While Barcelona’s financial problems have been well documented, the issues at Valencia have somewhat gone under the radar. For a club that has appeared in two Champions League finals, their decline is striking, including a lowly 13th place in La Liga last season #VCF

#VCF challenges were highlighted when the club could not pay all the salaries for the 2019/20 season. Instead they issued players with promissory notes (like an IOU), so the outstanding amount owed could be paid at a later date.

#VCF fans are unhappy with the owner, Singaporean businessman Peter Lim, who bought a 70% stake in 2014. There have been a series of protests under the banner “dignity for Valencia” against the owner, who has described the club as a “trophy asset” while limiting investment.

#VCF has seen huge managerial turnover with Lim getting through 9 managers to date, including Gary Neville’s short-lived tenure. Perhaps the most shocking dismissal was Marcelino, whose record included two top four finishes, a Europa League semi-final and a Copa del Rey victory.

In fairness, #VCF were in a desperate state before Lim’s arrival with over half a billion of debt following significant operating losses, only partly mitigated by selling stars such as Villa, Silva & Mata. President Anil Murthy argued, “A bankrupt club is not a better club.”

Importantly, the stadium issue has been hanging over #VCF for many years with work on the Nou Mestalla halted since 2009. More encouragingly, this week the club announced new development plans with a 2024 completion date.

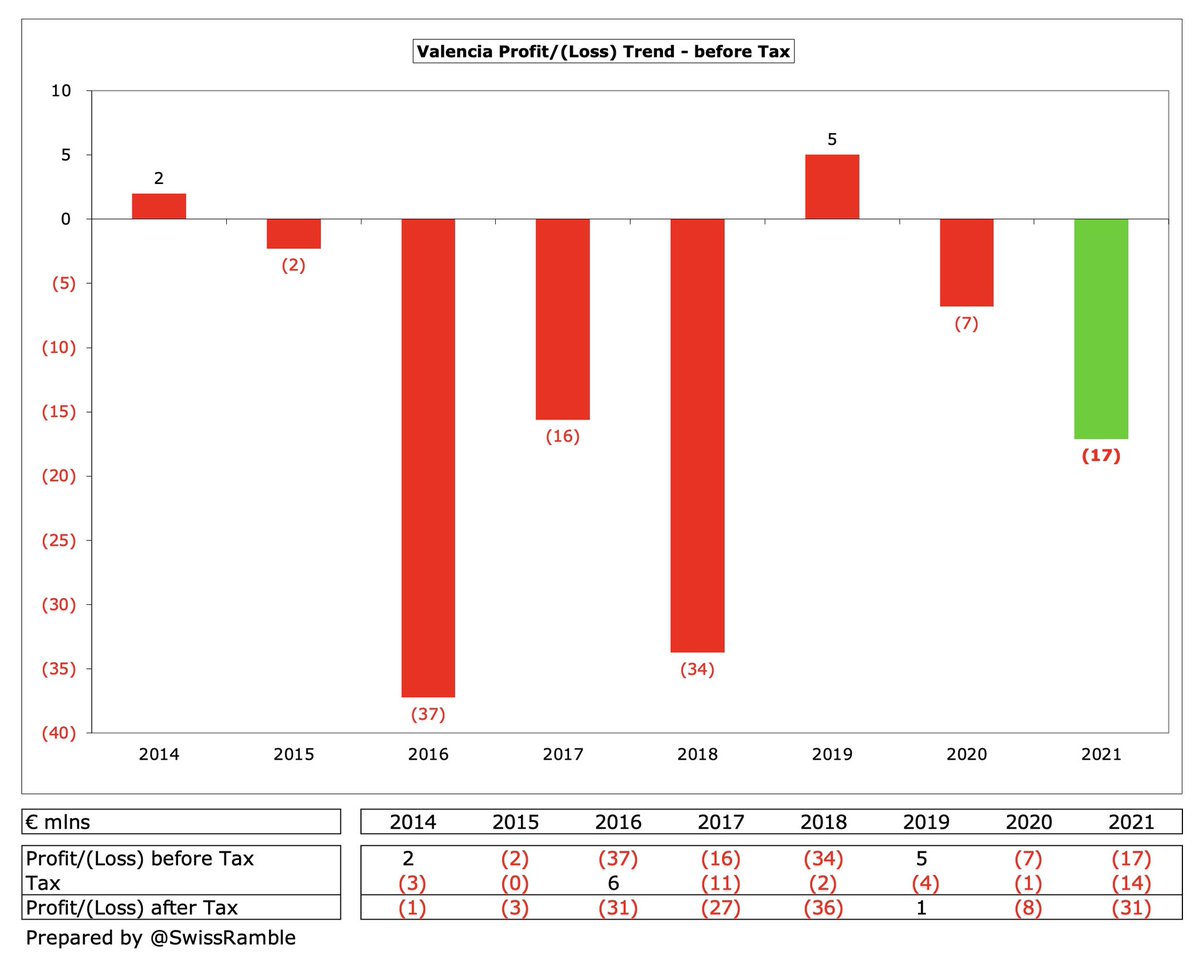

#VCF 2020/21 pre-tax loss widened from €7m to €17m (after tax €31m), as revenue fell €64m (37%) from €172m to €108m. Partly offset by profit on player sales rising €33m to €49m and expenses being cut €20m (10%). Murthy noted, “The financial situation is far from ideal.”

#VCF €64m revenue slump was largely due to not qualifying for Europe, as broadcasting fell €52m (38%) from €135m to €83m, while match day halved from €12m to €6m (deferred from 2019/20 accounts) and commercial fell €6m (22%) from €25m to €19m.

#VCF compensated for the revenue decline by cutting costs, as wages fell €12m (11%) from €109m to €97m and player amortisation decreased €17m (27%) from €65m to €48m. Partly offset by a €9m flip in exceptional items from €8m credit to €1m charge.

