1/ Time to look at the main stablecoins, including people's favorite #UST which looks rather weak.

There is one undisputed winner, despite any criticism.

The reason? Adoption, liquidity, and volume.

The rest are kings in their niche. A thread 👇

#USDT #USDC #BUSD #DAI #UST

There is one undisputed winner, despite any criticism.

The reason? Adoption, liquidity, and volume.

The rest are kings in their niche. A thread 👇

#USDT #USDC #BUSD #DAI #UST

2/ Ranking by market cap is easy (see pic), but that barely says anything.

What is more important is volume and where this volume comes from!

Let's do a ranking by 7-day volume divided by mcap.

See next tweet for the results. 👇

What is more important is volume and where this volume comes from!

Let's do a ranking by 7-day volume divided by mcap.

See next tweet for the results. 👇

3/ WoW look at that #UST adoption... barely any. Even DAI looks better.

1. #USDT = 4.78 (392 bil volume / 82 bil mcap)

2. #BUSD = 1.59 (27 / 17)

3. #USDC = 0.58 (29 / 50)

4. #DAI = 0.28 (2.5 / 9)

5. #UST = 0.20 (3.4 / 17)

Clearly, USDT and BUSD are in their own class.

Why? 👇

1. #USDT = 4.78 (392 bil volume / 82 bil mcap)

2. #BUSD = 1.59 (27 / 17)

3. #USDC = 0.58 (29 / 50)

4. #DAI = 0.28 (2.5 / 9)

5. #UST = 0.20 (3.4 / 17)

Clearly, USDT and BUSD are in their own class.

Why? 👇

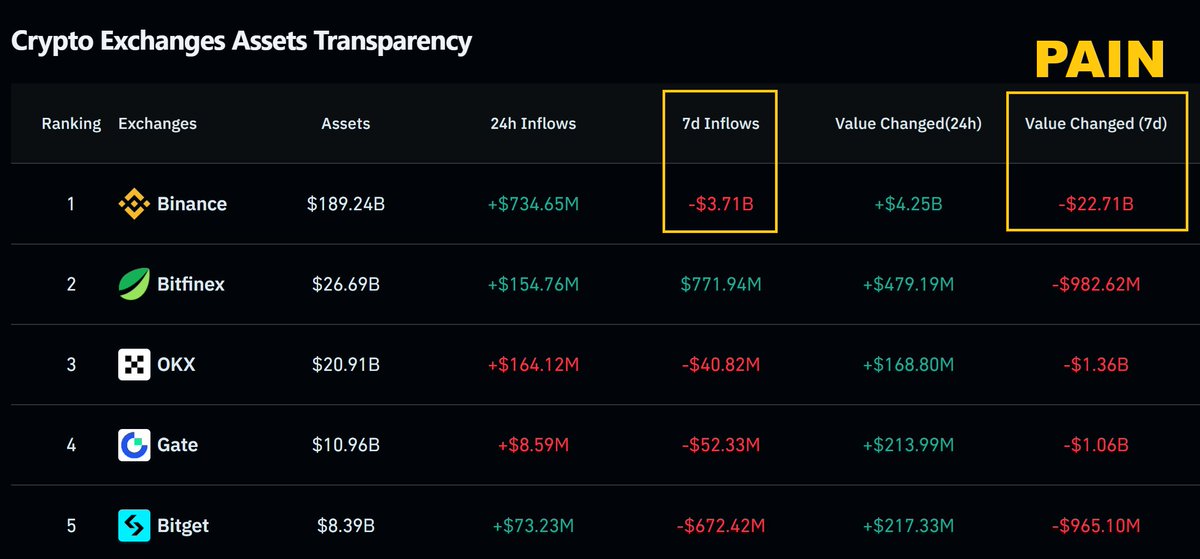

4/ Binance, the largest exchange in the world, drives most volume for USDT & BUSD (their own stable).

Binance listed UST. Yet, KuCoin drives more volume. Seems people are not that interested.

But what about... DeFI for UST?

As a decentralized stable volume is there right? 👇

Binance listed UST. Yet, KuCoin drives more volume. Seems people are not that interested.

But what about... DeFI for UST?

