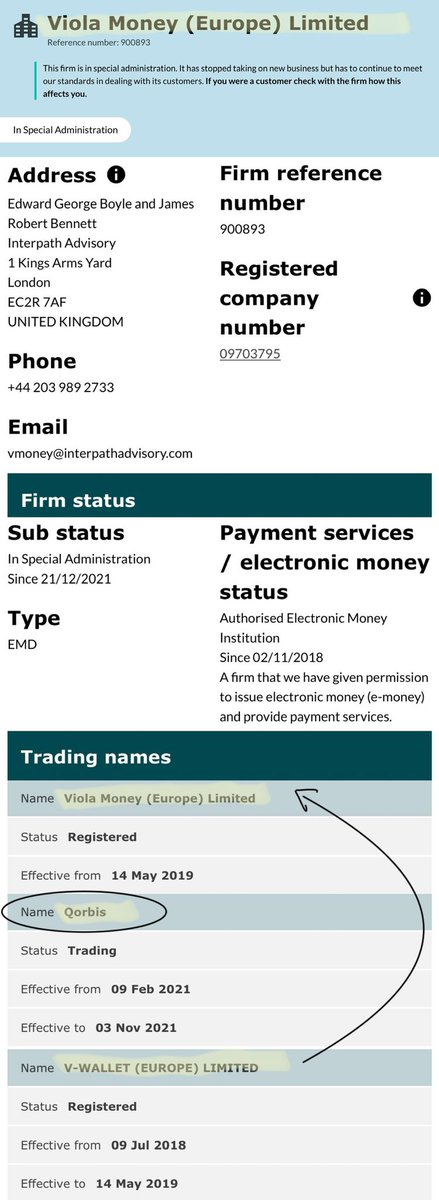

@ArmitageJim @premnsikka 1/ The curious case of “disguise, I see thou art a wickedness” [Viola, Twelfth Night] - PART 1 of 2: <Background>. On 22/Oct/2021 #ClearBank froze the accounts of @theFCA’s notorious #Emoney op #Viola Money(Europe) Ltd “VMEL”, …

2/ citing “financial crime concerns” + informed the slumbering UK regulator (@theFCA). A week later VMEL’s Estonian bank (#LHV) issued 2 months termination notice to VMEL. 4 days later (on 2/11/2021) the FCA finally issued a pitiful ‘1st supervision notice’ BUT astonishingly …

3/ still allowed VMEL to carry out unsupervised ‘individual transactions’ of <£5k (remember this + this date for Part 2). 6 days later astonishingly the FCA reportedly backtracked + rescinded even the conditions of it’s pitiful ‘1st supervision notice’ (#BigLaw no doubt …

4/ sending the FCA scurrying … as usual). On 25/11/2021 Estonian bank LHV shutdown with immediate effect VMEL’s banking, the multi £m balances reportedly transferred to VMEL’s partners: IFX(UK) Ltd (FCA auth. virtual bank account/FX op) + Transactive Systems UAB …

5/ (Lithuanian auth. Emoney op, subsidiary of UK FCA auth Emoney op Transactive Systems Ltd). The FCA continued to slumber until 14/12/2021 when it reportedly flip-flopped back to imposing a 2nd ‘supervision notice’ on VMEL, ordering it to cease all regulated Emoney + …

6/ payment services. On 31/12/2021 the Court appointed the FCA’s chosen special administrator, coincidentally the **Glasgow** office of #Interpath (formerly KPMG). A few days ago the administrator released their first report (scribd.com/document/56150…). Unsurprisingly, …

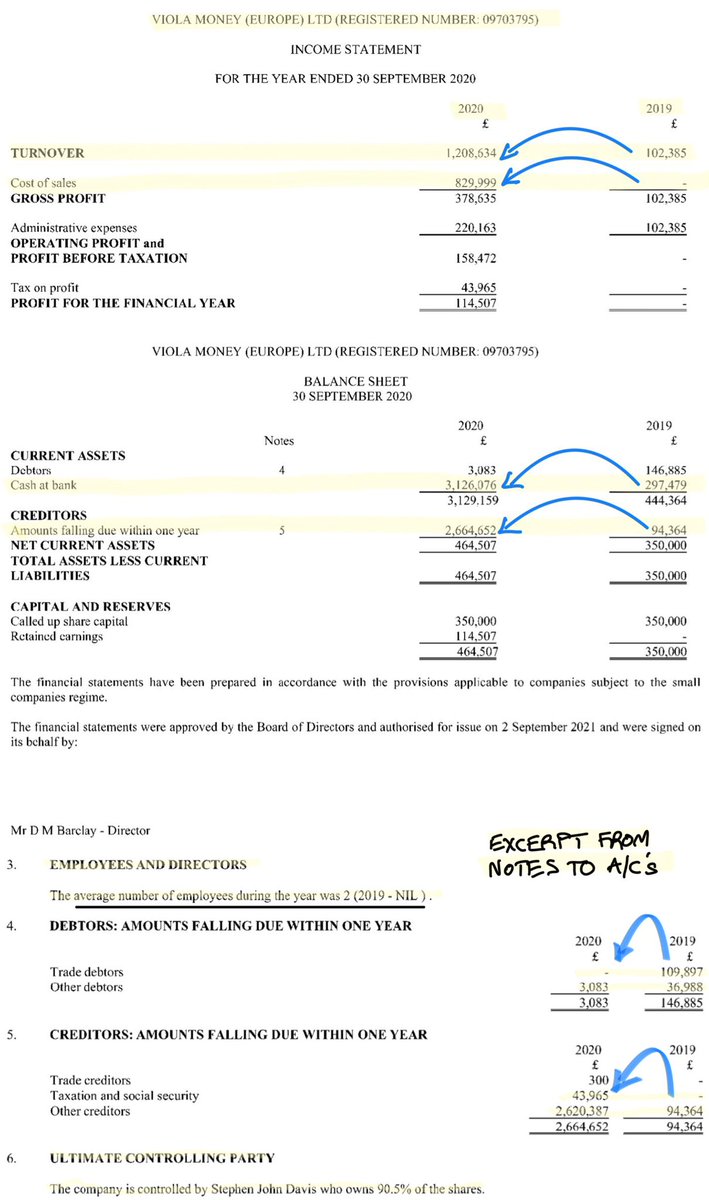

7/ they found the usual FCA auth. #Emoney shadowy shitshow - but what lurks in the shadows ?. The administrators reported a black hole of information & records in VMEL + that most of the funds remaining in VMEL had been frozen by the @NCA_UK /@HMRCgovuk. VMEL’s auditors were …