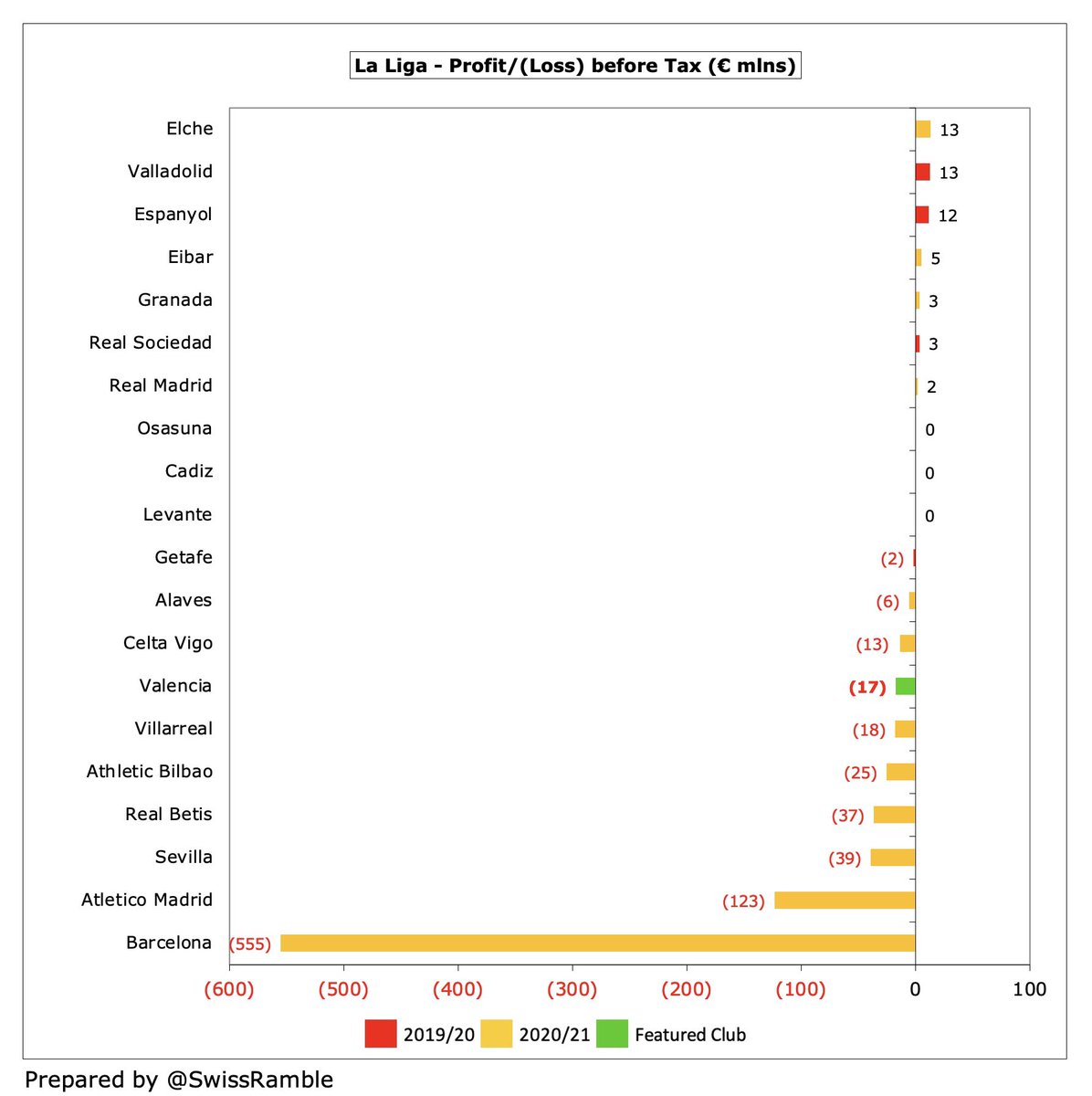

#VCF €31m post-tax loss was by no means the highest in La Liga, as it was surpassed by Real Betis €37m, Sevilla €41m & Atletico Madrid €112m, while Barcelona’s €481m deficit was in a class of its own. The €17m pre-tax loss is also less than Villarreal €18m & Bilbao €25m.

#VCF revenue loss due to COVID was €23m in 2020/21 (games played behind closed doors €19m, broadcasters rebate €4m), though this was largely offset by €18m of revenue deferred from the 2019/20 season for games played after the end-June accounting close.

#VCF loss would have been more without selling key talent to help balance the books, with profit on player sales up from €17m to €49m (2nd highest in Spain), including Rodrigo to #LUFC, Ferran Torres to #MCFC, Kondogbia to Atleti, Coquelin and captain Dani Parejo to Villarreal.

#VCF have only managed to post a profit once in the 7 years under Lim (and that was just €1m after tax in 2019). In that period they have accumulated €135m of losses, while the club has forecast another €37m deficit for this season.

This makes it likely that #VCF will continue to rely on player trading to restrict the size of their losses, having made over a quarter of a billion under Lim. Academy products like Soler, Gaya and Duro would be particularly lucrative sales, as their value in the books is zero.

#VCF figures have often been impacted by exceptional items. 2020 benefited from the €28m reversal of previous provisions for the European Commission ruling on state aid, though was hit by €16m impairment on the Mestalla value, while 2015 included €53m debt refinancing.

