Join me for my presentation on the 2022/23 Budget Debate || The Hon. Nigel Clarke - March 8, 2022 twitter.com/i/broadcasts/1…

I would like to begin by thanking Almighty God for his kindness, as well as his many blessings, and mercy. To God be the Glory, great things He hath done. #BudgetDebate2022

Today, March 8, is International Women’s Day, a global day, which celebrates the social, economic, cultural and political achievements of women and call for action for generating gender parity. #BudgetDebate2022

Most of all, I would like to thank my family for their incredible patience and understanding, particularly my mother, Mrs. Mary Clarke, and my wife and children, for their unconditional love and support. Thank you.

I begin my remarks today by expressing deepest condolences on behalf of the Government of Jamaica for the lives that have been lost and the devastation that has occurred in the Ukraine as a result of recent hostilities in that country. #BudgetDebate2022

I would like to commend the Prime Minister and the Minister of Foreign Affairs, the Hon. Kamina Johnson Smith, in ensuring that the Jamaicans in Ukraine were safely evacuated from the country. We are all grateful that they made it out safely.

We are closely monitoring developments and the reaction of markets. We will ensure that the poor and vulnerable are protected from the worst effects of this crisis. The Jamaican economy is resilient and will weather this storm. #BudgetDebate2022

Jamaica marks 60 years of independence this year. This is a significant milestone of which every Jamaican can be proud. #BudgetDebate2022

A country’s most used measure of economic advancement is the amount of goods and services that country produces each year and how this quantity changes over time. #BudgetDebate2022

When you examine Jamaica’s GDP per capita over the last 60 years it is easy to see that we have meandered in the economic wilderness for well over 40 years. #BudgetDebate2022

In fact, the IMF recently completed a health check-up on Jamaica, called an Article IV Consultation, which was published in February 2022. #BudgetDebate2022

“(Real) GDP Per Capita is lower today than it was in 1970, partly the result of repeated fiscal, balance of payments or banking crises.”

This is a sad, shocking reality.

This is a sad, shocking reality.

Jamaica’s average income today, is lower, in real terms, than it was 50 years ago! #BudgetDebate2022

Madam Speaker, my fellow Parliamentarians, my fellow Jamaicans, we need to be mindful of this history and resolve among ourselves that this shameful record is not repeated. The next 50 years cannot, cannot be like the past 50. #BudgetDebate2022

