Coventry City’s 2020/21 accounts covered a “very positive” season under manager Mark Robins, as they finished a creditable 16th to retain their Championship status after winning League One the previous season #PUSB

Coventry loss widened from £3.4m to £4.7m, which club said was “not unexpected”, due to increased investment in the squad after promotion. Revenue rose £6.7m from £5.1m to £11.8m, despite COVID impact, but expenses increased £6.5m and profit on player sales halved to £1.9m #PUSB

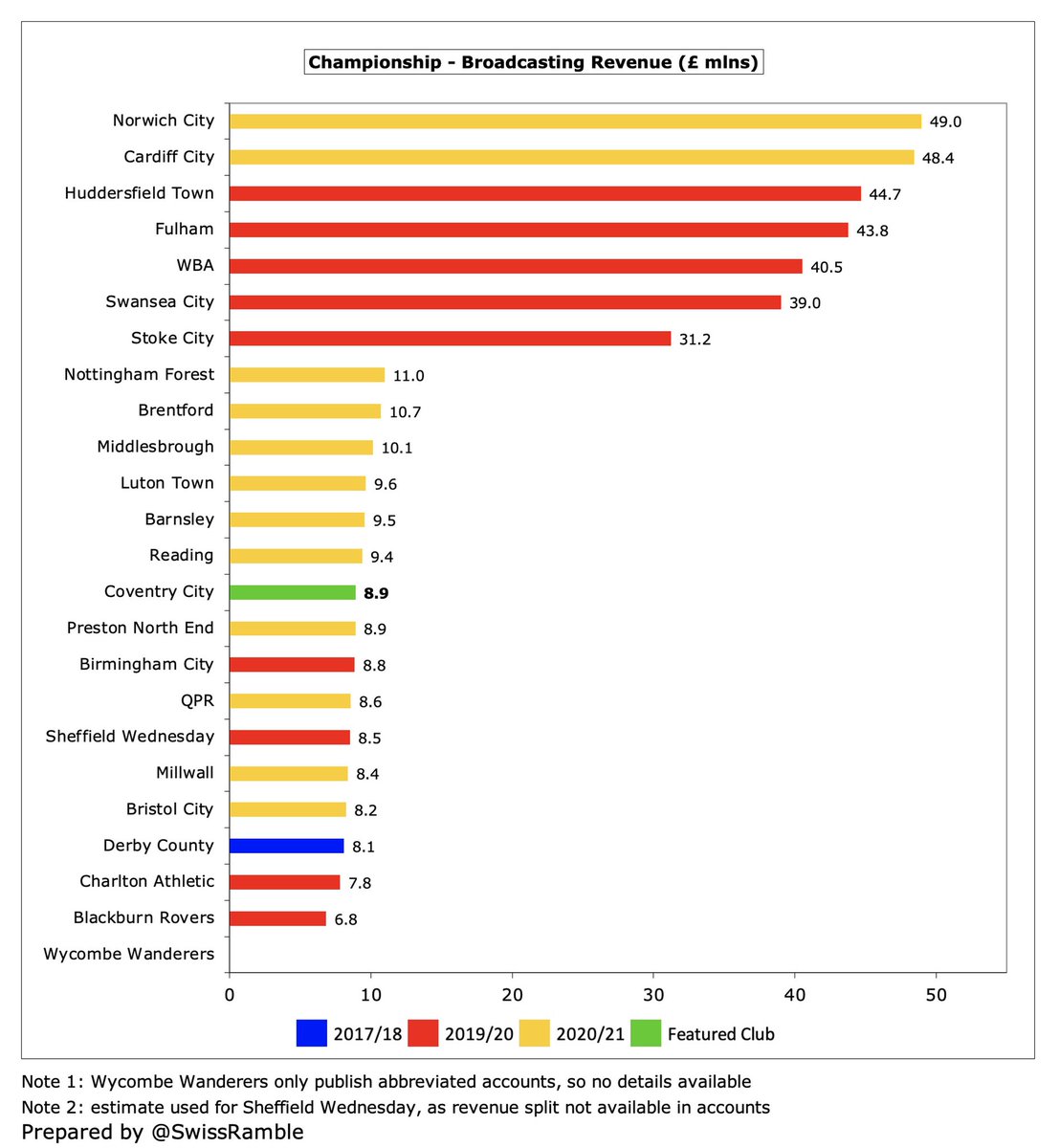

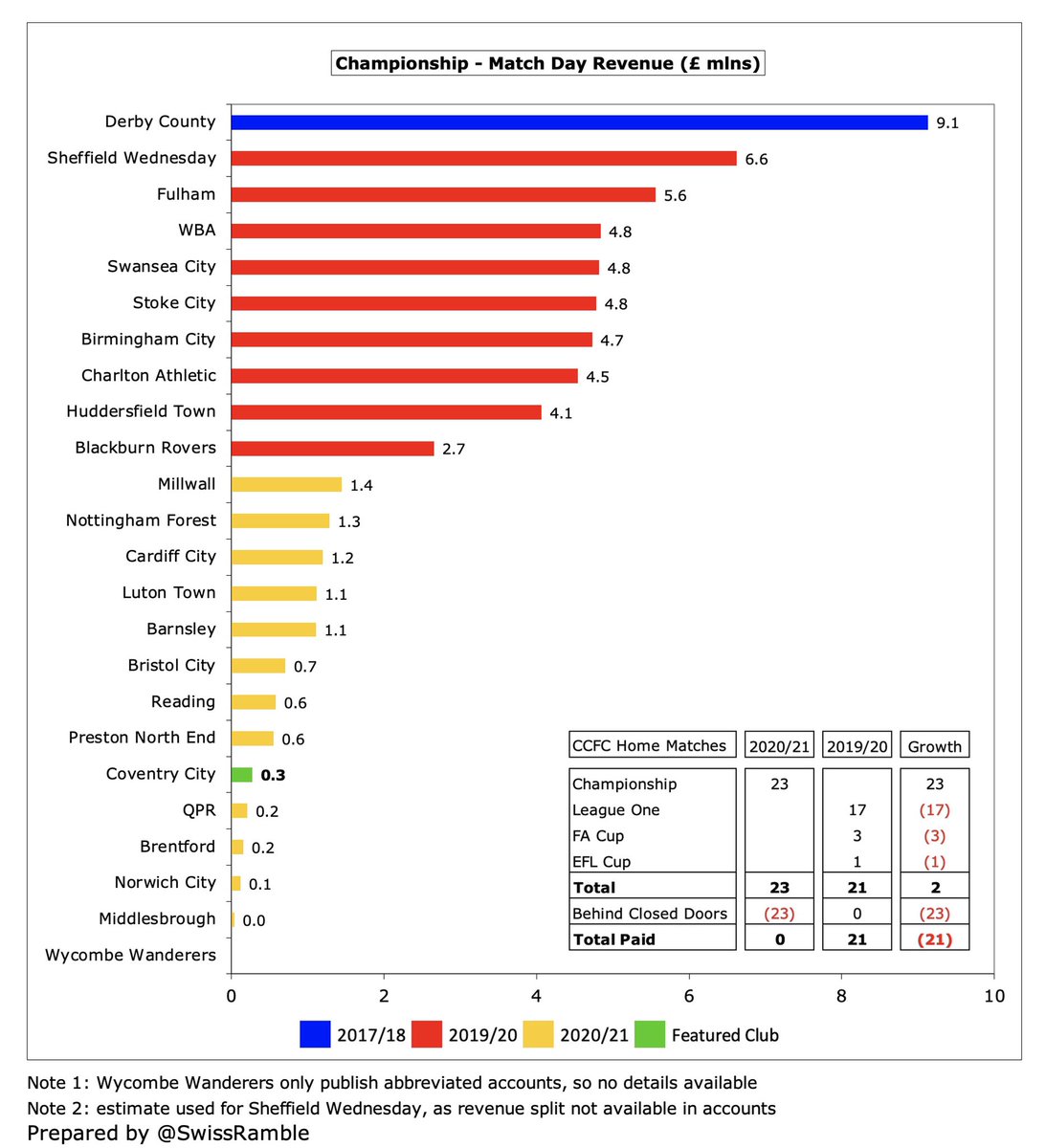

Coventry revenue increase was mainly due to higher broadcasting money in the Championship. This rose £7.2m from £1.7m to £8.9m, while commercial was also up £0.8m (44%) from £1.9m to £2.7m. Playing behind closed doors meant match day fell £1.2m from £1.5m to just £0.3m #PUSB

