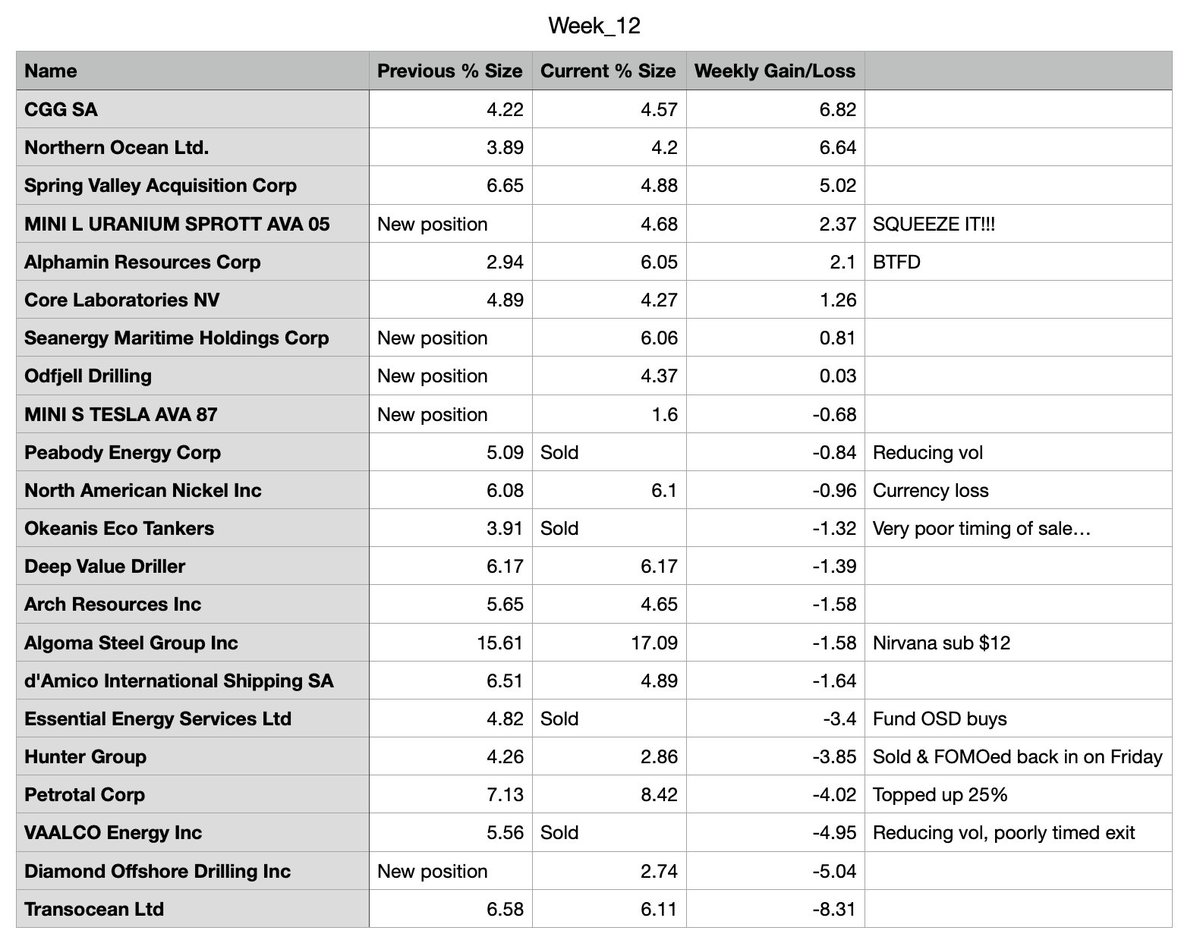

Time for another rather unexciting weekly update! Pretty much a repeat of last week, where my portfolio saw some weakness early on, yet managed to crawl back up & ended up flat regardless! Down around 0.5% points, current YTD is 82.5%!

https://twitter.com/Edark94/status/1510168314714148867

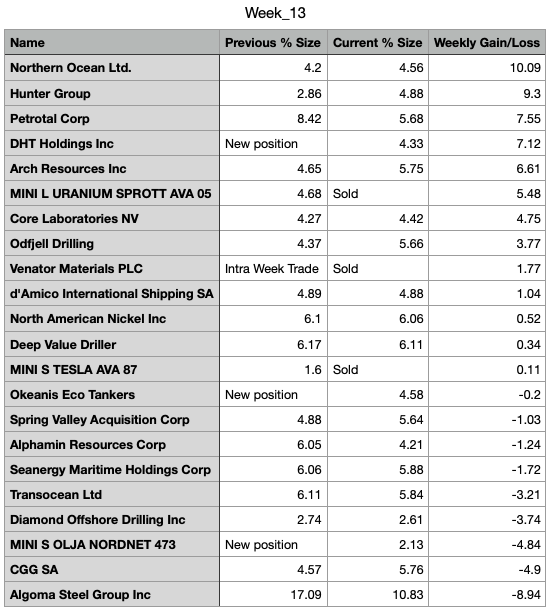

Current portfolio:

Sadly ASTL weighted down on performance this week & I had to make the tough choice to trim it down, so I could afford buying some #TANKERS!!! Added DHT & OET as VLCC rates finally have begun showing life again, looks VERY promising!

Sadly ASTL weighted down on performance this week & I had to make the tough choice to trim it down, so I could afford buying some #TANKERS!!! Added DHT & OET as VLCC rates finally have begun showing life again, looks VERY promising!

Comments: took profit from my SPUT longs a bit too early this week & added to SV longs instead, as I reduce leverage to minimize volatility in these wild times. So don't expect flashy moves from my portfolio, as I've intentionally tried to make it NOT do that!

That's also why I opened a phyz oil short to hedge my portfolio, as I'm just trying to not lose money at this point & waiting for Russia/Ukraine war, Iran deal, SPR release & China covid all to be behind us!

Nothing ever goes up in a straight line friends!!!

Nothing ever goes up in a straight line friends!!!

• • •

Missing some Tweet in this thread? You can try to

force a refresh