Writing a thread on key learnings from Prabhudas Lilladher’s report on Healthcare sector covering the entire sector & key listed players.

The content of the same is as follows:

-Overview of Healthcare Industry

-Investment rationale

-Key sectoral risks

-Company Analysis

#Pharma

The content of the same is as follows:

-Overview of Healthcare Industry

-Investment rationale

-Key sectoral risks

-Company Analysis

#Pharma

Overview:

India's healthcare industry has shown remarkable growth in the recent past and the momentum will certainly continue in FY23 with improvement in occupancy, better case mix and sustainability of current ARPOB.

#Pharma #Healthcare #Investment

India's healthcare industry has shown remarkable growth in the recent past and the momentum will certainly continue in FY23 with improvement in occupancy, better case mix and sustainability of current ARPOB.

#Pharma #Healthcare #Investment

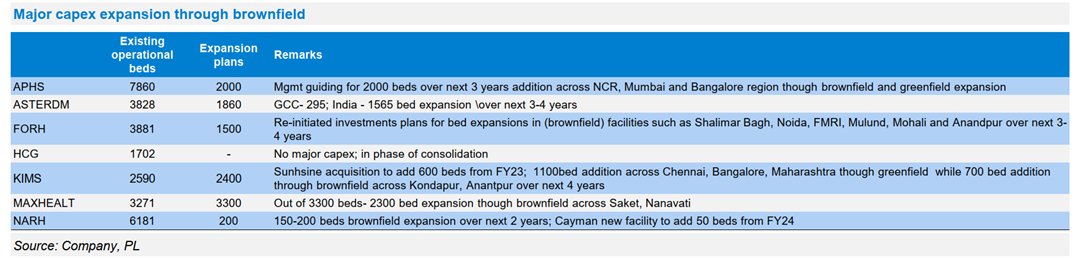

Beyond FY23, we believe hospital companies will be more focused on growth as they are

- adding new capacities largely through brownfield expansion for faster operationalization of beds & lower startup costs

- scaling up other ancillary businesses to tap further opportunities.

- adding new capacities largely through brownfield expansion for faster operationalization of beds & lower startup costs

- scaling up other ancillary businesses to tap further opportunities.

Investment Rationale:

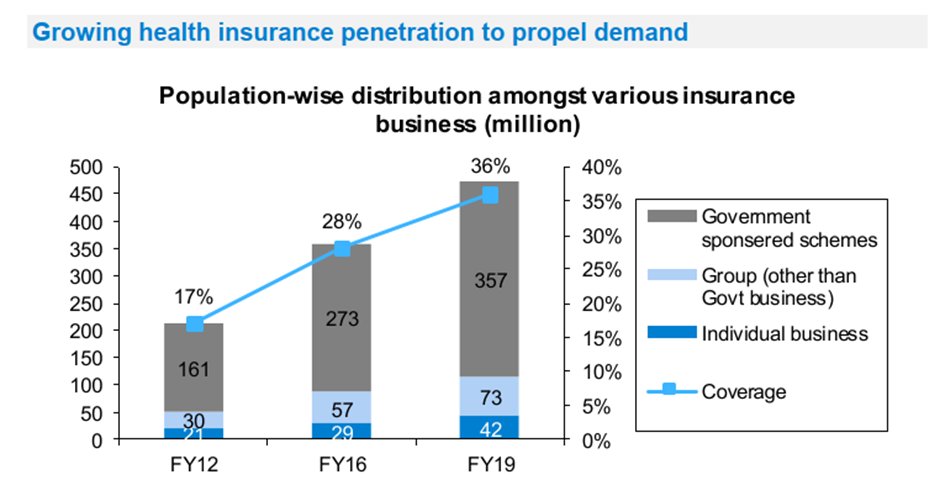

1. Secular story: Under penetration market with attractive dynamics

• India healthcare industry is poised to grow at a 15-17% CAGR driven by ageing population, burgeoning lifestyle diseases, rising affordability which in turn drives quality healthcare.

1. Secular story: Under penetration market with attractive dynamics

• India healthcare industry is poised to grow at a 15-17% CAGR driven by ageing population, burgeoning lifestyle diseases, rising affordability which in turn drives quality healthcare.

• India’s private sector accounts for 70-75% of healthcare spend; hence new investments will largely be driven by private firms

• Limited penetration of health insurance has led to out-of-pocket expense accounting for 63% of total healthcare which is one of highest in the world

• Limited penetration of health insurance has led to out-of-pocket expense accounting for 63% of total healthcare which is one of highest in the world

• India offers significant opportunity for growth of medical tourism. This market is expected to rise at a CAGR of 65- 70% between FY21-25.