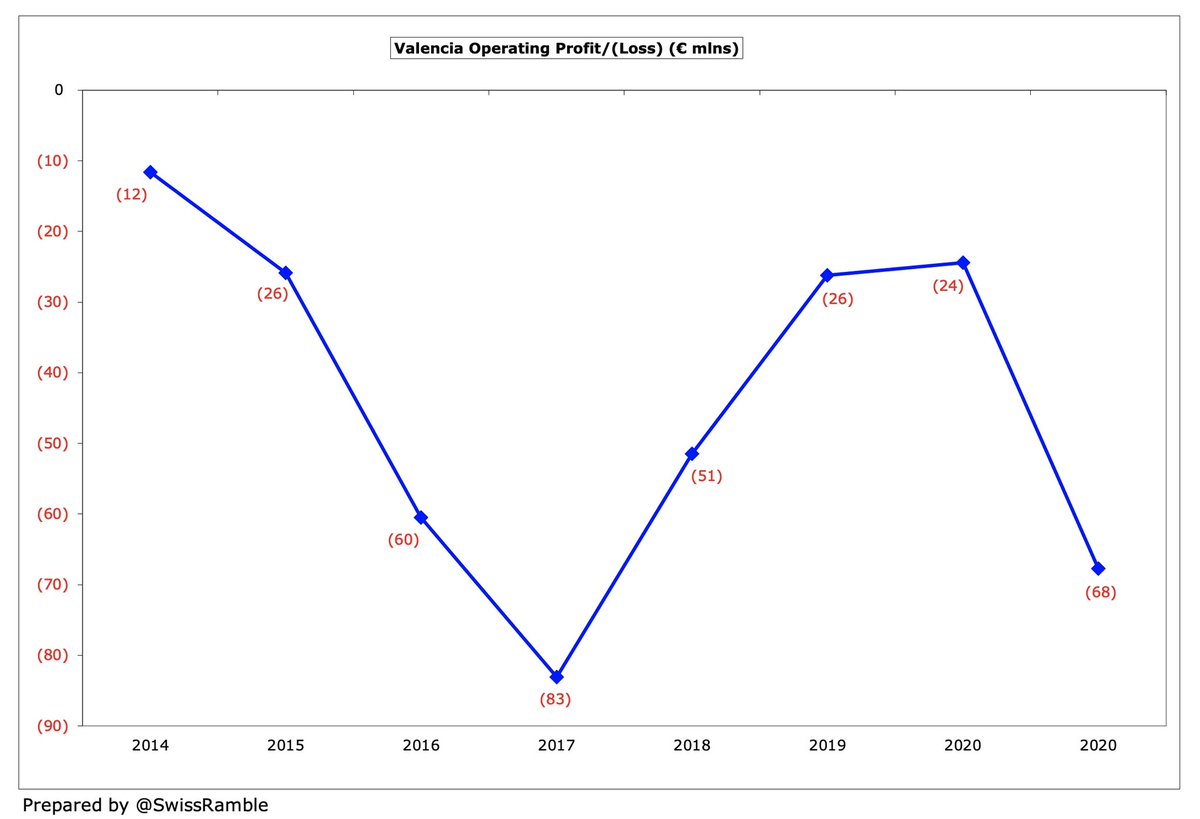

#VCF operating loss, excluding player sales and interest, nearly tripled from €24m to €68m in 2021, though this was actually a fair bit better than Spain’s “big three”: Real Madrid €101m, Atletico Madrid €129m and particularly Barcelona’s shocking €509m.

#VCF revenue fell by €76m (141%) from their 2019 pre-COVID €185m peak to €108m in 2021, though the main reason for the reduction was the lack of European football €57m. The pandemic drove falls in match day €18m and commercial €6m. Club has budgeted €104m for this season.

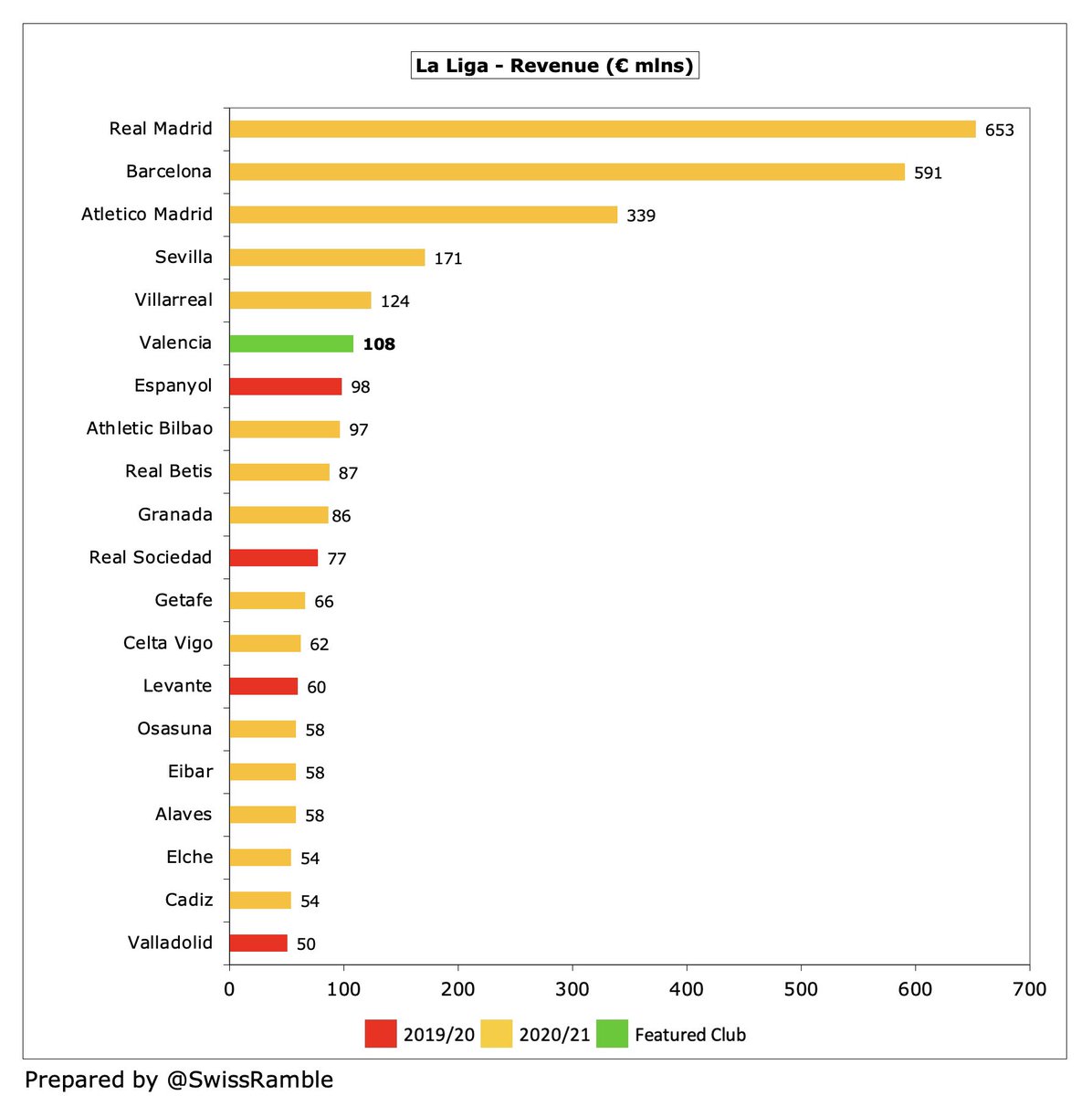

In last 10 years #VCF revenue has dropped €3m, while their Spanish rivals have seen decent growth. This was €231m at Atletico Madrid, while three other clubs are up more than €100m (Sevilla €111m, Barcelona €140m and Real Madrid €108m) and neighbours Villarreal grew €56m.

As a result #VCF revenue has fallen from 3rd best in Spain to only 6th highest. Their €108m is obviously miles below Real Madrid €653m, Barcelona €591m and Atletico Madrid €339m, but they have also been overtaken by Sevilla €171m and Villarreal €124m.

