#BANKNIFTY

Outlook for the week March 27-31, 2022

THREAD: Deconstructing BANKNIFTY on 5 different TF's

Outlook for the week March 27-31, 2022

THREAD: Deconstructing BANKNIFTY on 5 different TF's

#BANKNIFTY

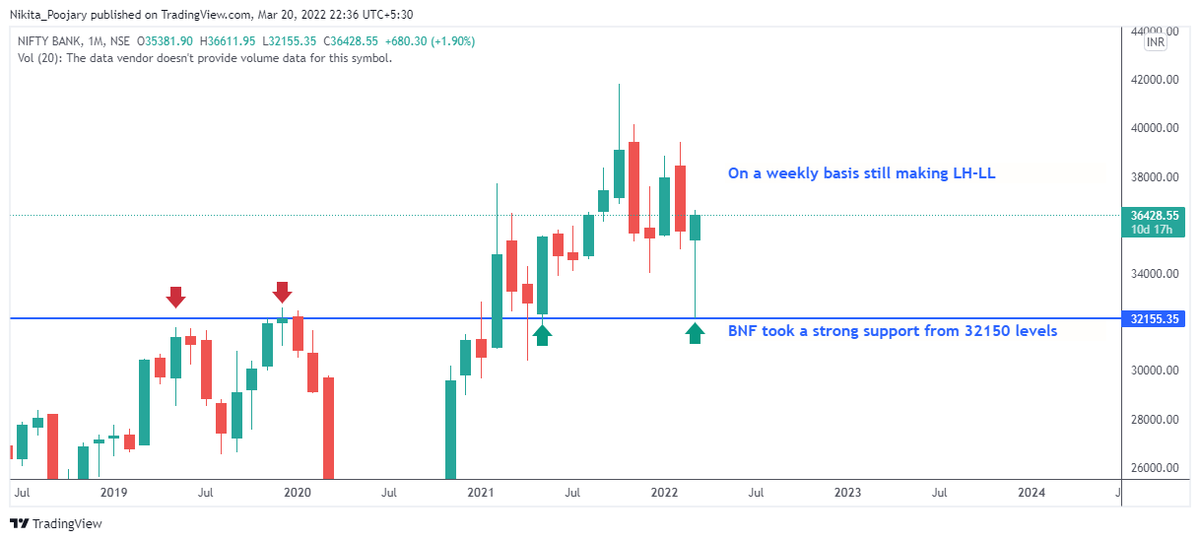

1. Monthly TF:

• 4 more trading sessions left for the monthly close

• So far the we are exactly where we opened for this month

• However the huge wicks on both sides clearly depicts the volatile moves for the month

1. Monthly TF:

• 4 more trading sessions left for the monthly close

• So far the we are exactly where we opened for this month

• However the huge wicks on both sides clearly depicts the volatile moves for the month

#BANKNIFTY

2. Weekly TF:

• The erstwhile structure of HH-HL has now changed to LH -LL

• So far we haven't got a closing below HL-2 (i..e. weekly close below 34k)

• Dark cloud cover (DCC) under formation

• Confirmation of the same would be if it starts trading <35400

2. Weekly TF:

• The erstwhile structure of HH-HL has now changed to LH -LL

• So far we haven't got a closing below HL-2 (i..e. weekly close below 34k)

• Dark cloud cover (DCC) under formation

• Confirmation of the same would be if it starts trading <35400

#BANKNIFTY

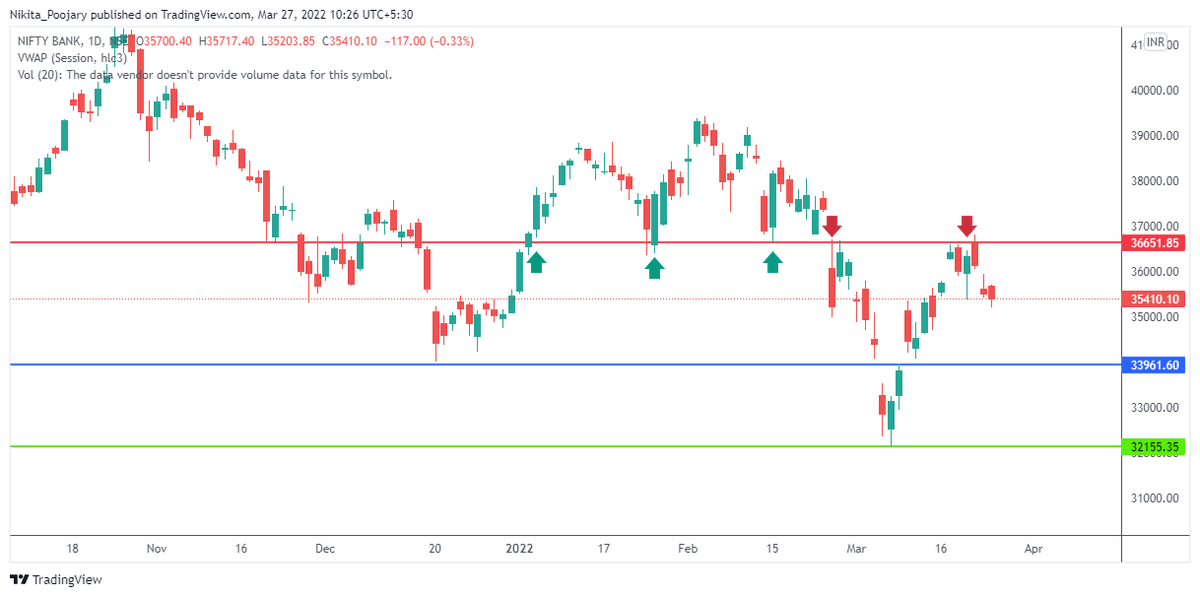

3. Daily TF:

• In the weekly chart I mentioned DCC formation near resistance

• Check daily chart to find the same

• M pattern formation (near resistance) no BD yet

3. Daily TF:

• In the weekly chart I mentioned DCC formation near resistance

• Check daily chart to find the same

• M pattern formation (near resistance) no BD yet

#BANKNIFTY

4. Hourly TF:

• M pattern formation, no BD yet

• Sharp upmove of 250-300 points in the last 15mins on Friday depicted some buying

4. Hourly TF:

• M pattern formation, no BD yet

• Sharp upmove of 250-300 points in the last 15mins on Friday depicted some buying

#BANKNIFTY

5. 15min TF:

• Will wait for 35725 to clear (immediate hurdle)

• If it fails to do so then will wait for BNF to trade below 35300

5. 15min TF:

• Will wait for 35725 to clear (immediate hurdle)

• If it fails to do so then will wait for BNF to trade below 35300

Conclusion:

•36700-800 is the high we made on Feb 24 (Mr. Putin announced a military operation in Ukraine)

• After 30 days BNF is unable to break & sustain above it

• Sharp downmove was followed by sharp upmove

• Need some sort of consolidation before the next direction

•36700-800 is the high we made on Feb 24 (Mr. Putin announced a military operation in Ukraine)

• After 30 days BNF is unable to break & sustain above it

• Sharp downmove was followed by sharp upmove

• Need some sort of consolidation before the next direction

• The consolidation range might be 36800-33k

• Range of consolidation is wider due to the volatility

• Upcoming week is a weekly & a monthly expiry

• Range of consolidation is wider due to the volatility

• Upcoming week is a weekly & a monthly expiry

If you enjoyed this, then do check out my other threads.

I regularly share weekly outlook on indices and many more threads on trading & finance.

I regularly share weekly outlook on indices and many more threads on trading & finance.

• • •

Missing some Tweet in this thread? You can try to

force a refresh