Alufluoride has given it's highest ever quarterly sales in Q3FY22

Maybe this is the break-out qtr or maybe this is just a flash in the pan.

It's a 250cr market (micro) cap co with low debt and high ceiling.

Lets learn about it before we conclude one way or the other!

0/n

Maybe this is the break-out qtr or maybe this is just a flash in the pan.

It's a 250cr market (micro) cap co with low debt and high ceiling.

Lets learn about it before we conclude one way or the other!

0/n

This is the most time I have spent on any company!

Since industry is a bit unique, tried elaborating the aluminium manufacturing process as well so you can appreciate what Alufluoride does

@Atulsingh_asan Bhai-Wud luv your feedback

Pls retweet if U learnt something

1/n

Since industry is a bit unique, tried elaborating the aluminium manufacturing process as well so you can appreciate what Alufluoride does

@Atulsingh_asan Bhai-Wud luv your feedback

Pls retweet if U learnt something

1/n

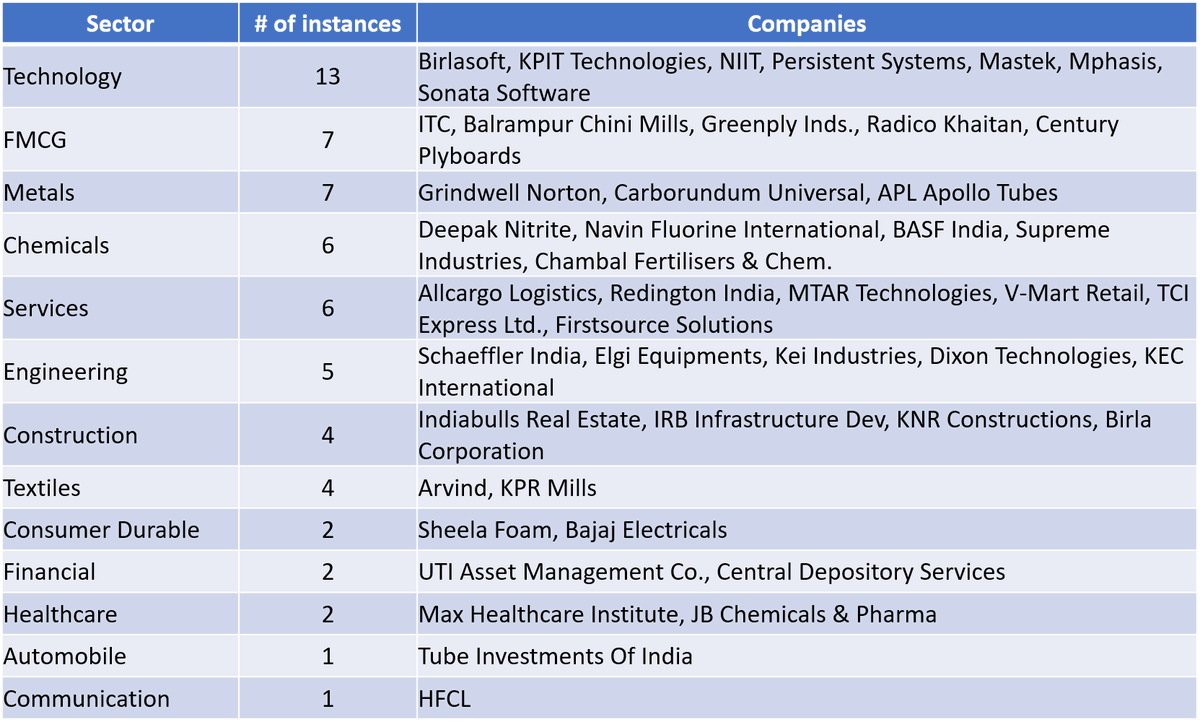

How this thread organized?

1)Alufluoride-Intro

2)Some facts about Aluminium industry & demand

3)Applications of Aluminium Fluoride (AlF3)

4)Role of AlF3 in Aluminium production

5)Market 4 AlF3

6)More abt Alufluoride & Peers

7)Valuations

8)Thesis & Anti-thesis

9)Conclusion

2/n

1)Alufluoride-Intro

2)Some facts about Aluminium industry & demand

3)Applications of Aluminium Fluoride (AlF3)

4)Role of AlF3 in Aluminium production

5)Market 4 AlF3

6)More abt Alufluoride & Peers

7)Valuations

8)Thesis & Anti-thesis

9)Conclusion

2/n

Alufluoride produces Aluminium Fluoride (AlF3), an important additive used in the production of Aluminium. Hence, lets understand a bit about Aluminium industry and it’s manufacturing process before we analyze Alufluriode.

