How to avoid FOMO?

Buying stocks at any price either keeps us in losses for a long time or gives us limited profits if they eventually recover. This is true with quality companies as well. Imagine, you bought

Divis @ 5450

IRCTC @ 1250

Laurus @ 700

Jubilant Foods @ 4500

1/n

Buying stocks at any price either keeps us in losses for a long time or gives us limited profits if they eventually recover. This is true with quality companies as well. Imagine, you bought

Divis @ 5450

IRCTC @ 1250

Laurus @ 700

Jubilant Foods @ 4500

1/n

When you ask successful investors, they will tell you that they made most money in 3-5 stocks and rest of the stocks were complimentary. What it means is, we just need to get lucky with identifying 3-5 right stocks and buy them at right price.

2/n

2/n

We often tend to chase stocks because we believe in that fraction of a moment that there is no better business to invest in. Instead, what if we make a list of 15-20 cos (with tailwinds for next 3+ yrs) & arrive at best buying price, and patiently wait for them to come down

3/n

3/n

Now, you are thinking what's the guarantee the price will come down to our liking. There is no guarantee but who would have thought Divis (best API player in the town) would come down to 3900 after it touched 5500. I can give you 20 more examples!

4/n

4/n

The point is we just need to get lucky with 3-5 cos. Luck favors the patient! Here are 10 cos that I want to buy @ the price of my comfort (some may never fall)

