0/ What happened in markets last week?

Get caught up every Saturday with Options Insight's weekly macro roundup.

Check it out below 🧵 ⤵️

Get caught up every Saturday with Options Insight's weekly macro roundup.

Check it out below 🧵 ⤵️

1/ US stock indices remained heavy this week, plagued by "imminent invasion from Russia" headlines, OPEX short gamma dynamics and more realisation that the FED may "need" to crash markets to reduce inflation.

2/ Crypto still looking much more like tech stocks than "digital gold" as tightening monetary conditions and it's high beta nature seem to outweigh any "safe haven" characteristics that people claim it may have. I think we are still a long way from a major decoupling of crypto.

3/ Credit markets continued to slide to their widest since Dec20. Largest outflows across IG/HY?EM debt since April20. Charts from @zerohedge

4/ Equity risk premium (aka VIX) not showing the same stress, suggesting room for some serious catchup either through a major VIX spike or yields compressing in coming weeks.

5/ Nice thread showing how financial conditions are already tightening and how longer term inflation markets are pricing the impact of early hikes forced by political pressure on FED.

https://twitter.com/countdraghula/status/1494105833327579140?s=20&t=P-ZzjgfSnxEX9fktOgY5sg

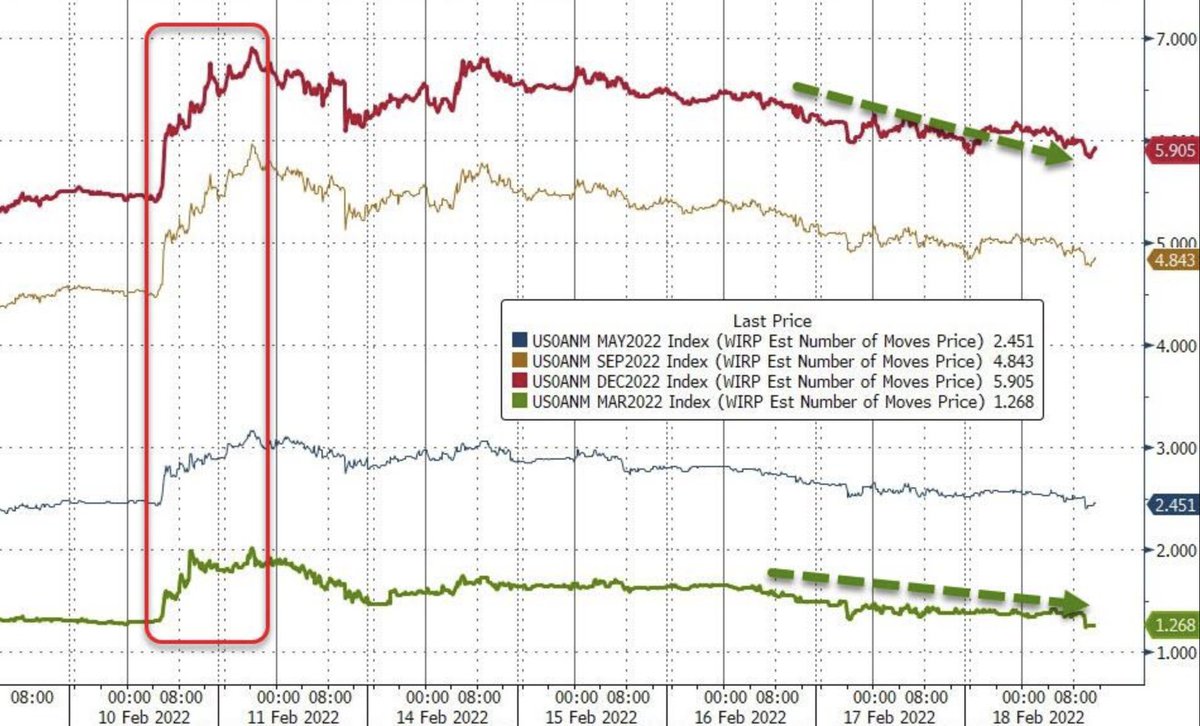

6/ The market weakness last week took some steam out of rate hike expectations for March, now only pricing 25% chance of 50 bps hike from 100% chance a week ago after Bullard comments.

7/ No good choices for the FED with Zoltan Pozsar calling for a "Volker moment" from the FED

zerohedge.com/markets/fed-re…

zerohedge.com/markets/fed-re…

8/ The only thing the market has going for it right now is that everyone is bearish! Sentiment this low typically leads to some kind of bear squeeze. I'm using some bullish call structures into Mar/Apr expiry to play a bounce. Better PMIs next week?

https://twitter.com/sentimentrader/status/1494300924604526595?s=20&t=P-ZzjgfSnxEX9fktOgY5sg

9/ Was great to chat to my friend @42macroDDale on his weekly Q&A about macro and volatility. Both his and my subscribers got full access to the conversation where I went through some options strategies that could be used to play the current environment.

https://twitter.com/42macro/status/1494041894535544844?s=20&t=P-ZzjgfSnxEX9fktOgY5sg

10/ Join our community to get all of this info & more in real-time through our group chat, weekly zoom calls, market reports & exclusive trade ideas.

Start your 14-day free trial - Come back Monday for our Stock market update

options-insight.com/macro-insight-…

Start your 14-day free trial - Come back Monday for our Stock market update

options-insight.com/macro-insight-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh