Borrowers are rewarded & savers punished.

Both #CeFi & #DeFi's financial elite have mastered "strategic leverage". Banks themselves amplify $$$ w/ fractional reserve lending @ these rates below.

If you can't beat whale arbitragers, join 'em!

Learn how in this mega-thread🧵👇

Both #CeFi & #DeFi's financial elite have mastered "strategic leverage". Banks themselves amplify $$$ w/ fractional reserve lending @ these rates below.

If you can't beat whale arbitragers, join 'em!

Learn how in this mega-thread🧵👇

2/ We'll be covering loans on:

- 0% Credit Cards

- Cars

- 401k

- Stock Brokerages

- Life Insurance

- Real Estate

- & On #Terra there's @anchor_protocol, @mars_protocol, @EdgeProtocol, @mirror_protocol

*(leverage amplifies the risk & reward potential of any investment strategy)

- 0% Credit Cards

- Cars

- 401k

- Stock Brokerages

- Life Insurance

- Real Estate

- & On #Terra there's @anchor_protocol, @mars_protocol, @EdgeProtocol, @mirror_protocol

*(leverage amplifies the risk & reward potential of any investment strategy)

3/ In #DeFi, no one explains leverage better than @Shigeo808 aka "LUNAomics"

His Pinned Tweets discuss creating multiple "positive feedback loops" with tactics:

- To borrow against $LUNA

- To stack more $LUNA

- To borrow against $LUNA

- An so on...♾

His Pinned Tweets discuss creating multiple "positive feedback loops" with tactics:

- To borrow against $LUNA

- To stack more $LUNA

- To borrow against $LUNA

- An so on...♾

https://twitter.com/Shigeo808/status/1499768672331599878?s=20&t=deTXtZYtqYiHSEs4tHsKxQ

4/ @Shigeo808 "bootstrapped" his initial crypto buy-in by essentially looping a series of 0% credit cards leading to more offers!

Back then he focused on less volatile yield farms 2 payoff the balance. Despite the risk of bankruptcy, he trusted his thesis on early crypto growth

Back then he focused on less volatile yield farms 2 payoff the balance. Despite the risk of bankruptcy, he trusted his thesis on early crypto growth

5/ @Shigeo808 applied some entrepreneurial hustle using the cash advances to buy vehicles outright then renting them on @turo.

With yet another positive feedback loop, he took out low-interest loans against these vehicles to free up liquidity to generate even more #DeFi yield!

With yet another positive feedback loop, he took out low-interest loans against these vehicles to free up liquidity to generate even more #DeFi yield!

6/ Read @Shigeo808's version of his early exploits wen parlaying 4-figures into a 7-figure $LUNA stack below.

The remainder of my thread will focus on "responsible & strategic leverage tactics I learned as an ex-financial planner in #TradFi. NFA/DYOR

The remainder of my thread will focus on "responsible & strategic leverage tactics I learned as an ex-financial planner in #TradFi. NFA/DYOR

https://twitter.com/Shigeo808/status/1420280697952956417?s=20

7/ The most common investment plan in America is the 401k. Many would like to cash out their 401k to get into crypto.

What if you didn't have to?

Most 401k plans have a loan feature where you can borrow 50% of your account balance up to a total $50k loan.

What's the catch?⬇️

What if you didn't have to?

Most 401k plans have a loan feature where you can borrow 50% of your account balance up to a total $50k loan.

What's the catch?⬇️

8/ You will sell mutual funds in your 401k to create the liquidity

You pay monthly principle & interest (lately 3%-4%). This interest goes straight back into your 401k, but it creates a small double tax wen you take out again.

Often the loan is amortized on a 5-year arc, but 👇

You pay monthly principle & interest (lately 3%-4%). This interest goes straight back into your 401k, but it creates a small double tax wen you take out again.

Often the loan is amortized on a 5-year arc, but 👇

9/ If you quit or get fired then your 401k loan must be paid in full by that year's tax filing either:

- Next April

- Or October (if you go on extension).

Otherwise, the outstanding balance will become subject to tax at your highest marginal rate plus the 10% early WD penalty.

- Next April

- Or October (if you go on extension).

Otherwise, the outstanding balance will become subject to tax at your highest marginal rate plus the 10% early WD penalty.

