GameStarter is expanding its services and we want to spread the word. If you're a game developer working to get your idea or partially built project off the ground and ready for market, @Gamestarter is providing the resources and connections you'll need to make it happen.

🧵👇

🧵👇

1/ Gamestarter is a game development studio and NFT marketplace as well as #launchpad and #accelerator that is expanding its platform to include full-service incubation, marketing, and promotion as well as coaching and support for game development teams.

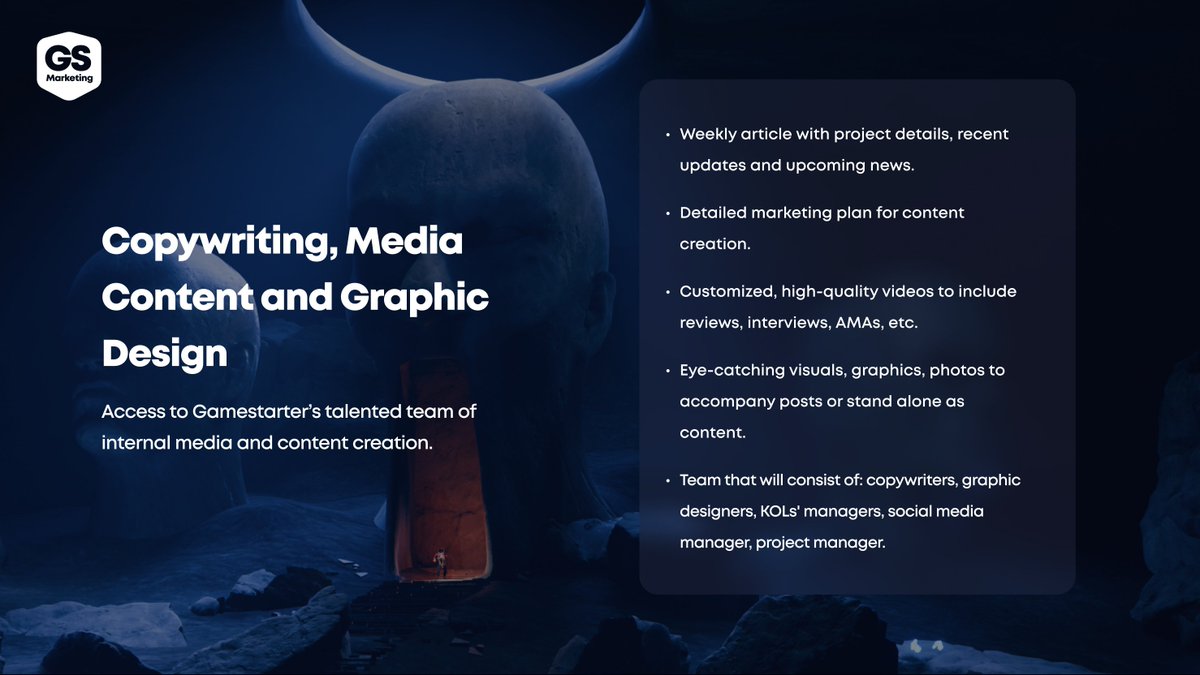

2/ The team has experience launching dozens of games and can provide support, insight, and coaching in all areas that matter for a game to succeed. From developing graphic designs and social media promotions to partnership recommendations and more. They have the tools and skills

3/ You can also utilize Gamestarter's content creation team and network of influencers to make sure your project is getting fresh, consistent content coverage as you build.

4/ GameStarter's NFT marketplace can also be utilized by supported developer teams, and they'll have access to consultants with expertise in #NFTs and the #IDO process.

5/ They've already built an impressive network that can provide infinite value to new game developers, and also save them a ton of time versus trying to build this network from scratch.

6/ If you're a game developer ready to accelerate your development and marketing processes, check these guys out. They can handle all the other important details so you can focus on the most important part: Building a genuinely engaging and enjoyable game

twitter.com/Gamestarter

twitter.com/Gamestarter

You can read the unrolled version of this thread here: typefully.com/Momentum_6/4Ot…

• • •

Missing some Tweet in this thread? You can try to

force a refresh