$GLD $SLV

The US/EU could play the SWIFT sanctions card just once-just once and they chose to play it not with a pair ofAces but with a pair of 2s. - why? EVERY despot leader, China, Saudi Arabia all now know that if the US is not happy with you all your

wsj.com/articles/if-cu…

The US/EU could play the SWIFT sanctions card just once-just once and they chose to play it not with a pair ofAces but with a pair of 2s. - why? EVERY despot leader, China, Saudi Arabia all now know that if the US is not happy with you all your

wsj.com/articles/if-cu…

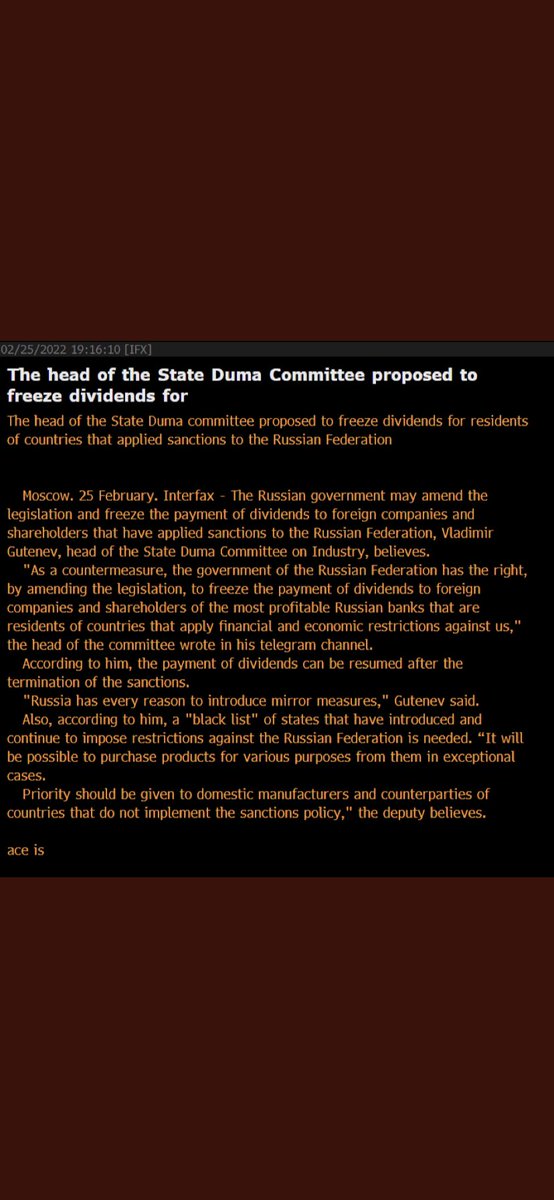

Assets can get frozen instantly. The implications are that they will now want to hold US treasuries (problematic with an ever increasing Current Acc deficit. BTC you saw? Nope-with the entry and exit off-ramp controlled by US sanctions what use is it to have BTC and not being

Able to convert it- hence the sell off this week in Crypto (which is really a NDX levered play anyway) vs Gold which is again shining (no pun intended lol). See with gold you can own it and transact it and there is no @contrarian8888 stamped on the gold bar. I can sell it

Anonymously. The US swift card was the dumbest decision with little thought- where is our US Treasury secretary- why did Yellen not weigh in? If ever there is a reason to think the US$ demise is close-historians will point to this one action. May not happen instantly as world is

Going risk off. But mark my words we played the swift sanction with a pair of 2s when we are massively short commodities. Not everyone has connected the dots but the px action on Precious metals are finally showing the way. Even if Putin withdraws, you’ve lost your virginity and

U can never get it back. GOLD AND SILVER are going to MOON!!!!!!!!!!!!!!

• • •

Missing some Tweet in this thread? You can try to

force a refresh