About -

Aarti Industries Ltd (AIL) is a leading Indian manufacturer of speciality chemicals & pharmaceuticals with global footprint. They manufacture chemicals used in downstream manufacturing of pharmaceuticals, agrochem, polymers, additives, surfactants, pigments & dyes.

Aarti Industries Ltd (AIL) is a leading Indian manufacturer of speciality chemicals & pharmaceuticals with global footprint. They manufacture chemicals used in downstream manufacturing of pharmaceuticals, agrochem, polymers, additives, surfactants, pigments & dyes.

Aarti's wide portfolio has made them a global partner of choice for various major global & domestic customers.

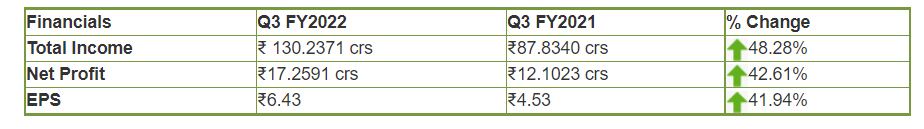

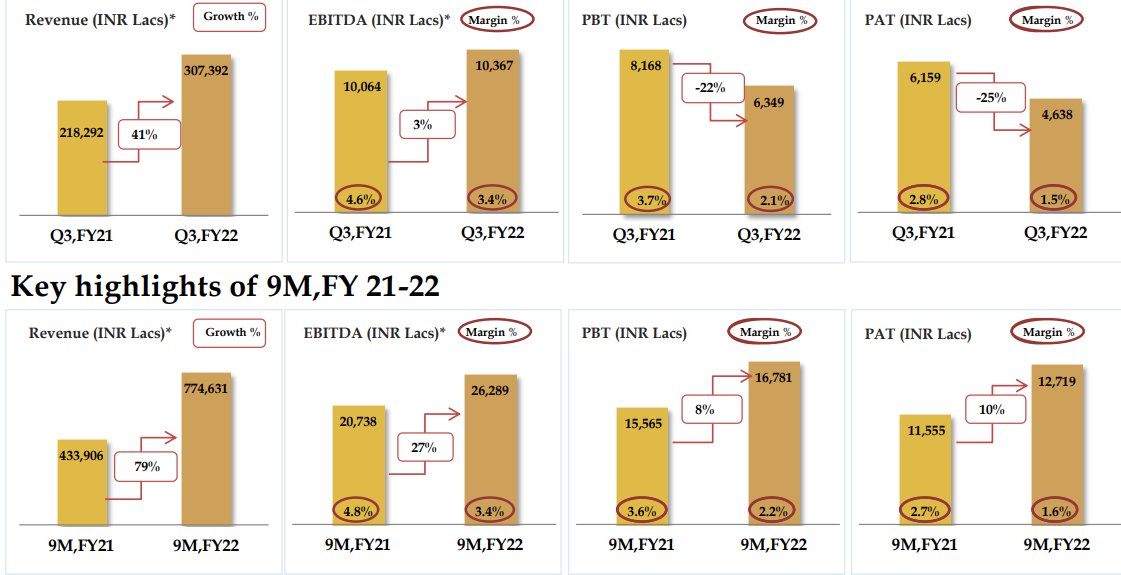

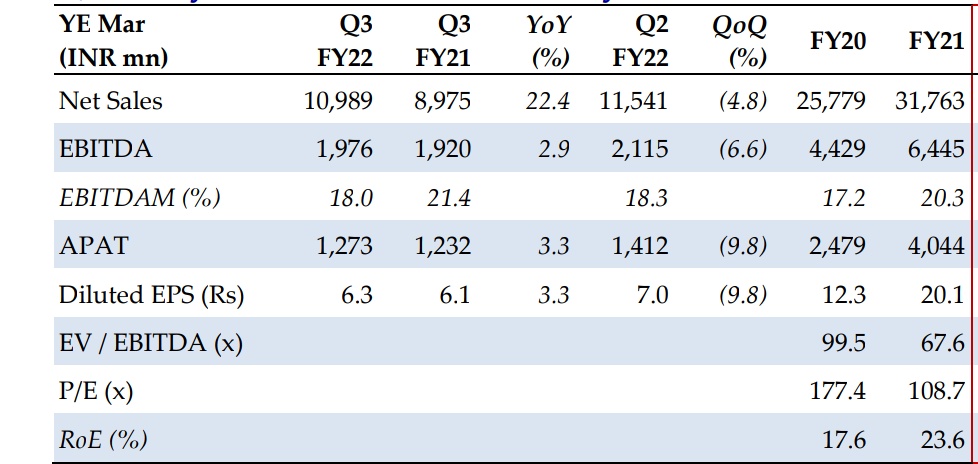

Financial Summary -

Q3 FY22 (YoY)

Revenue were at Rs.2376 Cr.⬆️100%

EBITDA at Rs.966 Cr.⬆️239%

PAT at Rs.772 Cr.⬆️368%

Q3 FY22 (YoY)

Revenue were at Rs.2376 Cr.⬆️100%

EBITDA at Rs.966 Cr.⬆️239%

PAT at Rs.772 Cr.⬆️368%

Revenue Breakup -

Aarti Industries earns 83% of it's revenue from Speciality Chemicals & rest 17% from Pharmaceuticals.