As a decentralized stable volume is there right? 👇

5/ The largest DEX on Terra pulls $100 mil volume per day on the Luna/UST pair (pic).

Not bad, yet DAI also pulls similar numbers across Uniswap (70 mil) + Curve where fees are much higher since they use the ETH network (pic).

Remember, DAI market cap is HALF of UST!

Huh? 👇

Not bad, yet DAI also pulls similar numbers across Uniswap (70 mil) + Curve where fees are much higher since they use the ETH network (pic).

Remember, DAI market cap is HALF of UST!

Huh? 👇

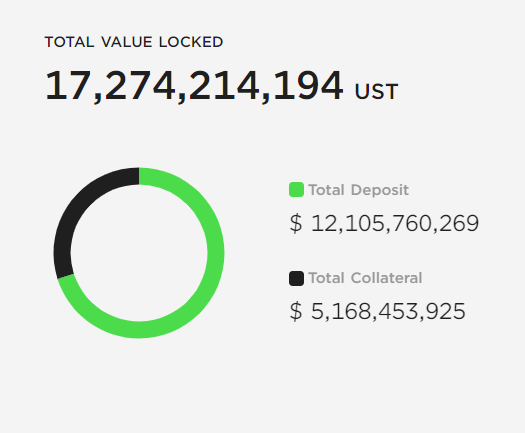

6/ Of the five stablescoins we have, UST is the weakest.

Its market cap (17 bil) is inflated and sits in Anchor doing nothing (over 70%).

In contrast, BUSD, with a similar mcap pulls over 3 bil in volume per day!

UST? 400 mil / day. But at least UST is decentralized, right? 👇

Its market cap (17 bil) is inflated and sits in Anchor doing nothing (over 70%).

In contrast, BUSD, with a similar mcap pulls over 3 bil in volume per day!

UST? 400 mil / day. But at least UST is decentralized, right? 👇

7/ Not when 12 bil in UST (out of 17 bil) sits in Anchor protocol. That is not decentralization, sorry.

UST = king in Terra ecosystem. But that's it.

So what is the alternative and who's the real winner here?

Let's look at DAI and work ourselves up to USDT. 👇

UST = king in Terra ecosystem. But that's it.

So what is the alternative and who's the real winner here?

