Blackburn Rovers’ financial results for 2020/21 cover a season when they finished 15th in the Championship under Tony Mowbray (down from prior year 11th). Club described the campaign as “unprecedented”, due to the impact of the COVID-19 pandemic. Some thoughts follow #Rovers

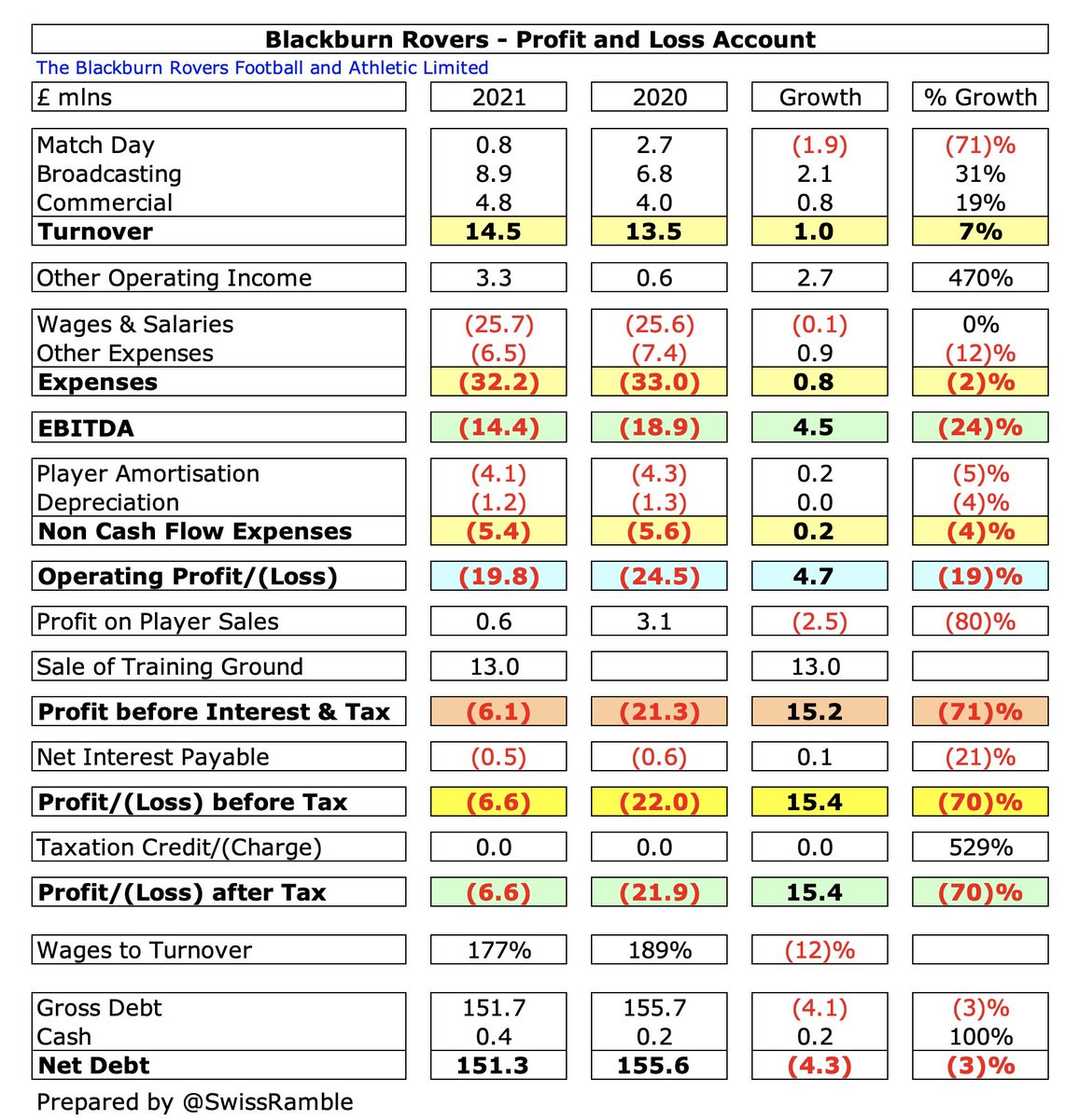

#Rovers loss narrowed by £15.3m from £21.9m to £6.6m, mainly due to £13m profit from sale of training ground. Revenue rose £1.0m (7%) to £14.5m, but profit on player sales fell £2.5m to £0.6m. Expenses were cut £1.0m (3%), while other operating income rose £2.7m to £3.3m.

