Last day of the month & like clockwork, I bought some more $TUN.L 😤

Next month I'll probably add First Tin #1SN to my compounder list, as I continue my no-brainer strategy of betting on the GOAT @METhompson72 leading me to generational wealth.

Next month I'll probably add First Tin #1SN to my compounder list, as I continue my no-brainer strategy of betting on the GOAT @METhompson72 leading me to generational wealth.

https://twitter.com/Edark94/status/1501140628809424897

@METhompson72 #1SN starts trading the 8th, so I might miss out on the IPO pump but I'm sure it will be fine as tin is heading to +$100k within a year or two.

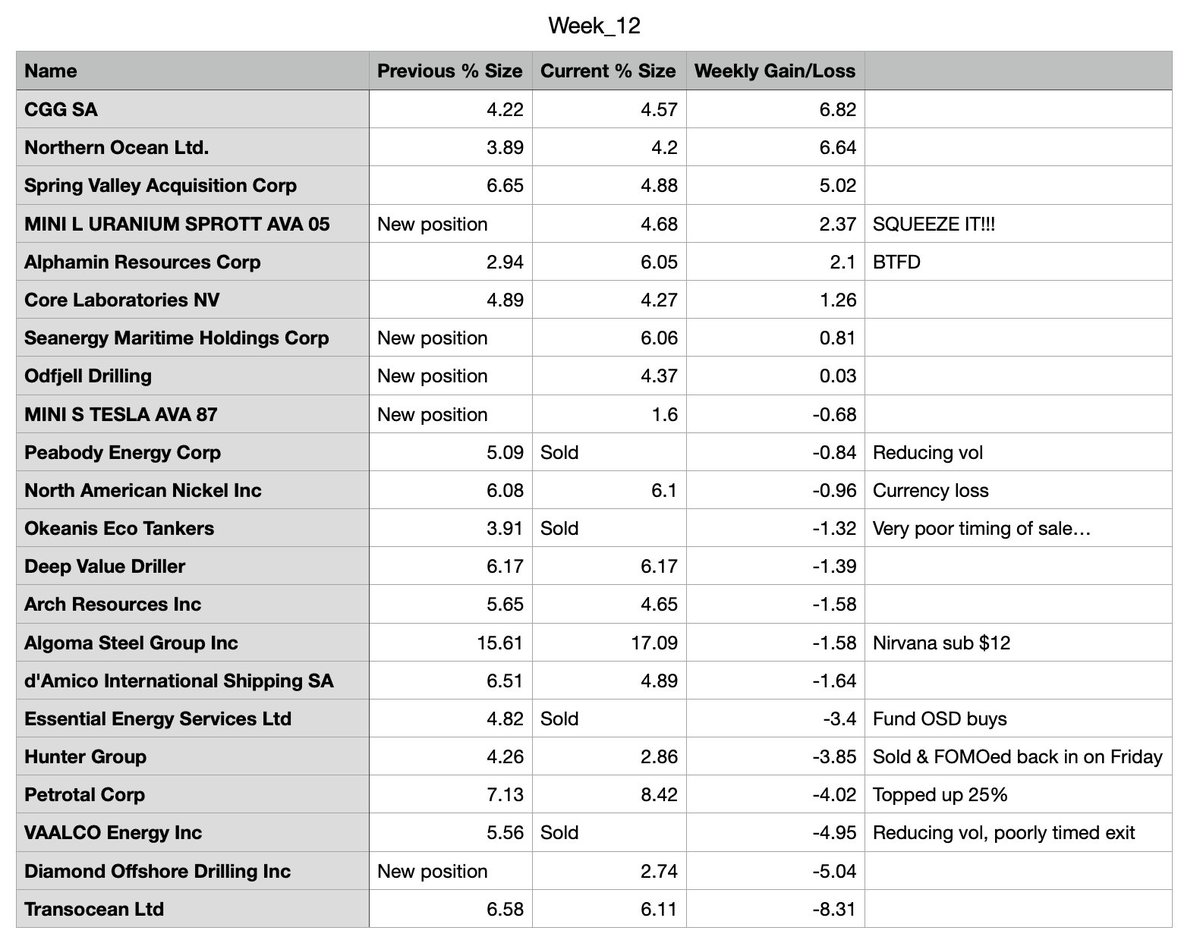

Will be damn interesting to see if my dollar cost averaging strategy will outperform my regular portfolio!

Will be damn interesting to see if my dollar cost averaging strategy will outperform my regular portfolio!

https://twitter.com/Pete__Panda/status/1509443758101864450

@METhompson72 PS: I won't tweet regularly about these picks as I compound away, nor include them in my weekly updates. This portfolio is a long-term buy & hold, as I've done my DD & know that +$100k #tin prices is a question about WHEN, not IF.

PPS: Will be very interesting to see if this strategy beats my active trading portfolio. So far it has not, but #tin has also not gone completely parabolic yet. Nor has the impact of $600BN invested in ramping up semi prod even begun showing itself in the tin market!

• • •

Missing some Tweet in this thread? You can try to

force a refresh