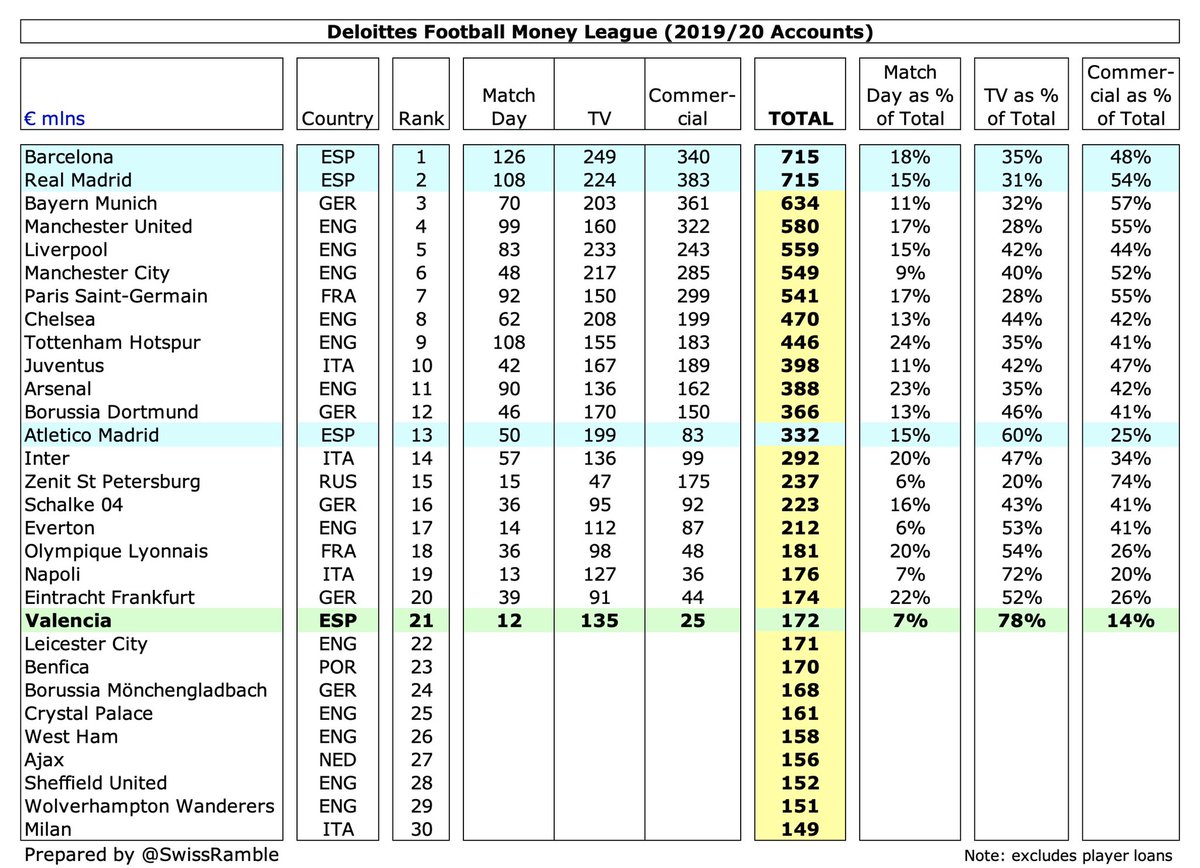

In the most recent version of the Deloitte Money League, which ranks clubs globally by revenue, #VCF were in 21st place, based on 2019/20 figures. However, this was boosted by Champions League money, so it is likely they will fall when the 2020/21 edition is published.

#VCF broadcasting income fell €52m (38%) from €135m to €83m, despite €13m deferred from 2019/20 for games played after the accounting close, mainly due to prior year including €61m Champions League money. Real Madrid €302m and Barcelona €281m more than 3 times as much.

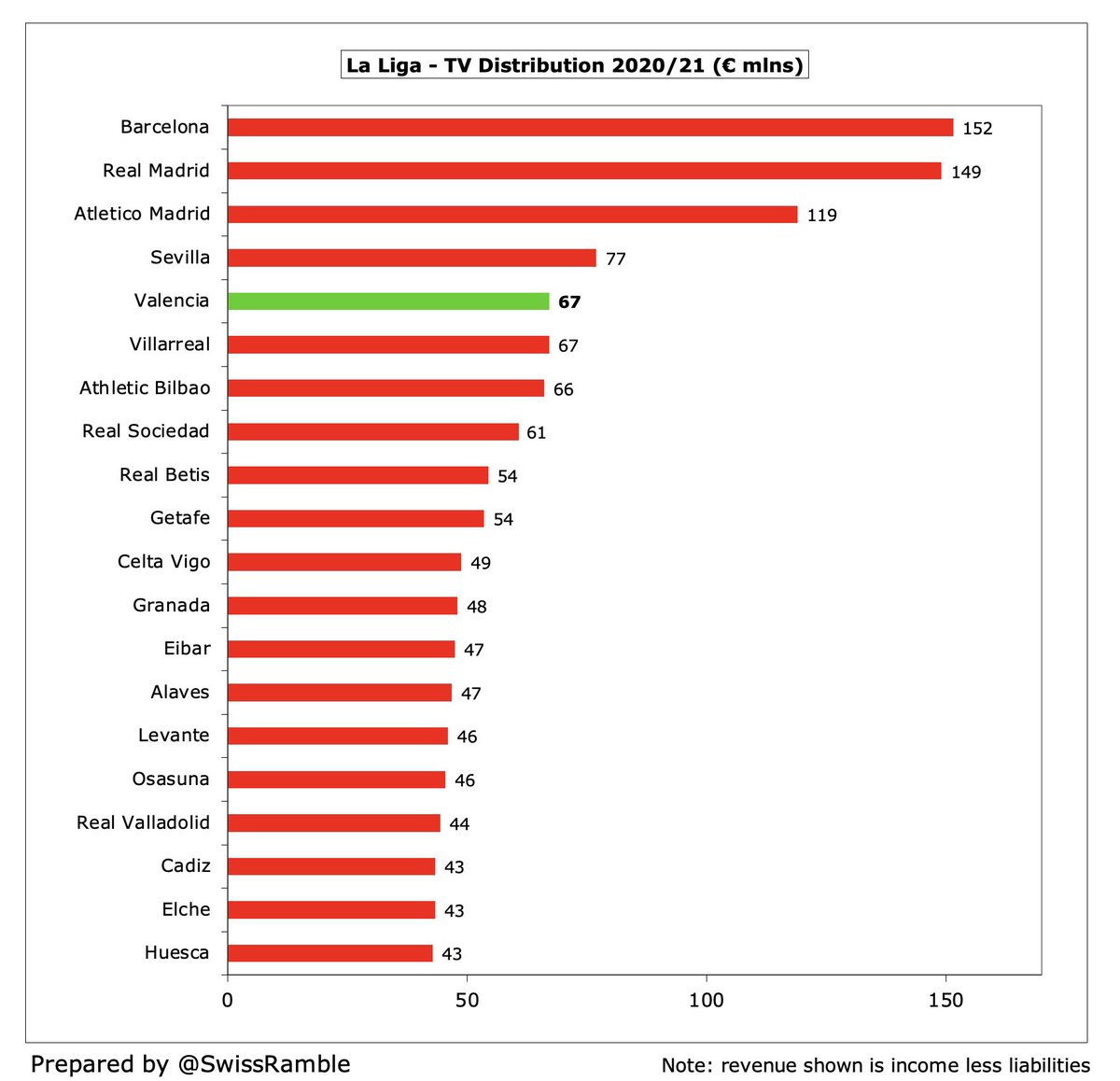

After years of individual deals in Spain, La Liga have introduced a collective deal, based on 50% equal share, 25% performance over last 5 years and 25% popularity (1/3 for average match day income, 2/3 for number of TV viewers). Gross income reduced by liabilities.