Max Health:300

Laurus:450

APL Apollo:700

SRF:2100

RHIM:450

KPIT:450

SonaBLW:500

IEX:180

Fluorochem:2200

LTTS:4000

5/n

Max Health:300

Laurus:450

APL Apollo:700

SRF:2100

RHIM:450

KPIT:450

SonaBLW:500

IEX:180

Fluorochem:2200

LTTS:4000

5/n

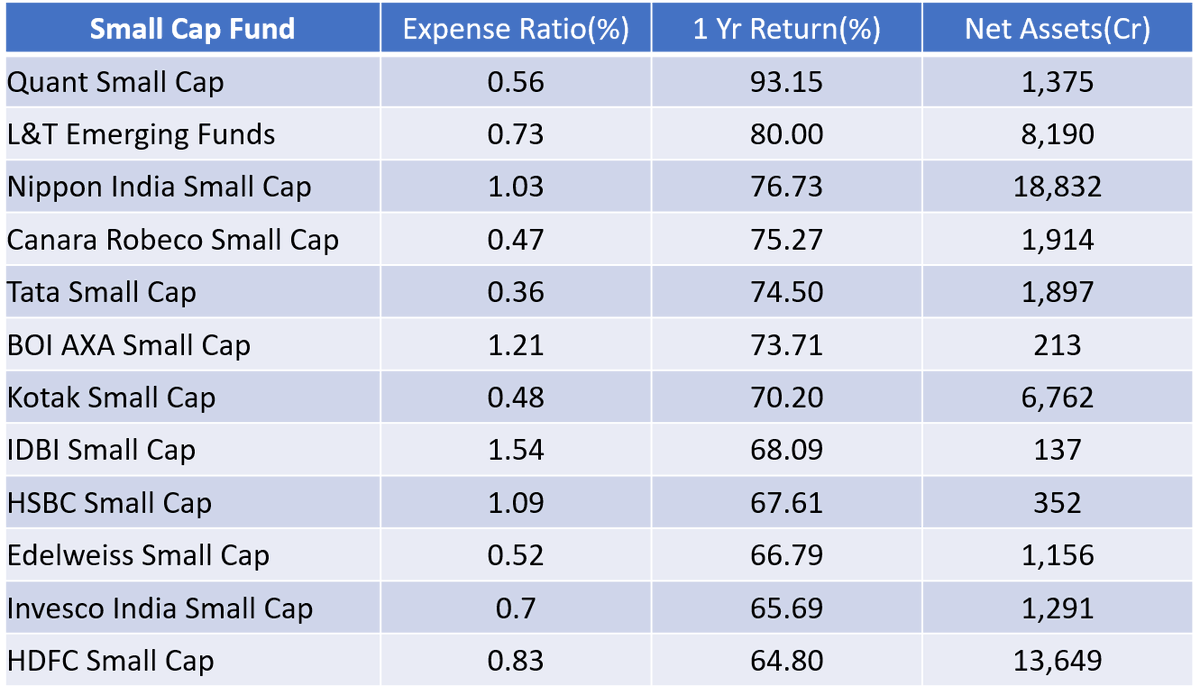

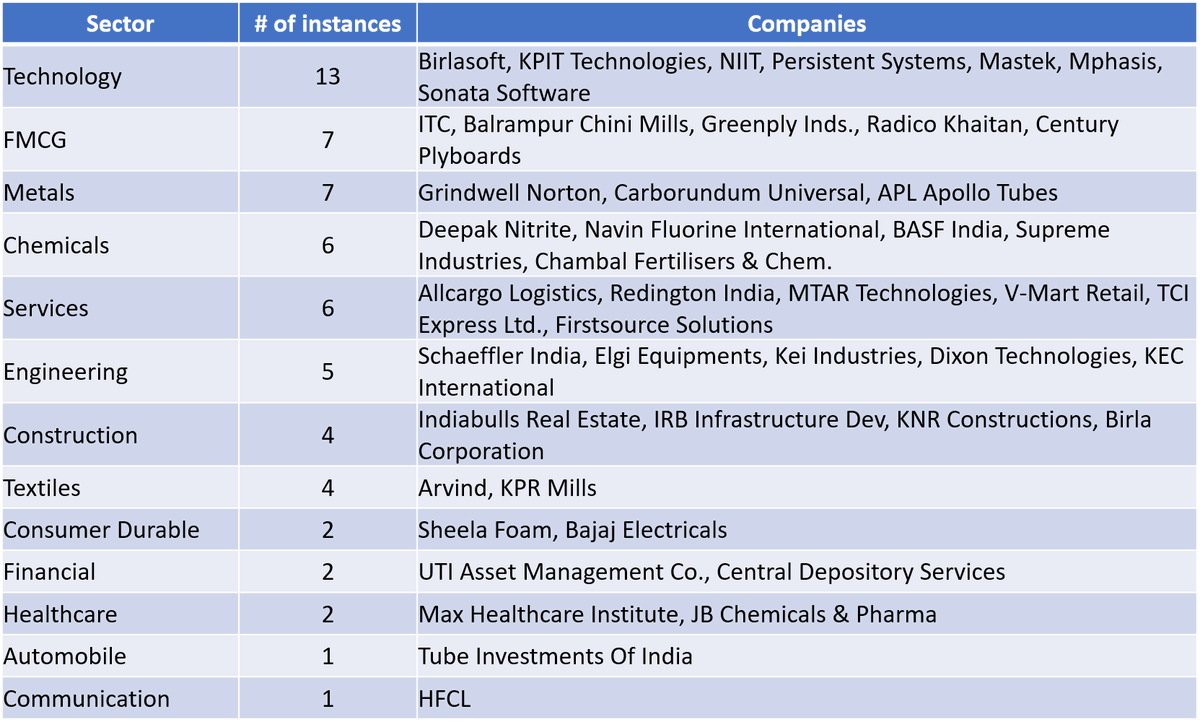

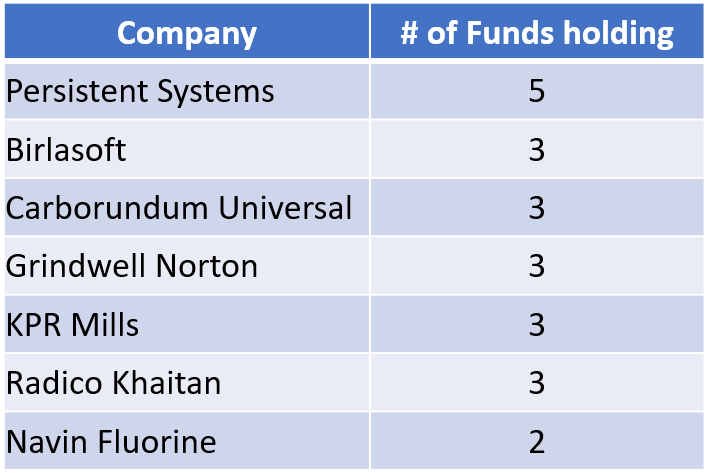

You may not like my list or you may have other preferences. As long as we do research, have discipline and be patient, we can find the opportunities. Here is a @soicfinance video that can give you few ideas (with good tailwinds).

n/n

n/n

• • •

Missing some Tweet in this thread? You can try to

force a refresh