3/n

3/n

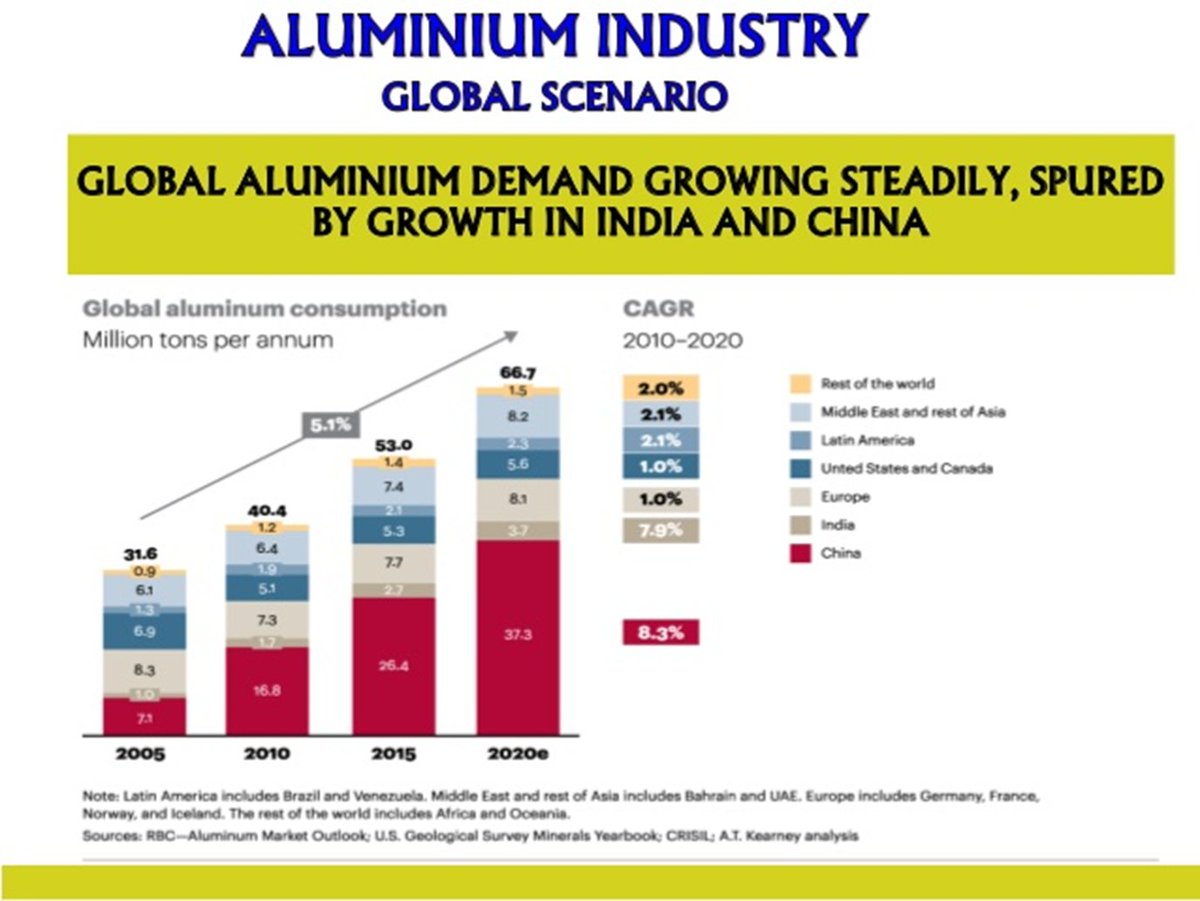

Aluminium, or ‘aluminum’ is one of the most abundant minerals on Earth. It is the second-most used metal globally and it is largely used as an alloy.

Alloy - a metal made by combining two or more metallic elements (to give greater strength or resistance to corrosion)

4/n

Alloy - a metal made by combining two or more metallic elements (to give greater strength or resistance to corrosion)

4/n

Aluminum uses are found across the industries such as power lines, high-rise buildings, consumer electronics, household & industrial appliances, aircraft & spacecraft components, ships & trains, automobiles etc.

Each year, applications of Aluminium are only going up!

5/n

Each year, applications of Aluminium are only going up!

5/n

What makes aluminum so wanted metal?

1. Strong, lightweight, recyclable & unique.

2. It weighs up to 65% less than the steel.

3. It increases energy efficiency. For example, lightweight aluminum contributes to increased fuel economy in vehicles - from cars to armored tanks.

6/n

1. Strong, lightweight, recyclable & unique.

2. It weighs up to 65% less than the steel.

3. It increases energy efficiency. For example, lightweight aluminum contributes to increased fuel economy in vehicles - from cars to armored tanks.

6/n

Aluminium & Construction

The future of sustainable construction is unthinkable without aluminum. Aluminum building products are resistant to atmospheric influences, corrosion & harmful effects of UV rays.

Indeed, the modern skyscrapers can’t be built without aluminum

7/n

The future of sustainable construction is unthinkable without aluminum. Aluminum building products are resistant to atmospheric influences, corrosion & harmful effects of UV rays.

Indeed, the modern skyscrapers can’t be built without aluminum

7/n

Now that we have established the fact Aluminium is the cousin sister of Oxygen for human needs, let's get back to Aluminium Fluoride.

Why is it imp?

Because, to produce 1 ton of Aluminium, we need abt 16-25 kg of aluminium fluoride.

But, how much aluminium do we produce?

8/n

Why is it imp?

Because, to produce 1 ton of Aluminium, we need abt 16-25 kg of aluminium fluoride.

But, how much aluminium do we produce?