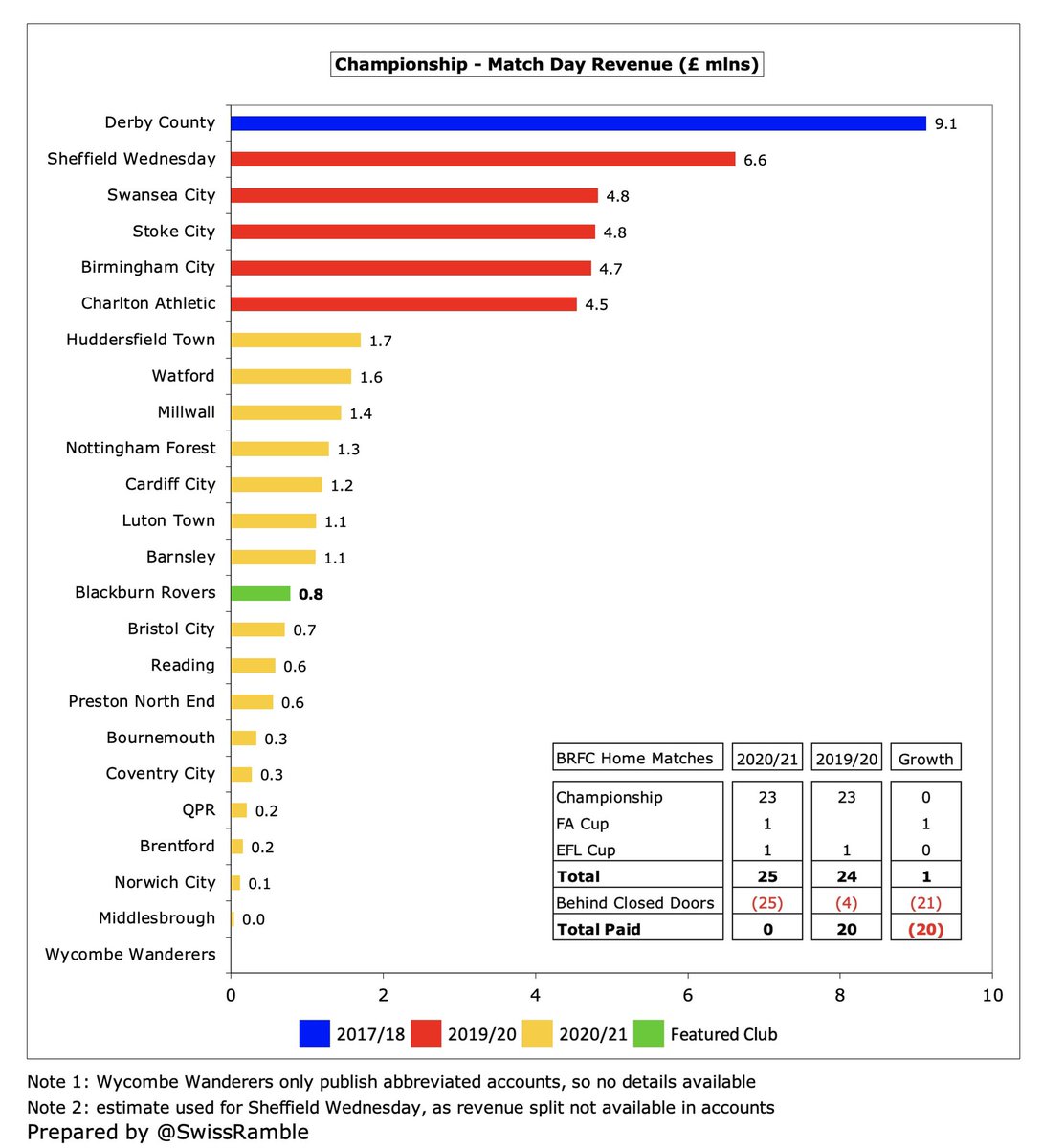

#Rovers revenue increase was driven by growth in broadcasting, up £2.1m (31%) from £6.8m to £8.9m, and commercial, up £0.8m (19%) from £4.0m to £4.8m, which offset the COVID driven reductions in match day, down £1.9m (71%) from £2.7m to just £0.8m.