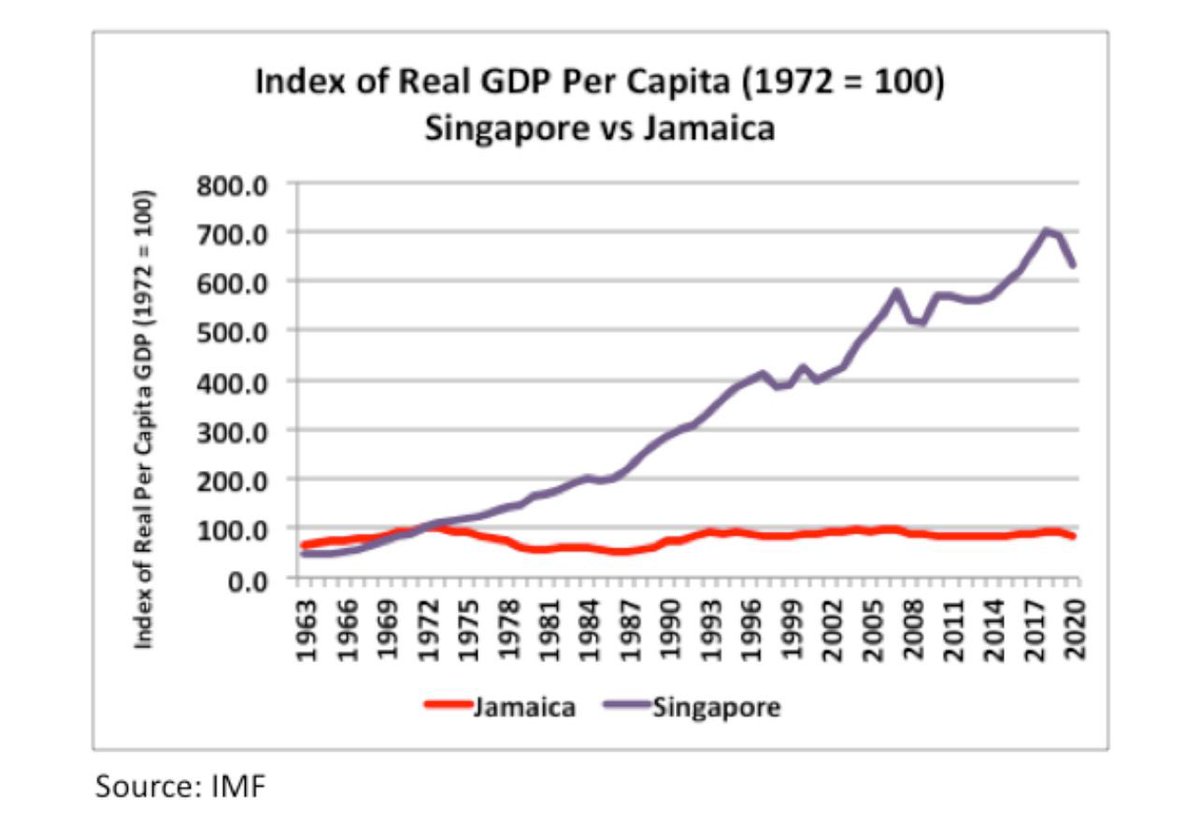

We know this story anecdotally, but we usually hear it with comparisons to Singapore and we often dismiss it with a nonchalant – “Dem different from we”. #BudgetDebate2022

