#BANKNIFTY

Outlook for the week March 21-25, 2022

THREAD: Deconstructing BANKNIFTY on 5 different TF's

Outlook for the week March 21-25, 2022

THREAD: Deconstructing BANKNIFTY on 5 different TF's

#BANKNIFTY

1. Monthly TF: Two more weeks to go for this month, however so far on monthly a strong pinbar at crucial support

1. Monthly TF: Two more weeks to go for this month, however so far on monthly a strong pinbar at crucial support

#BANKNIFTY

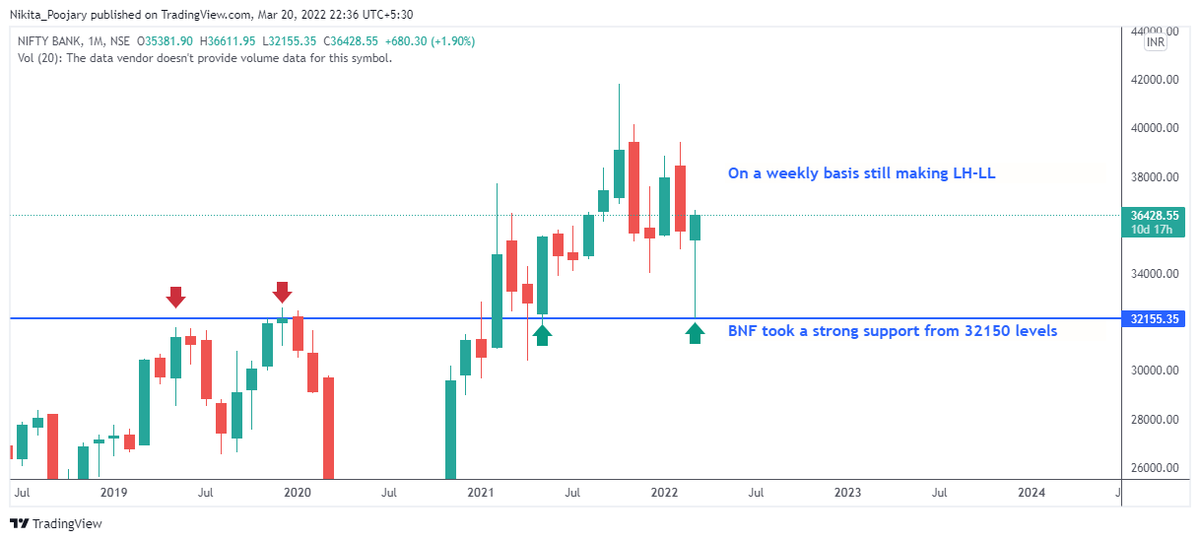

2. Weekly TF: Structure of LH-LL.

However last two weeks strong bullish candle under formation

2. Weekly TF: Structure of LH-LL.

However last two weeks strong bullish candle under formation

#BANKNIFTY

3. Daily TF: 36700 is an imp level; erstwhile support may turn into a resistance.

Friday's candle has an upper wick indicating presence of sellers at higher levels.

Also everyday gap of 500-800 points is not sustainable.

3. Daily TF: 36700 is an imp level; erstwhile support may turn into a resistance.

Friday's candle has an upper wick indicating presence of sellers at higher levels.

Also everyday gap of 500-800 points is not sustainable.

#BANKNIFTY

4. Hourly TF: No clear pattern, as it was a V shaped recovery with so many gaps.

S/R mentioned on the chart.

4. Hourly TF: No clear pattern, as it was a V shaped recovery with so many gaps.

S/R mentioned on the chart.

#BANKNIFTY

5. 15 min TF: for the past two days the momentum is done in the opening itself and thereafter BNF remained sideways.

5. 15 min TF: for the past two days the momentum is done in the opening itself and thereafter BNF remained sideways.

Conclusion:

1. As mentioned everyday gap ups cant sustain long.

2. Although b2b two weeks candles are bullish however the structure of LH-LL still indicates a weak structure.

1. As mentioned everyday gap ups cant sustain long.

2. Although b2b two weeks candles are bullish however the structure of LH-LL still indicates a weak structure.

3. Imp to see this weeks move:

• whether it sustains at the higher level (i.e a pause before the next leg of upmove).

• or fizzles out due to any adverse news globally.

• whether it sustains at the higher level (i.e a pause before the next leg of upmove).

• or fizzles out due to any adverse news globally.

If you enjoyed this, then check out my other threads.

I regularly share weekly outlook on indices and many more threads on trading & finance.

I regularly share weekly outlook on indices and many more threads on trading & finance.

• • •

Missing some Tweet in this thread? You can try to

force a refresh