About -

Astral Pipes was established in 1996 with the aim of manufacturing plumbing & drainage systems in India. Today, it cover the needs of millions of households.

Astral has successfully established itself as one of India’s dominant

brands in the plastic piping segment.

Astral Pipes was established in 1996 with the aim of manufacturing plumbing & drainage systems in India. Today, it cover the needs of millions of households.

Astral has successfully established itself as one of India’s dominant

brands in the plastic piping segment.

Financial Summary -

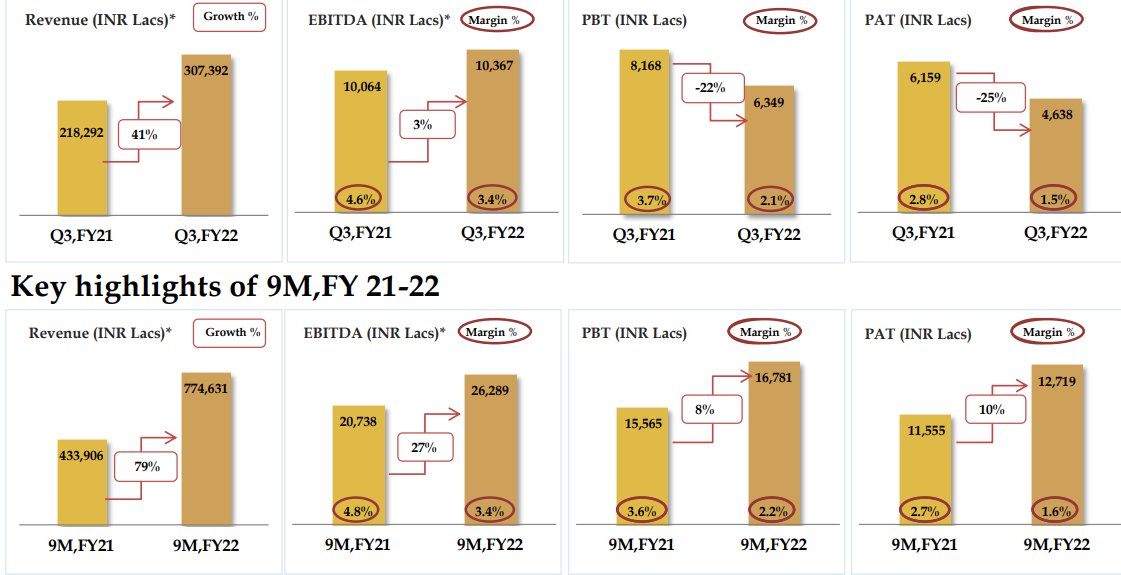

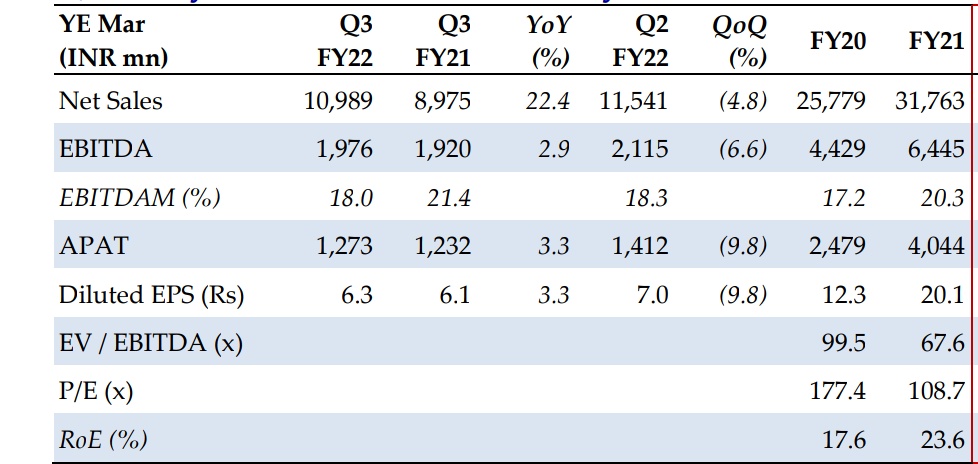

Q3 FY22 (YoY)

Rev were at Rs.10,989 Cr.⬆️ 22.4%

EBITDA at Rs.1,976 Cr.⬆️ 3%

PAT at Rs.1,273 Cr.⬆️ 3.3%

Q3 FY22 (YoY)

Rev were at Rs.10,989 Cr.⬆️ 22.4%

EBITDA at Rs.1,976 Cr.⬆️ 3%

PAT at Rs.1,273 Cr.⬆️ 3.3%

▪️Pipes & Fittings:

Astral has been the pioneer of plastic pipes

& fittings in India.The pipes manufactured by Astral are used across

various applications including plumbing, sewage,agricultural, industrial, etc.