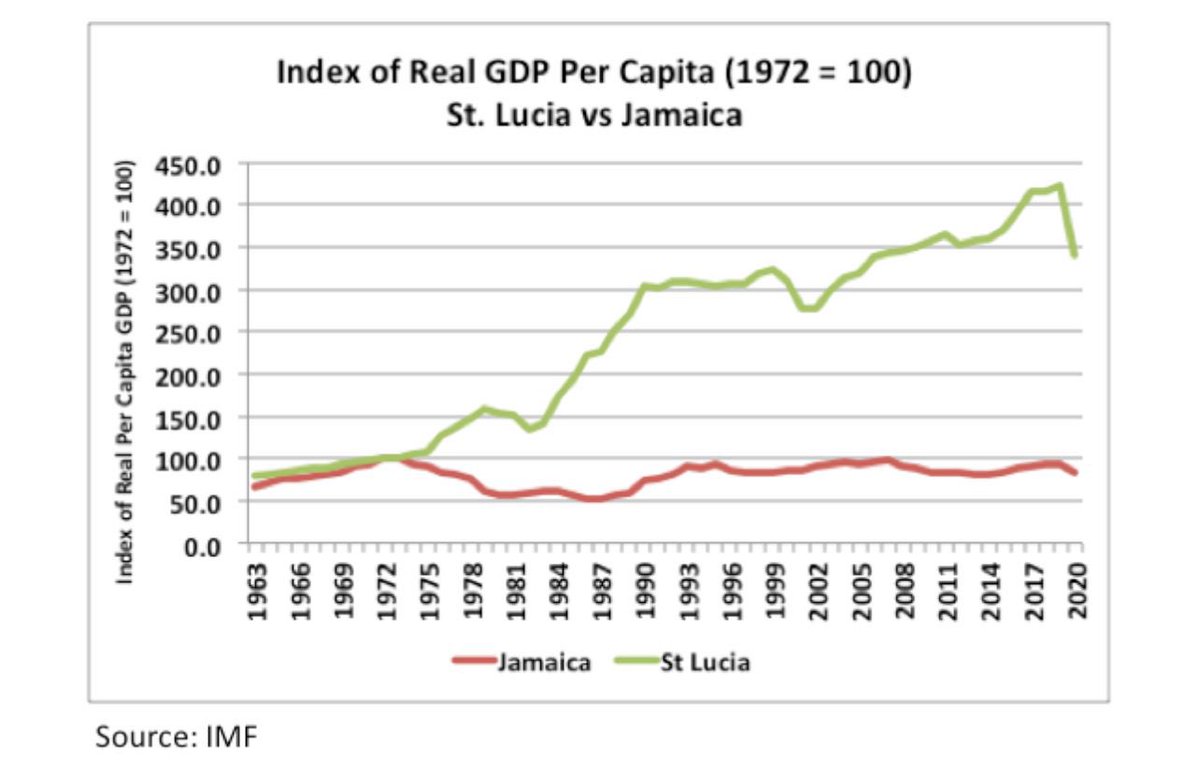

When you compare this same metric – change in real per capita GDP – with our Caribbean neighbours, the contrast is staggering. #BudgetDebate2022

For the first ten years after Independence in 1962, Jamaica’s increase in real per capita GDP growth tracked closely with that of Barbados. #BudgetDebate2022

However, Barbados continued on that track of increasing real per capita over the next four decades, while Jamaica did not. #BudgetDebate2022

Today, despite pronounced reversals of these gains over the decade after 2008, real per capita GDP in Barbados is still approximately 20% higher today than it was in 1972, unlike Jamaica. #BudgetDebate2022

This comparison with Barbados is not unique. Most countries in the Caribbean have zoomed past Jamaica in terms of per capita GDP! Let’s look at St Lucia.

This brief comparative review of real per capita GDP would not be complete without comparison with Singapore. Jamaica’s increase in real per capita GDP initially outpaced Singapore in the 1960’s. #BudgetDebate2022

The enduring economic history lesson across countries is that fiscal, balance of payments and banking crises are enormously costly and damaging. And Jamaica’s 60 years of independence bears testament to that.

The most important lesson is that, in all we do, we should never, ever sacrifice discipline, policy sustainability, or economic resilience for short term expediency. #BudgetDebate2022

We remain firmly committed to making sound, sustainable policy decisions that strengthen our economic resilience and ensure that when faced with unforeseen external shocks, we are ready and prepared to address and overcome them.

With that brief historical overview and a reminder that we must remain committed to making sound and prudent policy decisions, let me turn to where we stand today. #BudgetDebate2022

Over the past year, the Jamaican economy has begun an impressive recovery from the devastating impact of the COVID-19 pandemic. #BudgetDebate2022

Across several metrics – such as economic growth, job growth, debt reduction, and credit ratings --- the Jamaican economy has been recovering from COVID-19 well ahead of most of our peers. #BudgetDebate2022

With the blessings of God Almighty and good policy choices, the historic shock delivered by the pandemic did not lead to a balance of payment crisis, as in the past, did not lead to a debt crisis, as in the past, and did not lead to a fiscal crisis, as in the past.

Any of these knock-on effects would have complicated Jamaica’s recovery.

Instead, the Jamaican economy came roaring back with 14% growth in the first quarter of the fiscal year – the highest quarterly growth rate ever recorded in Jamaica. #BudgetDebate2022

In our history, economic decline has often been followed by further decline, sadly. Together, we, the Jamaican society, broke that cycle this time and, hopefully, we have established a template for the future.

As a result, our economic recovery in Jamaica has been faster and stronger than the vast majority of our peers in the Caribbean, quite a few of whom had the unfortunate experience of a second year of economic decline in 2021.