8/n

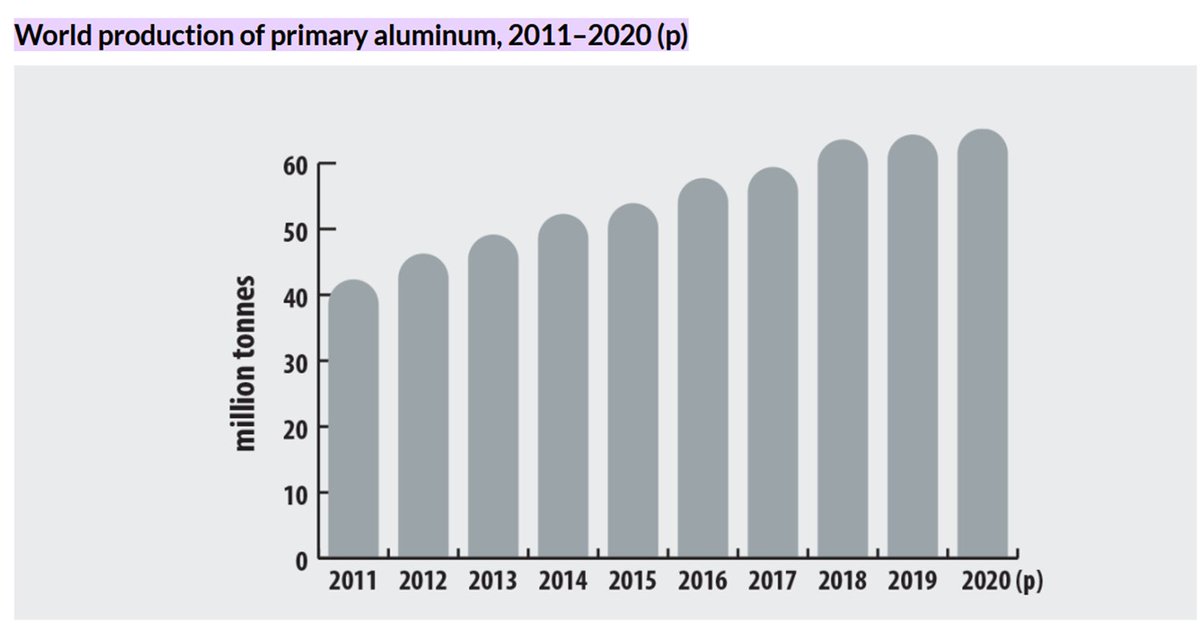

Why is Aluminium Fluoride (AlF3) key?

1900: Annual aluminum o/p was 1000 tons

2020: Annual o/p was about 65 "million" tons.

Gradually, Aluminium is becoming as important as Oxygen to Humans!

1 ton of Aluminium production needs about 16-25 kg of AlF3. You do the math

9/n

1900: Annual aluminum o/p was 1000 tons

2020: Annual o/p was about 65 "million" tons.

Gradually, Aluminium is becoming as important as Oxygen to Humans!

1 ton of Aluminium production needs about 16-25 kg of AlF3. You do the math

9/n

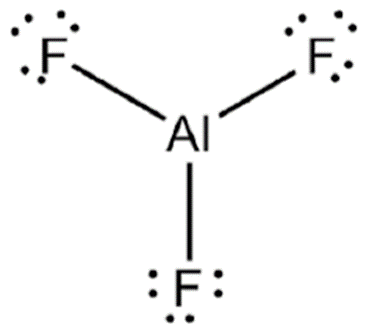

What is Aluminium Fluoride?

Also known as AIF3, it is an odorless white crystalline powder. It is used:

1. in the production of Aluminum (we will discuss how, in detail, in a minute)

2. as a flux (cleaning agent) in welding applications

3. in ceramic glazes & enamels.

10/n

Also known as AIF3, it is an odorless white crystalline powder. It is used:

1. in the production of Aluminum (we will discuss how, in detail, in a minute)

2. as a flux (cleaning agent) in welding applications

3. in ceramic glazes & enamels.

10/n

More uses of Aluminium Fluoride:

4. It is an ingredient in fluoroaluminate glass production. Fluoroaluminate glass is found in optical fiber applications, such as fiber-optic imaging & medical applications.

5. It is also included to create refractory ceramic products.

11/n

4. It is an ingredient in fluoroaluminate glass production. Fluoroaluminate glass is found in optical fiber applications, such as fiber-optic imaging & medical applications.

5. It is also included to create refractory ceramic products.

11/n

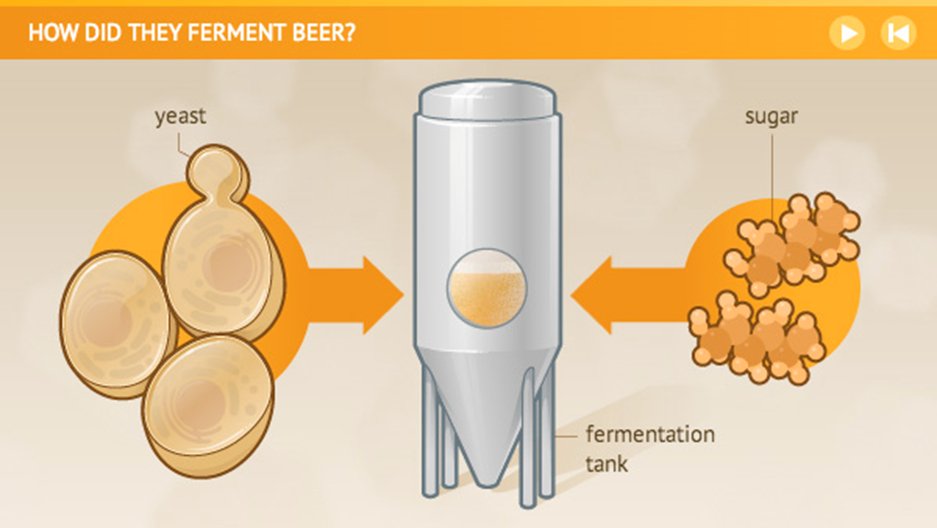

More uses of Aluminium Fluoride (AlF3):

6. And in another instance of seemingly surprising uses for a chemical such as aluminum fluoride, it is widely used in beer and wine making industries, where it has the ability to inhibit the fermentation process.

12/n

6. And in another instance of seemingly surprising uses for a chemical such as aluminum fluoride, it is widely used in beer and wine making industries, where it has the ability to inhibit the fermentation process.