Let's look at DAI and work ourselves up to USDT. 👇

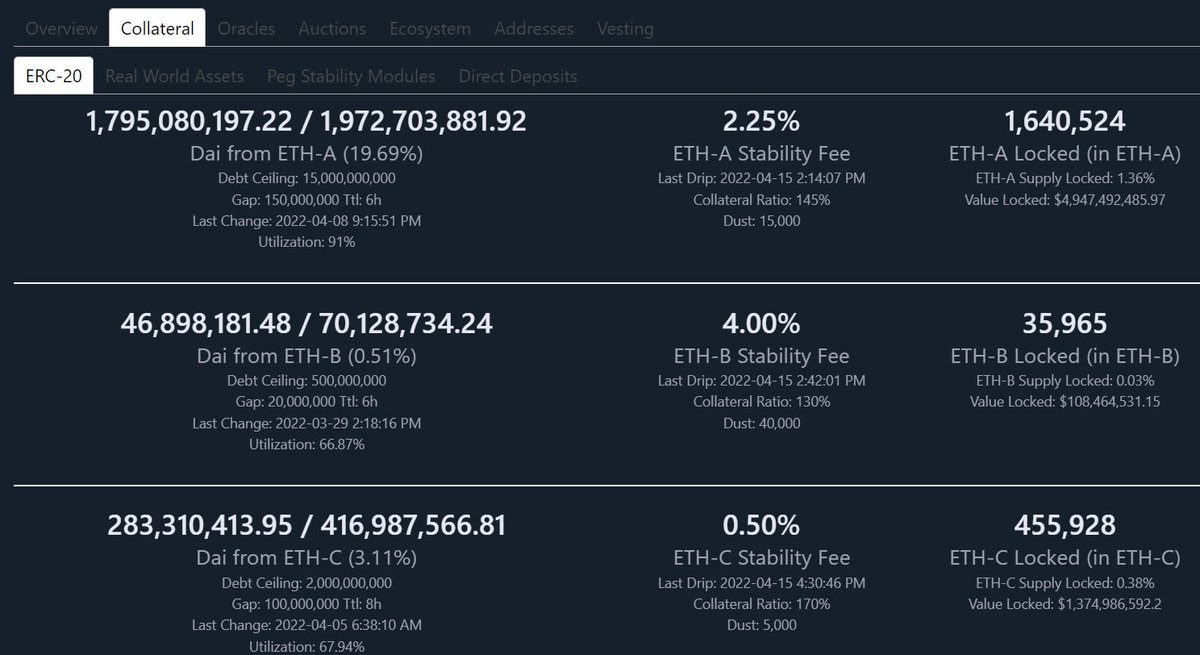

8/ #DAI is a decentralized and overcollateralized stablecoin (pic)

Most of its volume is from Binance + Coinbase + DEXes like Uniswap

A nice balance

Yet, it has two shortcomings: it can't scale easily (depends on borrow demand) + is capital inefficient (collateral needed). 👇

Most of its volume is from Binance + Coinbase + DEXes like Uniswap

A nice balance

Yet, it has two shortcomings: it can't scale easily (depends on borrow demand) + is capital inefficient (collateral needed). 👇

9/ But at least DAI is a sound & proven stablecoin that can back up its mcap with real collateral in times of need (pic).

You can't say that about UST! Got to be careful there.

DAI = king on DEXes as a decentralized stable

Now let's look at centralized stables. 👇

You can't say that about UST! Got to be careful there.

DAI = king on DEXes as a decentralized stable

Now let's look at centralized stables. 👇

10/ #BUSD is basically PAX Dollar (#USDP) with a different name. Binance used PAX to issue it.

It's centralized and 90% of the volume is on Binance.

BUSD = king on Binance, nowhere else

That is it. PAX is a proven name in crypto, so should be safe.

USDC next 👇

It's centralized and 90% of the volume is on Binance.

BUSD = king on Binance, nowhere else

That is it. PAX is a proven name in crypto, so should be safe.

USDC next 👇

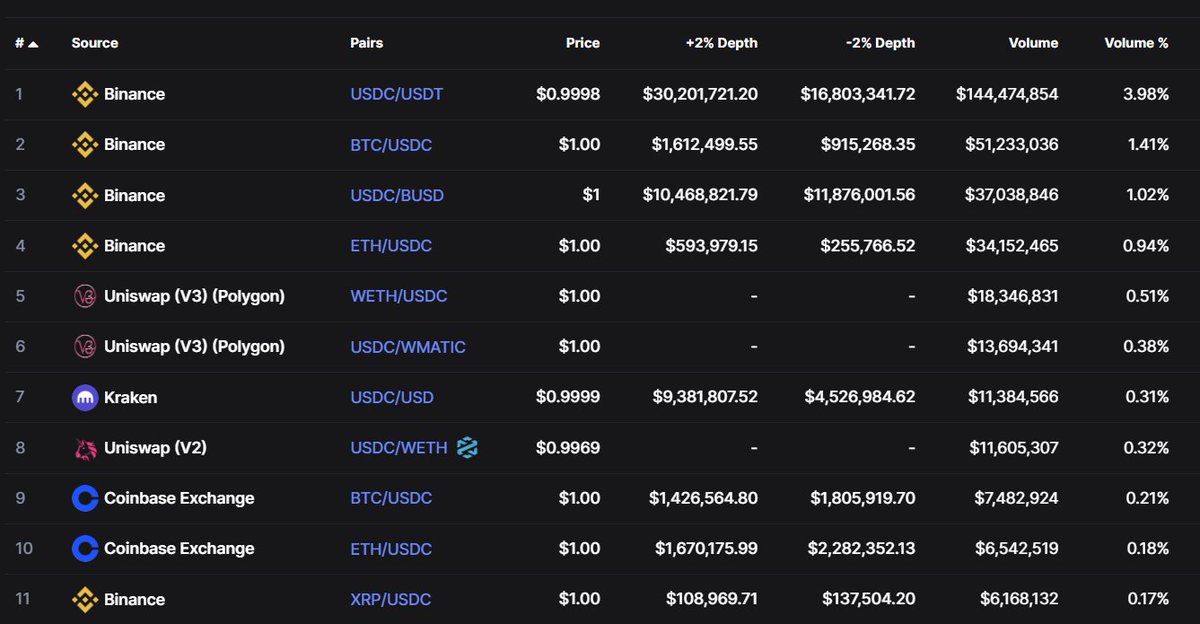

11/ #USDC is issued by Circle and most recently BlackRock announced they will manage USDC!