10/ It seems scary, but if you got fired (or maybe just quit cuz you're crypto rich):

wouldn't you be in a lower tax bracket that year to absorb the tax + penalty?

Or you could borrow against your crypto to pay back the 401k loan until you can roll your account to the next job.

wouldn't you be in a lower tax bracket that year to absorb the tax + penalty?

Or you could borrow against your crypto to pay back the 401k loan until you can roll your account to the next job.

11/ In @etrade, you may have stocks you don't want to sell. Or maybe you own stocks/funds you wish to sell, but you don't because of embedded capital gains tax.

An optimized Margin-Loan is a way to unlock equity & it's tax free liquidity since it's merely a loan against an asset

An optimized Margin-Loan is a way to unlock equity & it's tax free liquidity since it's merely a loan against an asset

12/ Reg-T margin allows borrowing up to 50% LTV. If your loan exceeds this, the broker will liquidate stocks to put you below the 50% LTV threshold.

Borrowing 25% means you can lose 50% value before any liquidation. If you can quickly infuse cash, maybe you can push LTV to 37%.

Borrowing 25% means you can lose 50% value before any liquidation. If you can quickly infuse cash, maybe you can push LTV to 37%.

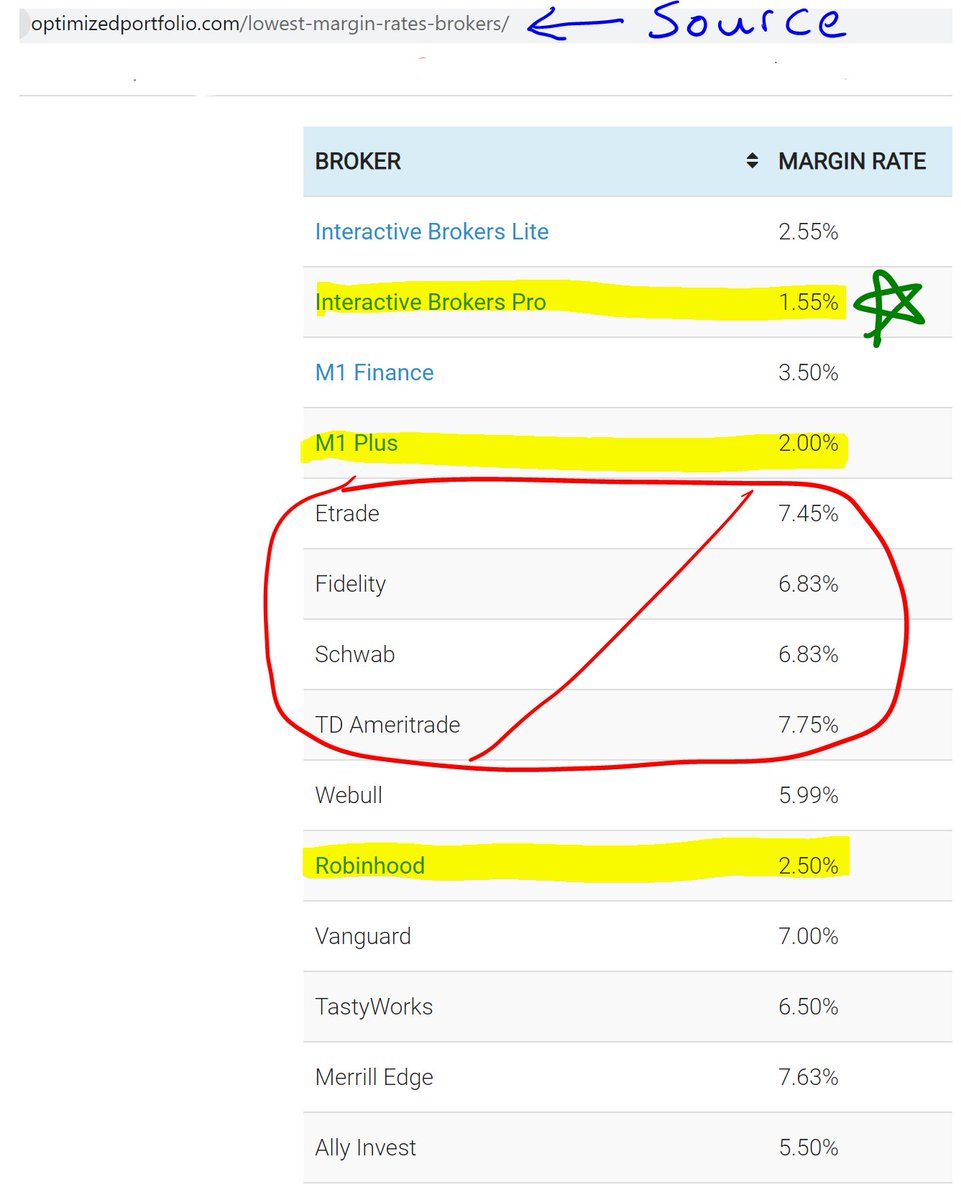

13/ Margin rates from big brokerages houses are terrible.