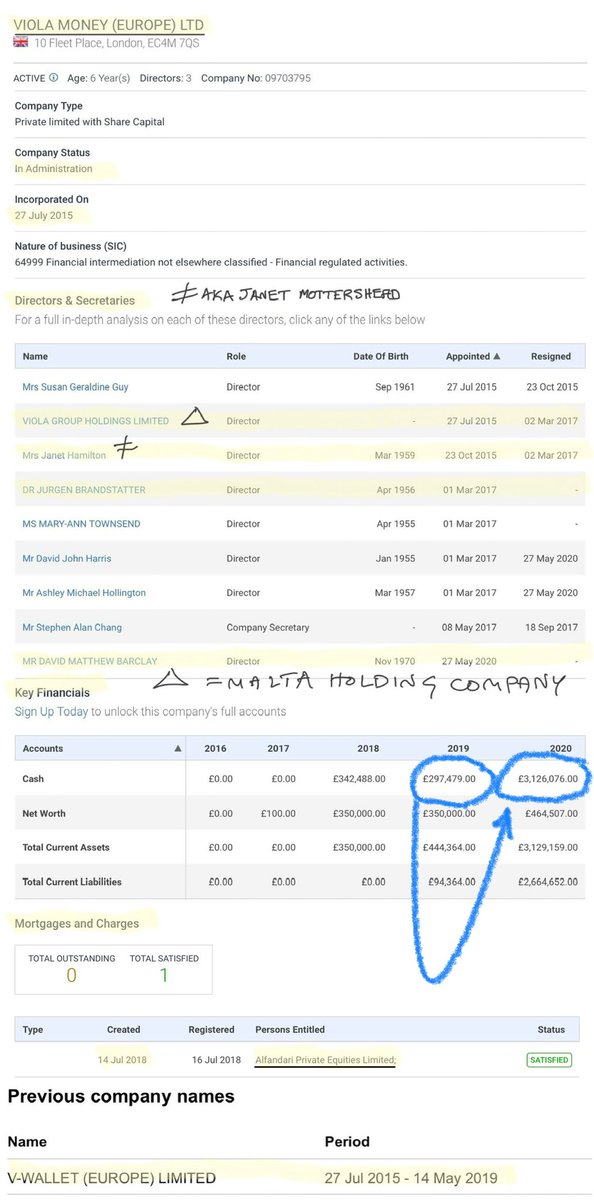

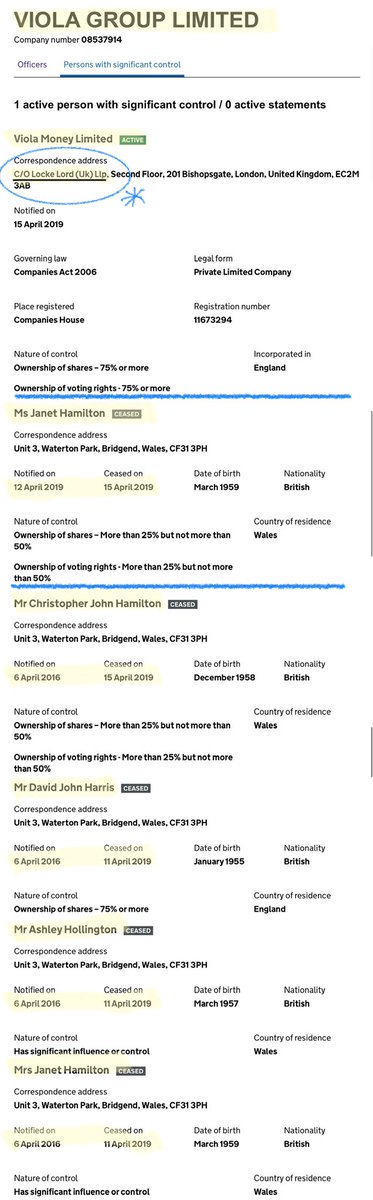

8/ the small Kent #ICAEW firm - Stephen Hill Partnership. Seventeen months before the FCA issued it’s 1st supervision notice to VMEL (02/11/2021), Viola Group Ltd had been shut down by Court Order. Noteworthy was that in 2019 Viola Group Ltd recorded it’s …

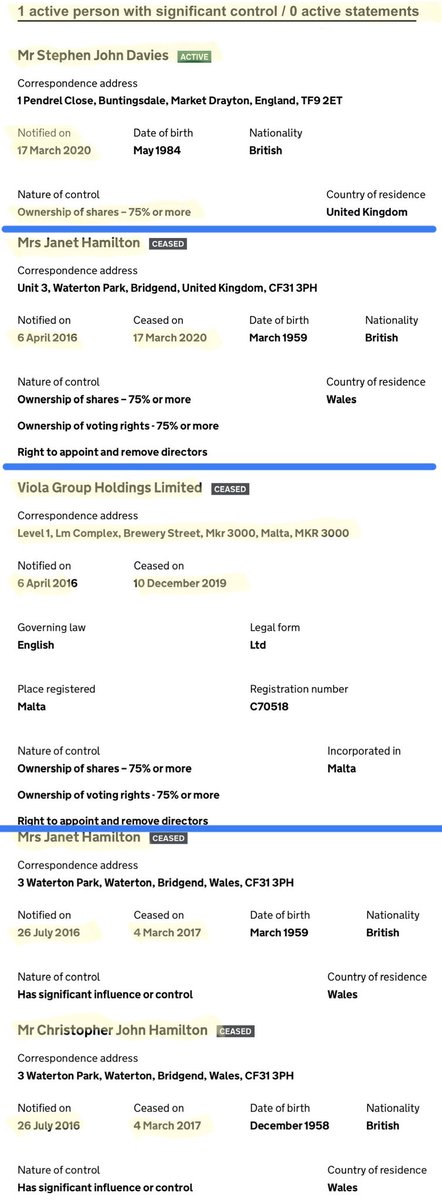

9/ PSC’s (Viola Money Ltd) correspondence address as being ‘C/O Locke Lord (UK) LLP’. VMEL’s purported UBO since 03/2020 was the ‘mysterious’ 37 yr old Stephen John Davies, saddled up alongside him as VMEL’s ‘low profile’ commercial director, a 51 yr old Scotsman:

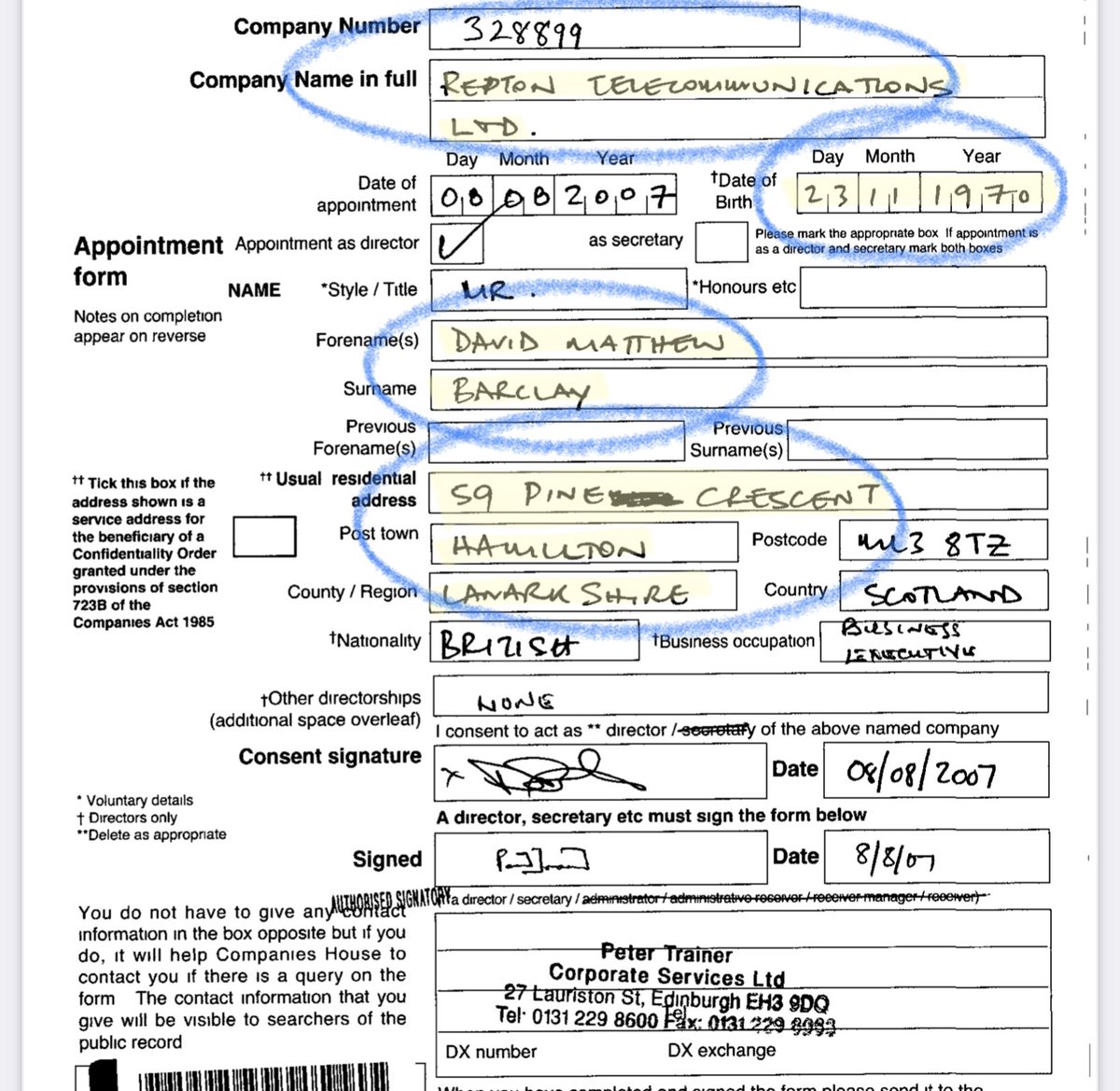

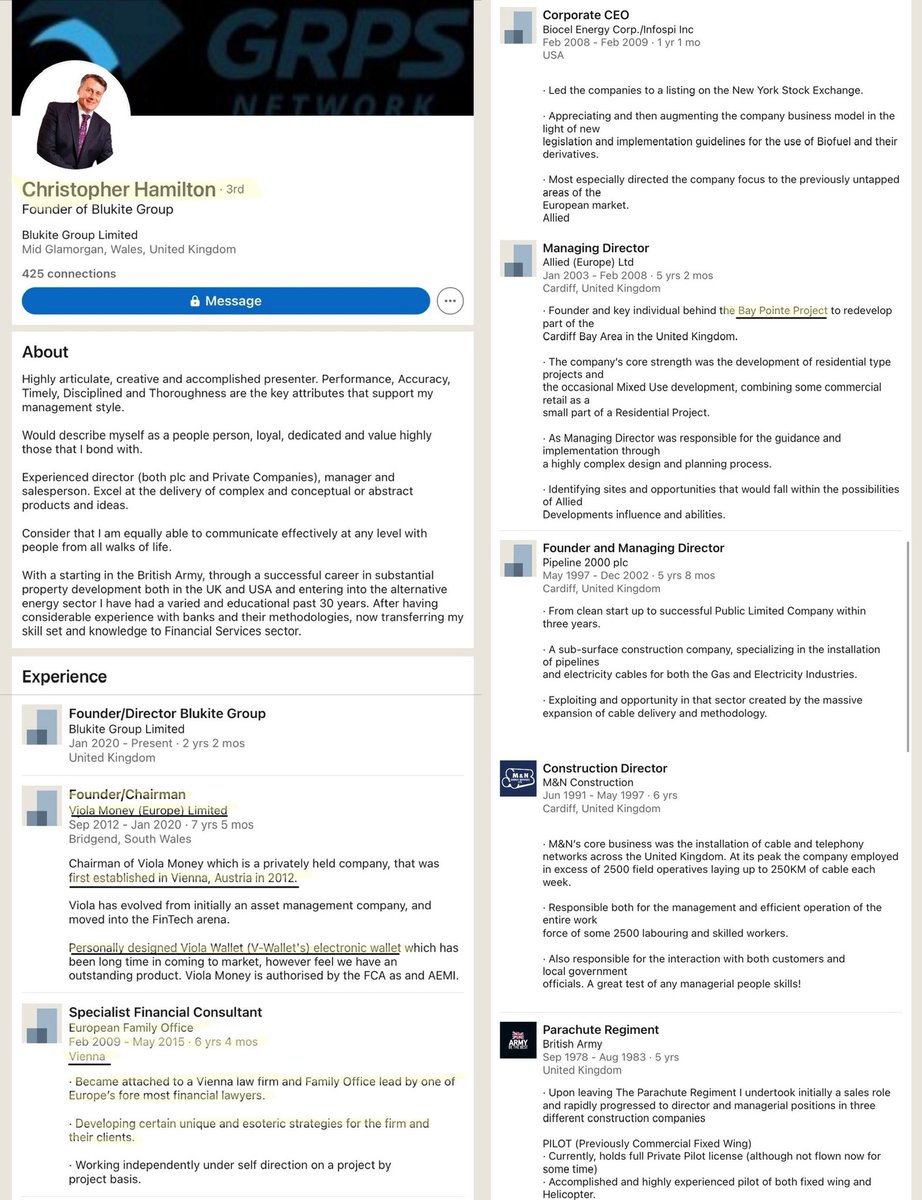

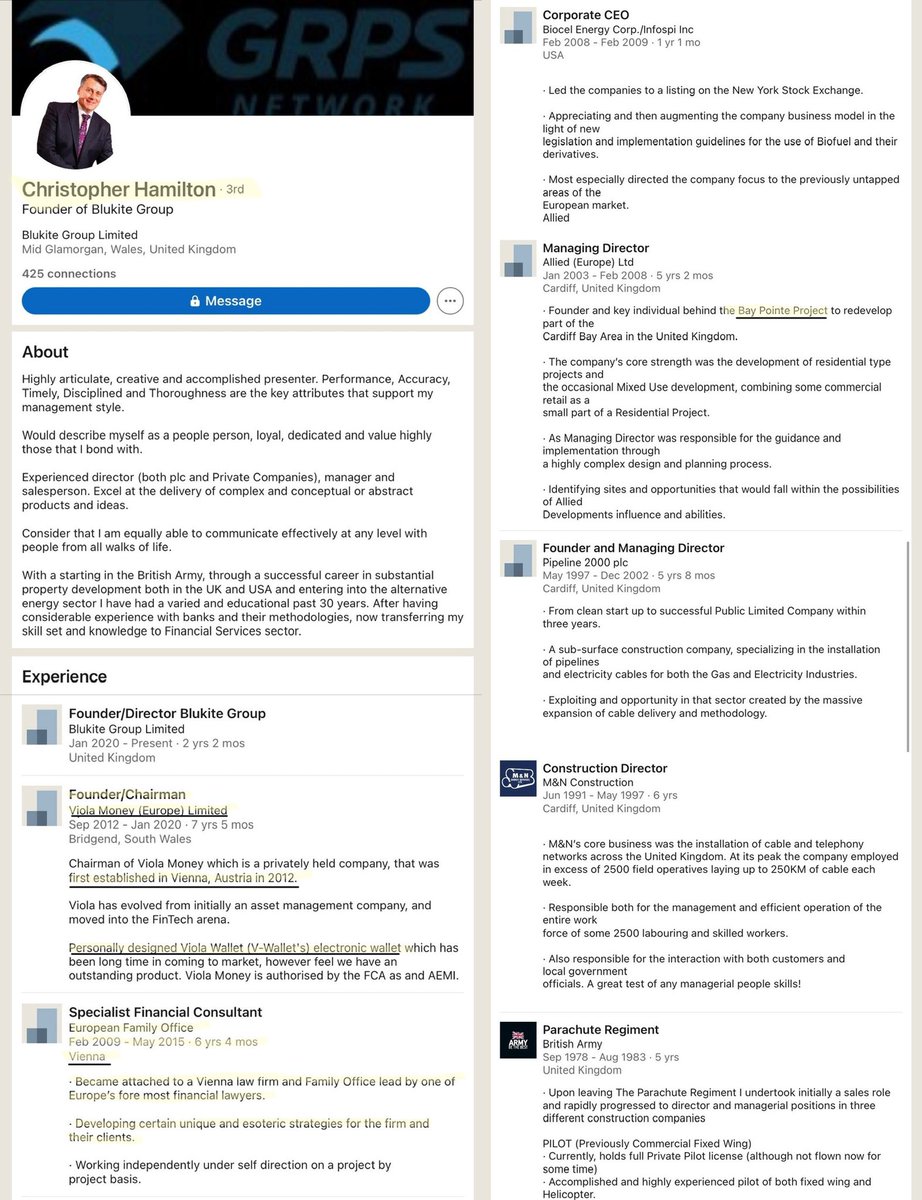

10/ David Matthew Barclay. VMEL’s purported UBO had purportedly acquired VMEL from its purported founders: Christopher Hamilton/Janet Hamilton (aka Janet Mottershead). David Matthew Barclay is rumoured (which may or may not be true) to be a veteran of #Barclays, …

11/ #Barclaycard & VISA #Cybersource. Back in the day in 2010, before VISA’s acquisition, Cybersource’s ‘accredited Payment Service Provider (#PSP)’ service was allegedly re-sold to the shadowy ‘merchant aggregators’ of scammers, #PornMen, #GamblingMen, fake #Pharma ops etc.

12/ One of the notorious resellers was reportedly the billet of one of the #PornMen, who was also one of the ‘fathers of #Wirecard’ (the subject of a future expose). There is, however, another David Matthew Barclay, also a Scotsman + with an identical birthdate. This …