12/n

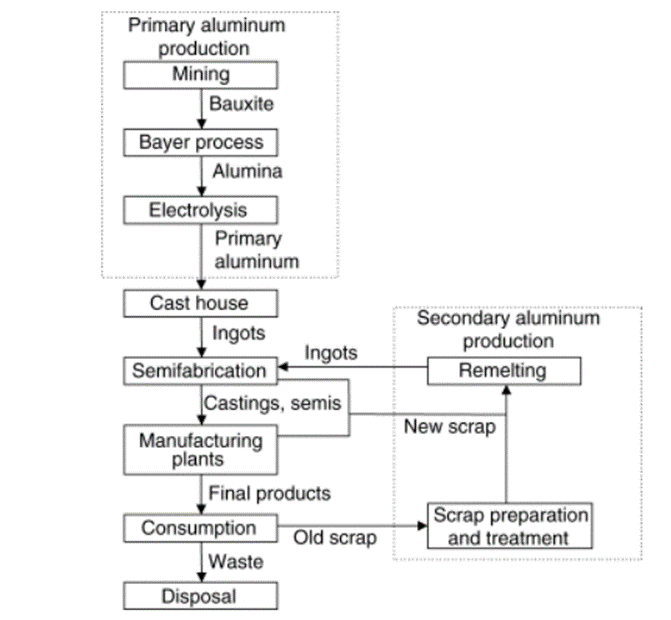

While we have seen many uses of AlF3, the biggest use obviously is in producing Aluminium.

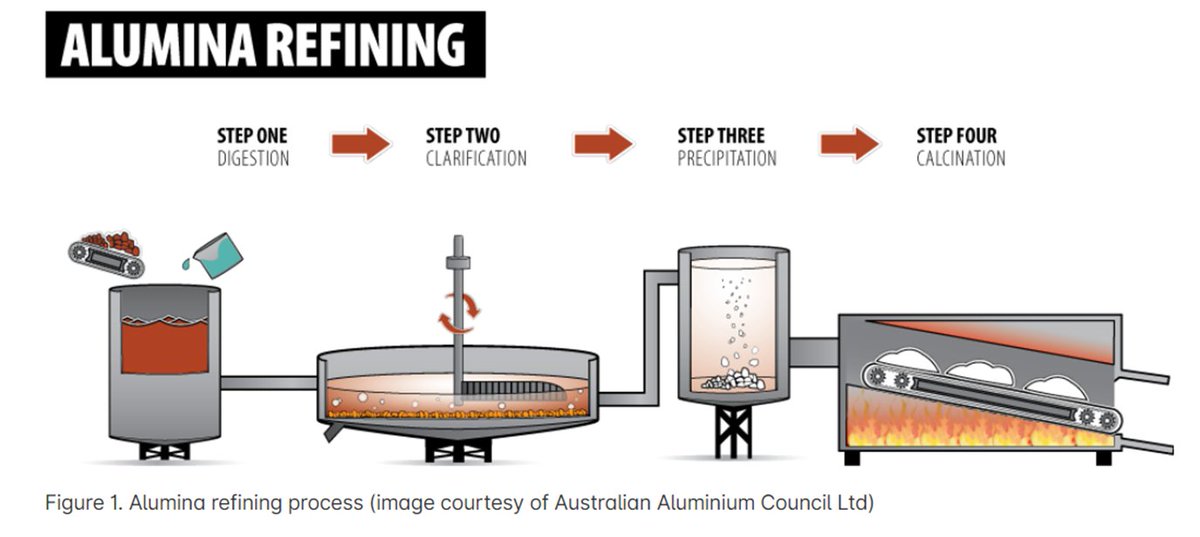

Broadly, Bauxite (“aluminium ore”) refined to Aluminium oxide (alumina) electrolyzed to Molten aluminium (see the graphic)

Electrolysis needs Aluminium Fluoride

Lets C the details

13/n

Broadly, Bauxite (“aluminium ore”) refined to Aluminium oxide (alumina) electrolyzed to Molten aluminium (see the graphic)