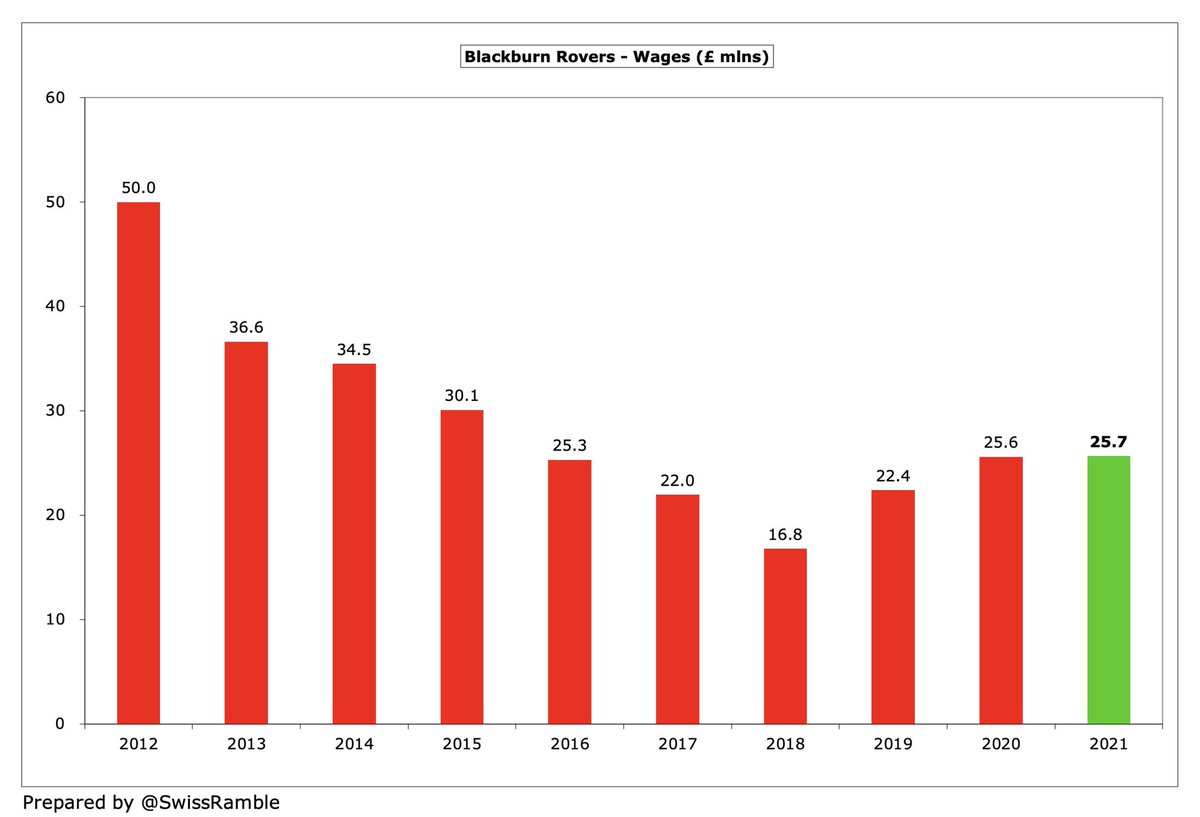

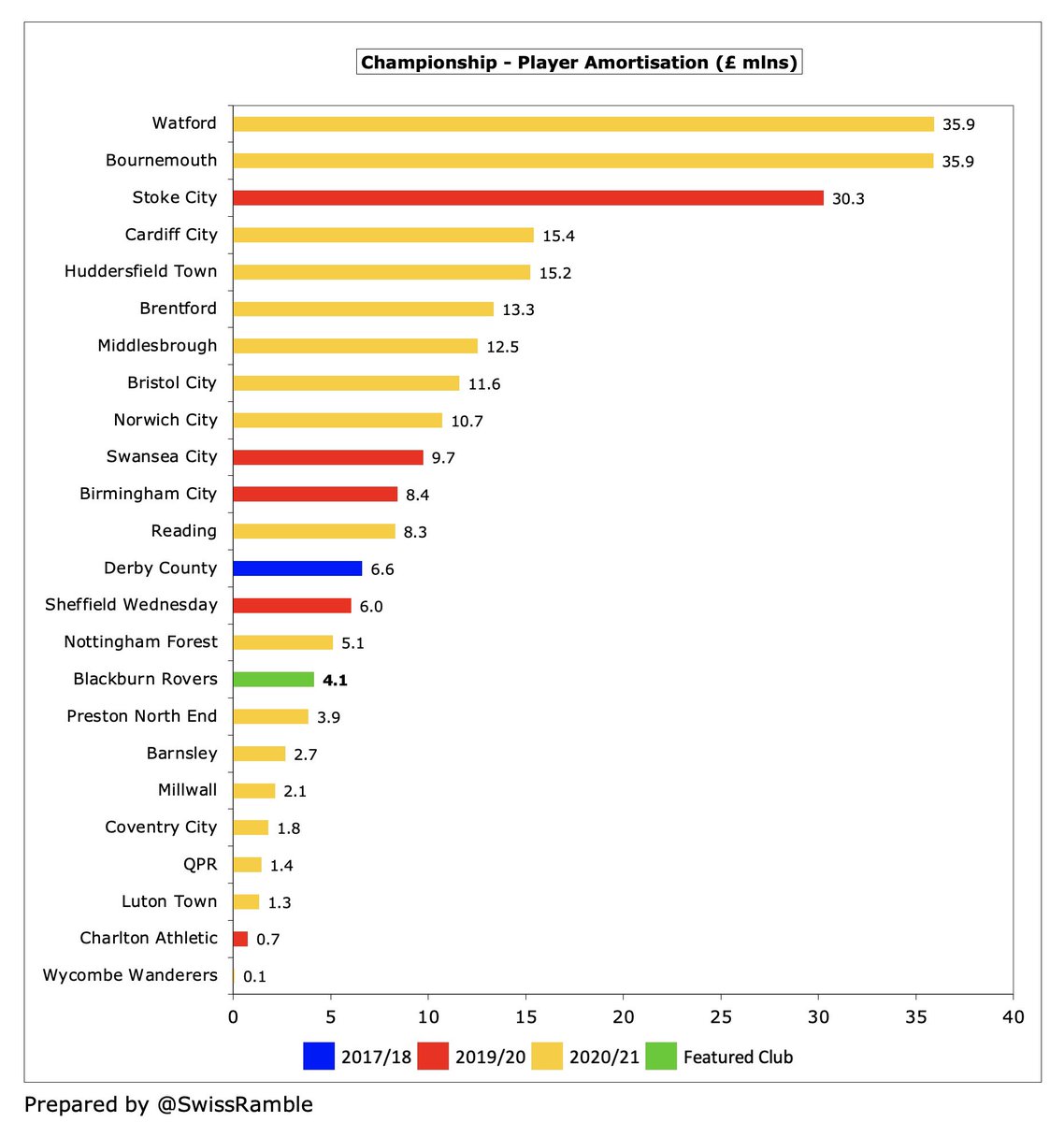

#Rovers wage bill slightly increased from £25.6m to £25.7m, while player amortisation dropped £0.2m (5%) from £4.3m to £4.1m. Other expenses were cut £0.9m (12%) to £6.5m, partly due to the reduced cost of staging games, and interest payable was down £0.1m to £0.5m.

#Rovers £7m loss is mid-table in the Championship, much better than the likes of Bristol City £38m, Reading £36m and Middlesbrough £31m in 2020/21. They did well to restrict the size of their deficit, given that there was a full year of the pandemic.

That said, #Rovers loss would have been £20m without the £13m profit from selling the Senior training ground at Brockhall to a company set up by owners Venky’s (£17m sales proceeds less £4m value in accounts). Cash payment due by June 2023. Leased back to the football club.

#Rovers financials have obviously been hit by the pandemic, resulting in money lost from games played behind closed doors and a broadcasters’ rebate, though 2020/21 was boosted by deferred revenue for games played after 30th June 2020 accounting close.