The forces unleashed by good policies, including abolishment of distortionary transaction taxes could not be stopped by a mere pandemic! #BudgetDebate2022

It is also worth noting that after a dreadful and painful 2020, the Tourism sector returned with a bang, growing over 300% in the second quarter of 2021, over 100% in the third quarter, and over 75% in the fourth quarter:

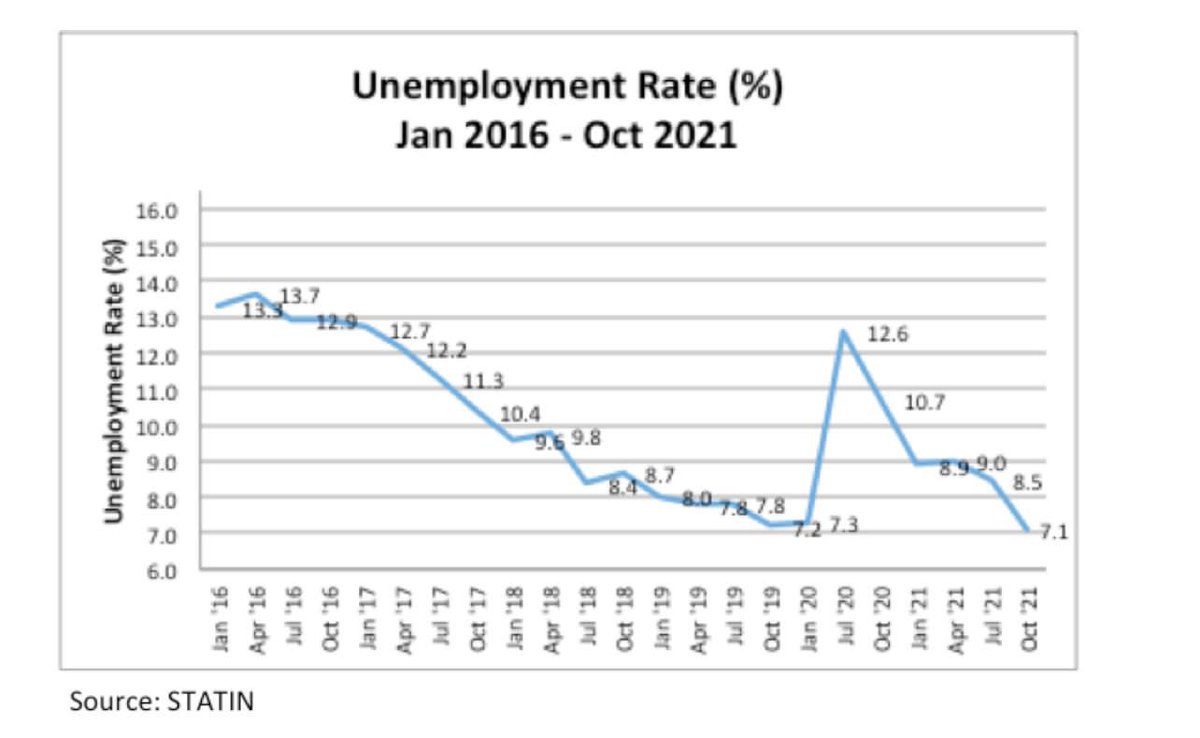

Madam Speaker, I am pleased to report that during 2021/22, we recovered jobs at a rapid pace:

There was a growth of 100,000 jobs between July 2020 and July 2021.

There was a growth of 100,000 jobs between July 2020 and July 2021.

There was a growth of 75,000 jobs between October 2020 and October 2021. #BudgetDebate2022

In fact, the unemployment rate in October 2021 fell to the lowest level in Jamaica’s history, 7.1%, even lower than the pre-Pandemic unemployment rate!

Jamaica’s Debt to GDP ratio was 94% in March 2020 and, due to the COVID-19 pandemic, and the measures necessary to slow its spread, this critically important ratio climbed to approximately 110% by March 2021.

Well a year later I am pleased to report that along with strong GDP growth and strong jobs growth, we have also significantly reduced our Debt to GDP ratio, which is now projected to be 96% by March 2022.