Electrolysis needs Aluminium Fluoride

Lets C the details

13/n

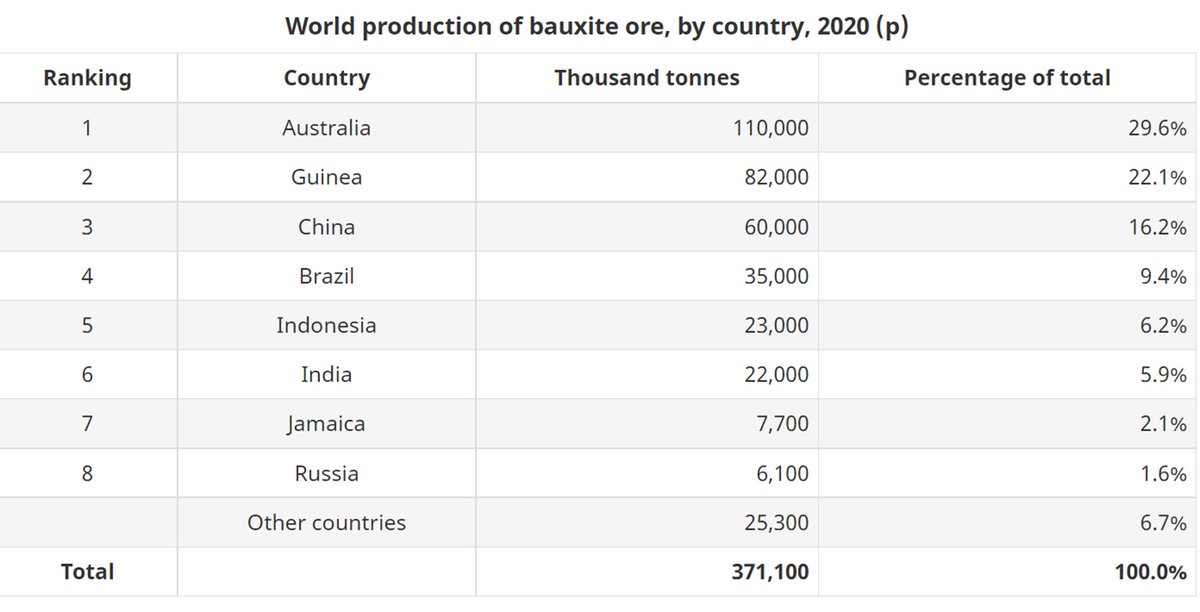

Step 1: Aluminium production begins with bauxite, the “aluminium ore”. Most bauxite is mined in tropical areas & there is abundant of bauxite available for ages to come (see the graphics to get an idea).

Australia produces > 1/3rd of the world's supply of bauxite.

14/n

Australia produces > 1/3rd of the world's supply of bauxite.

14/n

Step 2: Pure aluminium oxide, called alumina, is extracted from bauxite via a process called refining (Caustic soda is used to dissolve the aluminum compounds found in the bauxite)

2.3 tons of bauxite is = 1 ton of alumina

2 tons of alumina = 1 ton of primary aluminum

15/n

2.3 tons of bauxite is = 1 ton of alumina

2 tons of alumina = 1 ton of primary aluminum

15/n

Step 3: Electrolytic smelting is the third step in which the alumina is poured into a reduction cell with 950°C molten cryolite. 400kA electrical currents are passed through the mixture to produce 99.8% pure aluminium.

Aluminium Fluoride (& thus Alufluoride) comes in here!

16/n

Aluminium Fluoride (& thus Alufluoride) comes in here!

16/n

Aluminum fluoride essentially lowers the melting point of alumina feed and together with Cryolite, it increases the electrolyte's conductivity, reducing the electric power consumption. So, it essentially is an important additive in electrolysis.

But, why is it important?

17/n

But, why is it important?

17/n

Aluminium production is energy intensive. About 17 kWh of electricity are required to produce 1 kg of aluminium. The cost of electricity represents about one-third of the cost of smelting aluminum.

Aluminium fluoride plays a role in containing that cost!

Lets see how.

18/n

Aluminium fluoride plays a role in containing that cost!

Lets see how.

18/n

Melting point for aluminium oxide (alumina) is b/w 1,500 °C & 2,072 °C based on the complex. Adding Aluminium Fluoride allows the electrolytic process to take place at a temp around 850 °C.

Using today's technologies, it is impossible to manufacture aluminium without AIF3

19/n

Using today's technologies, it is impossible to manufacture aluminium without AIF3

19/n

Now that we have established two facts:

1. Aluminium usage would continue to grow

2. Aluminium can't be produced without Aluminium Fluoride

Lets jump right into analyzing Aluflouride.

In short, Alufluoride supplies Aluminium Fluoride to Aluminium smelters (manufacturers)

20/n

1. Aluminium usage would continue to grow

2. Aluminium can't be produced without Aluminium Fluoride

Lets jump right into analyzing Aluflouride.

In short, Alufluoride supplies Aluminium Fluoride to Aluminium smelters (manufacturers)

20/n

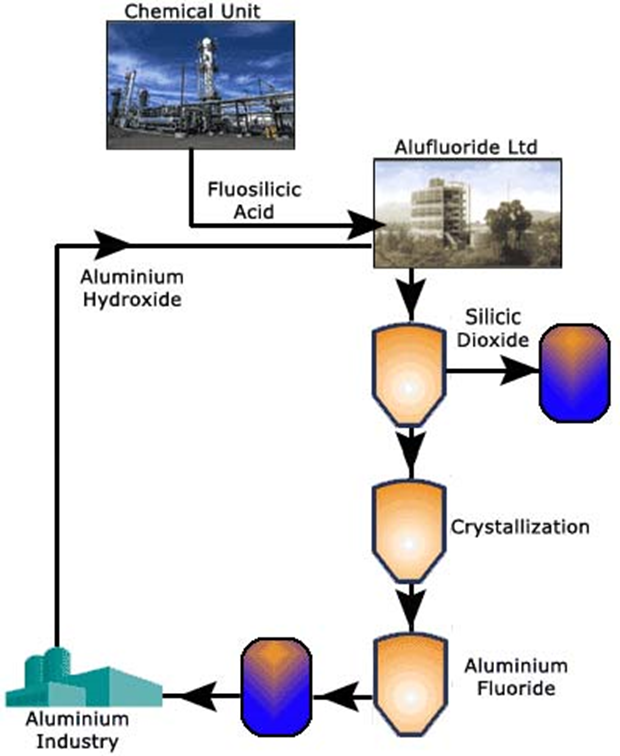

We already know how Aluminium Fluoride (AlF3) aids in manufacturing Aluminium. Now, lets learn how AlF3 is produced

There are 2 ways of producing AlF3:

1st: Processed from Fluorspar and Sulphur (80 percent of world production).

2nd: Processed from the fluosilicic acid

21/n

There are 2 ways of producing AlF3:

1st: Processed from Fluorspar and Sulphur (80 percent of world production).

2nd: Processed from the fluosilicic acid

21/n

Alufluoride adopted 2nd method (see the graphic) where in it sources fluosilicic acid from Coromandel Fertilisers. Thus raw materials aren't imported & hence is relatively cost effective.