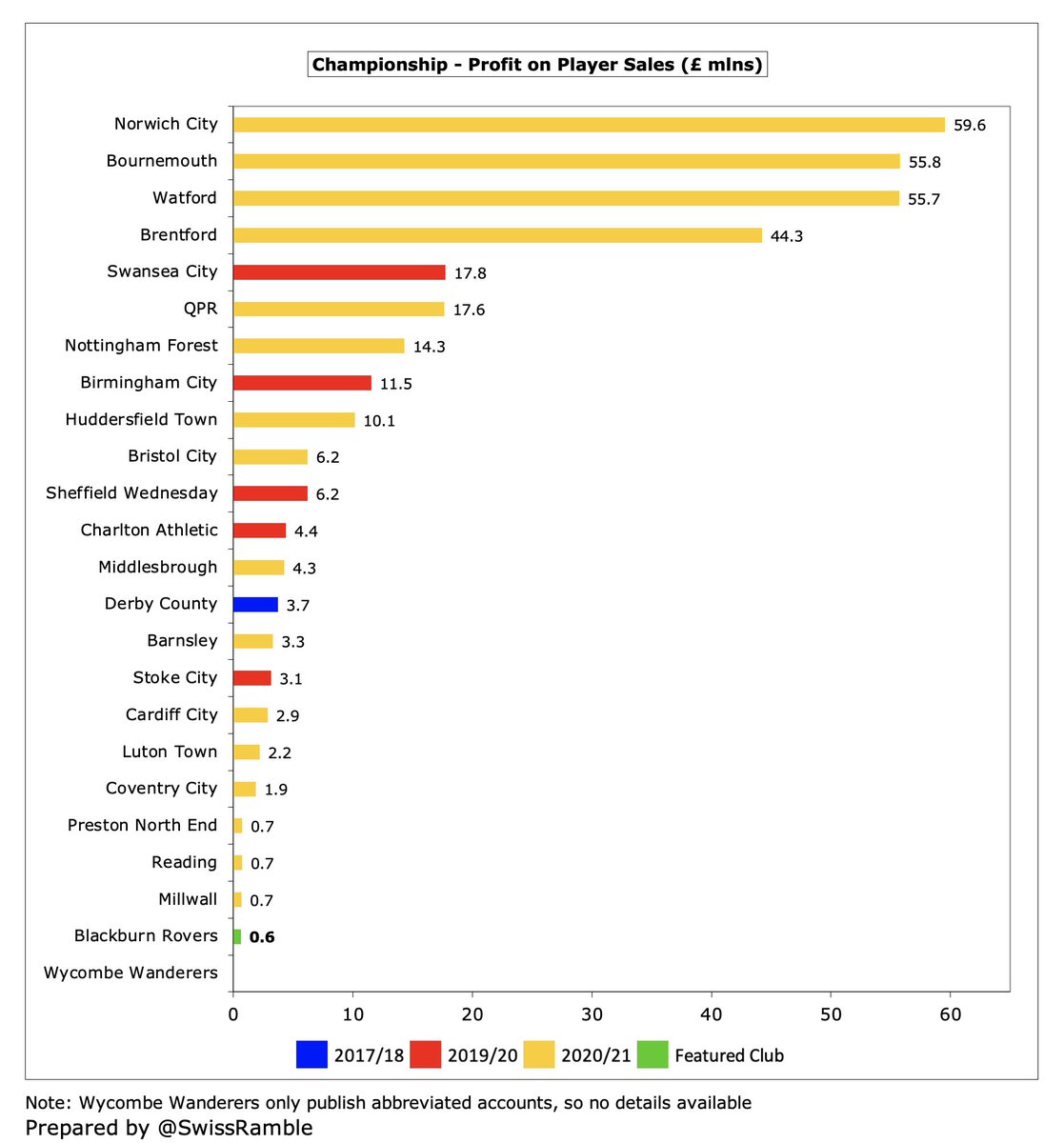

#Rovers profit on player sales decreased from £3.1m to £0.6m, as prior season included David Raya to Brentford. This is the lowest player trading profit in the 2020/21 Championship, in stark contrast to the likes of #NCFC, #AFCB and Watford, who all generated more than £50m.

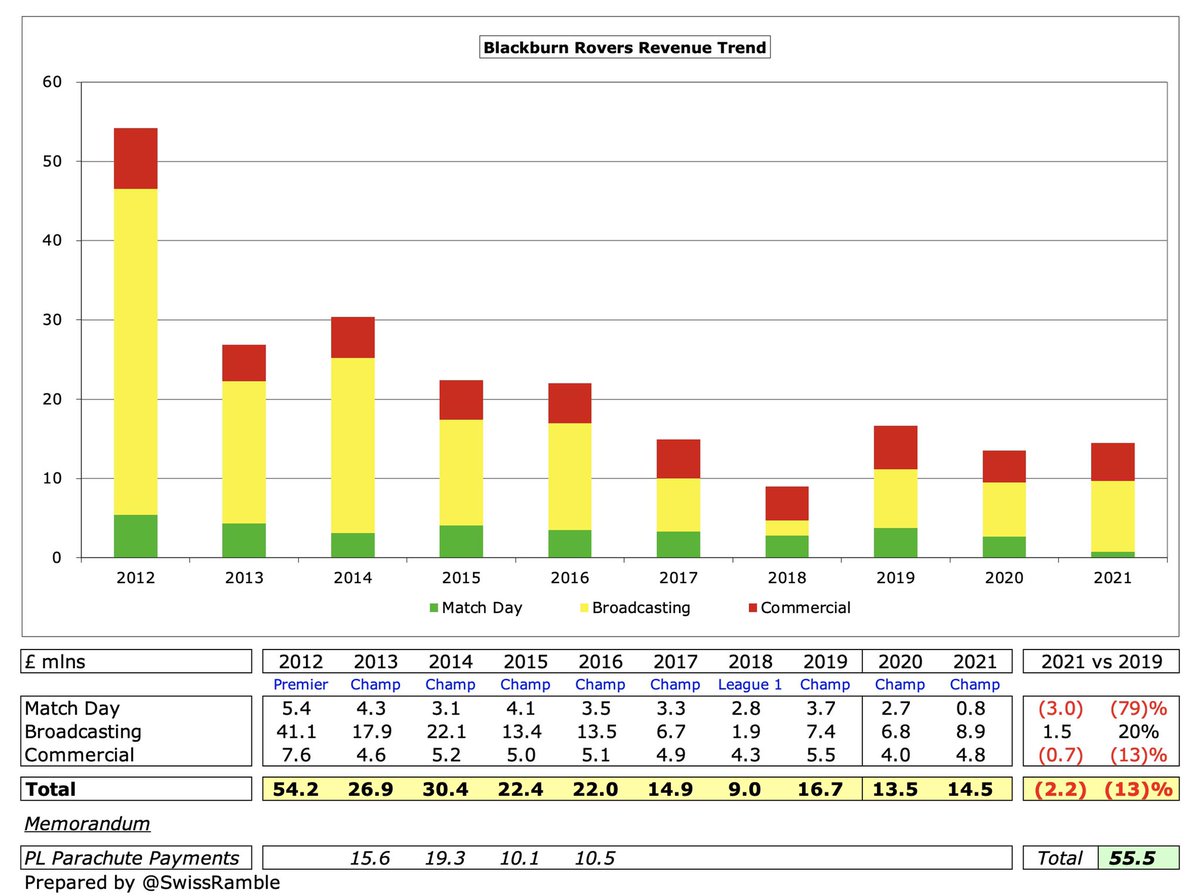

Since Venky’s arrival in 2010, #Rovers have only once made a profit – in 2012 when they were last in the Premier League (boosted by £23m player sales). Since then, they have managed to lose £165m in 9 years, despite benefiting from 4 years of parachute payments.

