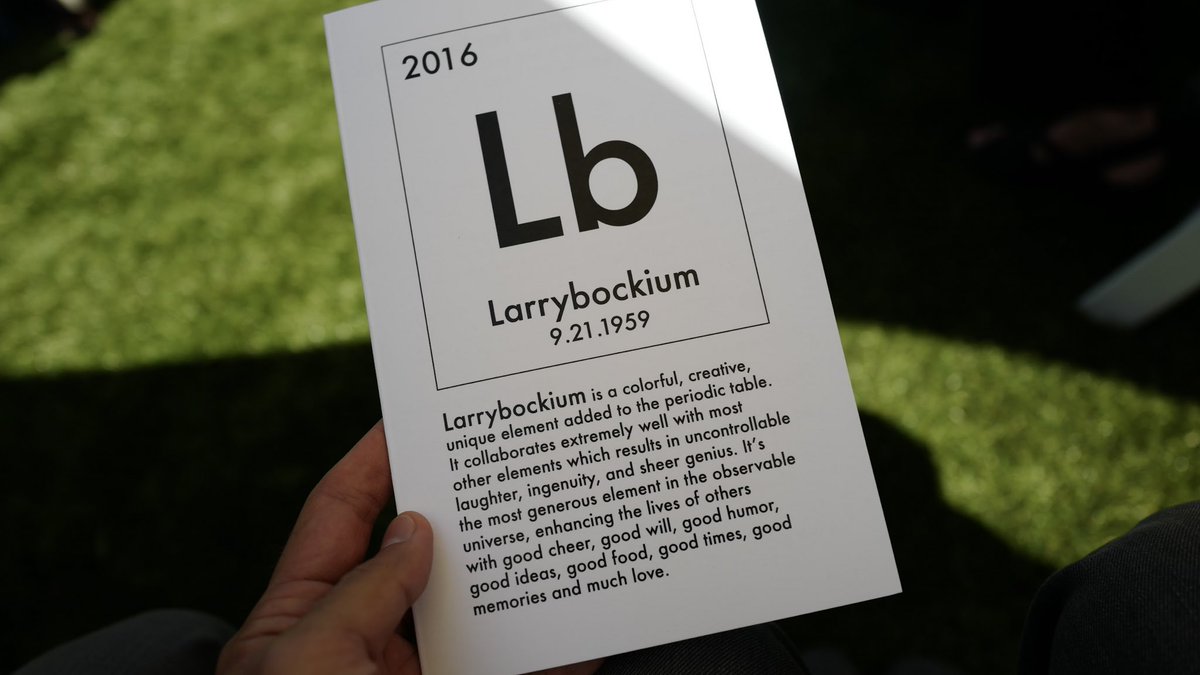

1/ LARRY BOCK—

Five and a half years ago longtime Lux partner, mentor, friend, father, husband, cutting-edge biotech investor, company founder––and Brooklyn-born(!) merry prankster passed….medium.com/@lux_capital/a…

Five and a half years ago longtime Lux partner, mentor, friend, father, husband, cutting-edge biotech investor, company founder––and Brooklyn-born(!) merry prankster passed….medium.com/@lux_capital/a…

2/ Larry’s email was “BioBock” (his dad’s nickname as an “OG” stockbroker for biotech in the 70s + 80s)…

Larry (legally blind w/deteriorating eye condition, Stargardts) would join Genentech as one of the first 50 employees—before launching 17 co’s from scratch + taking 14 IPO—

Larry (legally blind w/deteriorating eye condition, Stargardts) would join Genentech as one of the first 50 employees—before launching 17 co’s from scratch + taking 14 IPO—

3/ One of my FAVE stories is how Larry had hoped to get into Princeton, Harvard, Yale—but instead was steered towards Bowdoin

He had a friend who used to prank him….This friend once had his sister pretend she was another girl Larry had a crush on— asked him out to the prom….

He had a friend who used to prank him….This friend once had his sister pretend she was another girl Larry had a crush on— asked him out to the prom….

4/ The next day Larry goes to school—thinking this girl asked him out to the prom was utterly devastated when he learned the truth…Fast forward a few weeks—Larry is on the waitlist for Bowdoin…

5/…and Larry gets a phone call that night from a woman who says: "Congrats––you are off the waiting list." Larry assumes its his friend getting his sister to prank him again.

So Larry, furious, curses her out––

and then found out it was really admissions woman from Bowdoin!!

So Larry, furious, curses her out––

and then found out it was really admissions woman from Bowdoin!!

6/ He calls and apologizes and says “Oh no! Please, trust me, i am exactly the kind of person you want at Bowdoin!”