However, in its qtrly report, it mentioned about supply challenges (to be monitored)

22/n

However, in its qtrly report, it mentioned about supply challenges (to be monitored)

22/n

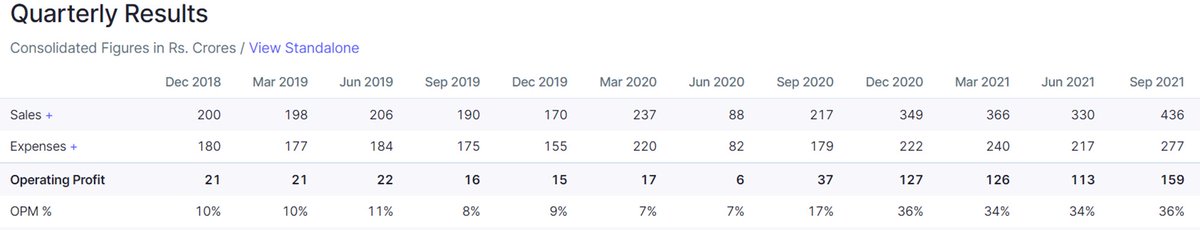

How does the AlF3 market look like?

In FY21, Co produced 6,072 MT (as against 8,223 MT in FY20). COVID hurt FY21 numbers

AlF3 demand for India is b/w 65-80 thousand tons.

With Aluminium demand going up, demand for AlF3 would go up as well. Thus, Demand is not a problem

23/n

In FY21, Co produced 6,072 MT (as against 8,223 MT in FY20). COVID hurt FY21 numbers

AlF3 demand for India is b/w 65-80 thousand tons.

With Aluminium demand going up, demand for AlF3 would go up as well. Thus, Demand is not a problem

23/n

Lets understand the demand space for AlF3:

Excerpt from NALCO's FY21 AR: "...Also contributing to high cost are high import duties on critical raw materials like Aluminium Fluoride, CP Coke & Caustic Soda..."

Import substitution is the market opportunity for Alufluoride

24/n

Excerpt from NALCO's FY21 AR: "...Also contributing to high cost are high import duties on critical raw materials like Aluminium Fluoride, CP Coke & Caustic Soda..."

Import substitution is the market opportunity for Alufluoride

24/n

Lets understand more:

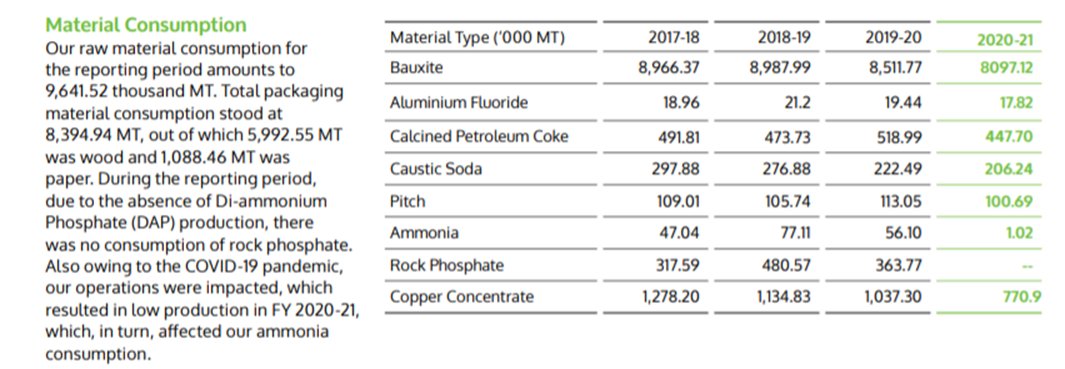

NALCO had spent 75cr, 80cr & 75cr on Aluminium Fluoride in FY19, FY20 & FY21 respectively. FY21 dipped due to COVID lockdown, so, we need to see what would be numbers for FY22.

Alufluoride's TTM revenue is 58cr & NALCO is just one of many Cos!

25/n

NALCO had spent 75cr, 80cr & 75cr on Aluminium Fluoride in FY19, FY20 & FY21 respectively. FY21 dipped due to COVID lockdown, so, we need to see what would be numbers for FY22.

Alufluoride's TTM revenue is 58cr & NALCO is just one of many Cos!

25/n

Lets understand more:

HINDALCO, another large player had procured 17 to 20 thousand MTs of AlF3 since 2017. FY22 will give us more realistic picture of ongoing demand

So, long story short, there is enough internal demand for Aluminium Fluoride!

26/n

HINDALCO, another large player had procured 17 to 20 thousand MTs of AlF3 since 2017. FY22 will give us more realistic picture of ongoing demand

So, long story short, there is enough internal demand for Aluminium Fluoride!

26/n

Plant & Location:

Alufluoride's manufacturing plant is just 10 kms to the port of Visakhapatnam.

Coromandel Fertilisers who supply fluorosilicic acid to Alufluoride have plant nearby in Visakhapatnam

Thus they have location advantage in dealing with both i/p & o/p

27/n

Alufluoride's manufacturing plant is just 10 kms to the port of Visakhapatnam.

Coromandel Fertilisers who supply fluorosilicic acid to Alufluoride have plant nearby in Visakhapatnam

Thus they have location advantage in dealing with both i/p & o/p

27/n

International:

Alufluoride had signed a joint venture agreement with Jordan Phosphate Mines to commission a green field Aluminium Fluoride plant at Eshidiya Free Trade Zone, Jordan in January 2020

28/n

Alufluoride had signed a joint venture agreement with Jordan Phosphate Mines to commission a green field Aluminium Fluoride plant at Eshidiya Free Trade Zone, Jordan in January 2020

28/n

International:

The Company had incorporated two wholly owned subsidiaries:

1. ALUFLUORIDE INTERNATIONAL PRIVATE LTD on 21/12/2020 in Dubai

2. ALUFLUORIDE INTERNATIONAL PTE. LTD on 20/09/2021 in Singapore

These companies haven't commenced any operations yet.