#Rovers relatively small losses in 2016 and 2017 were due to decent profits from player sales, but they have only made £5m from this activity in the 4 years since then. However, this season will look better, as it will include the £16m sale of Adam Armstrong to Southampton.

#Rovers operating loss (excluding player sales, training ground sale and interest) reduced from £24m to £20m. This is not too bad in the Championship, where almost every club posts substantial operating losses, e.g. Watford £72m and Brentford £53m (hefty promotion bonuses).

#Rovers revenue has dropped £2.2m (13%) in last 2 years from £16.7m to £14.5m, due to COVID, which has driven reductions in match day £3.0m and commercial £0.7m. Revenue has fallen £40m (73%) since relegation from the Premier League.

#Rovers financial challenge is highlighted by the fact that their £14.5m revenue is firmly in the bottom half of the Championship, miles below clubs benefiting from parachute payments, e.g. #AFCB £72m, #NCFC £57m, Watford £57m and Cardiff City £55m.

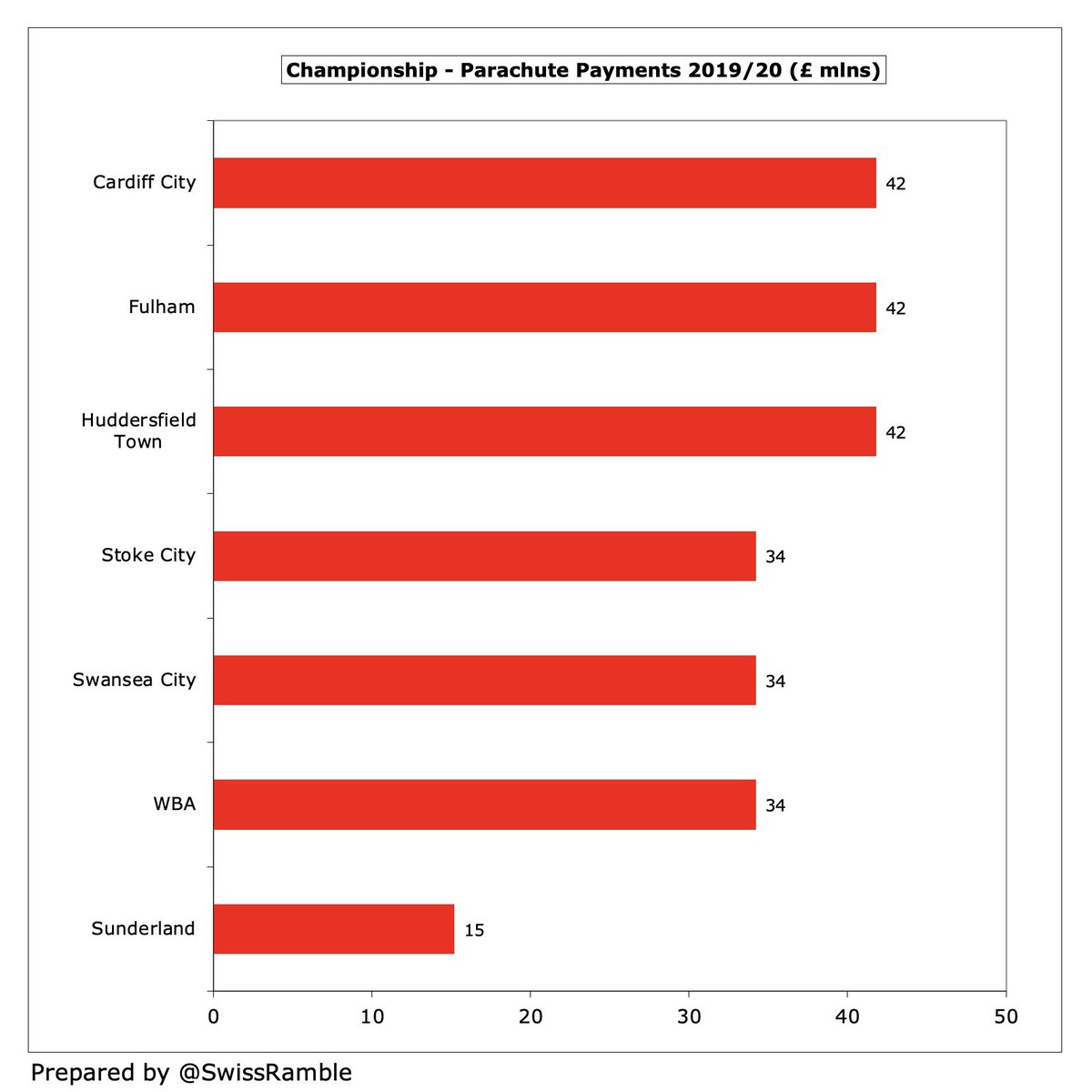

#Rovers no longer benefit from parachute payments, having received £56m in the 4 years up to 2016. These are so significant that they make it difficult for others to compete, e.g. in 2019/20 a relegated club received £42m in year one, £34m in year two and £15m in year three.

#Rovers broadcasting income rose £2.1m (31%) from £6.8m to £8.9m, including live iFollow streaming. A lot less than £13.5m in 2016 (last year of parachute payments). Most Championship clubs earn £7-9m, but there is a massive gap to clubs with parachutes.

#Rovers match day income fell £1.9m (71%) from £2.7m to just £0.8m, as all home games were played behind closed doors, though many fans still renewed their season tickets. Down from £3.7m two years ago, though gate receipts are still very low for the Championship.

#Rovers average attendance in 2019/20 (for games played with fans) was 13,836, which was firmly in the bottom half of the Championship. Around half the 25,427 peak that Blackburn enjoyed in the 2010 Premier League.

