I've updated the #tether attestation #googlesheets analysis. A few changes including fixing a glaring error 😳 #commercialpaper analysis h/t to @accountantInc catching the mistake. Document consolidates all reported quarters to date >>> bit.ly/3Kzkjz2

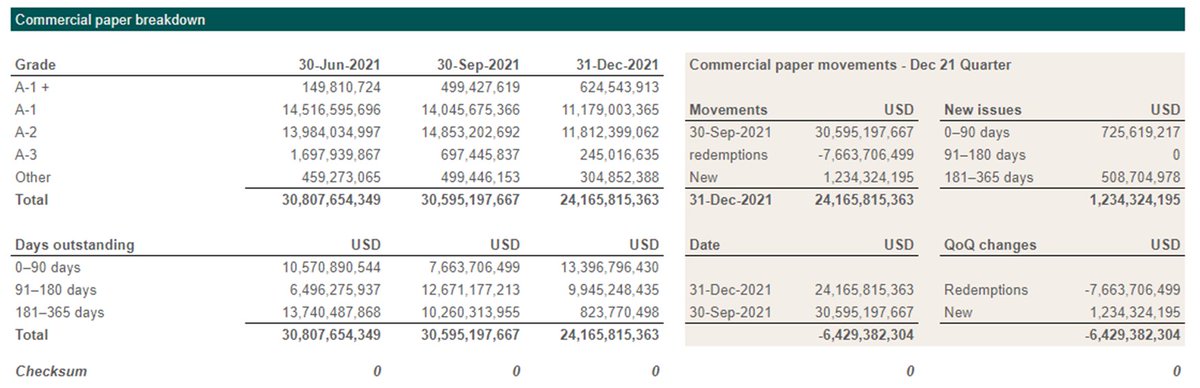

The #tether #commercialpaper section has been expanded/updated to show not just the net changes but the new issues/rollovers etc....

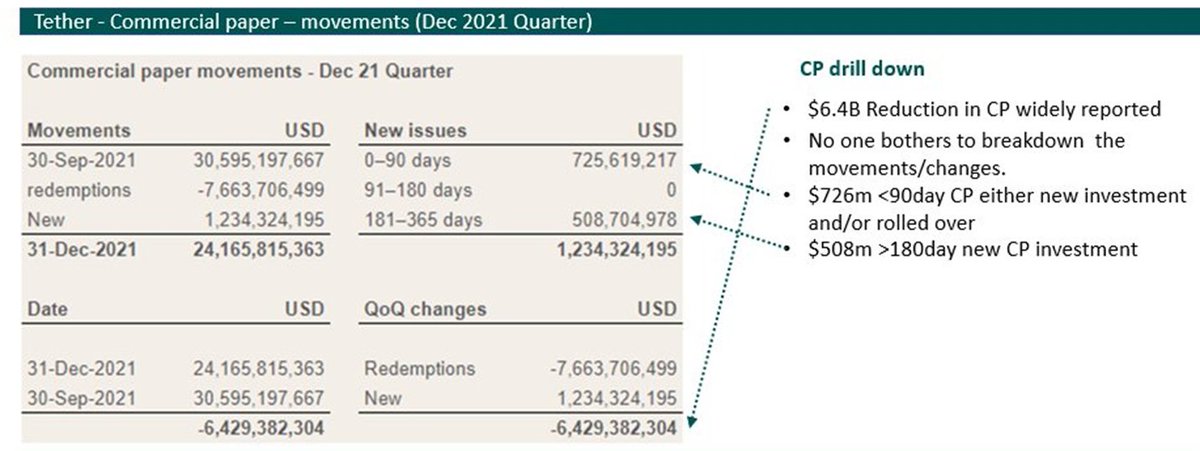

The purpose of the #commercialpaper analysis was to highlight that the reported $6.4B reduction in CP was only half the story....and it kinda shits me that the numbers are just trumpeted by most news as is...

Anyone can add/subtract the difference between the reported quarters. But it takes a bit more work to actually drill into the information to work out changes/movements. $7.6B of CP's matured during the Dec Quarter which is $1.2B more than the net reduction.

So if $7.6B of CP's matured....net change is $6.4B where has the additional $1.2B come from.

$726m <90day is either new and/or rolled over.

Of the $824m >80day CP's $509m is new/incoming and the balance is the residual from previous quarter.

$726m <90day is either new and/or rolled over.

Of the $824m >80day CP's $509m is new/incoming and the balance is the residual from previous quarter.

From there you can attempt to determine the returns on the matured CP. For example, assuming

(a) that the annualised 90day CP rate is 0.7% (stlouisfed.org).

(b) CP issued at a discount to face value

= $13.2m face value premium on maturity

[0.7% x 90/365=0.17%]

(a) that the annualised 90day CP rate is 0.7% (stlouisfed.org).

(b) CP issued at a discount to face value

= $13.2m face value premium on maturity

[0.7% x 90/365=0.17%]

But of course none of these returns can been seen to flow through the attested financials

Not just the CP its also the interest/yield from their other investments and the revenue's that should be being earned including the 0.1% fee on new funds.

Not just the CP its also the interest/yield from their other investments and the revenue's that should be being earned including the 0.1% fee on new funds.

57.26B+ of #tether issued CY2021 = $57.26m of revenue, the attested financials do not support this (non-token debt rises QoQ).

Does this infer that assets other than fiat are being accepted as consideration for new tether?

Does this infer that assets other than fiat are being accepted as consideration for new tether?

More problematically it appears that assets held/invested by #tether appear not be properly reconciled/revalued. A prime example of this is the #tether's investment in @celsiusnetwork

#tether followed its money in #celsiusnetwork's Series B round of which the investment was made and shares were issued in the Dec21 quarter crystallising a $181m uplift in its investment which if accounted for properly would more than double the reported $137m net assets.

#celsiusnetwork cap table analysis - (a) Series B issues (b) Cap table (all series) (c) pre/post money valuation by round

• • •

Missing some Tweet in this thread? You can try to

force a refresh