With God’s help, and barring any major surprises and exogenous setbacks, by the end of the upcoming fiscal year, we could see this ratio go below 90% for the first time in what would be 23 years! An entire generation!

Jamaica ranks 2nd among 30 countries of the Latin American and Caribbean region in restoring the national debt level – the Debt to GDP ratio – to almost pre-COVID-19 levels by 2021.

This is Jamaica’s achievement. This is your achievement. And this achievement lowers the risk of the Jamaican economy and provides better protection for turbulence.

Jamaica achieved a healthy balance of payments position of less than 2% of GDP last year. This is way ahead by “miles” of the balance of payments position of other tourism-dependent countries in the Caribbean.

In Jamaica, where 16% of GDP goes to interest, wages and salary expenditure, as compared to other countries in our region where the corresponding proportions are between 8% & 12%, finding 2% of GDP in a crisis & still remaining fiscally sound is a big deal.

In addition, there were temporary waivers of duties, Special Consumption Tax and spectrum fees to facilitate the response, in addition to additional measures undertaken by the National Housing Trust and the Student Loan Bureau. #BudgetDebate2022

Our direct COVID-19 Health Intervention has so far cost $26.4 billion. #BudgetDebate2022

By all accounts Jamaica is on a solid path of economic recovery from the COVID-19 pandemic and leading the way in the Caribbean. However, these are not easy times. These are unprecedented and unpredictable times.

This month, March 2022, the Ministry of Labour and Social Security plans to expand its reach to include needy families who are not in the receipt of the PATH grants. #BudgetDebate2022

Through the Ministry of Labour and Social Security, the Government of Jamaica is partnering with the Jamaica Red Cross, Food for the Poor, Council for Voluntary Social Services, Adventist Relief Association,

and several other Non-Governmental Organisations to identify persons in need, who are not on already on the PATH Programme, at a cost of $200 million.

Qualified families are set to receive a one-off grant of between $10,000 to assist in covering their food expenses. #BudgetDebate2022

Qualified families are set to receive a one-off grant of between $10,000 to assist in covering their food expenses. #BudgetDebate2022

Importantly, these payments will be made electronically. #BudgetDebate2022

In April, we will continue this intervention with a further $250 million in support for CARE packages to the most vulnerable through the Constituency Development Fund- $3 million per Member of Parliament and the balance through the Ministry of Local Government for Municipalities.

We have made provisions to be in a positon to follow up with another $250 million later in the year, depending on how the situation evolves. #BudgetDebate2022

Implementation of the Regulations for the Public Bodies Management and Accountability Act in Respect of the Nomination, Selection and Appointment of Boards of Public Bodies will begin in the upcoming fiscal year in accordance with the phased process provided for by the law.

While we are recovering from the COVID-19 pandemic we cannot forget the lessons we have learned. #BudgetDebate2022

In the Global Financial Crisis, which started in 2008, we lost 100,000 jobs over four years. In 2020, it was frightening for many to witness or experience 150,000 job losses in four months. #BudgetDebate2022

Eventually 55,000 Jamaicans who lost their jobs benefited from monthly stipends from the Government of Jamaica for 13 months through the SET Cash and BEST Cash programs. #BudgetDebate2022

Consistent with the recommendation of the COVID-19 Economic Recovery Task Force, therefore, the Ministry of Finance and the Public Service, through the Planning Institute of Jamaica,

and with technical and financial support from the International Labour Organization and the guidance of a Technical Oversight Committee, embarked on a feasibility study for unemployment insurance in Jamaica in May 2021.

The study will be completed by June 2022. On completion, the findings and recommendations will be submitted to Cabinet for a decision on implementation.

As I announced in last year’s opening budget presentation, as part of the Government’s digital transformation of the economy, the Bank of Jamaica carried out a pilot of the central bank digital currency (CBDC) in May 2021 which ran until December 2021.

The pilot was successful.

CBDC is a digital form of Central Bank-issued currency, which is legal tender. As legal tender, CBDC is fiat currency, which means it can be exchanged dollar for dollar with physical cash. It is not a cryptocurrency.