29/n

The Company had incorporated two wholly owned subsidiaries:

1. ALUFLUORIDE INTERNATIONAL PRIVATE LTD on 21/12/2020 in Dubai

2. ALUFLUORIDE INTERNATIONAL PTE. LTD on 20/09/2021 in Singapore

These companies haven't commenced any operations yet.

29/n

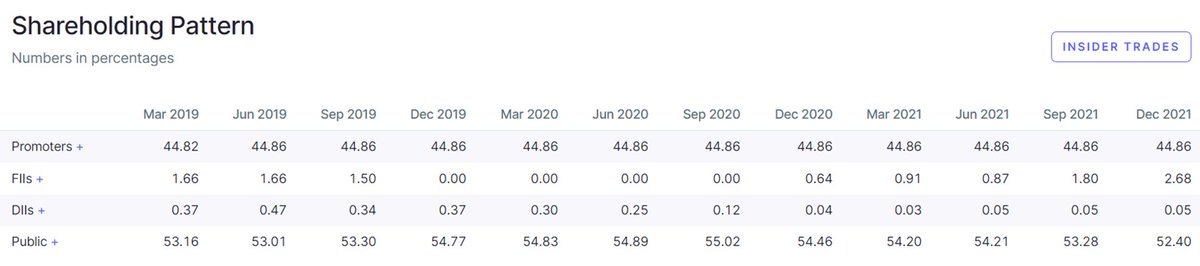

Management:

Venkat Akkineni is the MD of the company. He is elder brother of Film Hero Nagarjuna Akkineni. Nagarjuna is said to have great relationship with AP CM in case any Govt support is needed.

30/n

Venkat Akkineni is the MD of the company. He is elder brother of Film Hero Nagarjuna Akkineni. Nagarjuna is said to have great relationship with AP CM in case any Govt support is needed.

30/n

Domestic Market:

Alufluoride: 100% of revenue

SPIC: < 4% of it's revenue

Tanfac: 2% of its revenue (abt 3cr)

Earlier, Tanfac (Fluorspar method) had a huge capacity of 15,600 MT but over the yrs their production tapered off as it could not compete with the Chinese supply.

31/n

Alufluoride: 100% of revenue

SPIC: < 4% of it's revenue

Tanfac: 2% of its revenue (abt 3cr)

Earlier, Tanfac (Fluorspar method) had a huge capacity of 15,600 MT but over the yrs their production tapered off as it could not compete with the Chinese supply.

31/n

Domestic Market:

Domestic players cater to only ~14-20% of Indian demand. Hence, there is a huge scope for import substitution & creation of capacity

Crackdown in China Aluminium industry & China+1 theme should help Alufluoride. Tanfac & SPIC aren't focusing on AlF3

32/n

Domestic players cater to only ~14-20% of Indian demand. Hence, there is a huge scope for import substitution & creation of capacity

Crackdown in China Aluminium industry & China+1 theme should help Alufluoride. Tanfac & SPIC aren't focusing on AlF3

32/n

Pricing of Aluminium Fluoride Market:

What used to be Rs 60-70/kg until 2017 had gone up to 100/kg in 2017 and currently based on the price on indiamart.com/proddetail/alu…, its around Rs 140-150/kg

Demand is high and so is Price

33/n

What used to be Rs 60-70/kg until 2017 had gone up to 100/kg in 2017 and currently based on the price on indiamart.com/proddetail/alu…, its around Rs 140-150/kg