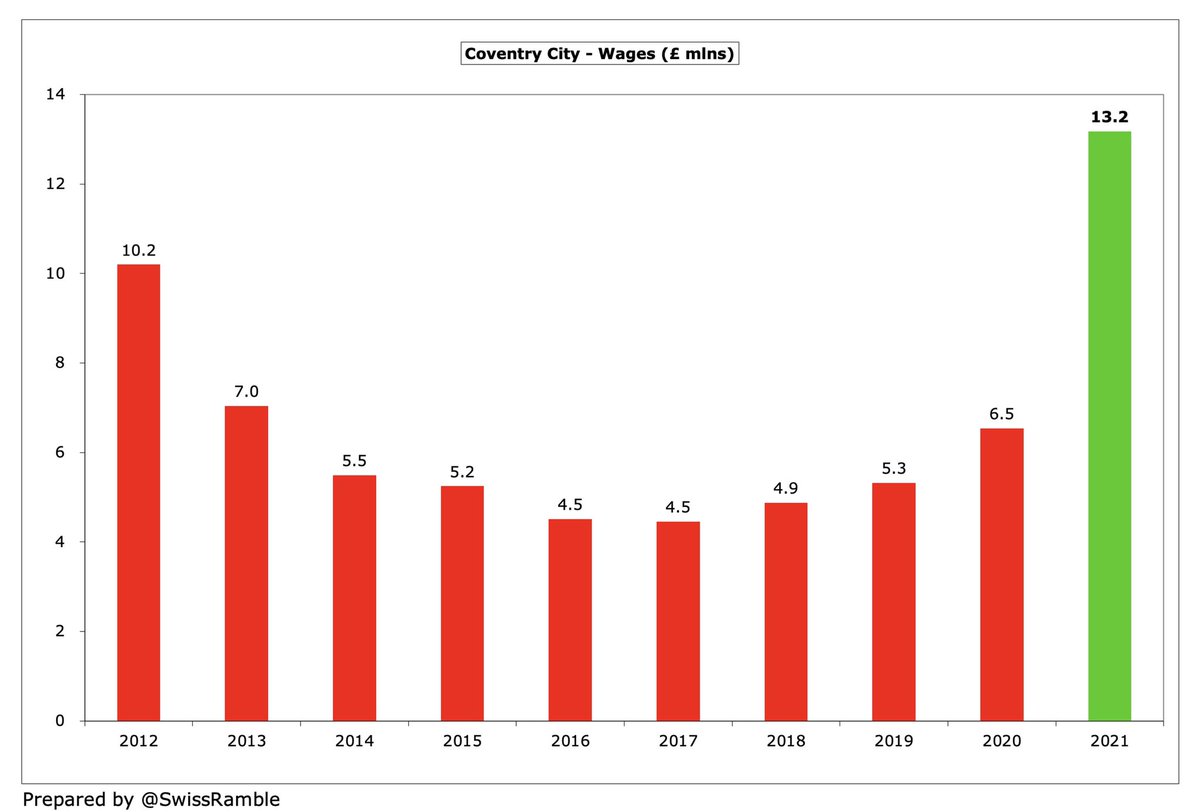

Following promotion, Coventry invested in the squad: wages doubled from £6.5m to £13.2m, as did player amortisation, up £0.9m to £1.8m. However, other expenses fell £1.1m to £1.8m, largely due to reduced costs of staging games, partly offset by requirements in Championship #PUSB

Coventry £4.7m loss is actually one of the better results in the Championship, much better than the likes of Bristol City £38m, Reading £36m and Middlesbrough £31m in 2020/21. They did well to restrict the size of the deficit, given there was a full year of the pandemic #PUSB

Furthermore Coventry’s figures did not benefit much from profit on player sales, which fell from £3.8m to £1.9m, predominantly contingent fees from previous sales, notably Callum Wilson. In contrast, #NCFC £60m and Brentford £44m generated huge gains from player trading #PUSB

Coventry have only reported a profit once in the last 10 years – and that was just £13k in 2019. That said, they have managed to keep the losses low with their conservative model, averaging less than £3m a season since 2015 #PUSB

Coventry have not made much money from player sales, as these have only generated £22m in the last decade, though nearly half of that (£10m) came in the last three years. This season will also be on the low side #PUSB

Coventry operating losses (excluding player sales and interest) reduced by £0.5m from £4.9m to £4.4m, which the club said was “a remarkable feat” given the lockdown. Second smallest in the Championship, where almost every club posts substantial operating losses #PUSB

Despite the impact of the pandemic, Coventry revenue has tripled to £11.8m from the £3.8m low in League One to 2014. This is also higher than the £10.8m generated the last time the club was in the Championship in 2012 #PUSB

Even after this growth, Coventry £11.8m revenue is lowest in the Championship, just below Barnsley, Millwall and Preston. To highlight their challenge, this is around a fifth of clubs benefiting from parachute payments, e.g. #NCFC £57m and Cardiff City £55m in 2020/21 #PUSB

Championship revenue is hugely influenced by parachute payments, which are so large that they make it difficult for clubs like Coventry to compete. Details not published for 2020/21, but in 2019/20 a relegated club received £42m year one, £34m year two and £15m year three #PUSB

Coventry broadcasting income shot up £7.2m from £1.7m to £8.9m, due to increased EFL central distributions and PL solidarity payments following promotion, plus higher iFollow streaming. Most Championship clubs earn £7-10m, but a huge gap to clubs with parachute payments #PUSB

Coventry match day income fell £1.2m (82%) from £1.5m to just £0.3m, as all home games were played behind closed doors. Down from £2.5m two years ago (and £3.6m last time in Championship). Still very low for this division #PUSB

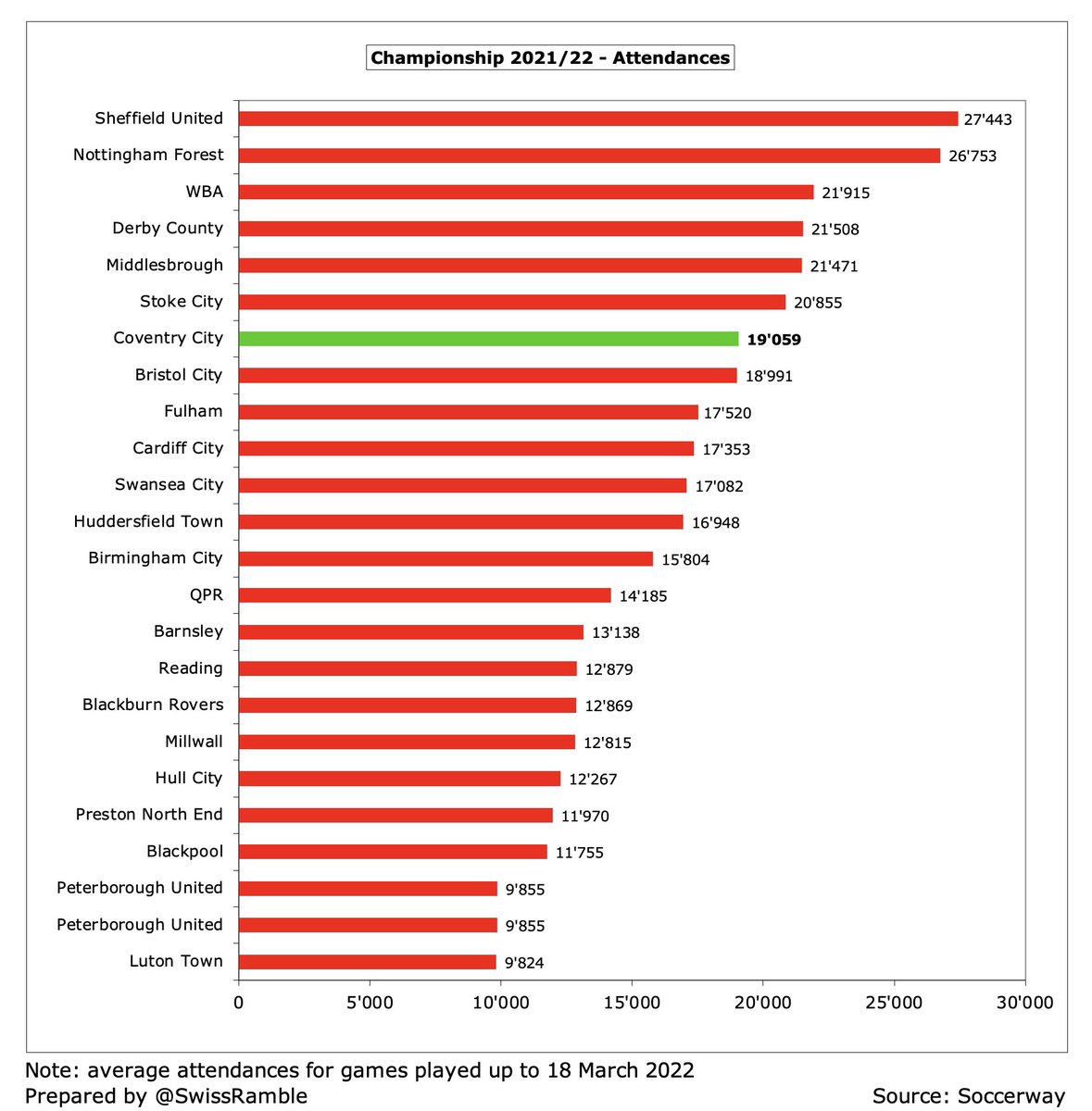

Coventry average attendance this season is just over 19,000, which is three times as much as 6,677 two years ago, largely due to the club returning to Coventry instead of having to play games at St Andrews in Birmingham. This is 7th highest in the Championship #PUSB

Coventry’s stadium issues are well known, forcing them to play home games in Birmingham for previous two seasons and Northampton in 2013/14. Club has now signed 10-year deal with rugby club Wasps, owners of the Ricoh, which has been renamed Coventry Building Society Arena #PUSB