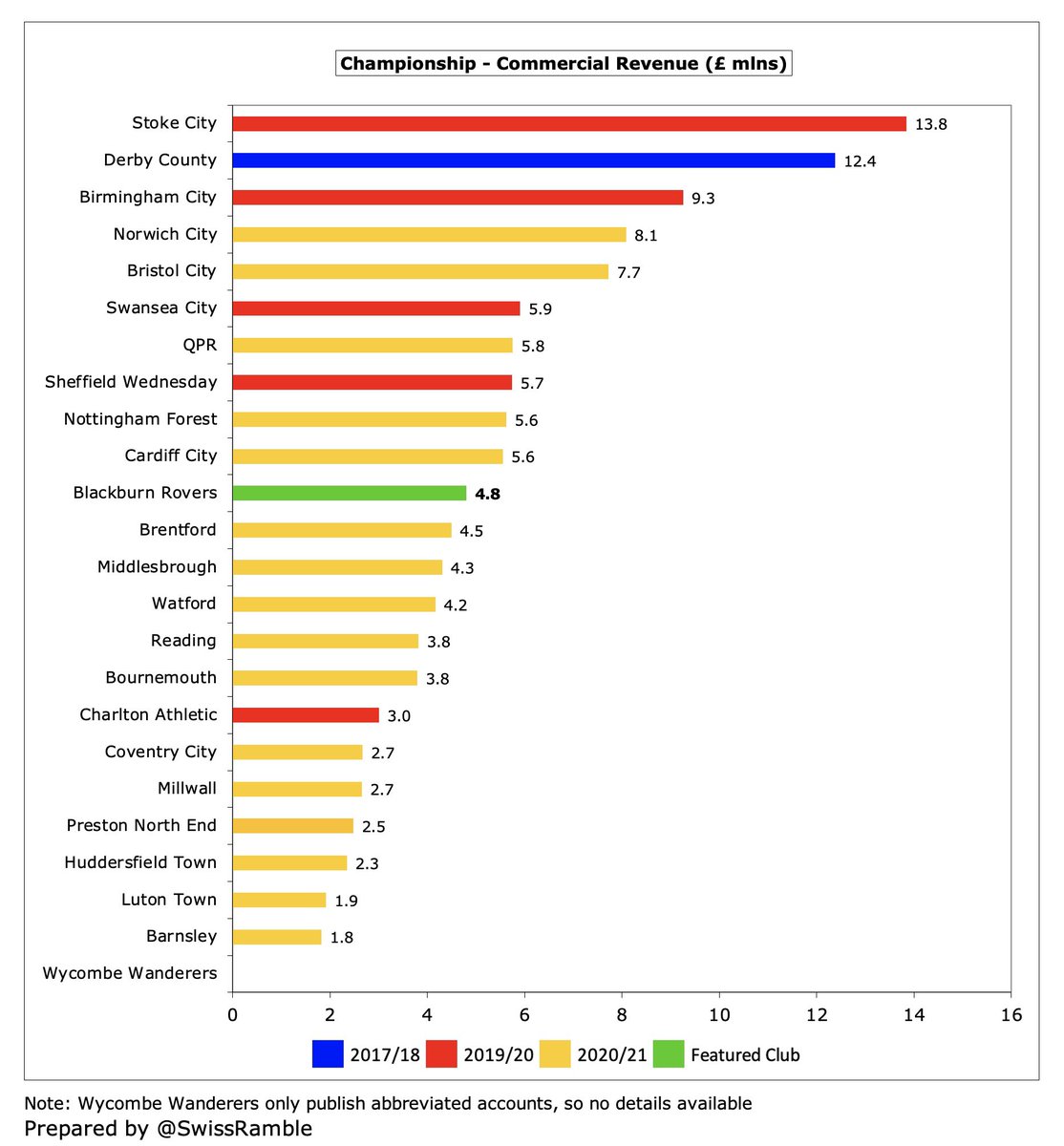

#Rovers commercial income rose £0.8m (19%) from £4.0m to £4.8m, which is mid-table in the Championship, sandwiched between Cardiff City £5.6m and Brentford £4.5m. Less than half the £9.5m they earned in the Premier League in 2011.

Recoverite Compression replaced 10Bet as #Rovers shirt sponsor in 2020/21, but have since been succeeded by local business Totally Wicked. Macron replaced Umbro in a 5-year kit supplier deal starting in 2021/22 with “significant financial benefit”.