BlackRock is the largest asset manager in the world with $10 trillion in assets under management (AUM).

If there is a stablecoin challenging the top spot, this is it.

Can it flip USDT?

BlackRock is the largest asset manager in the world with $10 trillion in assets under management (AUM).

If there is a stablecoin challenging the top spot, this is it.

Can it flip USDT?

12/ It's only a matter of time. USDC is positioned to become the de-facto digital dollar.

Plus, USDC has massive adoption in DeFI (ironic as it may sound) and centralized exchanges.

See that pic? Uniswap DEX has 3 spots in top 10 for USDC, plus Binance and Coinbase.

But... 👇

Plus, USDC has massive adoption in DeFI (ironic as it may sound) and centralized exchanges.

See that pic? Uniswap DEX has 3 spots in top 10 for USDC, plus Binance and Coinbase.

But... 👇

13/ No matter how you look at USDC, it remains a centralized, censor-prone stablecoin.

This means your USDC in your own private wallet can be frozen = your address on the network can be blacklisted together with all your USDC.

So you go back to... DAI? Think twice 👇

This means your USDC in your own private wallet can be frozen = your address on the network can be blacklisted together with all your USDC.

So you go back to... DAI? Think twice 👇

14/ For decentralization maxis, DAI has too much exposure to USDC as backing.

Check the pic, 51% in DAI is backed by USDC.

However, you can now tell there is a 'special' synergy between USDC & DAI. Indeed.

They are the best stablecoins, centralized & decentralized.

Hmmm 👇

Check the pic, 51% in DAI is backed by USDC.

However, you can now tell there is a 'special' synergy between USDC & DAI. Indeed.

They are the best stablecoins, centralized & decentralized.

Hmmm 👇

15/ USDC is positioned to be the top stablecoin & its use cases will equally be applied in decentralized + traditional finance (DeFI/TradFI).

USDC at 50 bil will soon catch up on USDT at 82 bil which does not enjoy the same trust in DeFI.

USDC = king of stables

So USDT? 👇

USDC at 50 bil will soon catch up on USDT at 82 bil which does not enjoy the same trust in DeFI.

USDC = king of stables

So USDT? 👇

16/ #USDT continues to pull the highest volume + liquidity across centralized exchanges, but not on Coinbase (which focuses on USDC)

Nor will you see any DEXes using it

Clearly, USDT is on borrowed time as the top stablecoin

USDT = king on (some) centralized exchanges

Next 👇

Nor will you see any DEXes using it

Clearly, USDT is on borrowed time as the top stablecoin

USDT = king on (some) centralized exchanges

Next 👇

17/ Plus, Tether has major trust issues as it was very obtuse about its backing for USDT in the past

Audits are scarce and even so, people don't trust those numbers.

Why use USDT when you can use USDC?

There is only one place at the top & BlackRock is the top.

Tick, tock. 👇

Audits are scarce and even so, people don't trust those numbers.

Why use USDT when you can use USDC?

There is only one place at the top & BlackRock is the top.

Tick, tock. 👇

18/ If you liked this thread, #retweet the first post to get more of this content in the future! 😍

Stay in touch + follow @DU09BTC:

Discord: bit.ly/3n2gng0

TradingView: bit.ly/3FUjwHj

YouTube: bit.ly/3p8vPdf

Newsletter: bit.ly/3BuXf13

Stay in touch + follow @DU09BTC:

Discord: bit.ly/3n2gng0

TradingView: bit.ly/3FUjwHj

YouTube: bit.ly/3p8vPdf

Newsletter: bit.ly/3BuXf13

• • •

Missing some Tweet in this thread? You can try to

force a refresh