He graduates, then applies to Genentech three times. Gets rejected all three times—until finally ends up working there for 3 years…

He graduates, then applies to Genentech three times. Gets rejected all three times—until finally ends up working there for 3 years…

7/ In an amazing personal coincidence—at Genentech Larry Bock ends up working on UROKINASE and blood related plasminogen activators…

Which 20 years later was one of my 1st published science paper—in Cell Biology

Which 20 years later was one of my 1st published science paper—in Cell Biology

https://twitter.com/wolfejosh/status/1102773454779105280?s=27

8/ Larry would end up going to UCLA for b-school and then worked for legendary biotech investor Jean Deleage (Burr, Egan, Deleage) early investors in CHIRON

Larry ends up looking at spin out of HYBRITECH* (called Cytotech)…but first a quick funny story about another famous VC…

Larry ends up looking at spin out of HYBRITECH* (called Cytotech)…but first a quick funny story about another famous VC…

9/ To show you technical backgrounds arent always necessary:)

This famous biotech VC (still alive) came out of the meeting with HYBRITECH…and turned to his colleague and says

“WAIT, PLANTS…HAVE CELLS?”

Larry would later team w/Kevin Kinsella (another early HYBRITECH investor

This famous biotech VC (still alive) came out of the meeting with HYBRITECH…and turned to his colleague and says

“WAIT, PLANTS…HAVE CELLS?”

Larry would later team w/Kevin Kinsella (another early HYBRITECH investor

10/…in Avalon ventures and team with other longtime Lux friends like Larry Fritz in founding cutting edge neuro companies like Athena Neuro + signal transduction Co’s like ARIAD and then Neurocrine…

11/ that would lead to doing BIOTECH x TECH at the intersection of computers + “lab on a chip” (which would become microfluidics and ultimately lead to Caliper, Pharmacopiea, Argonaut, and Illumina(!)…

12/ Notably––Illumina was NOT gene sequencing at first but rather sensor on a chip. At the time, Larry was trying to recruit Nate Lewis at Caltech who was also being recruited by “nose-on-chip” co Cyranose (an area I and Lux are still obsessed with!)…

13/ And there was a guy Mark Chee who Larry was recruiting to Caliper who had the idea that the TECH could be used for GENE SEQUENCING…

And then a year later Jay Flatley came in as CEO (now an advisor to Lux family co @VariantBio)…

And then a year later Jay Flatley came in as CEO (now an advisor to Lux family co @VariantBio)…

14/ Larry would see BIOxTECH as getting crowded at the time and started looking where others weren’t which led to the founding of NANOSYS—around nanotech Harvard, MIT, Berkeley pioneers in chemistry x material science x electronics…

One of Lux’s first investments was Nanosys…

One of Lux’s first investments was Nanosys…

15/ Larry teamed many times w/ incredible @rtnarch Bob Nelsen (ARCH) on series of his biotech + beyond ventures

Lux started out begging Bob + others to let us into their hot deals!;)

Larry joined Lux + we carry his 🔥 of starting de novo co’s

📸Bob + Wally P. @ Bock memorial

Lux started out begging Bob + others to let us into their hot deals!;)

Larry joined Lux + we carry his 🔥 of starting de novo co’s

📸Bob + Wally P. @ Bock memorial

16/ from Genocea (vaccines) to Kala (back of the eye delivery) to Aira (tech for visually impaired) to Kallyope (gut-brain axis) to Variant (outlier genetics) to Auris (robotic surgery)…

17/ Larry’s DNA courses thru all we do at Lux.

Larry had joined the board of FEI Corp where Don Kania was CEO until its $4B sale to ThermoFisher. Don is now chairman of Lux family co Gandeeva (next-gen CRYO EM)

Fiat Lux…. “Fiat Larry”!

Larry had joined the board of FEI Corp where Don Kania was CEO until its $4B sale to ThermoFisher. Don is now chairman of Lux family co Gandeeva (next-gen CRYO EM)

Fiat Lux…. “Fiat Larry”!

18/ To read more about Larry—

his amazing wife Diane, and daughters Tasha + Quincy (part inspiration for my own daughter ‘Quinn’) published this book of Larry’s big ideas + Larry’s Guide to Life…amazon.com/Ideas-Man-Fest…

his amazing wife Diane, and daughters Tasha + Quincy (part inspiration for my own daughter ‘Quinn’) published this book of Larry’s big ideas + Larry’s Guide to Life…amazon.com/Ideas-Man-Fest…

• • •

Missing some Tweet in this thread? You can try to

force a refresh