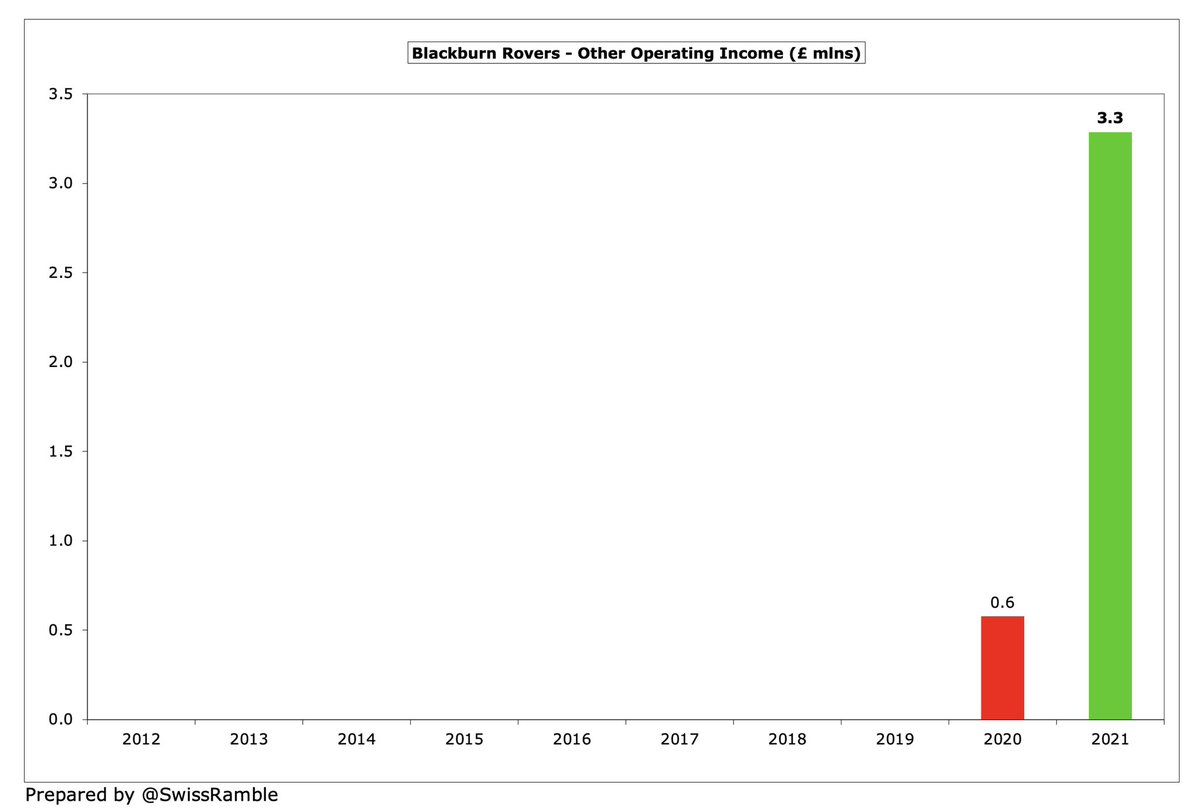

#Rovers other operating income rose £2.7m from £0.6m to £3.3m, comprising £2.6m business interruption insurance claim and £0.7m government furlough payments. Some clubs also report player loans here, e.g. #AFCB included £1.8m in their £5.0m.

#Rovers wage bill slightly increased from £25.6m to £25.7m, the club’s highest since 2015. However, for some perspective, this was £11m lower than their first season following relegation from the Premier League in 2013 (when they had parachute payments).

#Rovers £26m wage bill was again in the bottom half of the Championship. In fact, three clubs in the division paid wages over £30m more than Blackburn: Watford £68m, #NCFC £67m and #AFCB £57m (though the first two included large promotion bonuses).

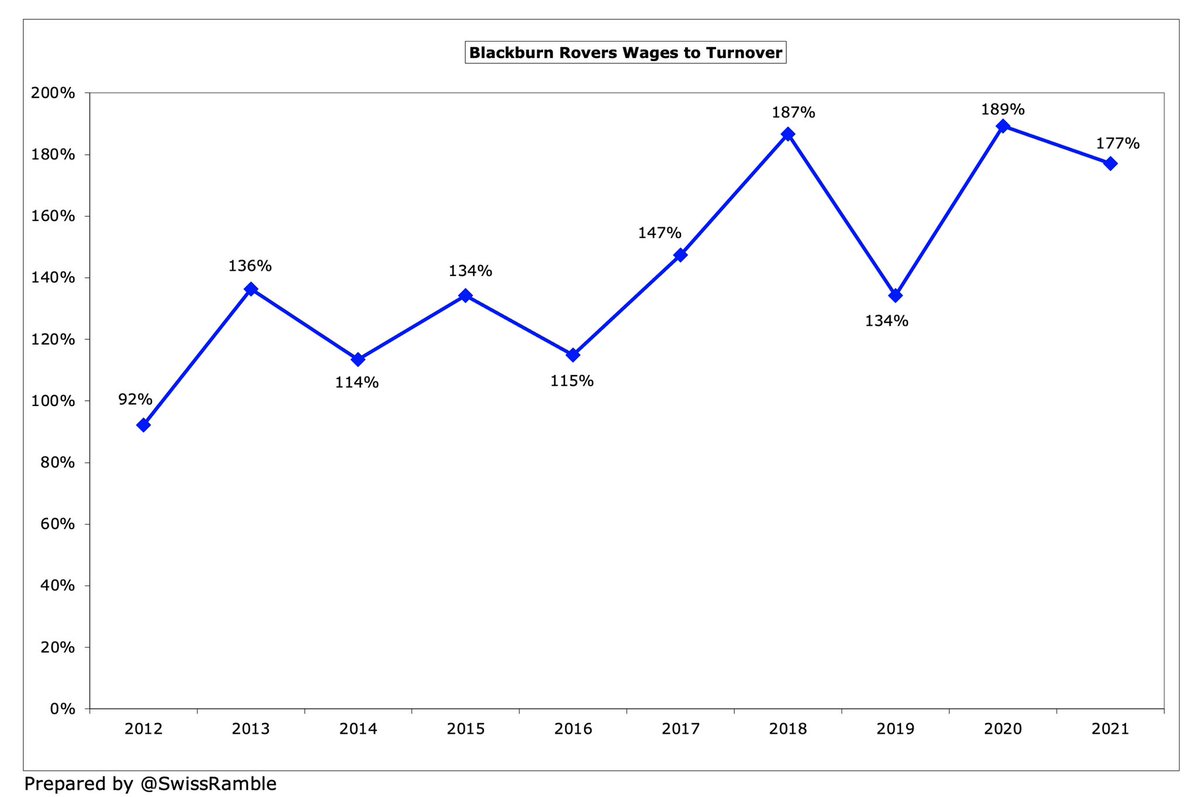

#Rovers wages to turnover ratio decreased from 189% to 177%. This is obviously not great, but in fairness most clubs in the very competitive Championship have unsustainable ratios well above 100% (four of them over 200%).

