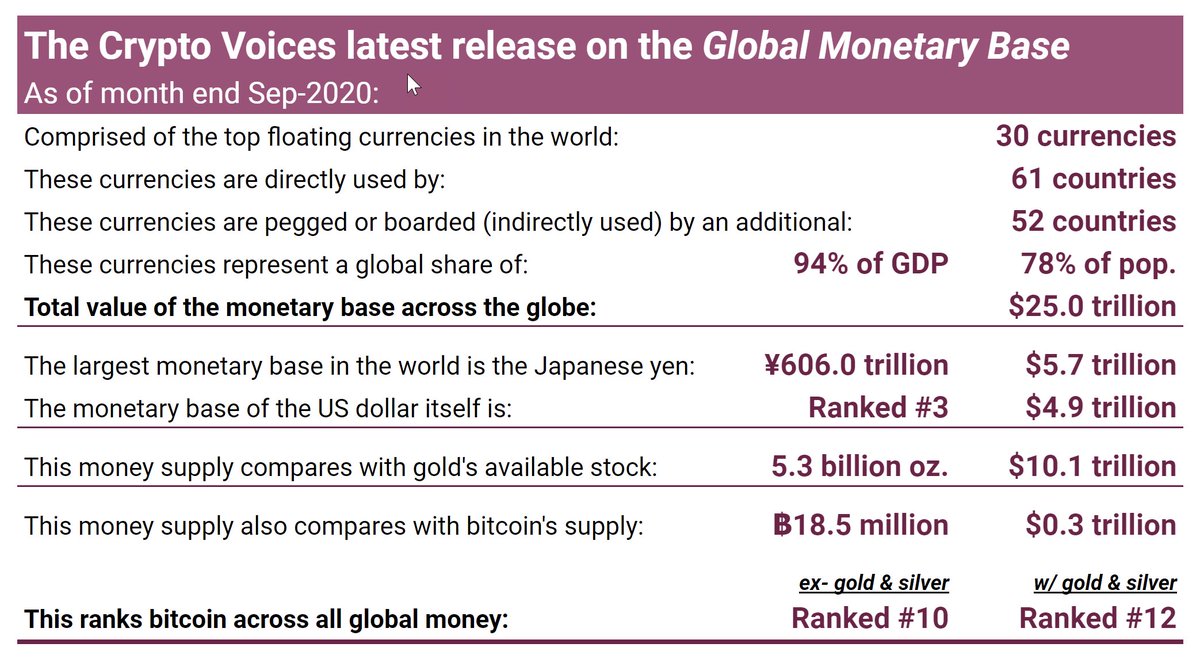

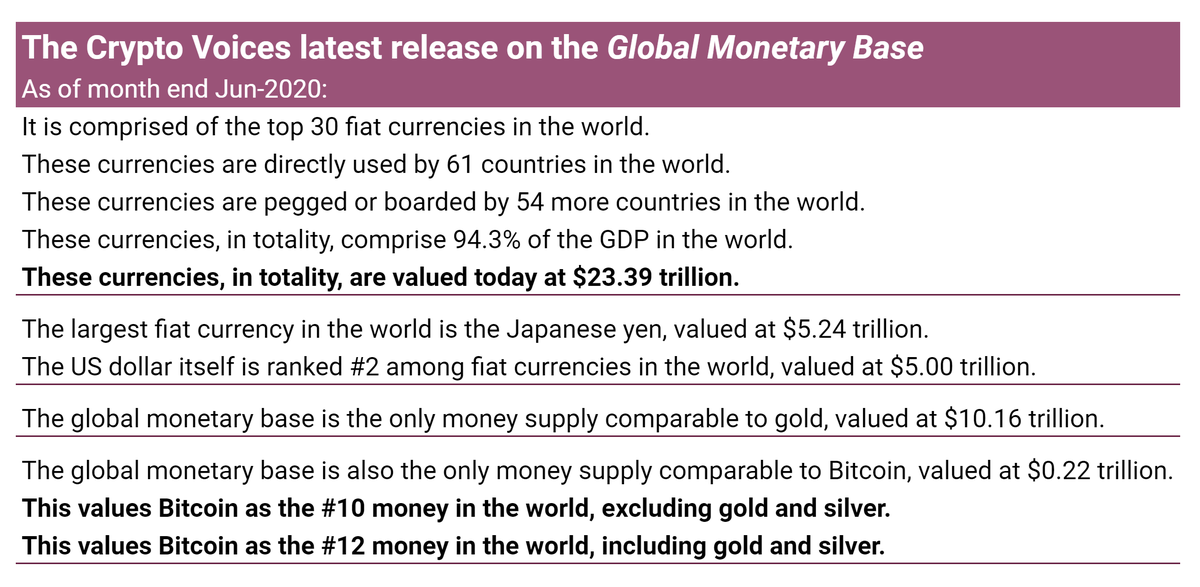

24/ And for a broad, historical ranking in table format, a progression of all major money for the entirety of #Bitcoin's history since 2009, that information is here. Quite remarkable to see its progress...