This is largely cuz their profits have compressed after offering "free trades" (even though they make a cut off the spread or get paid for non-optimal order flow).

They now seek revenue from cash deposits & margin loans

This is largely cuz their profits have compressed after offering "free trades" (even though they make a cut off the spread or get paid for non-optimal order flow).

They now seek revenue from cash deposits & margin loans

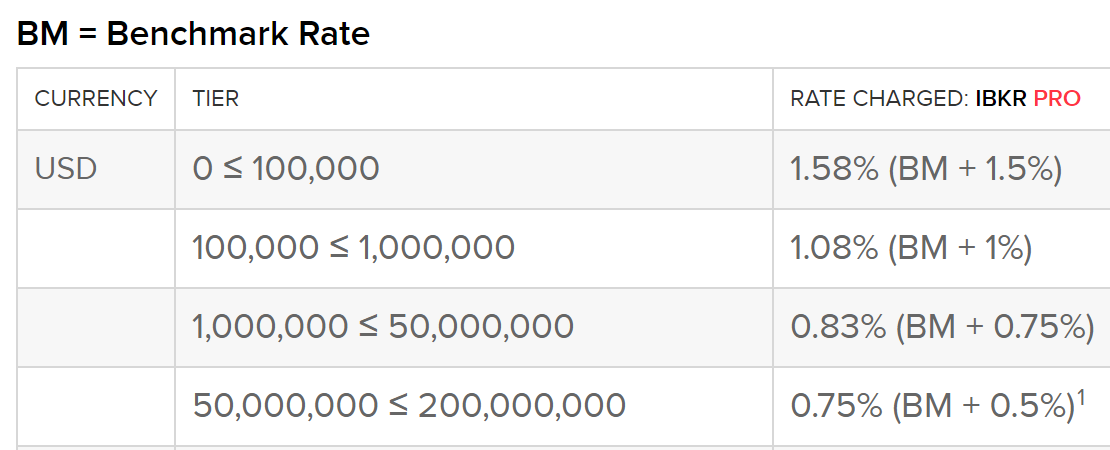

14/@IBKR margin rates get even lower than 1.58% the more you borrow (see table).

Since margin interest carries stocks, it's "investment interest" & therefore tax deductible (in the US). So 1.58% may feel like 1%, or 1.08% like 0.54%.

Code for $200 bonus:

ibkr.com/referral/john3…

Since margin interest carries stocks, it's "investment interest" & therefore tax deductible (in the US). So 1.58% may feel like 1%, or 1.08% like 0.54%.

Code for $200 bonus:

ibkr.com/referral/john3…

15/ For the max margin LTV capacity you can opt into "portfolio margin" if your @IBKR account > $100k.

Whereas Reg-T margin can get you 2:1 leverage (@ 50% LTV), Portfolio margin can get you 6:1 leverage for stonks or more if your positions are diversified or hedged w/ options.

Whereas Reg-T margin can get you 2:1 leverage (@ 50% LTV), Portfolio margin can get you 6:1 leverage for stonks or more if your positions are diversified or hedged w/ options.