Demand is high and so is Price

33/n

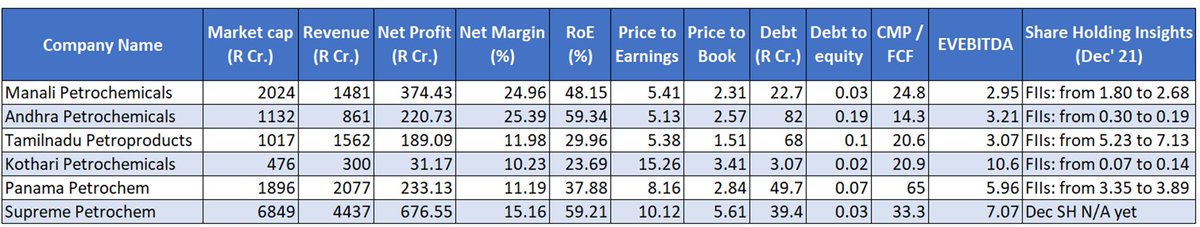

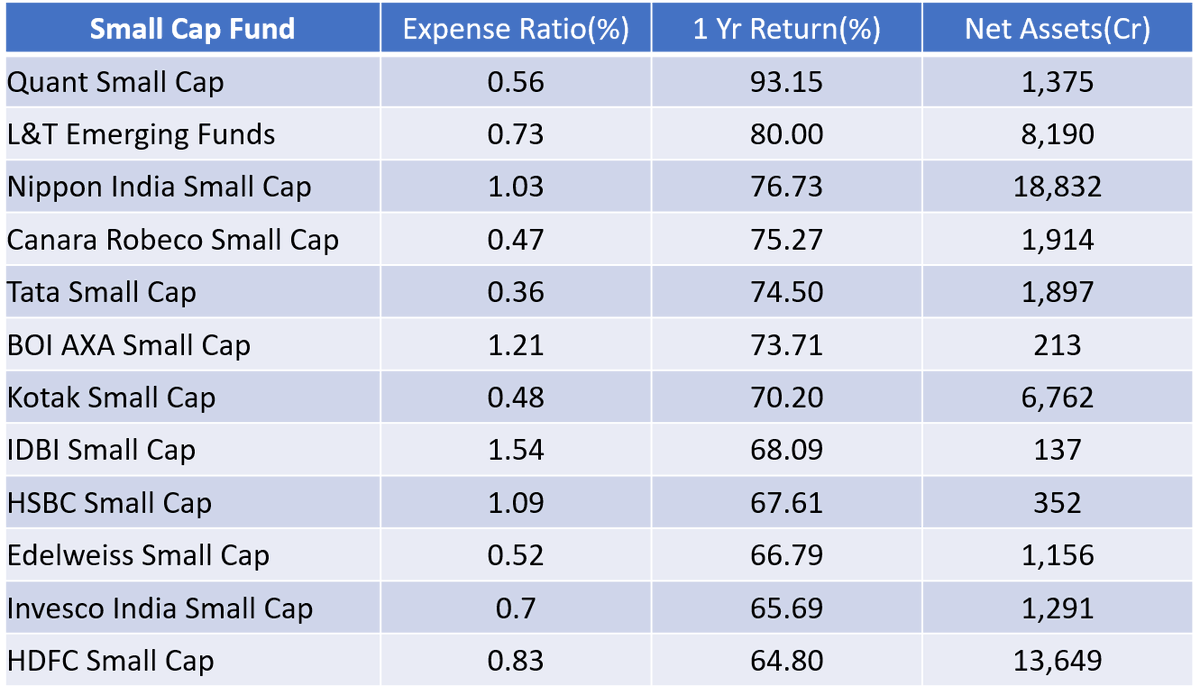

Valuations:

This is a micro cap and at this time, valuations don’t look attractive. So, this isn’t a company to invest based on valuations rather if one wants to consider investing, it should be based on future narrative & potential.

34/n

This is a micro cap and at this time, valuations don’t look attractive. So, this isn’t a company to invest based on valuations rather if one wants to consider investing, it should be based on future narrative & potential.

34/n

Thesis:

1. Aluminum's demand will continue to grow & hence demand for Aluminium Fluoride

2. AlF3 market is projected to grow at a CAGR of 4.6% b/w 2018 & 2028

3. Huge scope for import substitution (domestic players cater to only ~14-20% of demand)

4. China+1 strategy

35/n

1. Aluminum's demand will continue to grow & hence demand for Aluminium Fluoride

2. AlF3 market is projected to grow at a CAGR of 4.6% b/w 2018 & 2028

3. Huge scope for import substitution (domestic players cater to only ~14-20% of demand)

4. China+1 strategy

35/n

Thesis:

5. Location advantage for both raw materials & produced material

6. Application of AlF3 growing beyond Aluminium production

7. India & UAE's trade pact should help with its exports (+ they have a subsidiary in UAE)

8. AlF3 production requires costly lab set ups

36/n

5. Location advantage for both raw materials & produced material

6. Application of AlF3 growing beyond Aluminium production

7. India & UAE's trade pact should help with its exports (+ they have a subsidiary in UAE)

8. AlF3 production requires costly lab set ups

36/n

Anti-Thesis:

1. AlF3 has hazardous side effects & hence prone to regulatory changes

2. If Chinese govt allows it's cos to increase scale, could become a threat

3. Direct dependency on Aluminium demand

4. Alufluoride need to address RM constraint (as stated in qtrly report)

37/n

1. AlF3 has hazardous side effects & hence prone to regulatory changes

2. If Chinese govt allows it's cos to increase scale, could become a threat

3. Direct dependency on Aluminium demand

4. Alufluoride need to address RM constraint (as stated in qtrly report)

37/n

Anti-Thesis:

5. This could be a victim of cyclicality. Although Aluminium usage is becoming day to day, reality is it's a metal and biggest needs of aluminium are still cyclical.

38/n

5. This could be a victim of cyclicality. Although Aluminium usage is becoming day to day, reality is it's a metal and biggest needs of aluminium are still cyclical.

38/n

Conclusion:

1. It's a micro cap linked to a metal industry, thereby their is a risk & valuations aren't great.

2. Same time, no domestic competition & future opportunities look attractive.

3. Q4FY22 results are key to sustainability

4. It's a high risk-high reward play

39/n

1. It's a micro cap linked to a metal industry, thereby their is a risk & valuations aren't great.

2. Same time, no domestic competition & future opportunities look attractive.

3. Q4FY22 results are key to sustainability

4. It's a high risk-high reward play

39/n

References:

en.wikipedia.org/wiki/Aluminium….

nj.gov/health/eoh/rtk…

pubchem.ncbi.nlm.nih.gov/compound/Alumi…

noahchemicals.com/blog/what-is-a…

nrcan.gc.ca/our-natural-re…

futuremarketinsights.com/reports/alumin…

moneycontrol.com/news/opinion/a…

sciencedirect.com/topics/nursing…

entrepreneurindia.co/project-and-pr…

n/n

en.wikipedia.org/wiki/Aluminium….

nj.gov/health/eoh/rtk…

pubchem.ncbi.nlm.nih.gov/compound/Alumi…

noahchemicals.com/blog/what-is-a…

nrcan.gc.ca/our-natural-re…

futuremarketinsights.com/reports/alumin…

moneycontrol.com/news/opinion/a…

sciencedirect.com/topics/nursing…

entrepreneurindia.co/project-and-pr…

n/n

• • •

Missing some Tweet in this thread? You can try to

force a refresh