• India healthcare spend is just 3.8% of GDP vs 17% in case of US.

• India healthcare spend is just 3.8% of GDP vs 17% in case of US.

2 Brownfield expansion to aid hospital segment

• APHS: Company will continue to explore bolt on acquisitions in markets like NCR and Mumbai

• ASTERDM: Aster is looking to add 145 beds in Oman. In India – 276 beds are planned through brownfield expansion by H1FY23 end.

#Apollo

• APHS: Company will continue to explore bolt on acquisitions in markets like NCR and Mumbai

• ASTERDM: Aster is looking to add 145 beds in Oman. In India – 276 beds are planned through brownfield expansion by H1FY23 end.

#Apollo

• FORH: The Company has re-initiated its investment plans for bed expansion in select existing facilities which will see a cumulative addition of ~1,300 beds over FY22-25E

• HCG: No major capex

#AsterDM #HCG #Fortis

• HCG: No major capex

#AsterDM #HCG #Fortis

• MAXHEALT: Planning to expand 2,300 beds over next 5 years at existing location. These are brownfield expansion at locations which are already running at optimal occupancy.

• NARH: Will be exploring bolt on acquisitions / greenfield in markets like Kolkata, Bangalore, MMR.

• NARH: Will be exploring bolt on acquisitions / greenfield in markets like Kolkata, Bangalore, MMR.

• KIMS: KIMS will be adding 650 beds through brownfield expansion across units over FY21-25E. Company is looking to add additional 1000-1200 beds through greenfield across Chennai, Bangalore and Maharashtra regions.

#KIMS

#KIMS

3. Ancillary business scaling up: Hospital companies are scaling up ancillary business like third party diagnostics, retail pharmacy and digital business for future growth. Scaling up of these ancillary businesses and potential spin-offs could be a value unlocking opportunity.

Key risks

• Venturing into new geography: While we are positive on the companies strategy to venture into newer and challenging geographies but it will also test companies project execution and operational management capabilities.

• Venturing into new geography: While we are positive on the companies strategy to venture into newer and challenging geographies but it will also test companies project execution and operational management capabilities.

• Resource availability poses operational and financial risk: Getting super-specialist doctors for newer super-specialty units would be a challenge, given scarcity of highly qualified talent. It may lead to higher employee costs.

•Ability to successfully manage increased scale: Companies are likely to witness significant increase in scale over the next couple of years as it ramps up new hospitals. The scale will come with its own challenges. Management’s ability to successfully manage it will be critical

Apollo Hospitals Enterprise:

Largest healthcare provider: APHS is Asia’s largest healthcare group in India with ~7,650 operational beds. With 44 owned hospitals and focus on clinical outcomes. Apollo Pharmacy is the largest organized pharmacy chain in India with 4,300 stores.

Largest healthcare provider: APHS is Asia’s largest healthcare group in India with ~7,650 operational beds. With 44 owned hospitals and focus on clinical outcomes. Apollo Pharmacy is the largest organized pharmacy chain in India with 4,300 stores.

One of best omni-channel play: Apollo 24/7 will combine strengths of Apollo Group’s offline healthcare leadership with new-age digital offerings that will address all its healthcare consumer needs. Company intends to cover more pin-codes and faster order delivery.

#Apollo

#Apollo

Scale up in B2C diagnostic segment: Though APHS is late entrant in diagnostic business, but has outlined extremely aggressive targets for the business – Rs10bn revenues in 3 years vs Rs4bn in FY22. Digital platform is expected to play a key role in this growth.

Growth Levers: APHS will continue to explore bolt-on acquisitions in markets like NCR and Mumbai & can also add 1000-2000 beds through brownfield expansion in hospital segment. Further its digital health space foray will help APHS to cross sell its services to a larger population

Key Risk:

- Delay in break-even of 24x7 operations.

- Any major greenfield capex/inorganic expansion in hospital segment dragging profitability in near term.

- Delay in break-even of 24x7 operations.

- Any major greenfield capex/inorganic expansion in hospital segment dragging profitability in near term.

Aster DM Healthcare

ASTERDM is one of the leading healthcare providers in Gulf Cooperation Region with 921 operating beds, 233 pharmacies and 118 clinics. GCC revenues were impacted due to COVID led disruptions, it has now normalized and should see pick up from H2FY22.

#AsterDM

ASTERDM is one of the leading healthcare providers in Gulf Cooperation Region with 921 operating beds, 233 pharmacies and 118 clinics. GCC revenues were impacted due to COVID led disruptions, it has now normalized and should see pick up from H2FY22.