25/ And for those that wish to see the same progression but for all 50 currencies, and how quickly (if) #Bitcoin passed each one, that table is here. Note that #Bitcoin passed the major Swiss franc in value for the first time ever in 2021.

26/ Now for the main event: Inflation. Inflation today means 'price increases.' It's usually measured by the government and usually wrong. There is no way all prices can ever be blended in a simple index. The input variables are changed all the time to boot.

27/ When we analyze inflation, we are using the classical definition, which is 'monetary inflation.' In other words, 'money growth,' or 'money production.' Understanding this rate of increase can be very helpful when trying to understand money.

28/ Inflation is one of the most important things to understand about money, in fact. Money growth inflation reflects scarcity, and dilution, relative to other goods. But to be clear, 🤜the charts that follow have nothing to do with price growth, or prices, at all.🤛

29/ Let's jump to it. This is the trailing 12 months of all basic money growth. Remember, this is 'unit' growth. % changes in dollars, euros, or yen, ounces of gold, or bitcoins. Big numbers, and not a good thing.

30/ But we need to look deeper. Longer term. Remember the global fiat cash curve? ☝️In 1970, the US$ equivalent of global basic money was $200 billion. Today: $30.4 trillion. What does this mean? To understand it, you need to understand compound annual growth.

31/ Compound annual growth is an extremely important metric. It's 'stronger' than a simple, annual growth rate. We can use this rate to understand investment returns, or long-term trends like population growth. We can also derive doubling time from this figure.

32/ So let's start with the compound annual growth rates since 1970. Basic money. 50+ years of data. 19 nations' data goes back to early 1970s or earlier. For the rest, compound growth % displayed is since their start date. For bitcoin, the start date is Jan-2009.

33/ Doubling time also helps. From compound growth %, we can determine exactly how long it takes for an asset's supply to double. Here is the exact same chart as just shown, but displaying doubling time instead of compound growth.

34/ It should be clear why gold and silver arose historically as basic money. 'Twas difficult to inflate them, and thus low inflation %s meant long supply-doubling times, or scarcity. Fiat basic cash has typically been much quicker to double. Bitcoin... needs more explanation.

35/ Hopefully this will make it easier to understand how Bitcoin's supply works. From 2009 until now, yes, 50 bitcoins grew to 18.95 million. That's a ~59% compound annual growth rate, or doubling every 1.5 years. But, from now until ~2141… that's when things get interesting.

36/ Notice how the supply of bitcoins will only grow at 0.1% per year, or double every *800 years.* And it gets even more unique, as the Bitcoin protocol won't allow that doubling to happen, as it's supply will cap at 21 million in ~2141. No money in history worked like this.

37/ To clarify, this is the long-term compounding of all basic cash:

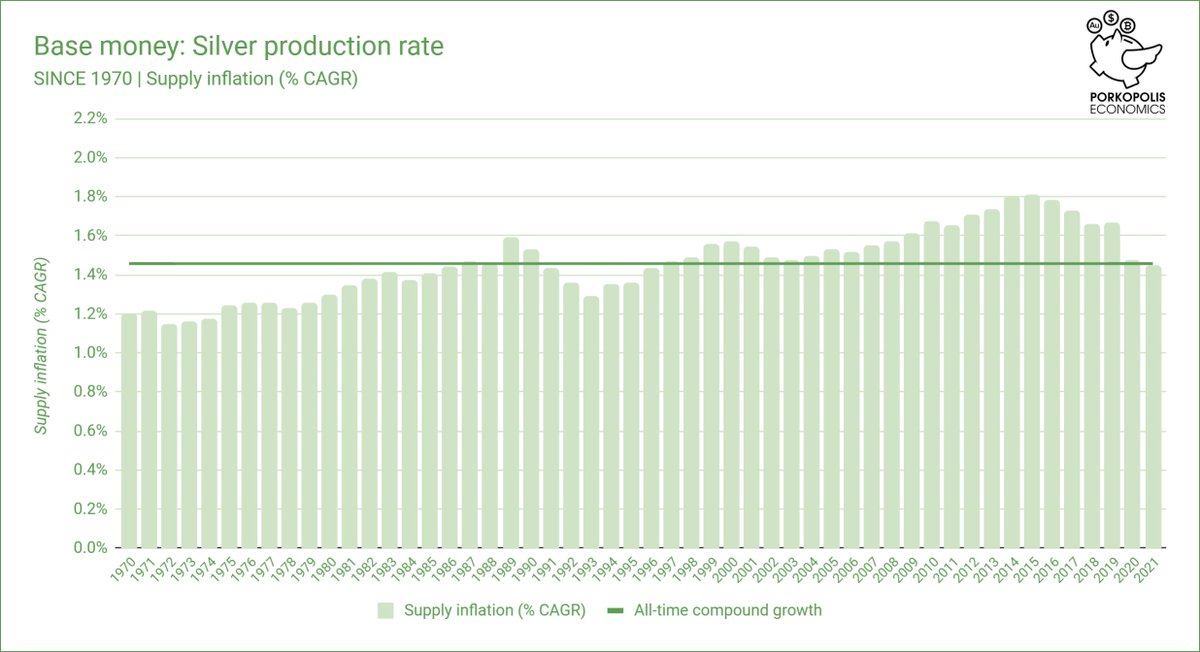

🪙 Gold: 1.8% (39 yr-doubling)

🥈Silver: 1.5% (48 yr-doubling)

💸US$: 9.6% (8 yr-doubling)

🌍Global fiat: 13% (6 yr-doubling)

#Bitcoin: 0.1% predictable until 2141 (800 yr-doubling)

🪙 Gold: 1.8% (39 yr-doubling)

🥈Silver: 1.5% (48 yr-doubling)

💸US$: 9.6% (8 yr-doubling)

🌍Global fiat: 13% (6 yr-doubling)

#Bitcoin: 0.1% predictable until 2141 (800 yr-doubling)

38/ Back to the 50+ year time series again. Here is the inflation rate of the global monetary base, weighted averaged by each currency's US$ equivalent. Notice it matches the overall 13% CAGR (6 year doubling time) we've already seen.

39/ Here's gold. Same concept. Notice again the overall series compounding will match the summaries we've already seen. Gold's rate of growth has, in fact, been around 1.8% per annum for the last 170 years.

41/ And now Bitcoin. Remember why the overall compound growth (the line), thus far, is quite high, and why it will never be that high again. And as a new (and expected) development, note how the compound annual issuance of #Bitcoin at this moment is 🤜at or lower than gold's.🤛

42/ Also notice the phrase 'supply issuance' for Bitcoin's chart titles, and not 'inflation.' Bitcoin's 'inflation,' economically, is already baked in. Everyone knows its max supply. As already demonstrated, its growth rate is known until ~2141, per the protocol.

43/ So when it comes to bitcoins, 'inflation' is not the best term. 'Coin issuance' is more apropos, as its overall supply is fixed & known. As monetary expert George Selgin said on our show, 'We know it's 21 million, and that's that.' This is uniquely unlike fiat, or even gold.

44/ One more thing on gold and silver. Bird's eye. Of all the 'transparent,' reported repositories of bullion (sourced from Nick Laird)… including all ETFs, even @PeterSchiff's GoldMoney, #Bitcoin has passed gold & silver in all of these vaults 🤜combined.🤛

45/ And yet another reminder, in 2021 #Bitcoin also passed the entire 'available' (not lost to industry) supply value of #silver in the world.

46/ Alright. Now that we've seen all the data, let's finally take a quick look at some price chat, because even though I told you none of the above covers prices, I know you're wondering how all of this monetary inflation affects prices.

47/ Milton Friedman said, 'Inflation is always and everywhere a monetary phenomenon.' He meant price inflation (again, not graphed above) always and everywhere follows money inflation (very much graphed above).

48/ The rub is it is impossible to predict how and when price inflation will happen. Impossible to predict, hyperinflations or otherwise. The best we can do is measure the money supply and its growth, and be cautious for the way it trends.

49/ But we can say this: If governments keep issuing currency units, and if there is no or a lesser increase in the demand for that money, then ceteris paribus, prices will rise. Ceteris paribus, a growing base money supply will always undermine that money's purchasing power.

50/ These are some of the reasons why the market chose hard money like gold & silver. Always emergent in human action, unless there is fiat monopoly intervention, the market will decide the best money. If aliens in a one-off whisked away our gold, we'd choose the next best...

