Industry Overview of Oleochemicals - Green Chemicals ? 🥗

Like & Retweet for better reach !

Read about other articles on Chemical Industry

Link : valueeducator.com/basics-of-chem…

Like & Retweet for better reach !

Read about other articles on Chemical Industry

Link : valueeducator.com/basics-of-chem…

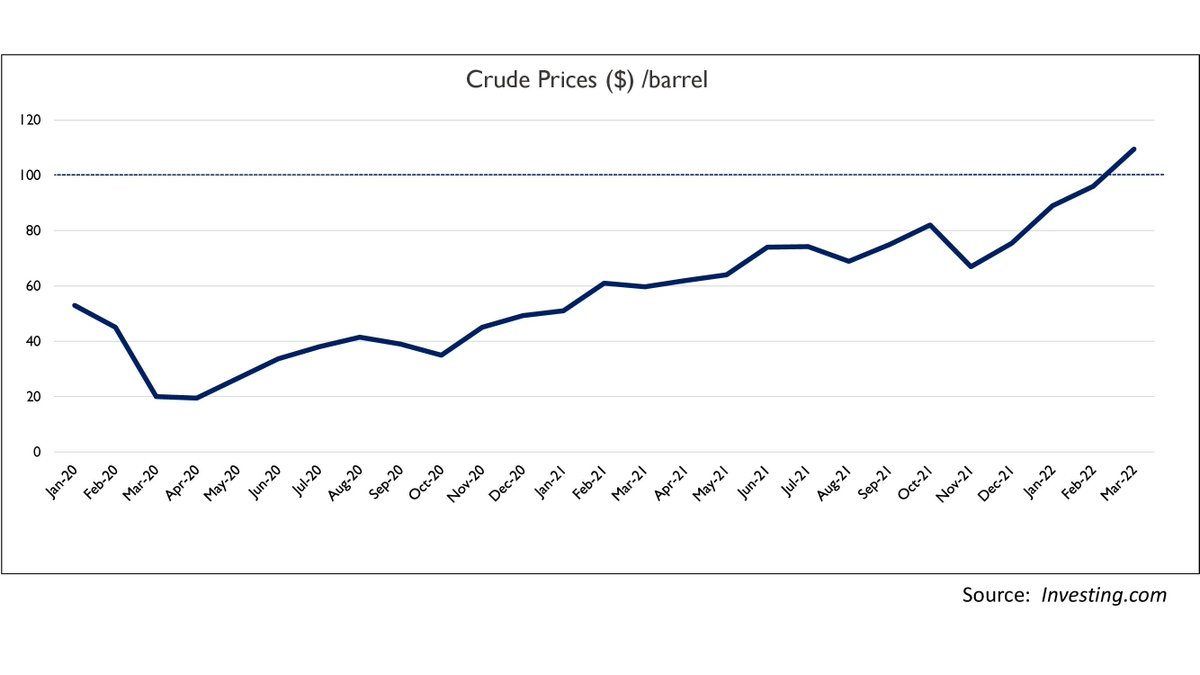

With the rising prices of crude oil and trend to reduce the dependency of petrochemicals is driving the companies to switch for cheaper and greener alternatives of oleochemicals.

The consumption of oleochemicals in the form of fatty acids are used for the production of soaps, detergents, surfactants, lubricants, varnishes, and pharmaceutical products. Oleochemicals are derived from plants and animal fats

acting as natural substitutes over petrochemical products.

As the crude oil prices rose in late 1970’s, manufacturers switched from petrochemicals to palm derived oleochemicals. The feedstock requirements of palm kernel oil for oleochemicals is met by

As the crude oil prices rose in late 1970’s, manufacturers switched from petrochemicals to palm derived oleochemicals. The feedstock requirements of palm kernel oil for oleochemicals is met by

Malaysia and Indonesia as they are the largest producer of palm oil globally. Palm oil and other vegetable oil is imported in India. The government import duty plays a crucial role in the import prices and volumes of oleochemicals.

The domestic volumes of oilseed refining is rising further driving the production of required raw materials in the oleochemical industry.

The palm oil comprises palmitic acid, oleic acid and linoleic acid. When the oil undergoes distillation and splitting, it gives basic oleochemical products like acid oil, linoleic acid and dimer acid. These commodity products are forward integrated to manufacture

specialty oleochemicals. The end application of products is in very low volumes and thus the incremental prices are passed on easily. There are five basic oleochemicals: fatty acids, fatty alcohols, fatty methyl ester, fatty amines, and glycerine.

The largest application for oleochemicals is for making soaps and detergents. The dimer acid is used in paints and coating industry and linoleic acid is used in feed additives. The oleochemicals are forward integrated to value added derivatives having application in

cosmetic industry, feed nutrition, rubber chemicals and others.

Domestic companies in the commodity oleochemical industry are Farichem organics and Fine organics in specialty oleochemicals. Fairchem organic have business verticals in oleochemicals and nutraceuticals.

Domestic companies in the commodity oleochemical industry are Farichem organics and Fine organics in specialty oleochemicals. Fairchem organic have business verticals in oleochemicals and nutraceuticals.

The oleochemicals segment have dimer acid, linoleic acid and other fatty acids in the basket. Oleochemicals contribute 97% of the total business. The revenue outlooks is expected to be robust on the account of large capacities.

Fairchem Organics manufactures oleochemicals from vegetable oil and soybean oil distillate. The oil refining companies use various processes to refine the seed oil. This changes the quality of byproduct from supplier to supplier.

Fairchem organics have developed the expertise to manufacture even quality products from uneven raw materials. Dimer acid has higher margins followed by linoleic acid and other fatty acids.

Fine organics limited manufacture speciality forward integrated derivatives of oleochemicals which are used as additives in other industries. Fine organics is the first company in India to manufacture anti-slip additives.

Slip-additives are products added in polymers to control friction. Fine organics have higher pricing power as they are closer to the end industry

Fairchem organics has been expanding the margins as the result of capacity addition and robust demand in the industry.

With increase in crude prices, the oleochemicals acts as a substitute but historical patterns explain the movement of palm oil prices alongside crude oil. This impacts the profitability of the company.

• • •

Missing some Tweet in this thread? You can try to

force a refresh