#AsterDM

Increasing India footprints: The company has 14 hospitals in India with 2,907 operational beds, mostly in South India, of which 946 beds were commissioned over last 4-5 years. India hospitals profitability witnessed sharp jump in 9MFY22 aided by better occupancy and higher ARPOB.

Co has managed to reduce debt by Rs10bn over last 12 month. Possible restructuring in Saudi hospital viability testing and revisiting of Cayman Island plans is key monitorable in future. If company intends to go ahead with Cayman unit expansion, it can drag profitability.

New growth avenues: ASTERDM is foraying into diagnostics (in India), home-care (in UAE) and tele-health creates new avenues for growth over medium to long term.

Key risks:

- Higher capital allocation to Cayman Island unit

- Heavy reliance on the GCC region (80% of sales).

Key risks:

- Higher capital allocation to Cayman Island unit

- Heavy reliance on the GCC region (80% of sales).

HealthCare Global Enterprises

Focused player: HCG business model is to provide specialty healthcare with focus on oncology and fertility incidences in India. Given that company offers one-stop solution at competitive prices makes it differentiated and scalable business model.

Focused player: HCG business model is to provide specialty healthcare with focus on oncology and fertility incidences in India. Given that company offers one-stop solution at competitive prices makes it differentiated and scalable business model.

Further company’s experienced management, high- quality board and pan- India focus enhances our comfort on its long term business outlook.

Ramp-up in new centers hold key: HCG’s 40% of operational beds have been commercialized over FY17- 20.

#HCG

Ramp-up in new centers hold key: HCG’s 40% of operational beds have been commercialized over FY17- 20.

#HCG

New centers are dragging overall EBITDA and profitability as they are in ramp-up phase. Currently, the company reported INR 160mn of EBITDA loss from new centers in FY21 and has also achieved break even in H1FY22. This should start to contribute in meaningful way over FY22-24.

Equity infusion by CVC capital was positive: In May 2020, HCG issued shares worth Rs6.5bn to US based PE fund CVC Capital. This has helped company to reduce high leverage risk. Further strategic investment by CVC will bring in more operational and financial efficiency.

We estimate strong 39% EBIDTA CAGR over FY21-24E aided by steady growth in Centre of Excellence, scale up in existing centres and reduction of losses from new centres.

HCG’s asset light approach with focus on partnering has made its business model capital efficient and scalable.

HCG’s asset light approach with focus on partnering has made its business model capital efficient and scalable.

Key risk

- Delay in break-even of new cancer centres

- Retaining partnerships across its existing cancer units

- Delay in break-even of new cancer centres

- Retaining partnerships across its existing cancer units

Narayana Hrudayalaya

Steady pick up in flagship hospitals: 3 flagship Hospitals (2,100 operational beds) witnessed temporary blip due to COVID induced disruption given heavy reliance on elective surgeries and international patients. We expect recovery in profitability from FY23.

Steady pick up in flagship hospitals: 3 flagship Hospitals (2,100 operational beds) witnessed temporary blip due to COVID induced disruption given heavy reliance on elective surgeries and international patients. We expect recovery in profitability from FY23.

Brownfield investments to improve mix: NARH intends to step up investments to upgrade existing facilities. It will take benefit of RBI policy by borrowing at attractive rates of ~5%. The objective is to increase high end complex procedures across network to improve overall ARPOB.

New hospitals to achieve breakeven in FY23, EBIDTA positive in FY24: Losses at three new hospitals in India were at Rs 424mn in FY21 and Rs 85mn in 9MFY22 (sharp loss reduction). The Delhi unit has already turned EBITDA positive.

#NARH #NarayanaHruda

#NARH #NarayanaHruda

We expect Gurgaon unit to be EBIDTA positive from FY23 while SRCC Mumbai will take time. We estimate zero EBITDA in FY23E and Rs250mn EBITDA in FY24.

Cayman profitability to sustain: Cayman operations, on account of increased domestic patients flow to the facility due to overseas

Cayman profitability to sustain: Cayman operations, on account of increased domestic patients flow to the facility due to overseas

travel restrictions, continued its strong run with FY21 EBITDA growing at a YoY 73.6% to USD 26.2mn. This momentum continued in 9MFY22 with EBITDA of USD 29mn. NARH focused more on primary and secondary healthcare offerings during COVID environment which has worked well.

We expect current profitability to sustain and expect higher growth from FY24 given expansion program through a new set-up at the Cayman Islands city center, which will offer full-fledged oncology and outpatient services.

Key Risks:

- Delay in break-even new hospitals

Key Risks:

- Delay in break-even new hospitals

Thanks for reading till end.

Please let me know if this is useful and do you need more such threads.

End

Please let me know if this is useful and do you need more such threads.

End

• • •

Missing some Tweet in this thread? You can try to

force a refresh