The new deal will give Coventry a greater proportion of non-ticketing match day revenue. The club is also exploring options to build a new stadium on land owned by University of Warwick #PUSB

Coventry commercial revenue rose £0.8m (44%) from £1.9m to £2.7m, though this is firmly in the bottom half of the Championship, just above Millwall £2.7m and Preston £2.5m. Less than a fifth of Stoke City’s £14m #PUSB

Coventry signed a “significant” shirt sponsorship deal with BoyleSports in 2020/21. Also had Jingltree as back of shirt sponsor, since succeeded by XL Motors. The kit supplier has been Hummel since 2019 #PUSB

Coventry other operating income doubled from £0.3m to £0.6m, comprising government grants. Other elements classified here by some clubs include insurance claims and player loans (the main reason for #HTAFC large £6.3m in 2019/20) #PUSB

Coventry wage bill doubled from £6.5m to £13.2m, due to contractual increases following promotion together with bonuses for winning League One. This is £3m higher than the last time the club was in the Championship in 2012 #PUSB

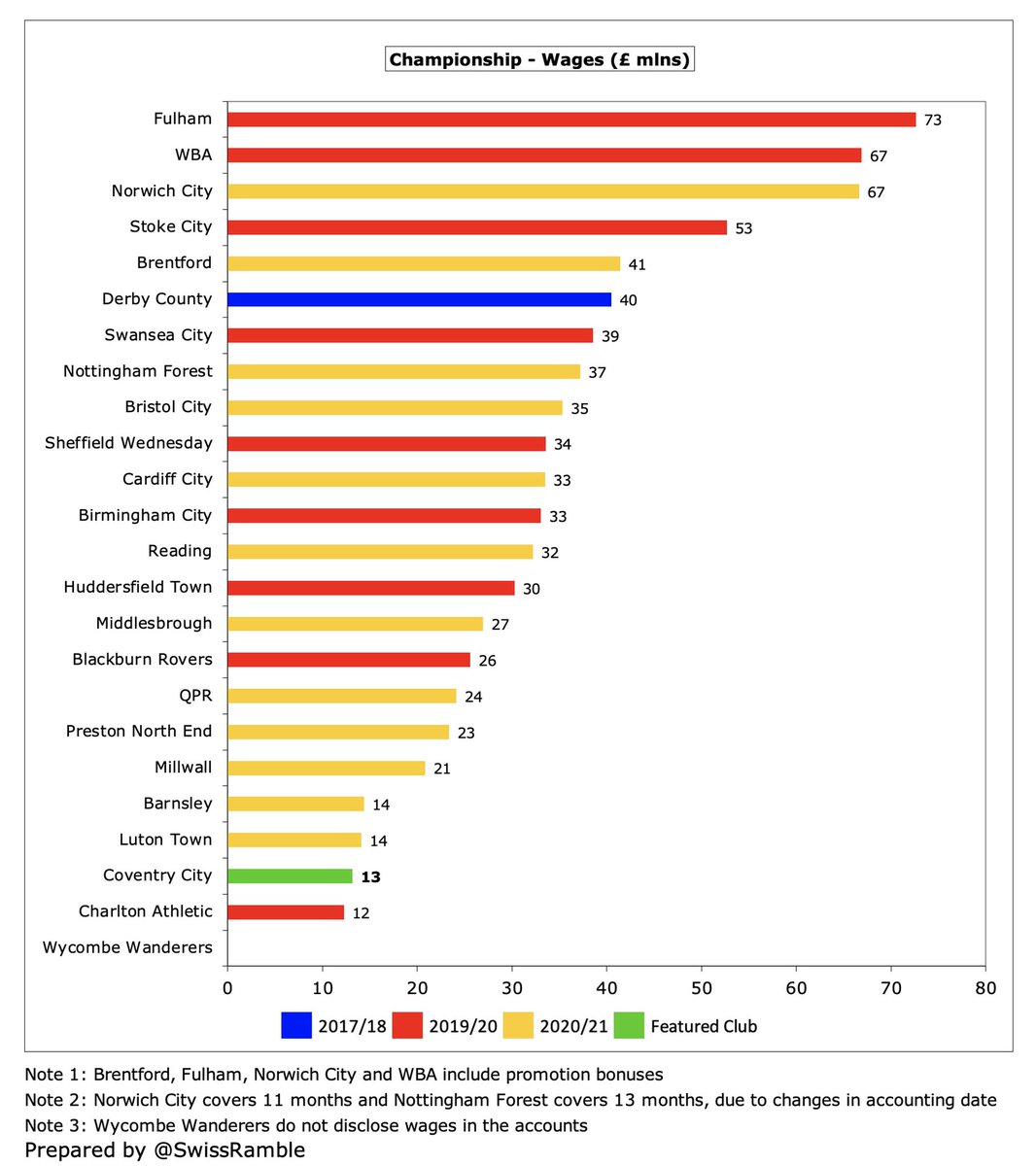

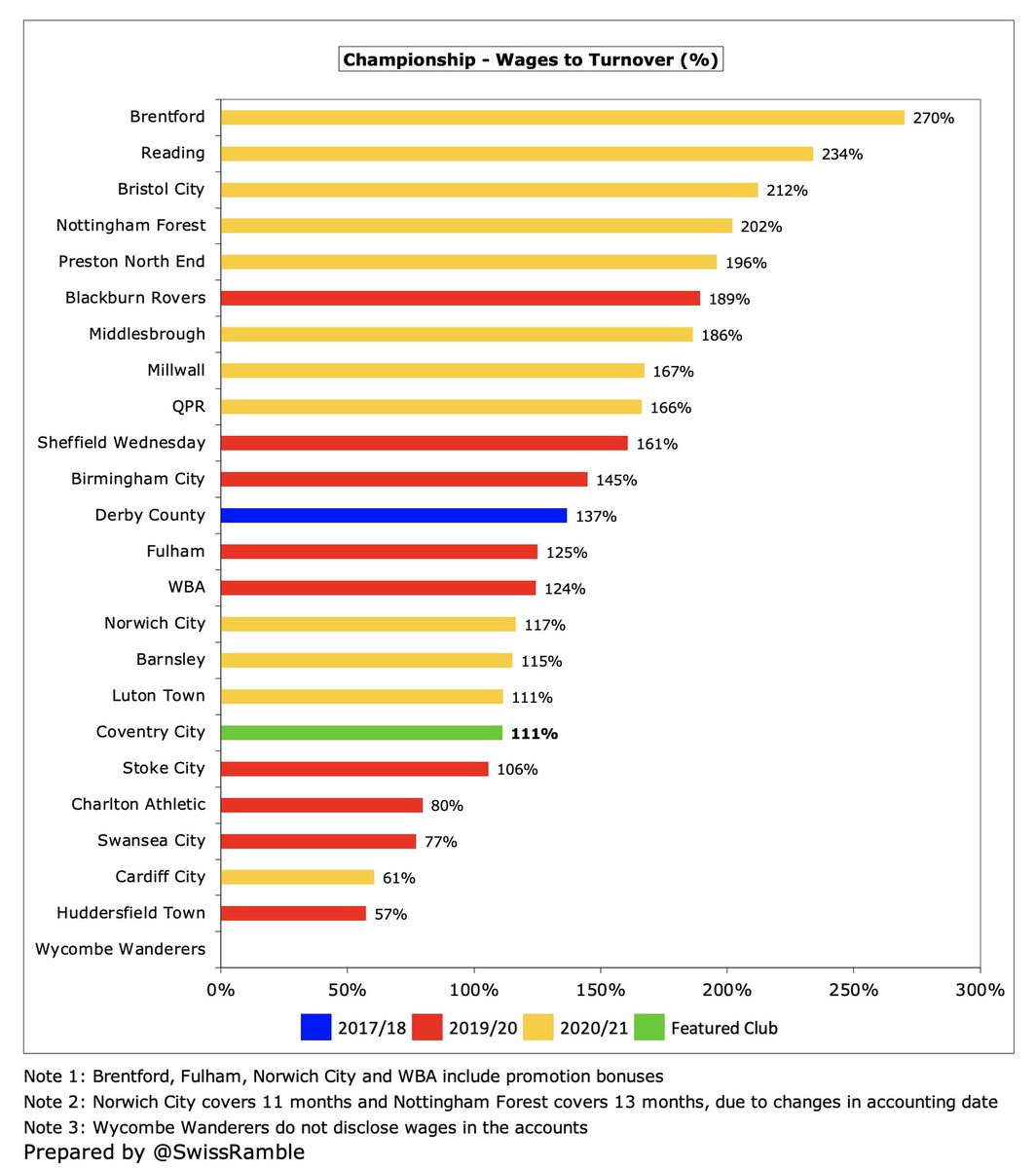

Even after this growth Coventry £13m wage bill was still one of the lowest in the Championship. To put this into perspective, this is over £50m less than clubs with parachute payments, e.g. #NCFC £67m. Brentford’s £41m includes promotion bonus #PUSB

Coventry wages to turnover ratio decreased (improved) from 128% to 111%. This would have been better without COVID revenue loss, but is still one of the lowest in the Championship, where most clubs have ratios well above 100% (four more than 200%) #PUSB

Coventry stated that no remuneration was paid in respect of services provided by directors, which was also the case in the previous three seasons. Except for Birmingham City, no club in the Championship paid more than £1m #PUSB