51/ Let's take one more detour back to the dollar and the USA specifically, to see why it matters to track the growth of the monetary base (the *money*), versus the growth of other economic stuff. Focus on the green box first...

52/ First, in the last 20 years the supply of basic money grew 12.6% per year, or doubled every 6 years. The Fed's mandate is to control inflation and keep people employed. GDP would be one way to measure economic health. How fast did it grow? Only 4% per year.

53/ In 2000, $1 of basic money printed got you $17 of GDP. Now? $1 gets you only $3.60 in GDP. In 2000, 1% of unemployment would cost you $89 billion in printed dollars. Now? $891 billion for the same 1%. And... government debt grew 8.4% per year as well, doubling every 9 years.

54/ And continuing, we can start to see why measuring 'price inflation' is hopeless. Gold valued in dollars? Grew 12% per year. Stocks? 9% per year. Bonds? Only 4.8% per year. Bonds (specifically the gov't variety) are return-free risk, not the colloquial opposite.

55/ One more way to view all this. Again, understanding compound growth is key. This curve is mathematical. Everything will fall on it, based on its compound rate. Einstein said compounding is the 8th wonder of the world. This is why. What is your preferred monetary asset?

56/ A few notes before the final summary. Almost done! Remember these are the top 50 currencies in the world over the past 50 years. Zimbabwe & Belarus don't make the cut; as their monetary base is so tiny, their hyperinflations would barely move the needle on what's presented.

57/ For the euro, its accounting creation began in 1999, and it started circulating in 2002. Prior to 2002, we are building a blended euro monetary base back to 1970. As of now, it includes 3 of the very largest: the Deutsch mark, the French franc, and the Italian lira.

58/ To be absolutely clear on the *global blended* fiat inflation rate: it's calculated using a weighted factor of each country's 🤜native🤛base money growth, based on how large their US$ equivalent actually is, during that month. This weight evolves as more currencies are added.

59/ As we look back in time, for those currencies that weren't established, they didn't factor into that period's global inflation. For example, the USD's weight itself was 35% of the pie in 1970, and only 22% today, as (among others), data on China begins only in Dec-1999.

60/ Regarding compound annual growth rates: they're always calculated from monthly fiat unit growth, then compounded to annual (to the 12th exponent). This is necessary due to cases like Brazil and Argentina, which had 6 and 4 different currencies respectively, since 1970 alone.

61/ Continuing, a compound annual growth rate from a 1970 currency to 2020 currency doesn't make sense for Brazil. So the *monthly* rate must be taken across time and then compounded, ignoring those 6 months when the central bank reset (slashed zeroes) from the old currency.

62/ Interesting note on Brazil. Though China is famously coming, Brazil is actually one of the first countries to have a proto-CBDC floating around, directly managed by CB. Called the PIX, established at end of 2020. Thx to @lucasrla for helping pinpoint the data.

63/ And finally, the mechanics of this method (compounding monthly growth rates to annual) were of course repeated across gold, silver, & bitcoin's supply curves, for consistency. The only exception is the TTM column in the summary (coming). Simple year-on-year growth there.

64/ Streams coming very soon with more charts, info available at porkopolis.io. More CV pods coming too at porkopolis.io/podcast. #Bitcoin is a real contender as the monetary media of ultimate settlement. We'll be there as its status progresses.

65/ This graphic includes all items. Print it out if you like. Modern history of money. 50 fiat currencies. Gold. Silver. Bitcoin. Supply-side summary on all the basic money in the world.

66/ Fiat monetary base data sourced from central bank balance sheets, wonderful gold and silver history from industry expert Nick Laird, and bitcoin from @coinmetrics.

67/ These penultimate graphics illustrate how Bitcoin's supply (US$ equivalent) compares across all other basic money, past and present. Bitcoin sits at 4.2% compared to the global fiat monetary system. The #RealBitcoinDominanceIndex.

68/ And finally, let's show again what it takes for #Bitcoin to surpass the Big 4 currencies' monetary base values. Again with the definite caveat that these are calculations, not predictions… that chart is here.

69/ More to come in the future, continuing to work on this topic. Any sats you could spare to donate are very much appreciated and help keep up the research.

Donations in $BTC may be made here: donations.cryptovoices.com

Thanks for reading.

/fin

Donations in $BTC may be made here: donations.cryptovoices.com

Thanks for reading.

/fin

• • •

Missing some Tweet in this thread? You can try to

force a refresh