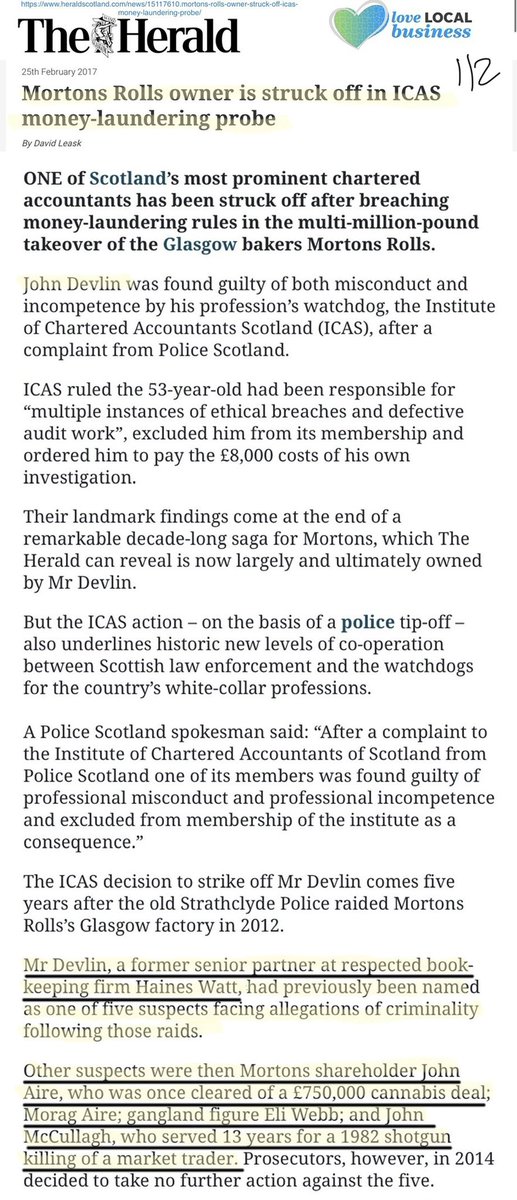

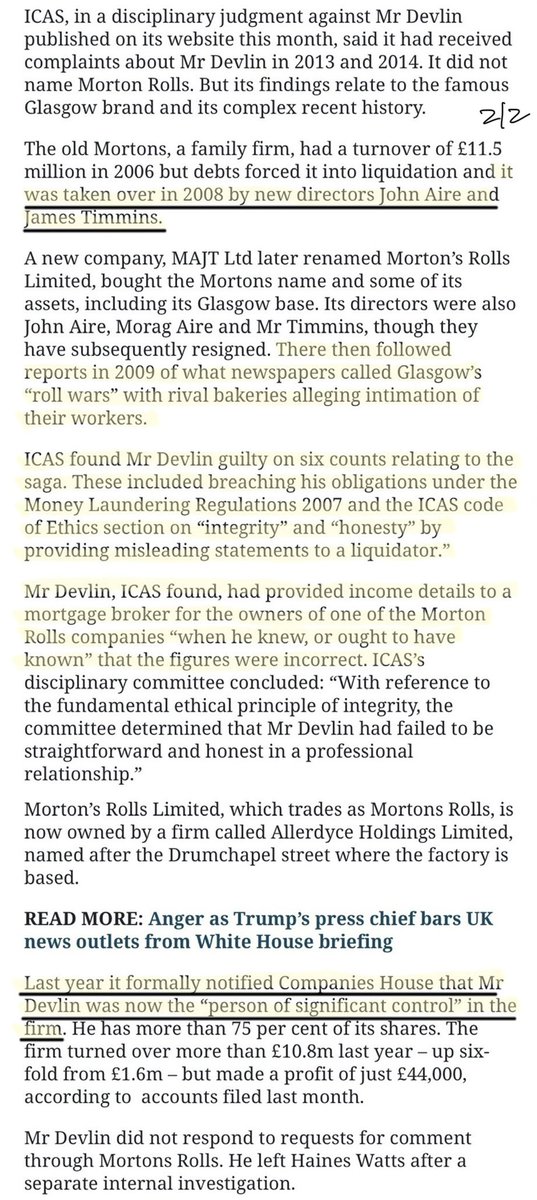

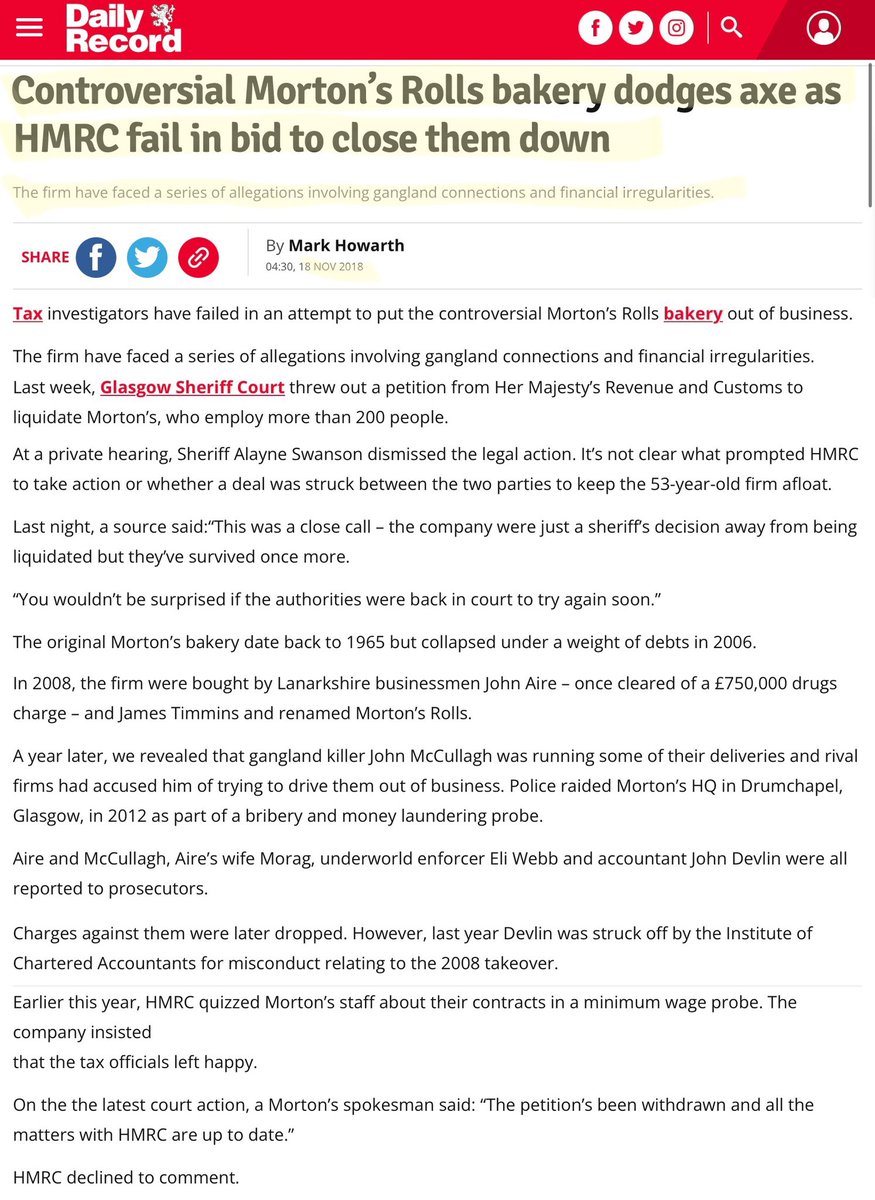

13/David Matthew Barclay slipped in & saddled up ~2008 at ‘Mortons Rolls’ which would become the epicentre of (as Glasgow newspapers called it) crime gang “roll wars” + later see a high profile #HainesWatts audit partner (who allegedly ended up with ‘Mortons Rolls’) struck off.

14/ Also nesting at David Matthew Barclay’s service address was then Russian national ‘Natalia Barclay’, a director of Ionastream Ltd along with then insolvency practitioner Graeme Cullen (allegedly with a sideline in ‘payroll ops’). As the “rolls wars” raged in Glasgow, …

15/ over in Cardiff, VMEL’s purported future founder Christopher Hamilton, after a string of liquidated/struck off ventures, was fronting (for the HBOS/Lehman’s backed #CityLofts op), the high profile ‘tallest building in Wales’, a ‘yuppie flats’ property development: …

16/ Bay Pointe (Bay Pointe Ltd). As HBOS/Lehman’s imploded, so too did City Lofts + with it Bay Pointe (shut down by court order). Christopher Hamilton had however found some new associates: ‘international men of mystery’, centred around a shell SPV (Powerbore Ltd) that …

17/ would eventually be renamed ‘Viola AM Ltd’. As well as USA national Sreenivasulu ‘Vasu’ Reddy (licensed by USA FCC for international premium rate telecom/prepaid calling card/VOIP ops), this SPV also featured a notorious German prince & fraudster (Carlos Patrick Godehard) …

18/ who would be later reportedly jailed for ‘dealing in multi-million dollar investment funds which didn’t exist’ (dailymail.co.uk/news/article-5…). Also on the scene, a ‘Mexican posse’, led by a Mexican national …

