$GLD $SLV Two years ago close to this day I made a fateful decision to dump all my $gdxj and buy $AR at $1/share. Close colleagues thought i was absolutely loony- sentiment on gold was sky high (similar to where oil sentiment is today fyi) and well sentiment on gas- you could

not find a more reviled asset. That was a life changing trade & even though i exited 1/2 my $ar at 10 & 1/2 at $14; the entries into $btu sub 3, and $5.50 ended up being even better switches. So why the back story-Twitter has made me so much $ from getting a real time sentiment

check on where sentiment is. Well now lets talk about oil; My timeline has everyone calling for $150 oil; don't believe me- look at COT o/s-now I'm not bearish oil- if anyone remembers for 2 years many of my followers have asked me about gold & i said nope-only care about energy

Well in the last week or so thats changed. Firstly on oil, although i think we do get to $100/150$ oil this is similar in my mind to uranium last fall before the 40% puke in equities-everyone was calling for Uranium 150$. well we may get there but that hasn't stopped equities

from crashing. Im not making the same mistake twice which is why i sold $oxy- which i successfully acquired at $10 (oct 20)- sold at 29, bot back at 22$ in aug 21 and doubled up at 26 in dec 21 (all those were tweeted). I have obviously sold a bit low at 36$ but thats ok. this

So moving on to gold. I have not purchased any gold in 2 years since i successfully dumped all the $GDXJ in 2/20 at 43$ (its still lower today despite $ar going from 1 to 20$.). The sentiment on gold is in the absolute toilet and you're probably rolling your eyes now reading this

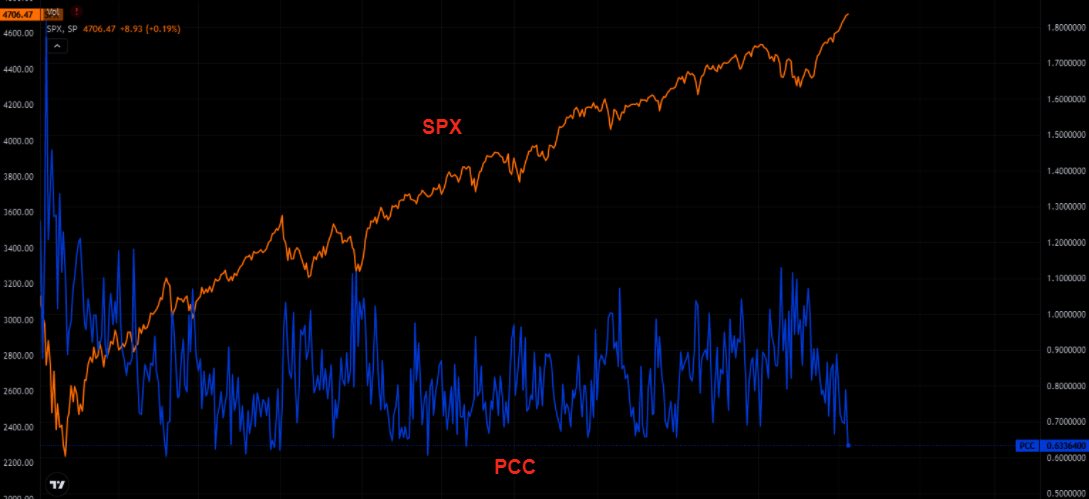

saying yet another gold bull. I can assure you Im not but i like playing sentiment and being contrarian and i think the things are lining up for gold today. Firstly, check out some indicators of sentiment; this from a great presentation by @RonStoeferle

From @jessefelder discounts on physical gold funds are at sky high levels- this is when sentiment is at near lows

I think it breaks upwards for a variety of reasons; firstly, gold tends to bottom at the time of the first rate hike as shown here

In addition, i think the economy is not doing as well as everyone thinks and as @KeithMcCullough has been calling, were in deep quad 4 which will become apparent as the months come by- @LynAldenContact has been saying anything past 2% & given the indebtedness the economy wont be

able to sustain it- thus, the Fed is trapped and when that becomes clearly apparent, the $ will fall & people will flock to gold. Now what is interesting is gold volatility is clearly too low- and that makes owning options on $GLD & $SLV particularly attractive.

now in the past 2 weeks we've had HFs (who are the new CRAMER), aggressively shorting gold. Well it seems to be getting snapped up and every sell off is shorter and shorter as evidenced by the mini pukes on thur and friday this past week. @htsfhickey had a good tweet on the flows

So to conclude & apology or kudos for anyone whos made it this far how am I playing it? Well despite gold equities being silly cheap, the horror of seeing $GDXJ fall 50% post my selling it during the covid crash makes me wary on going long. I have bought $GLD 180-200$ strike

calls for sept 2022 & $SLV Jan $26-30$ 2023 calls for silver. I believe you get paid with rising precious metal volatility & significant leverage if there is a realization that the fed is trapped. Although ive been bullish oil & Still own every share of $PANR that i have bot,

I have sold all my $oxy, & hedged a portion of the panr with $uso. I have been deploying the funds into $btu at $10 (which i tweetd about, $kap, $age $pdn (also tweeted about) & in the past week or so been aggressively adding call options on $GLD & $SLV.

For those that dont want to take option risk, i have also bot $AGQ as a double levered way to play physical silver. Again I hope ive 1. communicated that i am not a gold or silver bull and for the past 2 years have avoided a lot of heartache by not touching the sector. 2 I

think the time to retake a contrarian look at the metals makes a lot of sense. Finally if and when we get any equity puke/crash that will be the time to aggressively add to the miners. Thank you.

It goes without saying that speculating on options is highly risky so pls do your own Due diligence and recognize you could lose your principal. So this is not financial advice and im just mentioning how I’m investing my money .

• • •

Missing some Tweet in this thread? You can try to

force a refresh