About -

KEI was established in 1968 as a partnership firm under the name Krishna Electrical Industries, they serves customers globally in over 45 countries, through a rich network of 5000+ channel partners.

KEI was established in 1968 as a partnership firm under the name Krishna Electrical Industries, they serves customers globally in over 45 countries, through a rich network of 5000+ channel partners.

KEI manufactures & markets Extra-High Voltage (EHV),Medium Voltage (MV) & Low Voltage (LV) power cables. Serving both retail & institutional segments, KEI has emerged as a one-stop shop for products and services.

Financial Summary -

Q3 FY22 (YoY)

Rev. were at Rs.1564 Cr. ⬆️35%

EBITDA at Rs.159 Cr. ⬆️23%

PAT at Rs.101 Cr. ⬆️33%

EPS at Rs.11.19 ⬆️34%

Q3 FY22 (YoY)

Rev. were at Rs.1564 Cr. ⬆️35%

EBITDA at Rs.159 Cr. ⬆️23%

PAT at Rs.101 Cr. ⬆️33%

EPS at Rs.11.19 ⬆️34%

Revenue Mix -

Low Tension (LT) 37.5%, High Tension (HT) 16.5% & Extra High Voltage (EHV) 10%

Housing Wire & Winding Wire (HW/WW) 21.4%

Stainless Steel Wire (SSW) 3.4%

Engineering, Procurement & Construction Services (EPC) 11.2%

Low Tension (LT) 37.5%, High Tension (HT) 16.5% & Extra High Voltage (EHV) 10%

Housing Wire & Winding Wire (HW/WW) 21.4%

Stainless Steel Wire (SSW) 3.4%

Engineering, Procurement & Construction Services (EPC) 11.2%

EPC Division offers end-to-end turnkey solutions including

engineering, project management for EHV substation, underground cabling, overhead lines

etc. These services are delivered across core sectors like power, railways, petrochem, cement, steel, etc.

engineering, project management for EHV substation, underground cabling, overhead lines

etc. These services are delivered across core sectors like power, railways, petrochem, cement, steel, etc.

Segment Wise Rev Breakup -

Retail(34%) comprises house wires, winding & flexible wires, LT & HT cables.

Institutional(51%) comprises EHV cables, HT & LT power cables, turnkey projects & stainless steel wires.

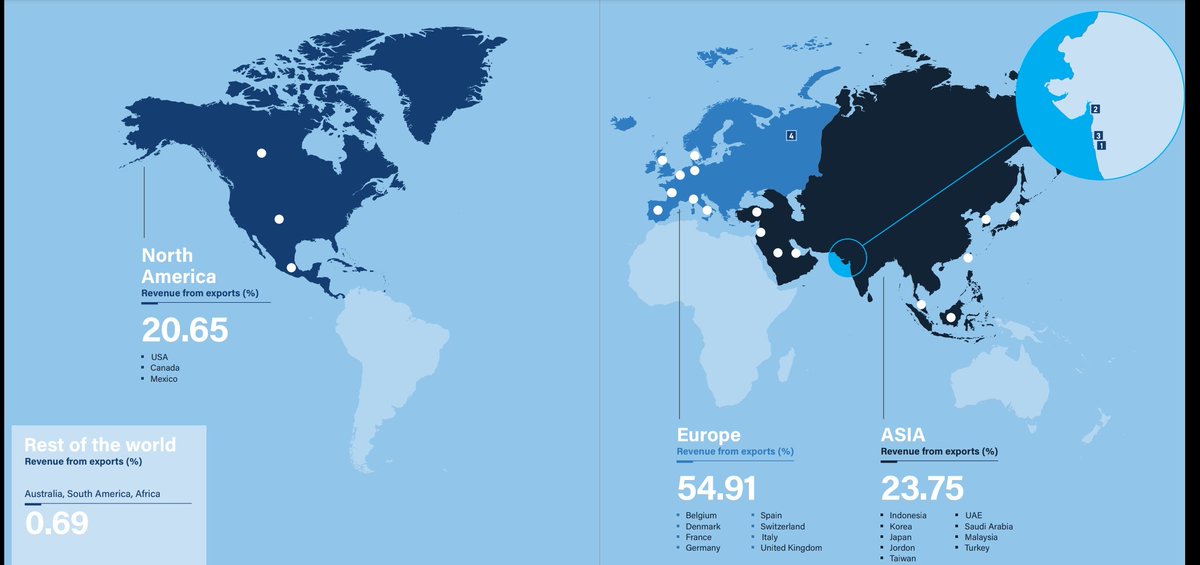

Exports(15%) presence in 45+ countries exports EHV, MV & LV cables.

Retail(34%) comprises house wires, winding & flexible wires, LT & HT cables.

Institutional(51%) comprises EHV cables, HT & LT power cables, turnkey projects & stainless steel wires.

Exports(15%) presence in 45+ countries exports EHV, MV & LV cables.

Industry Overview -

Global wires & cables market size is expected to expand at a CAGR

of 4.4% over 2021-28, to reach $260.16 billion by the

end of 2028.

Global wires & cables market size is expected to expand at a CAGR

of 4.4% over 2021-28, to reach $260.16 billion by the

end of 2028.

This growth is attributable to the increasing

use of cables & wires across the world for transmission

& distribution of power, for incremental application in

telecom sector & data centers.

use of cables & wires across the world for transmission

& distribution of power, for incremental application in

telecom sector & data centers.

Long Term Triggers -

• The retail demand for housing wires is

being fueled by flagship government schemes for urban & rural electrification.

• Increased demand for energy with growing

population & urbanization is driving EHV cables

market growth.

• The retail demand for housing wires is

being fueled by flagship government schemes for urban & rural electrification.

• Increased demand for energy with growing

population & urbanization is driving EHV cables

market growth.

• Smart grids are replacing aging grid infra. with new transmission networks

being needed to be set up for these upcoming grids. High volt cables are suitable for these networks.

being needed to be set up for these upcoming grids. High volt cables are suitable for these networks.

• Low volt cables market is also poised

to attractive growth due to rising demand from power

generation & distribution sector, renewable energy

segment, automotive industries.

• Rising real estate industry is also fuelling the demand for wires & cables.

to attractive growth due to rising demand from power

generation & distribution sector, renewable energy

segment, automotive industries.

• Rising real estate industry is also fuelling the demand for wires & cables.

Risks -

• KEI's products are used primarily by power utilities, infra, real estate & industrial these segments are cyclical in nature.

• KEI's products are highly competitive in nature & face strong threat from other large

players.

• Rise of the prices of raw material.

• KEI's products are used primarily by power utilities, infra, real estate & industrial these segments are cyclical in nature.

• KEI's products are highly competitive in nature & face strong threat from other large

players.

• Rise of the prices of raw material.

Targets for FY23 -

https://twitter.com/Nigel__DSouza/status/1509749474402312193?t=kqMJhfCaSUhHmR5Obfmn9A&s=19

Conclusion -

The focus on 100% electrification of existing railway

network, setting up of metro rail, providing public

charging infrastructure, laying

optical fiber cables will increase the demand for cables in India.

The focus on 100% electrification of existing railway

network, setting up of metro rail, providing public

charging infrastructure, laying

optical fiber cables will increase the demand for cables in India.

Please 🙏 like 👍, comment & retweet ♻️ if you find this useful.

@caniravkaria @shubhfin @DrdhimanBhatta1 @anandchokshi19 @saketreddy

@caniravkaria @shubhfin @DrdhimanBhatta1 @anandchokshi19 @saketreddy

• • •

Missing some Tweet in this thread? You can try to

force a refresh