1.#Turkmenistan is undergoing a presidential succession. Despite the isolation imposed by geography and its political system, this country has played an important role in Eurasian energy politics. A recapping thread 👇apnews.com/article/russia…

2.Through the lenses of Turkmen energy history, one can trace 30 years of shifts in international politics including the USSR collapse, the US unipolar moment, the war on terror, Russia’s resurgence (well…) and China’s rise.

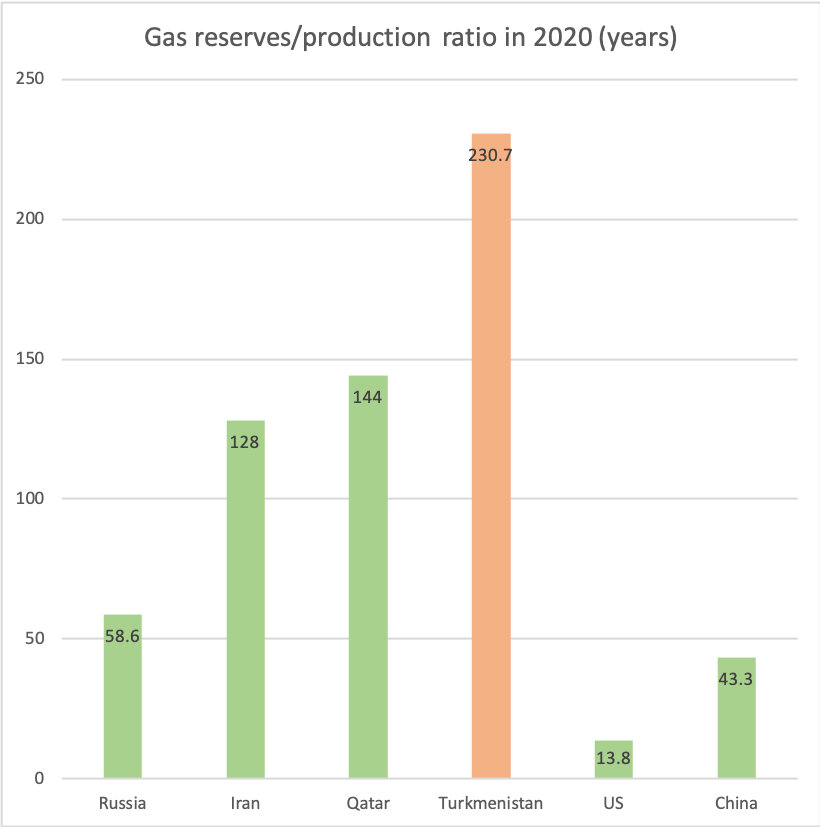

3. At the collapse of the USSR, newly independent Turkmenistan was a peripheral, impoverished state. Yet, an untapped treasure lied beneath its soil: 13.6 tcm of natural gas reserves (7% of global reserves), making Turkmenistan the fourth in the world.

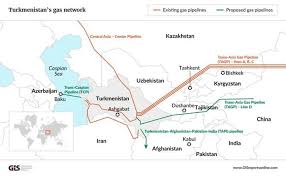

4.However,historical legacies,politics and geography got in the way of Turkmenistan’s access to market outlets. At the fall of the USSR,the only way to export Turkmen’s landlocked resources was the Central Asia-Centre (CAC) pipeline,connecting Turkmen gas to the Russian network

5.Russia used to dispatch Turkmen gas with nowhere else to go to CIS markets with low prices and prone to payment default –notably Ukraine– preserving Gazprom’s own gas for the profitable European markets.For most of the 1990s, the Turkmenistan-Ukraine gas trade was a barter deal

6.Later in the 90s,Gazprom started buying Turkmen gas,as underinvestment in Russian fields was compromising Gazprom’s ability to supply both domestic and European markets.A good deal for Russia,which accessed Turkmen gas from a monopsony position selling its own to rich Europeans

7.All in all, the whole Turkmen-Russia gas relation was deeply asymmetrical. Russia had the upper hand due to the material reality of a colonial infrastructural legacy. Opportunities for profits were seized by opaque intermediaries benefitting from Moscow's patronage

8.But how to diversify supply and access more profitable international markets? Too many promising outlets around – Europe, India, China – too many complicated geographical and political contexts in between.

9.For a long time, the only diversification success achieved by Turkmenistan was the Körpeje-Kordkuy pipeline to Iran – a 8 bcm pipeline commissioned in 1997, financed by Iran and re-paid through gas supplies.