Aarti Industries earns 83% of it's revenue from Speciality Chemicals & rest 17% from Pharmaceuticals.

▪️Speciality Chemicals:

Aarti has integrated operations across the benzene, sulphur & toluene product chains, ranked among the top 3 players globally for the mfg. of Nitro Chloro Benzenes (NCB) & Di-chloro Benzenes (DCB).

Aarti has integrated operations across the benzene, sulphur & toluene product chains, ranked among the top 3 players globally for the mfg. of Nitro Chloro Benzenes (NCB) & Di-chloro Benzenes (DCB).

▪️Pharmaceuticals:

Aarti Industries expertise lies in mfg. APIs, Intermediates & Xanthene derivatives for pharmaceuticals, food & beverage industry. Their cost, quality leadership & backward integration for most APIs manufactured provides an edge over the peers.

Aarti Industries expertise lies in mfg. APIs, Intermediates & Xanthene derivatives for pharmaceuticals, food & beverage industry. Their cost, quality leadership & backward integration for most APIs manufactured provides an edge over the peers.

Industry Overview -

(Speciality Chemicals)

Indian Speciality Chem Industry would nearly double by 2025 driven by consumption

growth & export opportunity. The industry has grown at a CAGR of around 11% from 2014-19 is expected to grow at 12% CAGR in the next 5yrs.

(Speciality Chemicals)

Indian Speciality Chem Industry would nearly double by 2025 driven by consumption

growth & export opportunity. The industry has grown at a CAGR of around 11% from 2014-19 is expected to grow at 12% CAGR in the next 5yrs.

Moreover,

the production cost of Chinese chemical companies has also gone up due to increase in pollution control norms & this has

narrowed down the cost differential between Indian & Chinese companies to an extent.

the production cost of Chinese chemical companies has also gone up due to increase in pollution control norms & this has

narrowed down the cost differential between Indian & Chinese companies to an extent.

(Pharmaceuticals)

The Indian domestic pharmaceuticals

market is valued at $42 billion in 2021

and is likely to reach $65 billion by

2024 and to $120-130 billion by 2030.

The Indian domestic pharmaceuticals

market is valued at $42 billion in 2021

and is likely to reach $65 billion by

2024 and to $120-130 billion by 2030.

Globally, India ranks 3rd in terms of pharmaceutical production by volume.

The Indian Economic Survey 2021

estimates the domestic market to grow

3x in the next decade.

The Indian Economic Survey 2021

estimates the domestic market to grow

3x in the next decade.

Clientele -

Aarti Industries 200+ products

are sold to 700+ domestic & 400+ export customers in 60 countries across the globe.

Aarti Industries 200+ products

are sold to 700+ domestic & 400+ export customers in 60 countries across the globe.

Long Term Triggers -

• Key projects such as project of long term contracts, pharma expansion are

nearing the final stages which are expected to get commercialised in Q4FY22.

• Higher share of value added business portfolio to improve margin profile of

the business.

• Key projects such as project of long term contracts, pharma expansion are

nearing the final stages which are expected to get commercialised in Q4FY22.

• Higher share of value added business portfolio to improve margin profile of

the business.

• Management has reiterated its revenue guidance of 25-35% for FY22 with higher

capacity utilization, better product mix & improving throughput from recently commissioned facilities supporting the growth.

capacity utilization, better product mix & improving throughput from recently commissioned facilities supporting the growth.

Risks -

• Volatility in the raw material prices.

• Slowdown in end user

industries demand can effect growth.

• Any changes made by govt to control pollution.

• Currency fluctuations.

• Volatility in the raw material prices.

• Slowdown in end user

industries demand can effect growth.

• Any changes made by govt to control pollution.

• Currency fluctuations.

Conclusion -

Long term views are positive on Aarti Industries. The domestic & global market of both speciality chem and pharmaceuticals have huge potential to grow. As global companies look to diversify sourcing, the China +1 focus is set to be a major growth driver for the Co.

Long term views are positive on Aarti Industries. The domestic & global market of both speciality chem and pharmaceuticals have huge potential to grow. As global companies look to diversify sourcing, the China +1 focus is set to be a major growth driver for the Co.

Please 🙏 like 👍, comment & retweet ♻️ if you find this useful.

@DrdhimanBhatta1 @caniravkaria @shubhfin @Ankush__Agrawal @option_square @AshishZBiz @SumitResearch @deepdbhandari @HareshVithlani @sahneydeepak @AdeParimal @DhanValue

@DrdhimanBhatta1 @caniravkaria @shubhfin @Ankush__Agrawal @option_square @AshishZBiz @SumitResearch @deepdbhandari @HareshVithlani @sahneydeepak @AdeParimal @DhanValue

• • •

Missing some Tweet in this thread? You can try to

force a refresh