$QQQ Some musings on a Saturday morning. @kevinmuir piece yesterday about HF continued buying of tech and selling of energy- something i had noted as well in several tweets from GS data made me think what is causing this apparent stupidity. H/t to Kevin for some of these charts

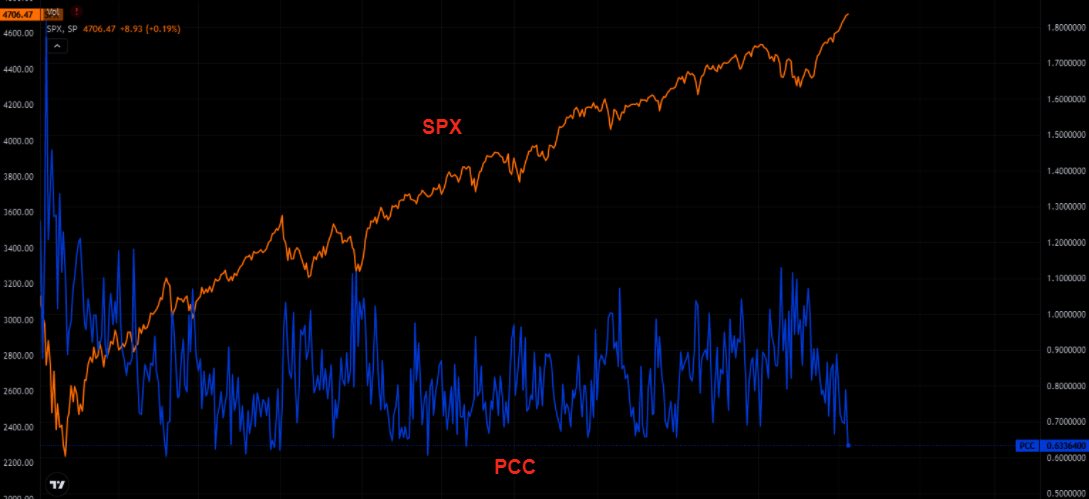

Rates are bad for high duration assets. So why the continued doubling down on a losing bet. & even though the charts don’t show it, GS data shows the continued buying of tech & selling of energy ytd.

And then it hit me- we’ve had a generation of managers that have never seen anything but buy the dip & the fed has your back. Long term inflation data although rising are still for now not

Blowing out and so tech investors think a lot of these commodity prices will come down due to lower base effects and viola you will get a fed pivot and tech is then off to the races. Well what i think investors are missing is that inflation even if it comes off, will remain at a

Higher threshold & particularly at the lower income spectrums disposable income has really been squeezed. Think how many stimmy checks went towards IPhones, new streaming service subs etc etc. Well thanks to captalist exploits, i dug up this chart showing palm oil up 200% last

Palm oil is used for a lot of processed foods. So we’ve seen bacon px up 28% ytd. Many other groceries up the same & gas prices are nearing $5+ /gallon in places like CA. So do we think people will continue consuming 5 streaming services and upgrading their iPhones every 2

Years or rather spending that $ on feeding their kids. Thus, if im right and even if the fed does become more dovish- something they may be forced to do despite the current hawkishness as the economy is slowing, it wont matter. See the current weakness in tech is 1. Caused by

Rising rates. 2. Recently concern about margin pressure. 3 will be even if rates start falling a concern on top line growth as consumers pull back and reorient their spending towards more Basic goods and less on frivolous tech spending. The tech bros are assuming #1 is

Transitory (and they may be right) but they haven’t figured out that #2 and #3 will crush the valuations. Dont forget in 2000-2002, fed funds rates fell hundreds of basis points and it didnt help nasdaq stop falling over 80%. And oh yeah there were a bunch of financial

Shenanigans like worldcom and Enron that didnt inspire confidence. My bet this cycle will be TSLA and CVNA & the implosion (asset freeze) of $ARKK if i had to make a bet. So thank you Kevin for inspiring me to remember a painful period in the markets!

• • •

Missing some Tweet in this thread? You can try to

force a refresh