Even after the changes, the big two still receive by far the highest TV income from La Liga’s TV deal. In 2020/21 Barcelona and #RealMadrid got around €150m, while #VCF received less than half with €67m, down €9m compared to previous season, due to lower league position.

Europe is vital to #VCF business model, so failure to qualify 5 times since Lim’s arrival has really hurt the club, as can be seen by Spanish rivals earning between €68m and €111m in 2020/21 Champions League. Valencia received €61m for reaching the last 16 the previous season.

#VCF earned €118m from Europe in the last 5 years, which might not seem too bad, but is far below four Spanish clubs: Real Madrid €446m, Barcelona €421m, Atletico Madrid €361m and Sevilla €201m. Villarreal received €32m in 2020/21 for winning the Europa League.

#VCF match day revenue halved from €12m to €6m (money deferred from 2019/20 accounts), as all home games were played behind closed doors. This is down from €23m pre-pandemic, when they also benefited from 7 European games, though still much lower than the Big 3 Spanish clubs.

#VCF had sixth highest crowds in Spain in 2019/20 with just over 40,000 (for games played with fans). Obviously lower than Barcelona, Real Madrid and Atleti, but also Real Betis and Athletic Bilbao. Club will be delighted that stadiums have been re-opened to fans this season.

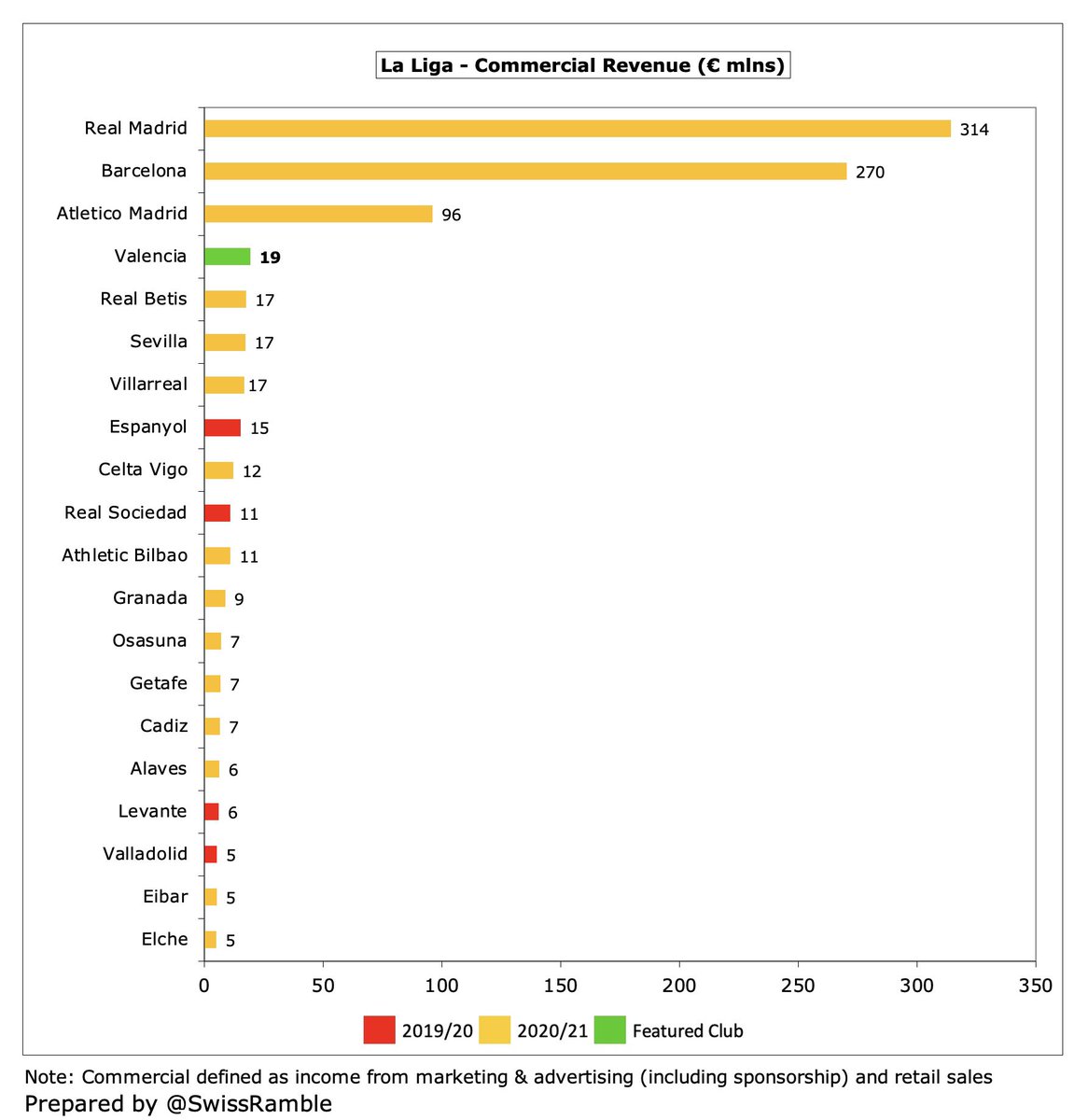

#VCF commercial income fell €6m (22%) from €25m to €19m, comprising sponsorship & publicity €17m and merchandising €2m. This is fourth highest in Spain, but a long way below the top three clubs: Real Madrid €314m, Barcelona €270m and Atletico Madrid €96m.

#VCF shirt sponsor was Bwin, though replaced by Socios in 2021/22 in deal promoting fan tokens, to be succeded by Cazoo in 2-year deal from 2022/23 for €4m per annum. Puma succeeded Adidas as kit supplier in 2019 in deal running to 2022 (also reportedly worth €4m a year).