Astral has been the pioneer of plastic pipes

& fittings in India.The pipes manufactured by Astral are used across

various applications including plumbing, sewage,agricultural, industrial, etc.

▪️Adhesives & Sealants:

Astral has evolved to

become one of the leading player of adhesives &

sealants. They manufactures a diversified range of

adhesives, sealants, putties & construction aids are

used in varied applications like automotive, woodcare, construction, etc.

Astral has evolved to

become one of the leading player of adhesives &

sealants. They manufactures a diversified range of

adhesives, sealants, putties & construction aids are

used in varied applications like automotive, woodcare, construction, etc.

▪️Water Tanks:

In 2020, Astral has expanded its

product portfolio & entered into the

Water Tanks Segment with an acquisition of

"Sarita" an Aurangabad based trusted brand

of water tanks with decades of experience

&expertise in manufacturing water

tanks.

In 2020, Astral has expanded its

product portfolio & entered into the

Water Tanks Segment with an acquisition of

"Sarita" an Aurangabad based trusted brand

of water tanks with decades of experience

&expertise in manufacturing water

tanks.

Industry Overview -

The global PVC pipes industry is expected to exhibit CAGR of 4.47% during 2022-27 with the global market touching 29.7

mn tons by 2027.

Government of India initiatives such as Jal Jeevan Mission Urban scheme,

which aims to provide uniform water supply

The global PVC pipes industry is expected to exhibit CAGR of 4.47% during 2022-27 with the global market touching 29.7

mn tons by 2027.

Government of India initiatives such as Jal Jeevan Mission Urban scheme,

which aims to provide uniform water supply

in all 4738 urban local bodies with 2.86 crs household tap connections as well as liquid waste management in 500 AMRUT cities, will drive demand for PVC pipes.

Capex Update -

New plants at Bhubaneswar (for plumbing products), Hosur (water

tanks), Ahmedabad (valve products) & blow moulding water

tanks in Rajasthan & Santej will start from Q1FY23 onwards.

New plants at Bhubaneswar (for plumbing products), Hosur (water

tanks), Ahmedabad (valve products) & blow moulding water

tanks in Rajasthan & Santej will start from Q1FY23 onwards.

Construction of new adhesive plant in Dahej (Gujarat) will be fully

operational from Q4FY23.

operational from Q4FY23.

Key Triggers -

• Pick-up in construction activities expected to augment

growth in both pipes & adhesives.

• Launch of new products (water tank, valve) to help drive revenue of piping business.

• CPVC pipes price is expected to

rise due to its shortage & higher input cost.

• Pick-up in construction activities expected to augment

growth in both pipes & adhesives.

• Launch of new products (water tank, valve) to help drive revenue of piping business.

• CPVC pipes price is expected to

rise due to its shortage & higher input cost.

• In Adhesive segment management has a target of doubling the topline in the next 4-5 years.

• Astral is planning to launch sanitary ware & faucet products

from Q1FY23 onwards.

• Astral is planning to launch sanitary ware & faucet products

from Q1FY23 onwards.

Risks -

• Rise in Input cost can effect profitability.

• Any unexpected demand slowdown in housing

market will adversely affect growth in the pipe segment.

• Sharp & sudden fall in PVC resin prices

will adversely affect the profitability of the company.

• Rise in Input cost can effect profitability.

• Any unexpected demand slowdown in housing

market will adversely affect growth in the pipe segment.

• Sharp & sudden fall in PVC resin prices

will adversely affect the profitability of the company.

Conclusion -

The domestic market of India is huge & has potential to grow for Astral.

Indian plastic pipes & fittings industry is expected

to reach ₹500-550 billion by 2025 growing at a

CAGR of 10% from the current levels of ₹290-300 Bill.

The domestic market of India is huge & has potential to grow for Astral.

Indian plastic pipes & fittings industry is expected

to reach ₹500-550 billion by 2025 growing at a

CAGR of 10% from the current levels of ₹290-300 Bill.

Please 🙏 like 👍 comment & retweet ♻️if you find this useful.

@DrdhimanBhatta1 @caniravkaria @shubhfin @anandchokshi19

@DrdhimanBhatta1 @caniravkaria @shubhfin @anandchokshi19

• • •

Missing some Tweet in this thread? You can try to

force a refresh