Out #openaccess!

With @apsmolenska we provide a birds-eye view of a bewildering world of EU climate finance policy. We argue for a radical overhaul, to make the prudential regulation of risk much more political. A 🧵 /1

@JFinReg Paper available here:

academic.oup.com/jfr/advance-ar…

With @apsmolenska we provide a birds-eye view of a bewildering world of EU climate finance policy. We argue for a radical overhaul, to make the prudential regulation of risk much more political. A 🧵 /1

@JFinReg Paper available here:

academic.oup.com/jfr/advance-ar…

As the @ECB recently acknowledged “few institutions have put in place Climate and Environmental risk practices with a discernible impact on their strategy and risk profile.” Banks are sleeping, greenwashing is rampant. /2

Today, bank lending mostly pursues short term profits.

In the neoliberal era, the Basel/EU framework acquired a narrow microprudential focus: preventing excessive risk-taking. The framework pursues this outcome by quantifying risk and setting bank capital as risk buffers. /2

In the neoliberal era, the Basel/EU framework acquired a narrow microprudential focus: preventing excessive risk-taking. The framework pursues this outcome by quantifying risk and setting bank capital as risk buffers. /2

These rules have failed to keep up. Climate change creates risks due to changing temperatures and an accelerating transition – the risks are long-term, complex, interconnected, so difficult to measure. /4

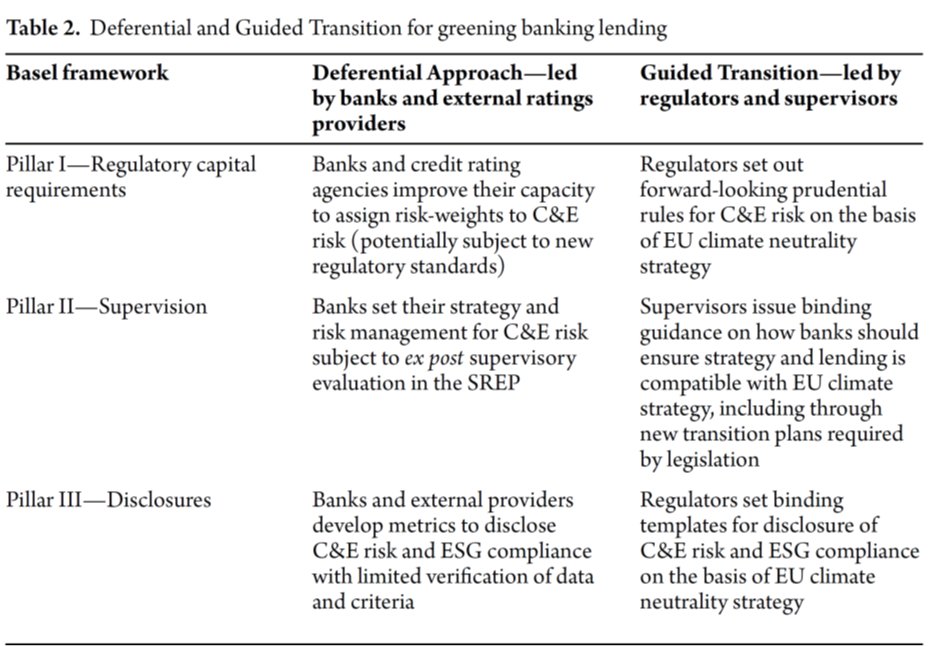

What should be the way forward? We sketch two scenarios: A business as usual “deferential” scenario asks firms to disclose and banks to model climate risks. We doubt that this strategy will work, it is a “risky bet” /5

We illustrate the problem with @shell’s EU 2050 strategy involving insane volumes of trees (a new forest the size of Romania) and as yet non-existent super technologies – with these assumptions banks can keep funding oil for decades to come. /6

The alternative we propose – a Guided Transition – sees supervisors take on radically new roles: setting out the future that banks should anticipate, in particular that of the EU’s climate agenda. /7

The Guided Transition breaks with the old regulatory paradigm. It acknowledges that banks are often unable and/or insufficiently incentivized to price risk. Prudential regulation must itself become political. /8

Instead of merely asking banks to estimate potential losses, policymakers should guide bank lending through a fine-grained account of how banks should invest. /9

As we also argue that, despite pervasive strategic ambiguity, a Guided Transition is already visible in major new policy initiatives: climate stress testing, taxonomy-aligned disclosure requirements, mandatory transition plans. /10

The major challenge we see now is to how to find adequate procedures. Financial policy that sets out the future that banks should anticipate will unavoidably become more political. This is the future, with it its own risks, for which we need to prepare. /end

Building on @ProfKAlexander @Smits1Rene @ArribaSellier @bencaldecott @NVJRobins1 @UliVolz @YannisDafermos @M_Nikolaidi @jryancollins @MonnetEric @Tam_Bayoumi @despresmorgan @Frank_vanlerven @RensvanTilburg @emacampiglio @deyris_j @RAN @JuliaSymon_ @Paorazio @lilitpopoyan

Huge joy to work on this with @apsmolenska. Special thanks also to the Expert Group “Draft ECB Guide on climate-related and environmental risks” @BJMbraun @clemfon @maxkrahe @KatharinaPistor V. Schreur I. Claeys J. Solana @ArribaSellier and @EBI_EU @JohnhoganMorris @smwrwsk

• • •

Missing some Tweet in this thread? You can try to

force a refresh