CBDC is a digital form of Central Bank-issued currency, which is legal tender. As legal tender, CBDC is fiat currency, which means it can be exchanged dollar for dollar with physical cash. It is not a cryptocurrency.

Households and businesses will be able to use CBDC to make payments and store value. Jamaica’s CBDC is called Jam DEX which stands for Jamaica Digital Exchange. #BudgetDebate2022

Jam Dex allows for the remote transfer of funds, anywhere and anytime which reduces the hassle faced with cash transactions today. You can transfer to anyone in Jamaica who has an electronic wallet anywhere and at anytime.

All Jamaicans will have access to Jam Dex through a Jam Dex-enabled wallet provider – a payment service provider or a bank. #BudgetDebate2022

Users can obtain a Jam Dex wallet automatically if they already have a bank account. If you don’t have a bank account, all that is required to set up a Jam Dex-enabled wallet are simplified Know Your Customer information.

The COVID-19 pandemic has changed lots of things. People have had to improvise and innovate. I have a barber, Paul, who used to operate from a shop before COVID. Since COVID, Paul turned mobile.

He came to my house yesterday to give me a haircut prior to this presentation. When he was finished I realized that I didn’t have all the cash to pay, I only had some of it.

Paul is here today and I am going to log into my Lynx account to pay Paul the $500 I owe him in Central Bank Digital Currency or JamDex. #BudgetDebate2022

The last population and housing census was conducted in Jamaica in 2011. #BudgetDebate2022

We were planning Jamaica’s 15th Population and Housing Census in 2021, thereby maintaining the 10-year frequency following from censuses conducted in 1991, 2001 and 2011. #BudgetDebate2022

The pandemic however resulted in us losing 2020 as the preparatory year and, as such, critical supplies to support the execution of a census were not available in time for 2021. #BudgetDebate2022

In light of these factors, I am pleased to announce that Jamaica will now conduct its 15th Population and Housing Census in 2022. #BudgetDebate2022

The census day will be September 12, 2022. A count will be made, and data collected in respect of persons who are usual residents of Jamaica (whether physically present or not) on that date.

The main data collection phase is expected to last up to December 2022 with a general census report available by December 2023. #BudgetDebate2022

The Marcus Garvey Public Sector Graduate Scholarship was established in 2020 by the Ministry of Finance and the Public Service as a human capital development tool for our public sector. #BudgetDebate2022

The Scholaship Selection Committee is chaired by His Excellency the Most Honourable Patrick Allen and I am proud that in 2021 the first cohort of thirty (30) Marcus Garvey Scholars was selected. #BudgetDebate2022

They will be attending UWI, UTECH, Harvard, Johns Hopkins, and Cambridge Universities to pursue graduate studies in a range of disciplines including economics,

education, public health, national security, urban planning, climate change, law, and procurement that align with the Government’s policy focus.

In July 2021 the SLB celebrated 50 years. It owes its origins to the government of Prime Minister Hugh Shearer in which the late Most Hon. Edward Seaga served as Minister of Finance.

The Students’ Loan Bureau (SLB) approved 11,092 student loans this year an increase of 1,090 or 10% over the previous year.

The SLB is embracing the GOJ’s digital strategy. With the online system customers will be able to pay online and enquire about loan balances online. #BudgetDebate2022

In this upcoming fiscal year the SLB expects that up to 3,000 students, who qualify based on needs, will benefit from $150 million in grants. #BudgetDebate2022

I want to turn my attention to the restructuring of public sector compensation, the implementation of which will begin this upcoming fiscal year. #BudgetDebate2022

Today, however, I want to address the restructuring of public sector compensation which is an ambitious and complex, yet necessary reform. #BudgetDebate2022

The current structure of public sector compensation has 325 salary scales and 185 allowances, which is unduly complex, utterly unworkable inequitable and unfair. The UK, by comparison has 7 pay grades in their public sector.

