If you are unfamiliar with "Liquidity Pools".

Liquidity providers lock two assets in a pool

Traders who want to swap the assets pay a small fee to the providers, and assets are swapped.

An article here by @binance going into more depth:

academy.binance.com/en/articles/wh…

Liquidity providers lock two assets in a pool

Traders who want to swap the assets pay a small fee to the providers, and assets are swapped.

An article here by @binance going into more depth:

academy.binance.com/en/articles/wh…

The core of #Thorchain protocol is built from Tendermint and Cosmos SDK

This allowed Thorchain to create its own blockchain with its own consensus and network layer without having to build it from scratch.

This allowed Thorchain to create its own blockchain with its own consensus and network layer without having to build it from scratch.

Tendermint allows Thorchain to reach consensus even if 1/3 of all the nodes start to fail.

Thorchain nodes need to work together to record transactions coming from blockchains.

Nodes that want to verify transactions operate under Proof-of-Stake concepts, staking $RUNE tokens.

Thorchain nodes need to work together to record transactions coming from blockchains.

Nodes that want to verify transactions operate under Proof-of-Stake concepts, staking $RUNE tokens.

In DeFi, security is paramount.

Threshold signature protocol (TSS) allows multiple parties to come together and sign a tx, when consensus between parties are reached.

TSS unlike multisig can be done off of the application layer and is not limited to one layer of the blockchain.

Threshold signature protocol (TSS) allows multiple parties to come together and sign a tx, when consensus between parties are reached.

TSS unlike multisig can be done off of the application layer and is not limited to one layer of the blockchain.

So why the massive hype around $RUNE?

Recently, it integrated with #Terra.

$UST and $LUNA went live on @THORChain, now supporting the following wallets and assets:

Recently, it integrated with #Terra.

$UST and $LUNA went live on @THORChain, now supporting the following wallets and assets:

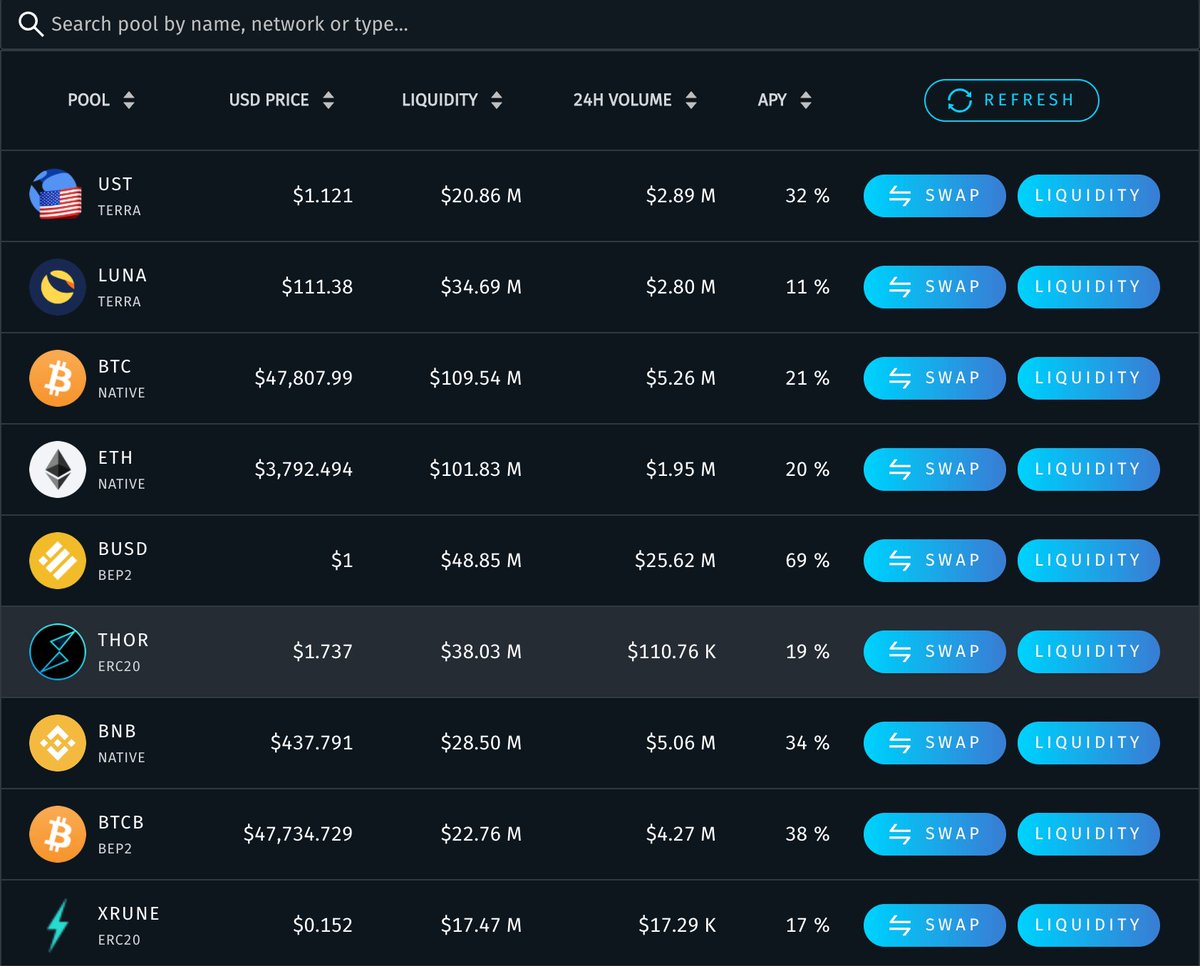

The recent integration with #Terra has seen the volume and TVL increase substantially.