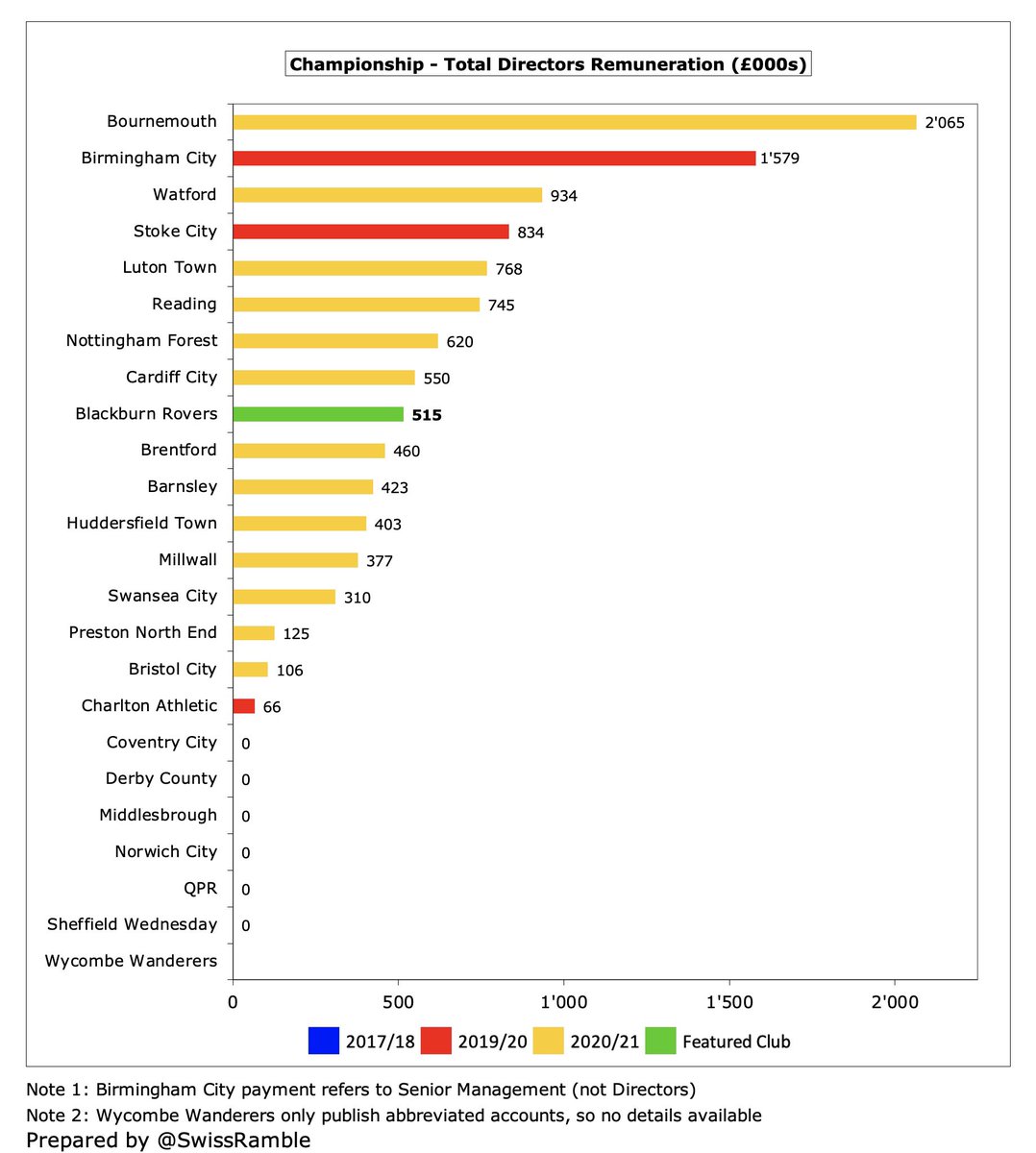

#Rovers total directors remuneration increased 4% from £496k to £515k, which is in the top 10 in the Championship. The payment for the highest paid director also rose from £272k to £292k.

#Rovers player amortisation, the annual charge to write-off transfer fees over a player’s contract, fell £0.2m (5%) from £4.3m to £4.1m. This is one of the smallest in the Championship, miles below Watford and #AFCB, both around £36m.

#Rovers only spent £1.6m on player purchases in 2020/21, mainly Harry Pickering, Thomas Kaminski and Aynsley Pears, though they brought in some interesting players on loan, especially Harvey Elliott from #LFC. Less than a tenth of Brentford £22m, #NCFC £22m and #AFCB £21m.

#Rovers transfer spend has significantly reduced following relegation from the top flight, exacerbated by an FFP transfer embargo. In fact, their gross outlay was only £18m in the last 5 years, compared to £40m in the preceding 5-year period. Expenditure down two years in a row.

#Rovers debt fell £4m from £156m to £152m, comprising £130m owed to Venky’s, a £14m bank overdraft and £8m loan from the EFL. The owner’s debt was down £11m, as £19m additional loan was more than offset by converting £30m into equity (partly to comply with FFP).

#Rovers £152m debt was the third highest in the Championship, only below Stoke City £187m and #AFCB £165m. In fact, they actually had the 10th highest debt in England at the end of the 2020/21 season.

Most Championship debt is provided interest-free by owners, which is the case with Venky’s loans. #Rovers paid £487k interest (down from £614k), due to paying 2.65% over LIBOR on the overdraft. Only four clubs in this division paid more than £1m interest.

#Rovers transfer debt was cut from £6.3m to £3.8m, around mid-table in the Championship. Much less than clubs like Watford £62m, #AFCB £45m and #NCFC £23m. Blackburn were in turn owed £0.9m by other clubs, leaving £2.9m net payables.

Even after adding back non-cash items such as amortisation & depreciation, #Rovers made a £21m cash loss from operating activities, then spent £4m on players (purchases £4.0m, sales £0.3m), £0.5m interest and £0.2m capex. Funded by additional loans: Venky’s £19m and EFL £7m.

As a result, #Rovers cash balance increased to £370k, but still one of the lowest in the Championship. That said, most clubs in this division had less than £3m cash in the bank, so this was not out of the ordinary. Cash payment for training ground sale will only come in 2023.

Since Venky’s bought the club, they have effectively been #Rovers only source of funds. The club has been heavily reliant on the owners to cover £159m operating losses since 2011. Also £7m interest payments, but only £5m invested in infrastructure and £1m (net) on players.

By my calculations Venky’s have now put in £163m money. The Championship is a division that has an endless appetite for owner funding, so the £144m #Rovers provided in the 10 years up to 2020 was by no means the highest, much lower than the likes of Fulham £315m & QPR £285m.

#Rovers stated that they ensure compliance with the Championship’s Profitability and Sustainability regulations, though the sale of the training ground clearly took into account the change in rules that would not allow the inclusion of profit on sale of assets after 30 June 2021.

#Rovers low revenue means that they will always face a tough challenge in the Championship, competing against clubs with much higher spending power, especially those benefiting from parachute payments. They remain dependent on financial support from Venky’s.

• • •

Missing some Tweet in this thread? You can try to

force a refresh