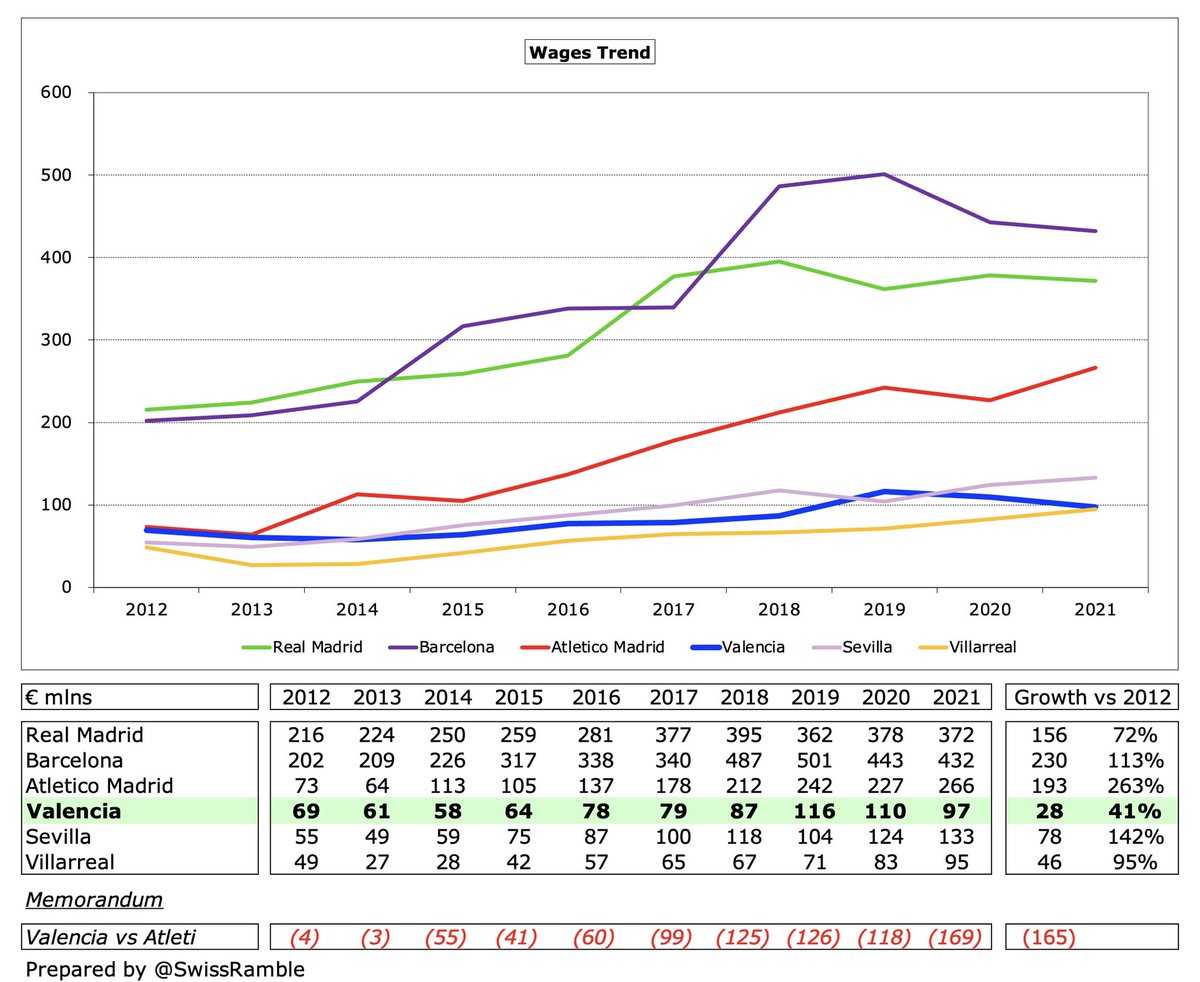

#VCF cut their wage bill by €12m (11%) from €109m to €97m, so down €19m from the 2019 peak of €116m. Reduction would have been higher without €4m wages slipped from 2019/20 season. Only grown by €28m since 2012, which is much less than Spanish rivals, e.g. Atleti up €193m

#VCF €97m wages now 6th highest in Spain, miles below Barcelona €432m, Real Madrid €372m & Atletico Madrid €266m. Also lower than Sevilla €133m & Athletic Bilbao €99m. However, Murthy argued: “In La Liga there are teams with a much lower squad cost who are competing well.”

#VCF challenge is illustrated by their salary cap being severely reduced by €140m from €171m two years ago to just €31m in 2021/22. This is actually the lowest in La Liga, miles below the likes of Real Madrid’€739m, Sevilla €200m and Atletico Madrid €172m.

