$MULN got rejected off $3, indicating a new area of resistance. Market makers are going to have a hard time keeping it down now, but they might pull the rug on Monday, so I'm not going to be adding to my positions. I'm going to wait to see how the market reacts next week.

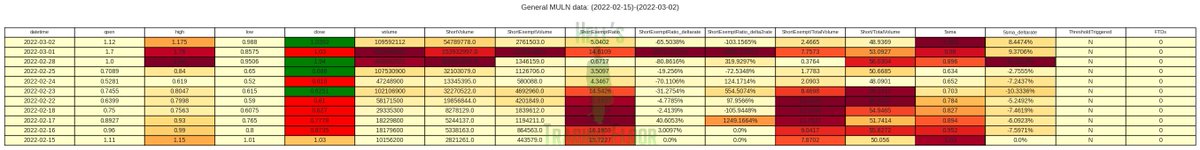

Short Exempt numbers show that 4.2M short exempts were used on the stock today, which is normal during a highly volatile market where market makers are struggling to fill the buy orders, but these numbers still seem excessive.

It seems probable that they will hit the stock PM.

It seems probable that they will hit the stock PM.

I'm specifically being cautious because of this nasty head & shoulders pattern that appeared during the day on the 15M chart, and MMs have two trading days to deliver the $2.5 strike calls that expired ITM today. Any exercised calls will not be redeemed until Tuesday.

Per SEC Form 4 filings (retrieved from Fintel), David Michery sold a small portion of his holdings. 200k shares, to be exact, at an average price of $1.65 as of his Form 4 submission today.

It's not a massive position for the CEO, but it's enough to cause FUD, so worth knowing.

It's not a massive position for the CEO, but it's enough to cause FUD, so worth knowing.

I called out during the stream today that I bought some protective puts, in case there's a sudden sell-off. They're cheap and strictly a hedge, but if for whatever reason, $MULN gets hit on Monday morning like I think it might, it will help soften the blow and provide dip-buy 💵

Market makers are feeling the pain, but we need to wait for the short exempt data to show what their next move is. If they're smart, they'll fill buy orders like their supposed to and stop playing this silly little games.

I just want to say congratulations to everyone who joined with us at #HellsTradingFloor back at $0.65.

Remember to always respect your risk and take some money off the table. Cover your cost-basis at the very least, and leave skin in the game with house money. Don't get greedy.

Remember to always respect your risk and take some money off the table. Cover your cost-basis at the very least, and leave skin in the game with house money. Don't get greedy.

We will be back again next week to cover the full gamut of DD on $MULN with the Analysts at #HellsTradingFloor, and we will give an update on where we sit with our thesis and investigation on $MULN accordingly.

Good luck to everyone, and raise some hell this weekend. ✌️

Good luck to everyone, and raise some hell this weekend. ✌️

• • •

Missing some Tweet in this thread? You can try to

force a refresh