Coventry player amortisation, the annual charge to write-off transfer fees over a player’s contract, doubled from £0.9m to £1.8m, up from just £0.1m three years ago. However, this was still one of the smallest in the Championship, miles below Fulham £40m #PUSB

Coventry spent £3.5m on player purchases, which was their highest for many years, including Gustavo Hamer from PEC Zwolle. First time club has had net spend (rather than net sales) in a decade. Still relatively small for Championship, but only just below Nottingham Forest #PUSB

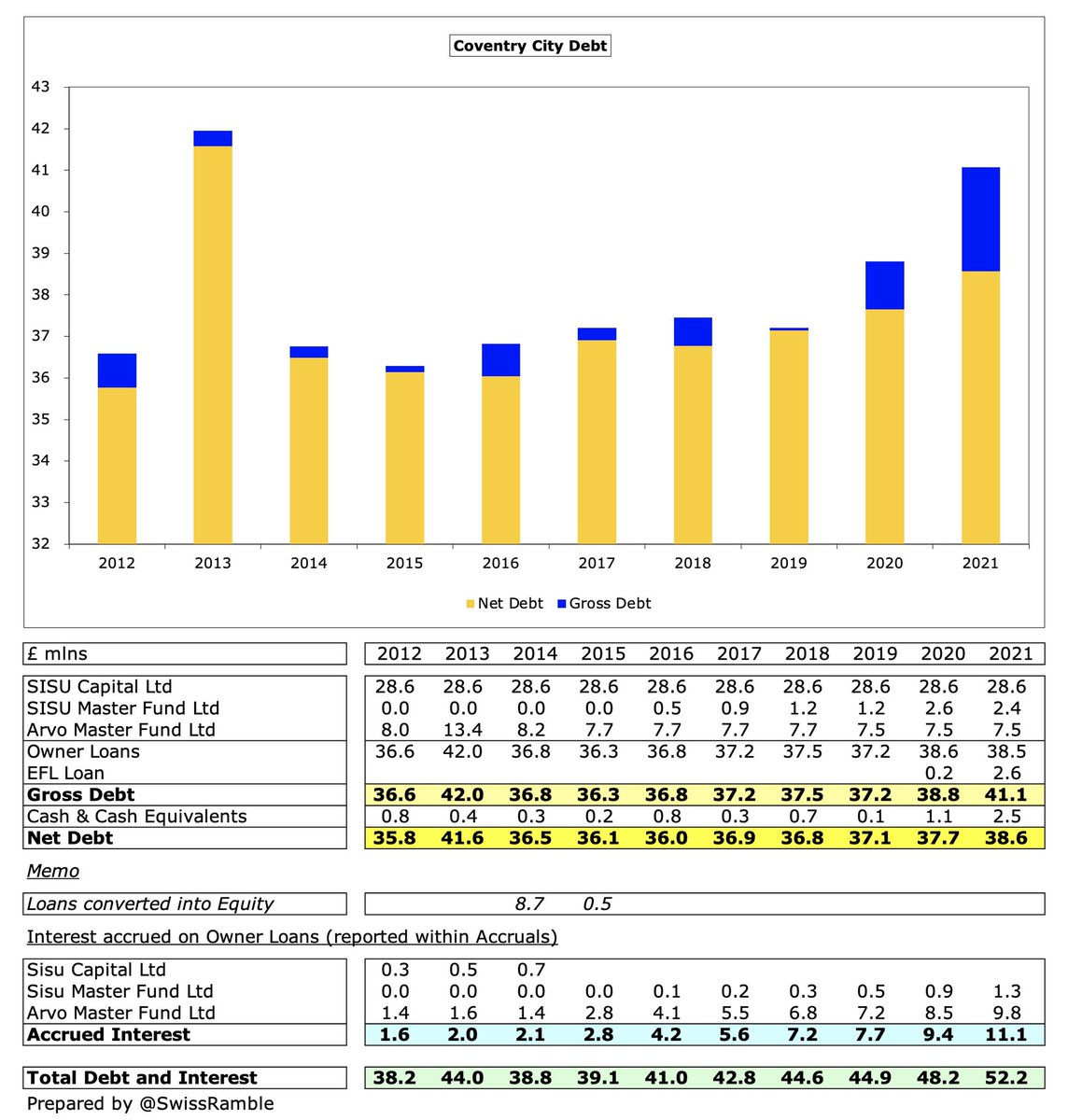

Coventry gross debt rose £2m from £39m to £41m, mainly £39m from the owners (SISU Capital and Arvo) plus £2m from the EFL. The club also includes £11m interest on the loans in accruals, which would give a total of £51m outstanding #PUSB