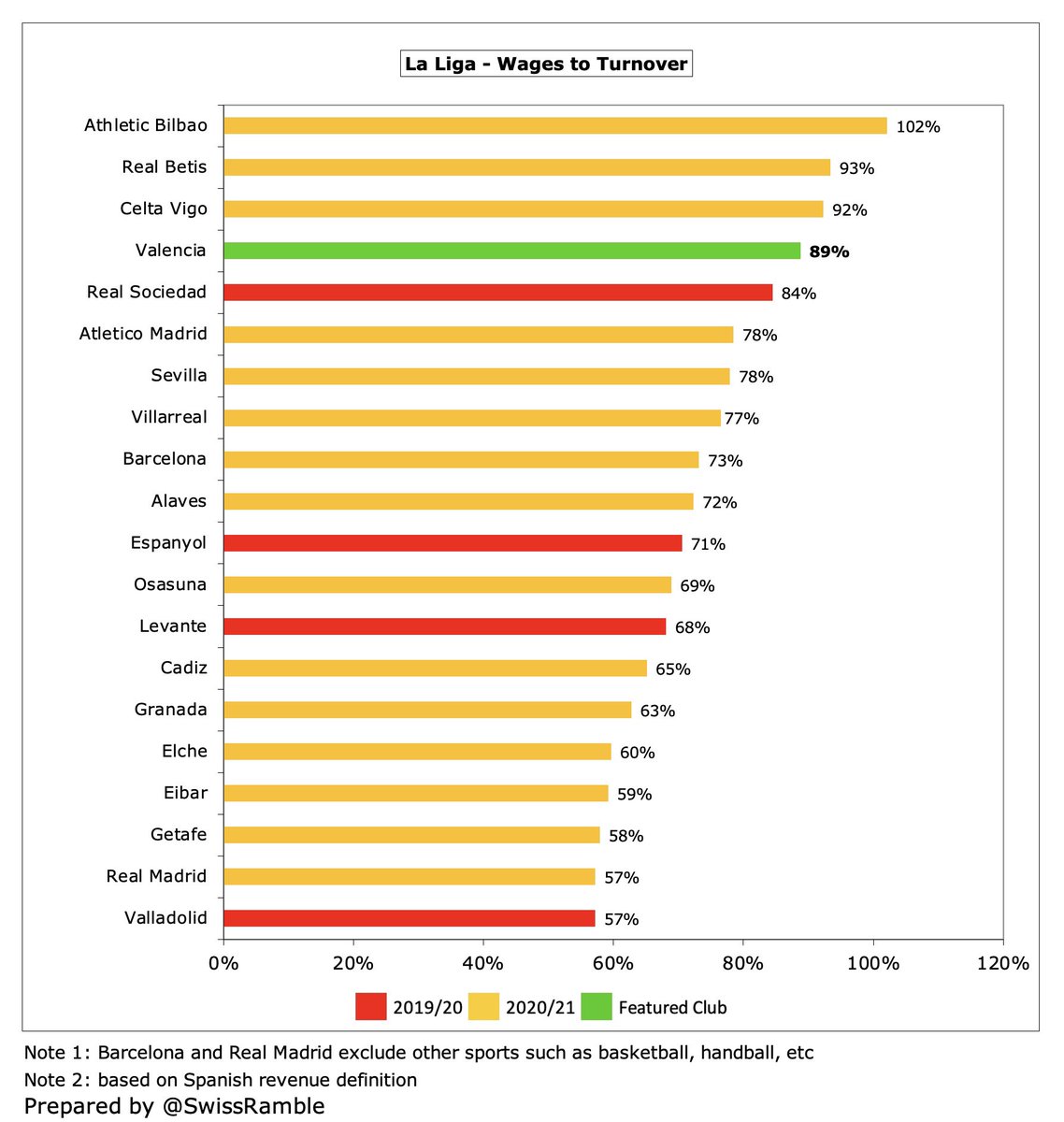

Following the revenue decrease, #VCF wages to turnover ratio increased (worsened) from 63% to 89%, one of the highest in La Liga. For a comparison, this is much worse than Real Madrid 57% and even Barcelona 73%. As Murthy put it, “We spend more than we make.”

#VCF further lowered squad costs after reducing player amortisation, the annual cost of writing-off transfer fees, by €17m (27%) from €65m to €48m. This is less than a third of Real Madrid €158m and Barcelona €155m, and also below Atletico Madrid €117m and Sevilla €65m.

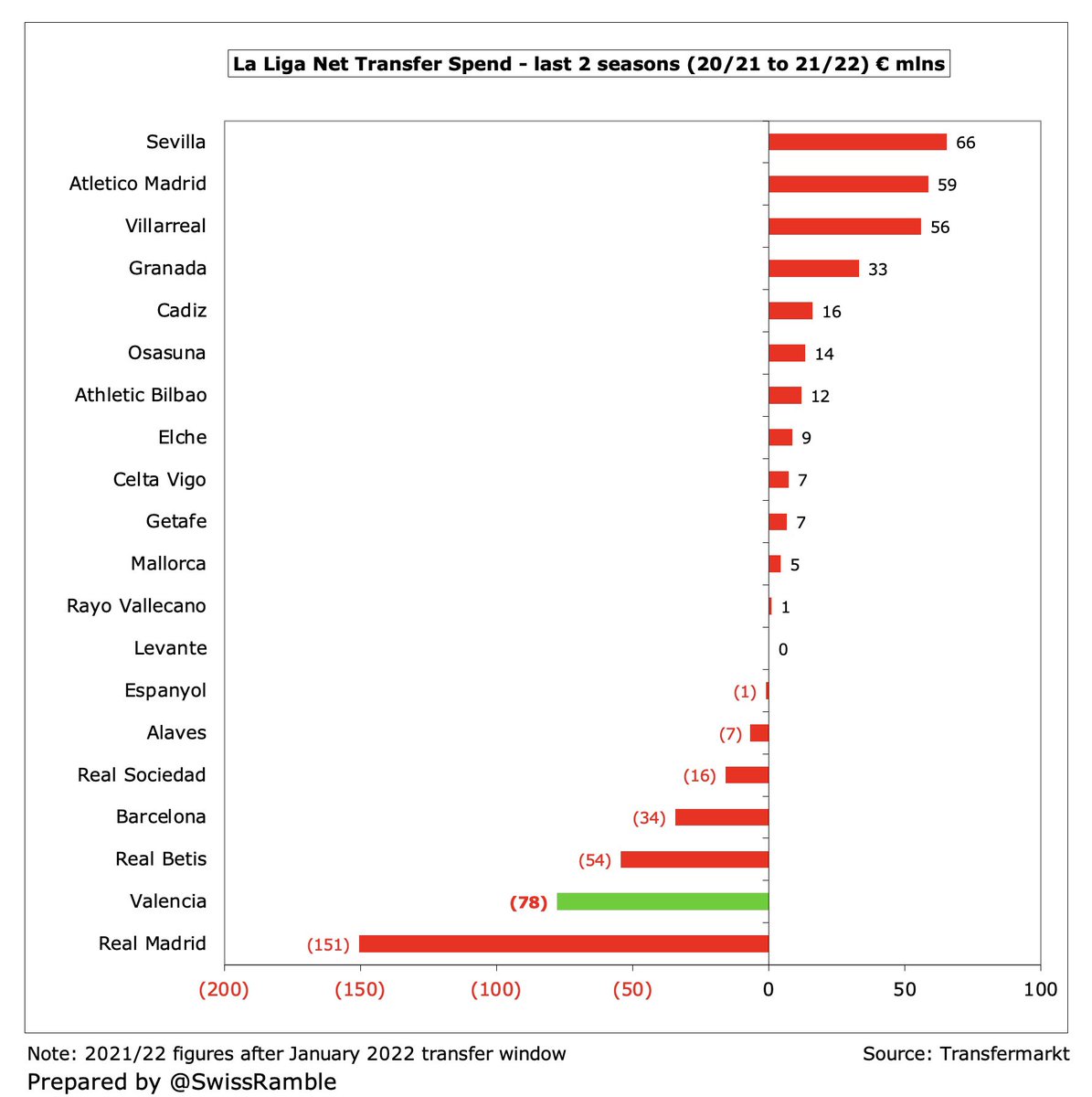

The scale of #VCF lower investment is highlighted by gross transfer spend, which averaged €82m in the six years up to 2019, but then fell to just €27m in the past 2 seasons, including only €3m in 2020/21. Swung from €25m net spend to €25m net sales over the same periods.