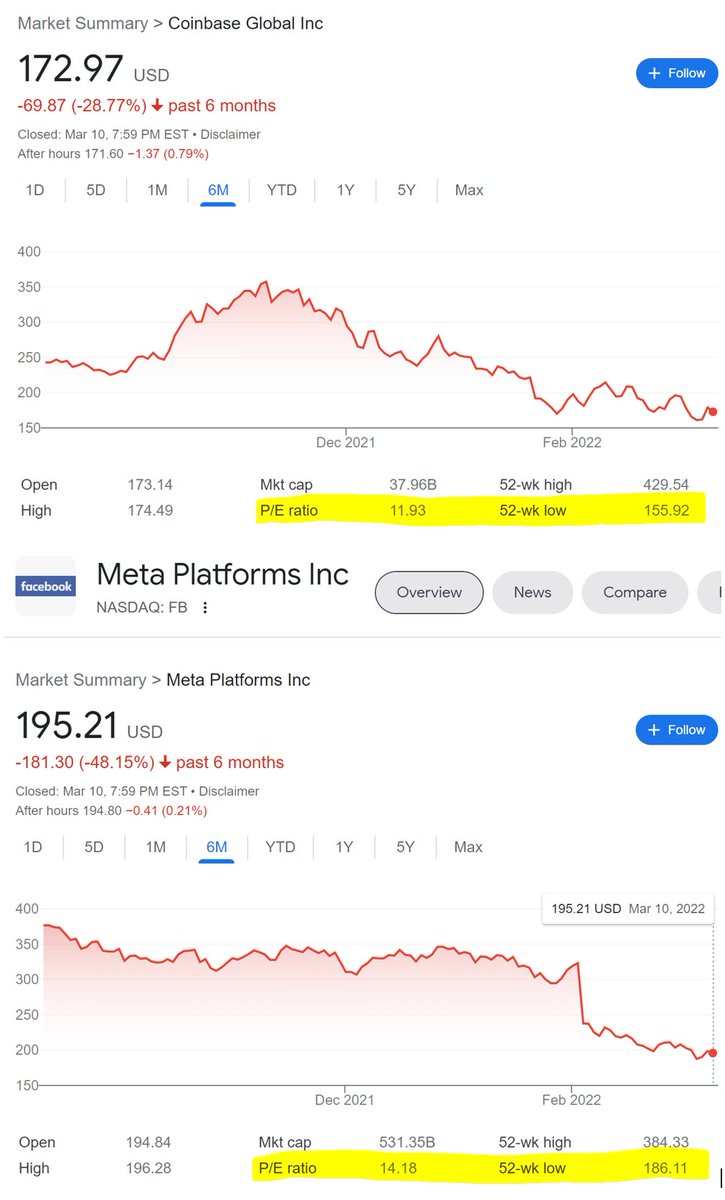

16/ What if you borrowed & parked stablecoins in @anchor_protocol or @investvoyager waiting for dips in anything?

Can you imagine the magnitude of @Cephii1-Martingaling right now on say FB & COIN using portfolio margin?

He'd be a freakin' board member if they dip much further.

Can you imagine the magnitude of @Cephii1-Martingaling right now on say FB & COIN using portfolio margin?

He'd be a freakin' board member if they dip much further.

17/ Your LTV threshold w/ portfolio margin is dynamic based on the real-time implied volatility of your composite portfolio.

As volatility⬆️your LTV capacity will⬇️. So I'm not saying you should even get close to 6:1, but at least you'll have a lot more cushion wen borrowing.

As volatility⬆️your LTV capacity will⬇️. So I'm not saying you should even get close to 6:1, but at least you'll have a lot more cushion wen borrowing.

18/ That's why I prefer a diverse array of asset classes wen borrowing w/ portfolio margin:

1) dividend stonks

2) growth stonks

3) spot gold ETFs

4) crypto-related stocks/ETFs

Lack of correlation maintains borrowing power to buy up systematic dips or to protect a crypto loan.

1) dividend stonks

2) growth stonks

3) spot gold ETFs

4) crypto-related stocks/ETFs

Lack of correlation maintains borrowing power to buy up systematic dips or to protect a crypto loan.

19/ Bolster buying power by selling covered calls.

They lower the implied volatility liquidation calculation by bringing you closer to delta neutral (long stock/short call).

You limit some potential growth but generate income. HODLers can sell calls 1-2 months out @ local tops.

They lower the implied volatility liquidation calculation by bringing you closer to delta neutral (long stock/short call).

You limit some potential growth but generate income. HODLers can sell calls 1-2 months out @ local tops.

20/ Before crypto I considered Whole Life cash value my stablecoin.

Today whole life earns me 4%-5%, but since it's tax-sheltered it feels like 8%-10%.