10.Previous plans to extend such a route to Turkey and Europe could not materialise, especially due to US' opposition to Iran's achieving a transit and supply role to European markets

11. The big prize was clearly the access to European gas market non mediated by Russia or Iran. A solution that for a long time attracted US and EU interest. Why?

12.For Europe, the promise of diversification as gas relations with Russia became increasingly contested – courtesy of Russia’s resurgent resource nationalism,divergences in energy governance models, disruptions on the Ukrainian corridor, and the EU enlargement

13.For the US, the promise of reducing European allies’ dependence on Russian supplies. And even more, the prospects of reducing post-Soviet states’ dependence on a Russia-controlled regional energy network - with the co-benefit of lucrative business for western companies

14. In particular, Turkmen gas was needed to make the Nabucco project -a European flagship diversification initiative-commercially viable. The Azeri resources committed to the project were not enough to justify a mega-pipeline. But how to access Turkmen resources?

15.With strong US pressures for avoiding passage through both Russia and Iran, the only safe passage was across the Caspian sea. The 16-30 bcm Trans Caspian Pipeline (TCP) was endorsed by Turkmen president Niyazov since 1998. But…

16. …Russia and Iran had powerful assets to deter the initiative. They vetoed for a long time a definition of the legal status of the Caspian sea, until a partial agreement among coastal states was reached in 2018 rferl.org/a/qishloq-ovoz… ; woodmac.com/news/opinion/r…

17.A second problem concerned Azeri-Turkmen relations. The two countries have been disputing oilfields in the Caspian for thirty years. An agreement to cooperate on the Dostlug field was only signed in 2021.

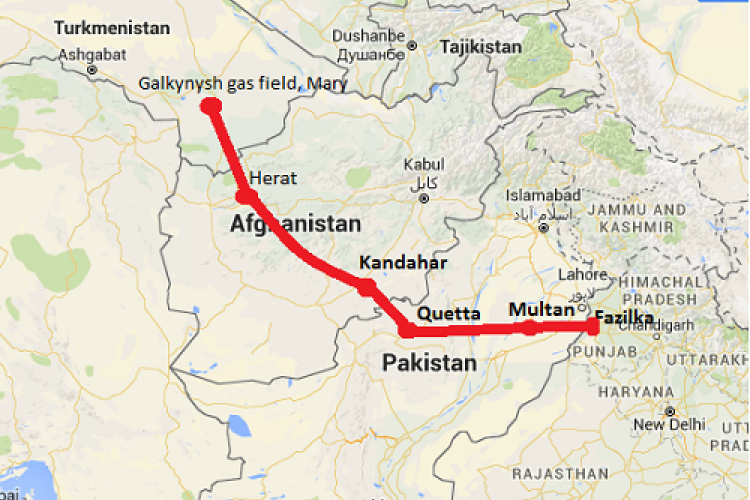

18. Turkmen leaders also looked south – to India and Pakistan. A US firm, Unocal, was interested in the TAPI project since the mid-90s. Just few political problems: passage through Afghanistan, and India’s reluctance to depend on transit through Pakistan

19.Turkmenistan and Unocal courted the Talibans, seen as prospective stabilizers – Unocal even shepherded a Taliban delegation through the State Department in 1997.But walked out as US-Taliban relations collapsed following the 1998 al-Qaeda attack to US embassies in Africa

20.Interestingly,in 2002 and again in 2022(23 years and a US occupation later),the Turkmen government and the Talibans–again seen as the “stabilizers-resumed discussions over the pipeline.Together with TCP, TAPI is a second multi-decade zombie project that recursively comes back

21.Finally,Turkmenistan looked east.The 30 bcm Central Asia-China pipeline was agreed in 2007 and commissioned in 2009,entrenching Turkmenistan and China destiny for decades to come. To understand the magnitude of the shift,here is how Turkmenistan export destinations changed

22.Through the Central Asia-China pipeline, Turkmenistan found a way to develop its eastern resources and end export dependence on Russia and Iran, bettering its negotiating position especially towards Russia

23. in the late 2000s the rise of a competitor pushed Russia to offer Turkmenistan cooperation to reconstruct a badly damaged western branch (Pri-Caspian) of CAC, and build up a domestic east-west connection. This marked...

24...a big change with respect to previous scant interest by Russia to develop the Turkmen upstream – a historically contentious chapter in Turkmenistan-Russia gas relations.

25.Russia intended to consolidate its grip on Turkmen exports to re-market cheap Turkmen gas as Russian to feed the South Stream mega-project – Nabucco’s rival – profiting from price differentials. Same old, same old.

