• A cash stock wizard, who doesn't trade the stereotype triangle, rectangle, H&S etc.

• Creative enough to look beyond the obvious

• Covering another unique set up: Rating Houses Contra Trades or as he calls it "Moody-no-so-Moody indicator"

🧵 to learn from @iManasArora

• Creative enough to look beyond the obvious

• Covering another unique set up: Rating Houses Contra Trades or as he calls it "Moody-no-so-Moody indicator"

🧵 to learn from @iManasArora

• Usually international rating agencies come with a downgrade only after a massive correction in the stock

• Similarly these rating agencies come with an upgrade report post a sharp rise in the stock

• Don't take them on face value and DYOR!

• Similarly these rating agencies come with an upgrade report post a sharp rise in the stock

• Don't take them on face value and DYOR!

• How Ultra Bullish articles from rating/broker houses is used to dump the stock to retail

• New traders provide liquidity for BIG players to offload their stocks

• New traders provide liquidity for BIG players to offload their stocks

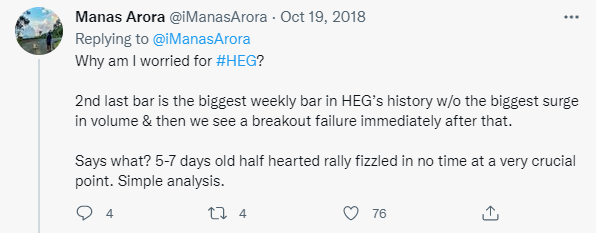

• Example 1: BofAML sees 100% rise

• Read this thread to know in detail #HEG

• Read this thread to know in detail #HEG

https://twitter.com/iManasArora/status/1053244351244103680?s=20&t=klFpPegLMkSRjCJUr-VU2Q

• How depressive articles from rating/broker houses is used to make the retailers sell their stocks

• Retailers provide opportunity to the BIG players to accumulate them at rock bottom prices

#TATAMOTORS

• Retailers provide opportunity to the BIG players to accumulate them at rock bottom prices

#TATAMOTORS

• Example 2: S&P downgrades TATAMOTORS

• Read this to know in detail #TATAMOTORS

• Read this to know in detail #TATAMOTORS

https://twitter.com/iManasArora/status/1246055392699793408?s=20&t=sPNIFbve9lpfs8rVV3uI1Q

Example 3: UBS downgrades #BAJFINANCE

https://twitter.com/iManasArora/status/1275098248932290560?s=20&t=XpTiW-90FbnTHD0EA5EylQ

Example 4: Moody's crack down on 5 Indian PSU's

@iManasArora utilized this opportunity to go long in PNB

@iManasArora utilized this opportunity to go long in PNB

https://twitter.com/iManasArora/status/1336249502966063104?s=20&t=klFpPegLMkSRjCJUr-VU2Q

• From the above examples it is quite clear that taking contra bets is easy

BUY, when the following conditions are met:

1. The stock has already plummeted by 90-100%

2. The rating report then downgrades the stock

3. The stock refuses to go down any further

BUY, when the following conditions are met:

1. The stock has already plummeted by 90-100%

2. The rating report then downgrades the stock

3. The stock refuses to go down any further

SELL, when the following conditions are met:

1. The stock had already had a fab run up (15-20x in a very short span i.e. 12m)

2. The rating report then gives an ultra bullish tgt of 100% up from CMP

3. News based rally on a low volume

1. The stock had already had a fab run up (15-20x in a very short span i.e. 12m)

2. The rating report then gives an ultra bullish tgt of 100% up from CMP

3. News based rally on a low volume

• Before blindly taking contra bets, check whether the conditions above are met and

• Also, learn Stage Analysis

• Also, learn Stage Analysis

• And if you think @iManasArora only takes contra bets on:

1. Extended moves

2. Rating houses report

Then wait, this time he is bullish on a country - 'Time to buy Russia'

1. Extended moves

2. Rating houses report

Then wait, this time he is bullish on a country - 'Time to buy Russia'

https://twitter.com/iManasArora/status/1499655000360112129?s=20&t=sPNIFbve9lpfs8rVV3uI1Q

Next time you see an upgrade/downgrade report from some major rating agency just see whether the conditions mentioned in this thread is met, basically DYOR before acting on it!

#BroTip

#BroTip

If you have missed @iManasArora Extended moves & Reversal plays set up then check it here

https://twitter.com/niki_poojary/status/1494911025765699589?s=20&t=nMHrvDd4WlN3KyAEYnxAgQ

You can also go through his TL @iManasArora where he shares his tricks which no textbook has covered

Hope you discovered something new (because that's the point!)

If you did, share it with a friend

Hop back up to retweet the first tweet

Hope you discovered something new (because that's the point!)

If you did, share it with a friend

Hop back up to retweet the first tweet

• • •

Missing some Tweet in this thread? You can try to

force a refresh