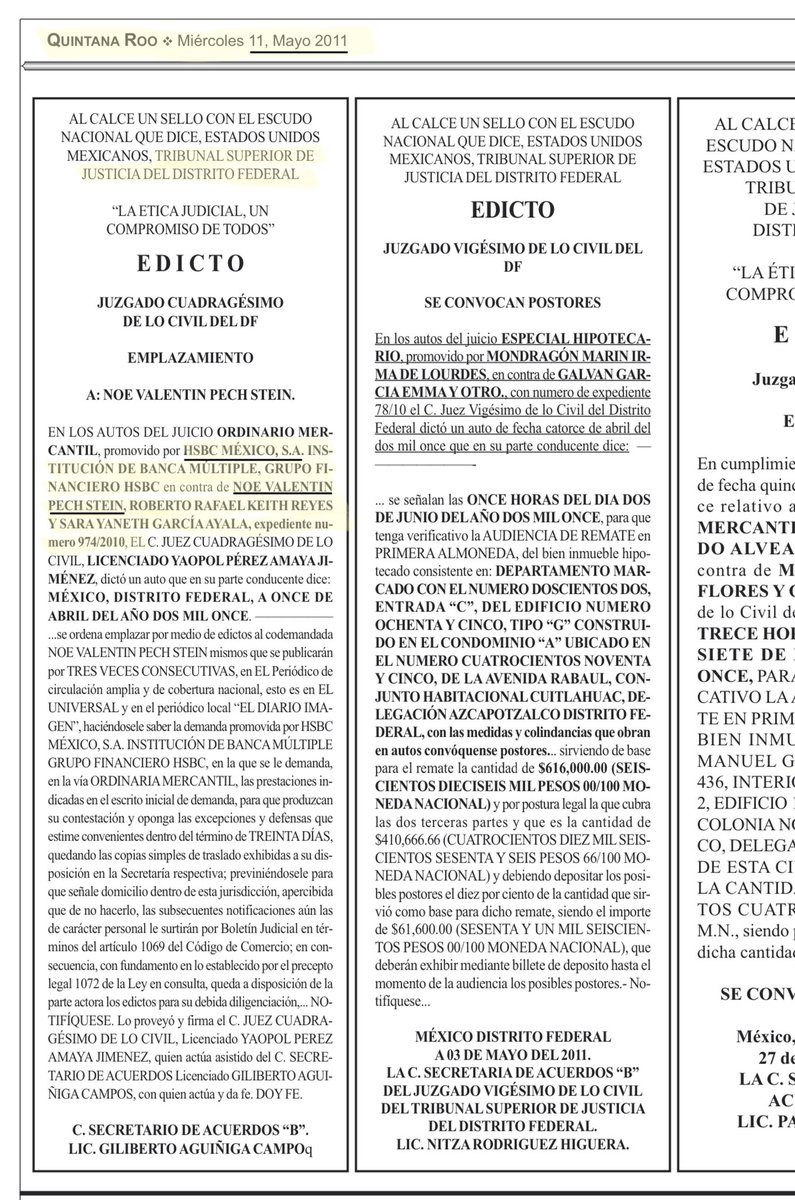

19/ ‘Noe Valentin Pech Stein’. At around this time an allegedly ‘whisper quiet’ scandal fizzled in Mexico where allegedly $US 9 BILLION of HSBC Mexico CDs (Certificate of Deposits) were allegedly fraudulently created , allegedly an ‘inside job’ - (scribd.com/document/56411…).

20/ Amongst those HSBC Mexico took legal action against was coincidentally a ‘Noe Valentin Pech Stein’. The case seemingly dragged on, no doubt HSBC Mexico had been busy with other things - e.g. the USA prosecution of HSBC Mexico for lax anti-money laundering controls ..,

21/ allowing vast amounts of Mexican drug cartel money to be laundered (reuters.com/article/us-hsb…). Rather tantalisingly in the USA, coincidentally a ‘Noe Valentin Pech Stein’ at around the same time was allegedly ‘doing a deal’ (via proxy) involving ~$US3.5 BILLION of …

22/ purported HSBC Mexico CDs. A later USA court case’s claim filings included some astonishing ‘deal’ documentation (scribd.com/document/56411… AND scribd.com/document/56411…). These documents purport a ‘spiffy deal’ yielding a return of ~250% on ‘trading

23/ the purported HSBC Mexico CDs’ for a year ‘in Europe’, allegedly involving well known parties (eg BNP). Presumably all geed-up by the ‘international men of mystery’, Christopher Hamilton had ‘gone international’, describing (LinkedIn bio) “becoming attached in 02/2009 …

24/ to a Vienna law firm/family office & developing certain unique + esoteric strategies”. ‘VIOLA’ was born in 2012 as ‘Viola Asset Management GmbH’ (FN 385820 h) aka “VAM”, set up by Vienna lawyer (+ future VMEL director) Juergen Brandstätter.

25/ The Brandstätters would reportedly remain 100% shareholders until ‘passing the baton’ in 2016 to Christopher Hamilton, who became 100% shareholder & Joint MD with the existing MD: Juergen Brandstätter - (scribd.com/document/56411…).

26/ The UK shell (Powerbore Ltd) the ‘international men of mystery’ previously roosted in was rapidly renamed in 2013 by it’s then sole director Christopher Hamilton to ‘VAM (UK) Ltd’ (renamed again in 2016 to ‘Viola AM Ltd’). The ‘Viola’, ‘Viola Securities’ & …

27/ ‘Viola Asset Management’ trademarks were registered in 2013 by Juergen Brandstätter’s law firm on behalf of Viola Asset Management GmbH. The ‘ViolaLux’ trademark was registered in 2015 by Juergen Brandstätter’s law firm on behalf of Viola Asset Management GmbH.

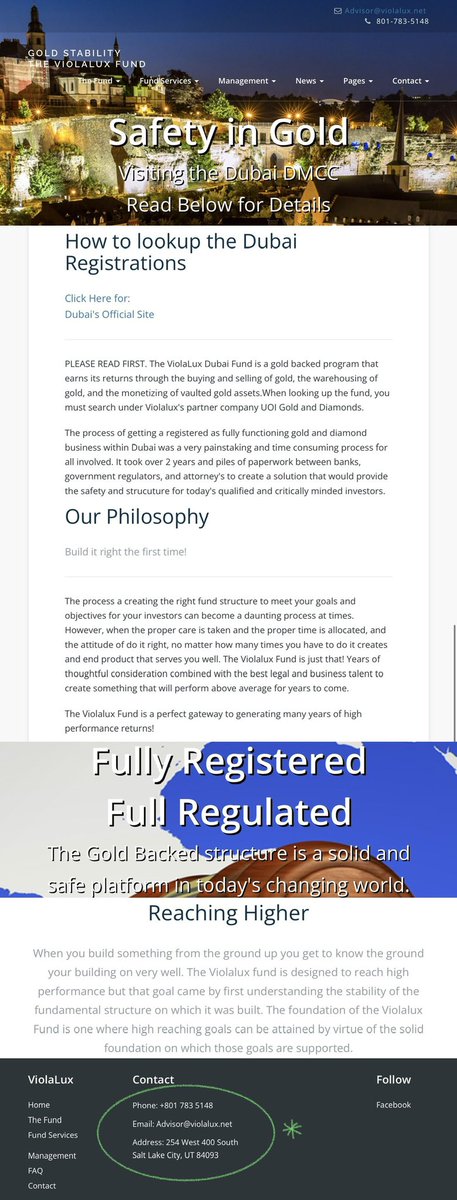

28/ Amongst ViolaLux’s wares allegedly knocked up +/or peddled were the purportedly Dubai registered ~2015 ‘ViolaLux Dubai Fund’ (gold backed it says) + the ~2015 Luxembourg registered ‘ViolaLux SICAV-SIF Fund’ (purportedly renewable energy project finance it drivelled).

29/ Needless to say things don’t appear to have gone well for these ‘funds’, the purported Dubai fund having ‘gone dark’ + the Luxembourg fund is now deregistered + purportedly ‘merging with another group’. Both funds allegedly had a ‘low profile’ Utah based USA partner - …