26.However, too late. The Pri-Caspian pipeline project was mothballed indefinitely in 2010, officially due to skepticism about the future of European demand. reuters.com/article/idUKLD… . And Turkmenistan built up the domestic east-west line on its own.

27.While the reorientation of Turkmen gas towards China could be seen as a strategic loss for Russia, things are more complex.Russia did not to take a confrontational stance towards the initiative.The priority for Russia was for Central Asian resources not to compete on EU market

28.The hope was to find grounds for cooperation with China in Central Asia, pragmatically emphasizing common interests in the region. An attitude rewarded through Russia’s StrojTransGaz involvement, in the Construction of the Central Asia-China pipeline.

29. It was of course an excellent deal for China. Who achieved exclusive access to North-Eastern Turkmen fields, mitigating its exposure to maritime LNG import routes and achieving the upper hand in the negotiations on Russian gas supplies

30.The gas relationship between Turkmenistan and China, however, is deeply asymmetrical. the financial benefits are eaten up by repaying loans for Chinese-funded infrastructure projects and upstream development in the form of gas exports

31.For the future, the challenge for the country is how to market the giant Galkynysh field. Berdymuhammedov senior invited Berdymuhammedov junior to keep seeking access to international markets. Turkmenistan continues pushing for TAPI, while...

32...a second best could be the 30 bcm Line D of the Central Asia-China pipeline. But none of them go ahead at the moment

33. Line D seems to be frozen since 2019 as… Turkmenistan restarted supplying Russia through good old CAC – at the moment the only large infrastructure ready for purpose. In all likelihood,Serdar Berdymuhammedov’s Turkmenistan will have to continue balancing btw Russia and China

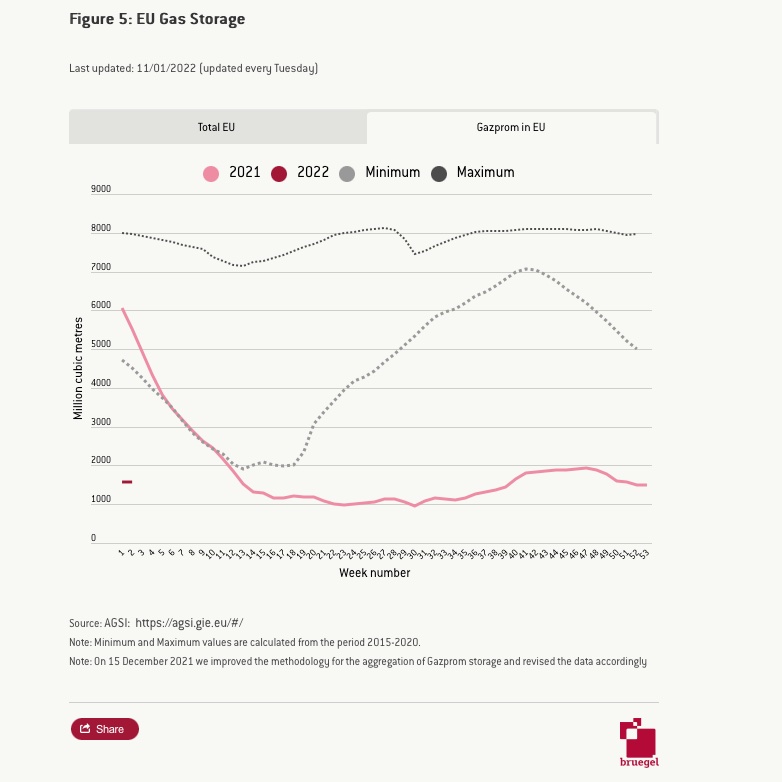

34. Will a new European quest for non-Russian gas inject new life in the TCP zombie project? I wouldn’t hold my breath. EU decarbonisaion plans are still there, as much as the decision not to support new fossil connectivity. Also, the Caspian legal status is only partially solved

35.Exporting to Europe by way of Iran an option with JCPOA? Unlikely. Whatever happens with JCPOA, Europeans know that energy relations with Iran will always be exposed to the vagaries of US-Iran relations. Plus a large number of practical problems.

36.All in all, looks like the country's energy future will be stuck with China and Russia for a while. And with the latter increasingly isolated and economically weakened by the war and sanctions for the foreseeable future, there might be less and less that Moscow can provide/FIN

• • •

Missing some Tweet in this thread? You can try to

force a refresh