In the 2 years up to January 2022 window, only one La Liga club had higher net sales than #VCF €78m (though that was Real Madrid). Their €13m gross transfer spend was firmly in bottom half of the table, far below Barca €182m, Atleti €166m, Sevilla €114m & Villarreal €91m.

#VCF financial debt fell from €207m to €181m in 2021. Lim has more than halved bank debt from €256m before his arrival to €121m, while he is owed €60m (including €16.5m loaned last season). The owner’s debt would have been higher without converting €62m to capital in 2016.

Even after the reduction and capital conversion, #VCF €181m gross debt remains 2nd highest in Spain, only “beaten” by Barcelona’s outrageous €533m, but ahead of Atletico Madrid €166m & Real Madrid €158m. There is then a big gap to next highest Spanish club: Real Betis €63m.

Since year-end #VCF took out a €51m loan with Rights and Media Funding Ltd, guaranteed on future TV income. On the other hand, Lim converted another €43m of debt (including accrued interest) to equity.

#VCF interest payments shot up to €11m in 2021, much higher than the €4m average over the preceding four years. This is third highest in Spain, albeit a long way below Barcelona €41m and Atletico Madrid €30m.

#VCF have also reduced transfer fees debt from €169m 2 years ago to €101m, though this is up from only €23m in 2014. Amount owed by other clubs is €42m, giving net payables of €59m. Again third highest in Spain, behind the usual suspects, Barcelona €231m and Atleti €196m.

After adjusting for non-cash items, #VCF €68m operating loss became €3m positive cash flow in 2020/21, boosted by €21m from player trading (sales €74m, purchases €53m) before spending €13m on capex and €11m interest. Repaid €30m bank loans, but received €17m from Lim.

As a result, #VCF cash balance fell by €13m from €14m to just €1m, one of the lowest in La Liga. This explains the need for the Rights and Media loan after these accounts to fund working capital requirement over the next 12 months.

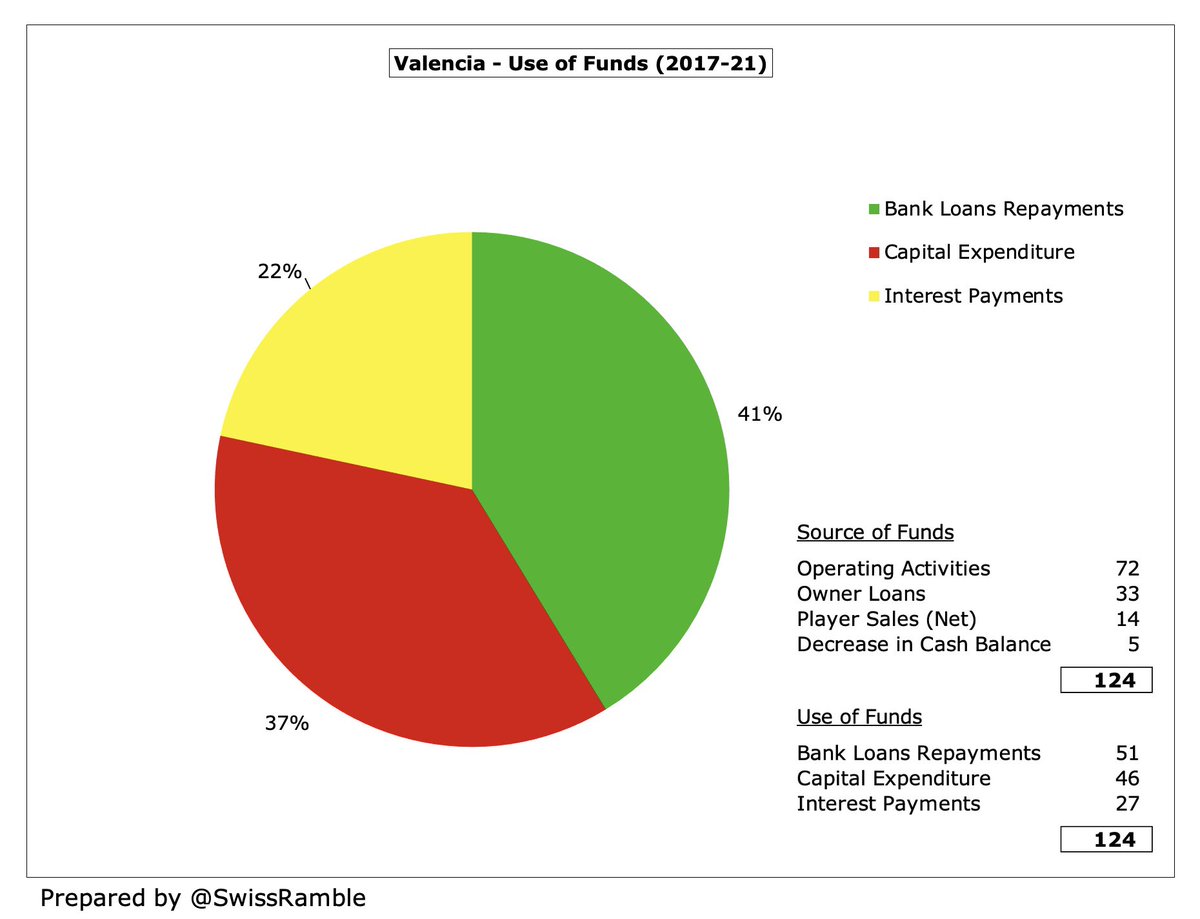

In the last 4 years #VCF have generated €72m from operating activities, enhanced by €33m from owner loans and €14m from net player sales. This has been used for bank loan repayments €51m, capital expenditure €46m and interest payments €27m.

#VCF will receive €121m from the new La Liga CVC deal. Most of this (€80m) will be allocated to the new stadium with 15% used to cover COVID debts and 15% on player registrations.

This money is intended to help finally build the new stadium, which #VCF estimate will cost €350m (€172m already invested). Aim to generate €120m from selling Mestalla land and will increase ticket prices by 15%. After many false dawns, work is due to recommence in October.

Poor management has left #VCF in a vicious cycle, where they can only balance the books by selling their best players, making it more difficult to qualify for Europe, which is imperative for their business model, though the Nou Mestalla could make a sizeable difference in future.

Murthy recently admitted, “We are not out of the hole; we still have financial problems to deal with. We are trying to do the maximum we can within this budget.” The good news is that #VCF have reached this season’s Copa del Rey final, though they remain mid-table in La Liga.

• • •

Missing some Tweet in this thread? You can try to

force a refresh