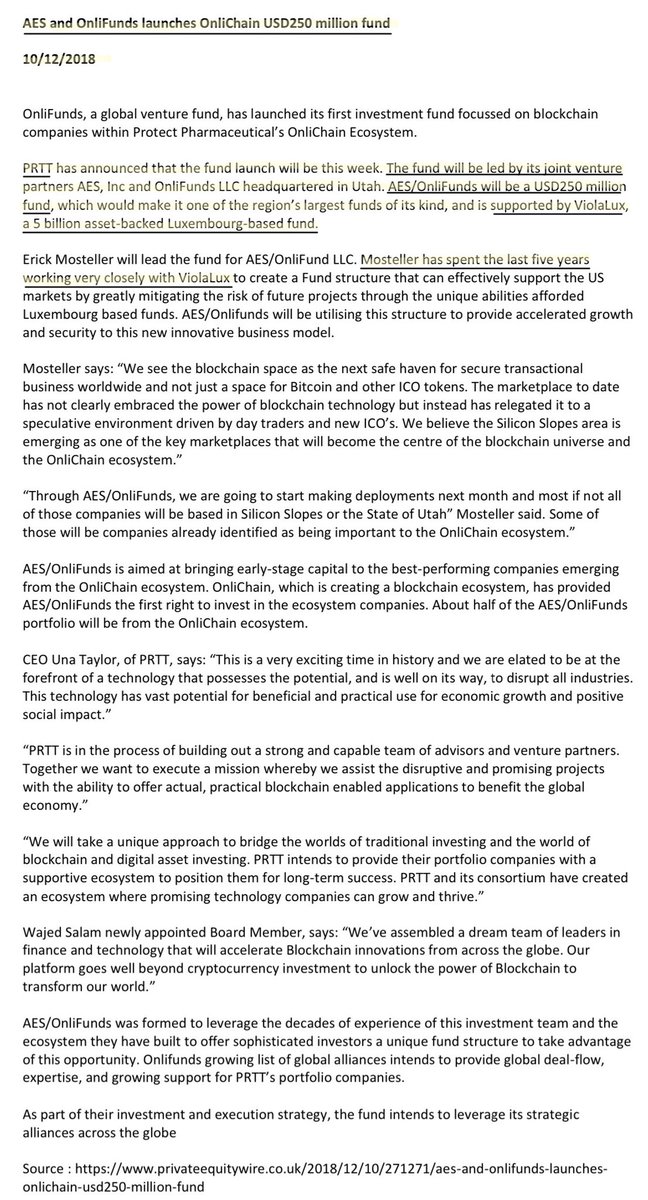

30/ ‘AES Inc’, it’s honcho the Utah resident Erick Mosteller (seemingly not FINRA registered in USA). Later in 2018 Erick Mosteller waxed lyrical about his ‘5 year involvement in ViolaLux’, describing it as a ‘US$ 5 BILLION asset backed fund’ as the ViolaLux fund purportedly …

31/ backed the Protect Pharmaceutical Corp (OTCPK:PRTT) shell, purportedly to the tune of US$ 250m, a shell allegedly primed to morph in to a #crypto #MLM (Multi-Level Marketing) aka pyramid scheme op. Unsurprisingly with the crazy 100’s of $m figures bandied around in …

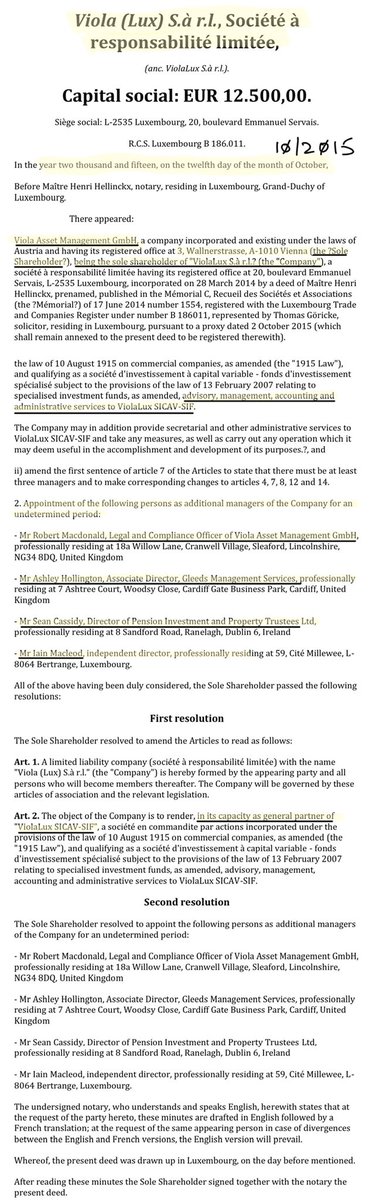

32/ press releases together with the notorious ‘faces’ appearing ‘on the scene’, it all imploded. A 2015 extract of the Luxembourg ViolaLux fund’s general partner (G.P.) filings showed Viola Asset Management GmbH as its 100% owner with Robert MacDonald (who would later …

33/ become a director of ViolaFX Ltd) as compliance manager of Viola Asset Management GmbH/one of the fund’s general partner directors + Ashley Hollington (who would later appear as a director & CEO of VMEL) also as one of the fund’s general partner directors. Also in 2015, …

34/ Juergen Brandstätter’s Vienna law firm filed 2 ‘V-Wallet’ trademarks on behalf of Viola Asset Management GmbH. A Malta holding company (Viola Group Holdings Ltd) was setup in 2015 along with a UK SPV: ‘V-Wallet (Europe) Ltd’ (which would eventually be renamed VMEL), …

35/ the purported UBO’s allegedly Christopher/Janet Hamilton. Early 2015 also marked the start of the public exposure of the nefarious practices of high profile EU payment processors with a hard hitting series of FT articles - ‘The House of #Wirecard’ (ft.com/content/534e7c…).

36/ The heat also fell on AIM come FTSE250 listed #OptimalPayments (later in 2015 renamed #Paysafe), #Wirecard’s ‘brother with a different mother’ - like Wirecard, fostered by the #PornMen, fattened by the #GamblingMen + both with roots in Vienna. In 2016 short-seller …

37/ #Zatarra released a blistering 100 page expose on Wirecard + its nefarious practices which led to Wirecard’s implosion. The same year short-seller #Spotlight released an explosive expose on #Paysafe (scribd.com/document/33406… ), alleging the facilitation of …

38/ illegal online gambling & further alleging that former executives setup payment processing ops, possibly in concert with Paysafe & the #GamblingMen’s ops - a Wirecard déjà vu. Short-sellers ripped FTSE250 listed Paysafe to shreds (standard.co.uk/business/marke…). A subsequent …

39/ incendiary 2020 IRPI expose alleged ‘#Paysafe processed payments for a string of gambling websites that were allegedly used by the Italian mafia for large-scale money laundering + tax evasion purposes’ (irpimedia.irpi.eu/en-paysafe-e-w…). In 2016, 100% shareholding in …

40/ Viola Asset Management GmbH was reportedly transferred to Christopher Hamilton + Christopher Hamilton became joint MD with Juergen Brandstätter. Juergen Brandstätter’s Vienna law firm: 1. re-registered Viola Asset Management GmbH’s Viola/V-Wallet trademarks in the name …

41/ of the Malta based Viola Group Holdings Ltd. 2. registered ~50 trademarks on behalf of newly renamed UK dormant SPV ‘Viola Group Ltd’. Various ‘Viola …’ SPV’s were created/renamed to match/use the trademarks. Noteworthy was that later in 2019 Viola Group Ltd recorded …

42/ it’s PSC’s (Viola Money Ltd) correspondence address as being ‘C/O Locke Lord (UK) LLP’. Meanwhile over in India in 2016 several SPV’s were setup to facilitate the launch of the VAM ‘V-Wallet’ e-wallet + FX ops there. It’s not clear where this e-wallet system hailed from …

43/ , noting Christopher Hamilton stated (Linkedin bio) he “personally designed it”. This was rapidly rebranded ‘Viola Wallet’ + the op branded ‘Viola Money’. The Indian unit of USA op ‘Divami’ did the UX (user interface) + app design/coding. Viola Money’s CEO + …