Plus it pays heirs 5x if I die. If I'm too sick to work again, I can get an advance on my death benefit tax free while alive

Today whole life earns me 4%-5%, but since it's tax-sheltered it feels like 8%-10%.

Plus it pays heirs 5x if I die. If I'm too sick to work again, I can get an advance on my death benefit tax free while alive

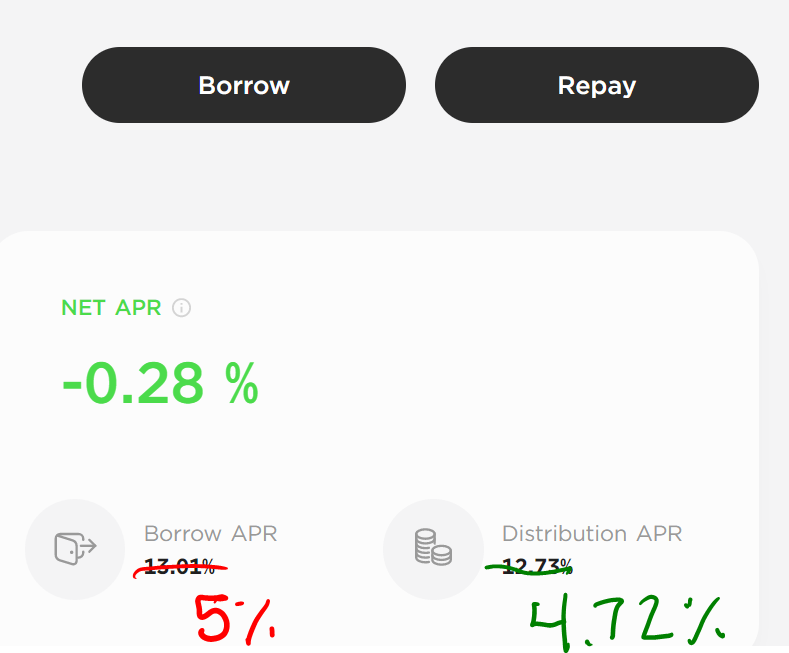

21/ Every whole life policy has a built-in loan mechanism similar to⚓wen the net cost to borrow is slightly +/- (see snip below)

But @thebancorp & @AmerisBank have turnkey lines of credit where you can borrow against 95% of your cash value between 2.75%-3.5% depending on size

But @thebancorp & @AmerisBank have turnkey lines of credit where you can borrow against 95% of your cash value between 2.75%-3.5% depending on size

22/ Indexed Universal Life (IUL) often tracks the S&P 500 index w/ guardrails:

- Floor guaranteed @ 0% (less insurance costs averaging around 1%-1.5%)

- Cap currently ranging from 8.5% - 11%

Caps will rise w/ interest rates since Ins. Co's get more yield to buy these hedges with

- Floor guaranteed @ 0% (less insurance costs averaging around 1%-1.5%)

- Cap currently ranging from 8.5% - 11%

Caps will rise w/ interest rates since Ins. Co's get more yield to buy these hedges with

23/ Whole/universal life gets a bad rap for being expensive.

When paying the max allowable IRS premium limit + using cheaper term riders to lower costs, it creates a less volatile tax-efficient alternative to traditional stocks & bonds.

AND you can borrow 90+% of your equity

When paying the max allowable IRS premium limit + using cheaper term riders to lower costs, it creates a less volatile tax-efficient alternative to traditional stocks & bonds.

AND you can borrow 90+% of your equity

24/ Mortgage refi's & HELOCs can be ideal to lock in 2022 rates.

Don't overpay principle, put it to work instead! Am I really in debt if I have that money in a safe yield-bearing asset?

For me that's life insurance. I did the math & I can pay off my mortgage quicker if I want

Don't overpay principle, put it to work instead! Am I really in debt if I have that money in a safe yield-bearing asset?

For me that's life insurance. I did the math & I can pay off my mortgage quicker if I want

25/ Always keep dry powder w/in your diversified "positive feedback loops" to manage different loans.

If you enjoyed this thread please Retweet the top tweet.

For questions on life insurance or Hutch's availability for private hourly education, you can DM his associate @IBCguy

If you enjoyed this thread please Retweet the top tweet.

For questions on life insurance or Hutch's availability for private hourly education, you can DM his associate @IBCguy

• • •

Missing some Tweet in this thread? You can try to

force a refresh