Coventry £41m gross debt is not that large for the Championship, far below the likes of Stoke City £187m, Blackburn Rovers £156m, Middlesbrough £129m and Birmingham City £116m #PUSB

Coventry paid just £47k interest in 2021. The club had £2.2m interest payable, mainly on owner loans, though this has only been accrued and not paid. The EFL loan is also interest-free. Most debt in the Championship is provided by owners who charge little or no interest #PUSB

Coventry transfer debt increased from £0.4m to £2.2m, though this is still on the low side for the Championship. Much less than clubs like #FFC £86m, #NCFC £23m and Brentford £19m #PUSB

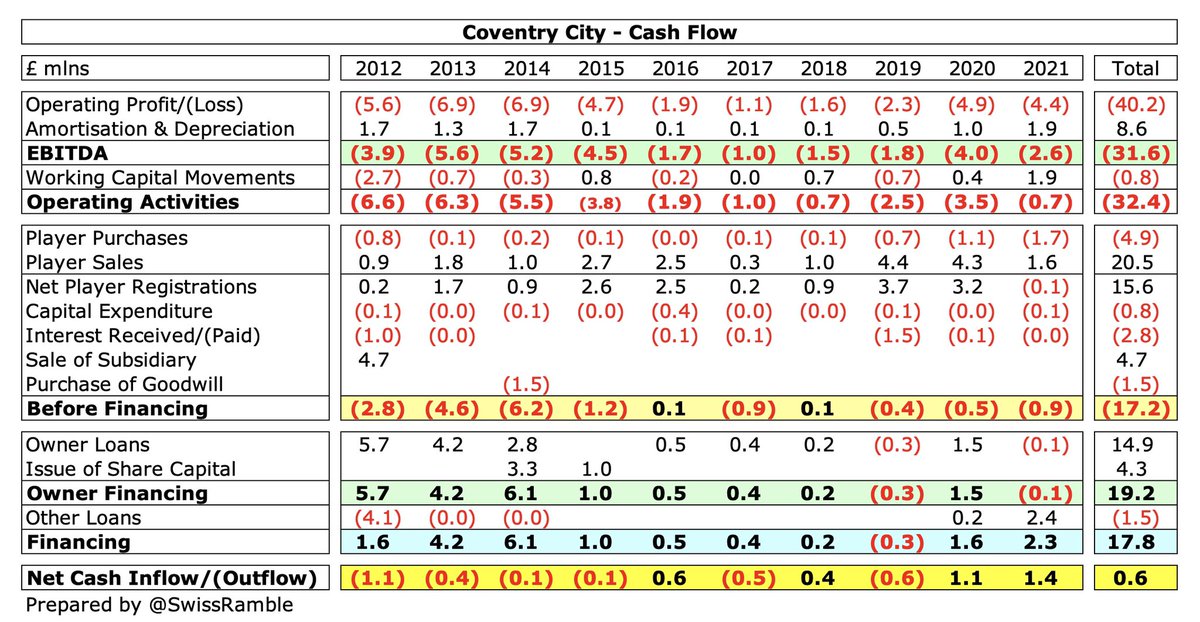

Coventry £4.4m operating loss became £0.7m negative cash flow after adding back non-cash and working capital movements. Then spent £0.1m on players (purchases £1.7m, sales £1.6m) and £0.1m on capex/interest. Funded by £2.4m loan from the EFL #PUSB

As a result, Coventry cash balance increased by £1.4m from £1.1m to £2.5m, which is pretty much the norm in the Championship, where 13 clubs had less than £3m cash in the bank #PUSB

In the last 10 years Coventry’s available cash has come from the owners £19m, player sales £16m and sale of a subsidiary £5m. This has very largely been used to cover £32m operating losses with very little spent on infrastructure or interest payments #PUSB

The owners have provided £25m funding in the last 11 years, though almost all of that came between 2011 and 2014 with only £3m since then. SISU saved the club from administration in 2007, but have come under fire from supporters for their frugal approach #PUSB

Indeed if Coventry are compared to clubs in the Championship in 2020, their £25m owner funding would be very much on the low side (e.g. Fulham £315m, QPR £285m and Stoke City £185m), though it is true that the Sky Blues spent most of that period in League One #PUSB

As a technical aside, this analysis has been based on the accounts for Sky Blue Sports & Leisure Ltd, Coventry City’s parent company, which owns the football club, Otium Entertainment Group Ltd, but the figures are identical for revenue, wages and profit #PUSB

The good news is that Coventry have secured two promotions in recent years and are competing strongly in the Championship. However, given their financial disadvantages compared to most other clubs, they would have to punch well above their weight to reach the play-offs #PUSB

• • •

Missing some Tweet in this thread? You can try to

force a refresh