44/ (+ director of Viola SPVs) in India was Shahid Tanveer, a veteran of the #GamblingMen’s ops & associated payment processing, previously Philippines based as COO of PSP #TranscomGlobal & ops manager for online gambling op #Devtechnik. Likewise Asra Fathima, Viola’s …

45/ HR director (+ director of Viola SPVs) in India was reportedly previously Philippines based at #Devtechnik. Images from Viola’s Indian operation in 2016/7 rather fascinatingly purport to show Viola offices listed as Hong Kong, Singapore & Dubai in addition to India, …

46/ Austria, UK, Luxembourg & Malta. One ponders what was already going on in Hong Kong, Singapore & Dubai ?. One also ponders where the likely many £millions in setup/opex funding came from. The ‘Viola FX Ltd USA’ website perhaps provides some answers (FX ops run out of …

47/ UK + Hong Kong ?), the UK ops purporting to be FCA authorised but seemingly not appearing on the FCA register?. The ‘Viola FX Ltd USA’ website describes it’s (ViolaFX Ltd’s) ops as FCA auth., as ‘an affiliate of FCA auth. Clear Treasury (UK Trading) Ltd’. However, …

48/ Clear Treasury’s FCA record seemingly has no record of ‘ViolaFX’. It’s been alleged (which may or may not be true) that VAM/Viola’s FX ops were linked to one of Clear Treasury’s then appointed reps (A.R.’s). The ‘Viola FX Ltd USA’ website is HQ’d unsurprisingly in Utah …

49/ allegedly at Erick Mosteller’s (ViolaLux funds) service address. Then there’s Viola India’s fx ops ?.

Coincidentally, also in 2016, former Powerbore Ltd (aka Viola AM Ltd) director & ‘international man of mystery’ Noe Valentin Pech Stein & a Mexican posse allegedly …

Coincidentally, also in 2016, former Powerbore Ltd (aka Viola AM Ltd) director & ‘international man of mystery’ Noe Valentin Pech Stein & a Mexican posse allegedly …

50/ returned to Companies House/UK banking system for another ‘deal’, this time saddled up with infamous USA national ‘James Frederick Pomeroy II’ (aka ‘the phoenix’). James Pomeroy was better known for the #BankHouse scam (a #HYIP aka #PrimeBank scam) which made headlines …

51/ not just in the USA (scribd.com/document/56418…), but also in the Scandinavian press, where the Bankhouse scam took in prominent Danish industrialist Klaus Helmersens. Another Bankhouse victim’s (‘ISG’ Ltd) law suits (scribd.com/document/56418…) exposed allegedly at the …

52/ scam’s core the use of ABN AMRO, entwined with the notorious unregulated ‘FMB bank’ in Northern Cyprus, allegedly run by the infamous Turkish national ‘Hakki Yaman Namli’ (no stranger to the @NCA_UK - scribd.com/document/56172…). Noteworthy was that post the BankHouse scam, …

53/ ‘James Frederick Pomeroy II’ had relocated to Florida, the escrow lawyer they used in the 2016 ‘deal’ was also Florida based (subsequently allegedly disbarred). It’s been reported that in 2016 Christopher Hamilton was arrested in the UK (courtnewsuk.co.uk/onecoin-money-…), …

54/ alleged to have been involved in laundering ~ $US 105m from the notorious #OneCoin Crypto MLM (Multi Level Marketing) aka pyramid scheme scam (the subject of future exposes). In 2017 it was reported that one of OneCoin’s key money launderers, the Florida based …

55/ Gilbert Armenta had allegedly hired ex UK special forces operator Dominic Welsh to ‘assist in the recovery’ of US$ 32m, alleged to have been owed by Christopher Hamilton to Gilbert Armenta (Christopher Hamilton reportedly denies this). Dominic Welsh was charged with …

56/ ‘demanding money with menaces’ + subsequently acquitted. The City of London Police (#CoLP) investigation was reportedly dropped post VMEL’s FCA authorisation, however, Christopher Hamilton reportedly remains subject to extradition proceedings. The USA are reportedly …

57/ pursuing him for alleged money laundering, alleging that he controlled ‘Viola Asset Management’ accounts which received funds from Gilbert Armenta. Christopher Hamilton reportedly denies these allegations. Astonishingly, with all these goings on @theFCA withdrew it’s …

58/ warning against the Onecoin crypto MLM scam. It’s been reported that #BigLaw was allegedly hired by OneCoin’s shadowy Londonski cabal to scare (or schmooze) the FCA in to submission (bbc.co.uk/news/technolog…). The OneCoin MLM scam (founded in 2014 with offices in …

59/ Bulgaria, Dubai & Hong Kong) had at it’s heart a purported Georgian crypto mining scheme (Georgia will be relevant later). It was fronted by MLM veteran, the Bulgarian ‘Crypto Queen’ Ruja Ignatova (+ her brother), with veterans of other notorious MLM scams in the background.

60/ As with #crypto shitcoin #ICOs, imploding MLM scams are often rolled in to new MLM scams - same with OneCoin. The Crypto Queen is currently on the run, the Crypto Queen’s brother reportedly pled guilty in the USA to money laundering & bank fraud (cointelegraph.com/news/onecoin-c…).

61/ Ex #BigLaw firm Locke Lord partner & Florida resident Mark Scott & his Florida residing associate David Pike have been convicted in the USA on money laundering +/or bank fraud conspiracy charges (justice.gov/usao-sdny/pr/f… AND

https://twitter.com/ianbeckett/status/1451132298162737152). Alleged paramour of …

62/ the Crypto Queen, the Florida resident payment processor Gilbert Armenta has pled guilty to wirefraud/money laundering charges (scribd.com/document/56236…). Noteworthy has been the law enforcement/prosecution ‘silence’ in the UK by comparison. Noteworthy also was the …

63/ acquisition purportedly by Gilbert Armenta of a debit card issuing **Georgian** bank (JSC Capital Bank) + his Mexican ‘activities’. (Gilbert Armenta & his long term serial ‘signature’ ops are the subject of a future expose). Other USA charges, trials, extraditions etc …

64/ IRO the OneCoin scam/money laundering ops are still pending. Londonski was at the heart of the OneCoin & Crypto Queen’s ops (bbc.co.uk/news/stories-5… )+ at it’s centre one of the big bad bear’s bean counters, a bean counter also at the heart of the City of London …

65/ establishment. In FBI intercepts the Crypto Queen warned her alleged paramour Gilbert Armenta “what these Russian guys can do, you cannot imagine”.

66/66 In 2018, astonishingly, the ‘6 figure apparatchiki’ at @theFCA authorised (as an Emoney op) VMEL - they (as always) didn’t hear a thing, didn’t see a thing + didn’t do much of anything at all.

<< TO BE CONTINUED IN PART (2/2) - VMEL, the ‘Emoney shot’ >>

<< TO BE CONTINUED IN PART (2/2) - VMEL, the ‘Emoney shot’ >>

For those that want to read the whole tweet thread in a single document - threadreaderapp.com/thread/1502948…

• • •

Missing some Tweet in this thread? You can try to

force a refresh