The UK has 67 million people. We have 2.7 million people.

The size of the UK’s economy is US$2.7 trillion. Jamaica’s is US$15 billion. That is the UK’s economy is nearly 200x times our size yet they have 7 pay scales in public sector compensation and we have 325!

The size of the UK’s economy is US$2.7 trillion. Jamaica’s is US$15 billion. That is the UK’s economy is nearly 200x times our size yet they have 7 pay scales in public sector compensation and we have 325!

If you were to print out each one of the grades we have in the public sector it would fill 15 pages, whereas you could fit the pay grades in the UK on the back of a Jamaican postcard.

This structure has evolved primarily through the use of multiple job evaluation tools to create different classifications and job families over the years. So you have people doing essentially similar jobs who are paid entirely differently.

I give you the example of stenographers who record the spoken word in Parliament and in the Courts. Same set of skills. Very similar jobs but, in our system these jobs have completely different salary grades and very different compensation.

There are many other examples. This creates inequity and tension, and often breeds resentment and negative attitudes. It is one thing to be a poor country – which we are, for now - but that does not mean that our systems must be unfair.

Public sector compensation improvement will cost over $100 billion over three years. Because our recovery is on track, we will reform public sector compensation and restore a better, fairer, simpler and more transparent compensation system.

The effective date of implementation will be April 1, 2022. Now that does not mean that your April paycheck will reflect the new compensation system.

First, we want to have the opportunity to continue our engagement with public sector unions and bargaining groups, and to provide more information and fine-tune the system.

We then propose that early in the second quarter of the new fiscal year the implementation will begin but it will be effective retroactively back to April 1, 2022.

Allow me to say, clearly and emphatically, that no public sector employee’s net pay will be lower as a result of the new compensation system. In fact every public sector employee’s net pay will be higher as a result of the new compensation system.

For the FY 2022/23 fiscal year, the Central Government plans to spend a total of $912 billion, comprised of:

Non-Debt Expenditure: $604.5 billion.

Debt Service Expenditure: $307.5 billion.

TOTAL: $912.0 billion

Non-Debt Expenditure: $604.5 billion.

Debt Service Expenditure: $307.5 billion.

TOTAL: $912.0 billion

$40 billion has been allocated for public sector pension payments. #BudgetDebate2022

We continue to allocate the largest share of our budget, outside of interest, to education.

$122 billion is allocated to education in the upcoming fiscal year. #BudgetDebate2022

$122 billion is allocated to education in the upcoming fiscal year. #BudgetDebate2022

$93.1 billion is allocated to the Ministry of Health including $10.6 billion for drugs and medical supplies.

$92.4 billion is allocated to the Ministry of National Security.

$92.4 billion is allocated to the Ministry of National Security.

$1 billion is allocated for production Incentives for farmers and

$800 million for the maintenance of rural farm roads. #BudgetDebate2022

$800 million for the maintenance of rural farm roads. #BudgetDebate2022

$1.8 billion is being allocated to facilitate the continuation of: (i) GOJ’s Broadband Initiative - $1.0 billion; and (ii) the Tablets in School Programme.

While we continue to depend on physical cash there is a need to make cash transactions more efficient. #BudgetDebate

Technical studies have shown the need for the introduction of a currency denomination between the $1000 note and the $5000 note. #BudgetDebate2022

The Bank of Jamaica advised me that the introduction of a $2000 note would bring greater efficiency to the currency structure allowing cash transactions to be settled easier. #BudgetDebate2022

With the introduction of the $2000 note alongside the $1000 and $5000 notes persons will require fewer notes to settle transactions. #BudgetDebate2022

The new and upgraded banknotes will be available later this calendar year.

The Bank of Jamaica will be holding sensitisation sessions so that the new security features can be understood and so that the visually impaired community can become familiar with features that differentiate the banknotes.

• • •

Missing some Tweet in this thread? You can try to

force a refresh