More institutions and individuals have made use of high % yields offered by the $RUNE liquidity pools.

More institutions and individuals have made use of high % yields offered by the $RUNE liquidity pools.

Why am I more bullish than ever on the future of Thorchain.

Mainly because of Anchor Protocol and their yield reserve depletion.

Sustainability proposals have only begun to be passed.

I wrote more about this here:

Mainly because of Anchor Protocol and their yield reserve depletion.

Sustainability proposals have only begun to be passed.

I wrote more about this here:

https://twitter.com/Crypto8Fi/status/1507297668451618818?s=20&t=3h-ivBFV7abHTXV82AkM9Q

Some of this $UST will need to move somewhere else.

It will be the same individuals who are looking for a safe APR.

So if Anchor payout rates do drop, it is very possible the $UST will migrate to the 32% APY payout of $RUNE.

Especially if the protocol has reputable security.

It will be the same individuals who are looking for a safe APR.

So if Anchor payout rates do drop, it is very possible the $UST will migrate to the 32% APY payout of $RUNE.

Especially if the protocol has reputable security.

The next question we must discuss, is how would this affect $Rune?

$3 of Rune must be locked for $1 of TVL.

Rune has a "deterministic" market cap of 3x TVL.

Which means that a movement of $UST capital will boost the value of $RUNE tokens.

$3 of Rune must be locked for $1 of TVL.

Rune has a "deterministic" market cap of 3x TVL.

Which means that a movement of $UST capital will boost the value of $RUNE tokens.

Let's do the maths.

TVL in Anchor Protocol is $15.038B.

If rates drop to 15% APR, we can expect an outflow of at least >$2B.

If $1B moves into the $UST or $LUNA pools, this will decrease the Mcap/TVL ratio making each $RUNE token more valuable.

TVL in Anchor Protocol is $15.038B.

If rates drop to 15% APR, we can expect an outflow of at least >$2B.

If $1B moves into the $UST or $LUNA pools, this will decrease the Mcap/TVL ratio making each $RUNE token more valuable.

Although it is likely that the opposite may happen.

As investors begin to discover the true value of $RUNE, the Mcap/TVL ratio may increase substantially.

The increase may occur before the movement of capital from Anchor or Curve.

All speculation will eventually come to pass.

As investors begin to discover the true value of $RUNE, the Mcap/TVL ratio may increase substantially.

The increase may occur before the movement of capital from Anchor or Curve.

All speculation will eventually come to pass.

So what about all that $BTC sitting in Curve Pools.

A portion of that BTC is likely to move away from the <1.5% APR it is recieving currently.

Bitcoin will move to wherever it is incentivised to go.

#Thorchain is also offering 21% on $BTC.

A portion of that BTC is likely to move away from the <1.5% APR it is recieving currently.

Bitcoin will move to wherever it is incentivised to go.

#Thorchain is also offering 21% on $BTC.

The APY on $RUNE is at 21% for $BTC.

Some investors have seen this and already hedged their bets in $RUNE.

With the amount of $BTC sitting around in #Curve and earning a relatively low return.

it is likely there will be a net migration of TVL to $RUNE soon.

Some investors have seen this and already hedged their bets in $RUNE.

With the amount of $BTC sitting around in #Curve and earning a relatively low return.

it is likely there will be a net migration of TVL to $RUNE soon.

Considerations for DeFi Pools:

@THORSwap is offering some very lucrative pools, especially on stable coins.

Beware, these pools aren't single sided as assets need to be 1:1 paired with $RUNE. This makes IL a consideration.

@THORSwap is offering some very lucrative pools, especially on stable coins.

Beware, these pools aren't single sided as assets need to be 1:1 paired with $RUNE. This makes IL a consideration.

As all of this liquidity enters $RUNE.

The tokenomics are second to none.

Low VC seed rounds.

High yield incentivises increased buy pressure on $RUNE, as deposited assets must be paired 1:1 with $RUNE.

$RUNE will accrue massive token value, and fast.

The tokenomics are second to none.

Low VC seed rounds.

High yield incentivises increased buy pressure on $RUNE, as deposited assets must be paired 1:1 with $RUNE.

$RUNE will accrue massive token value, and fast.

It's hard to not look at these metrics and not be bullish.

I'll be DCAing into a position over the coming weeks.

I think there's a powerful narrative returning for DeFi and $RUNE is positioned to spearhead this next bull charge.

I'll be DCAing into a position over the coming weeks.

I think there's a powerful narrative returning for DeFi and $RUNE is positioned to spearhead this next bull charge.

I hope this thread helps you understand $RUNE and its' role in DeFi better.

Follow me @Crypto8Fi for more threads on crypto, investment and financial independance.

I write deeper dives on these topics in my newsletter below. Join now to not miss out:

cryptofi.substack.com

Follow me @Crypto8Fi for more threads on crypto, investment and financial independance.

I write deeper dives on these topics in my newsletter below. Join now to not miss out:

cryptofi.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh