People R confused "Why trade $lkmex for $egld at such a bad rate!?" 😖⁉️

This is behavioral economics! 🧠

Cash is king. 👑 #egld

Don't believe me? 👇🤣 The mystery box = $lkmex and it's quite an uncanny example as to why $lkmex is being paper-handed.

youtube.com/shorts/fGlvB1g…

This is behavioral economics! 🧠

Cash is king. 👑 #egld

Don't believe me? 👇🤣 The mystery box = $lkmex and it's quite an uncanny example as to why $lkmex is being paper-handed.

youtube.com/shorts/fGlvB1g…

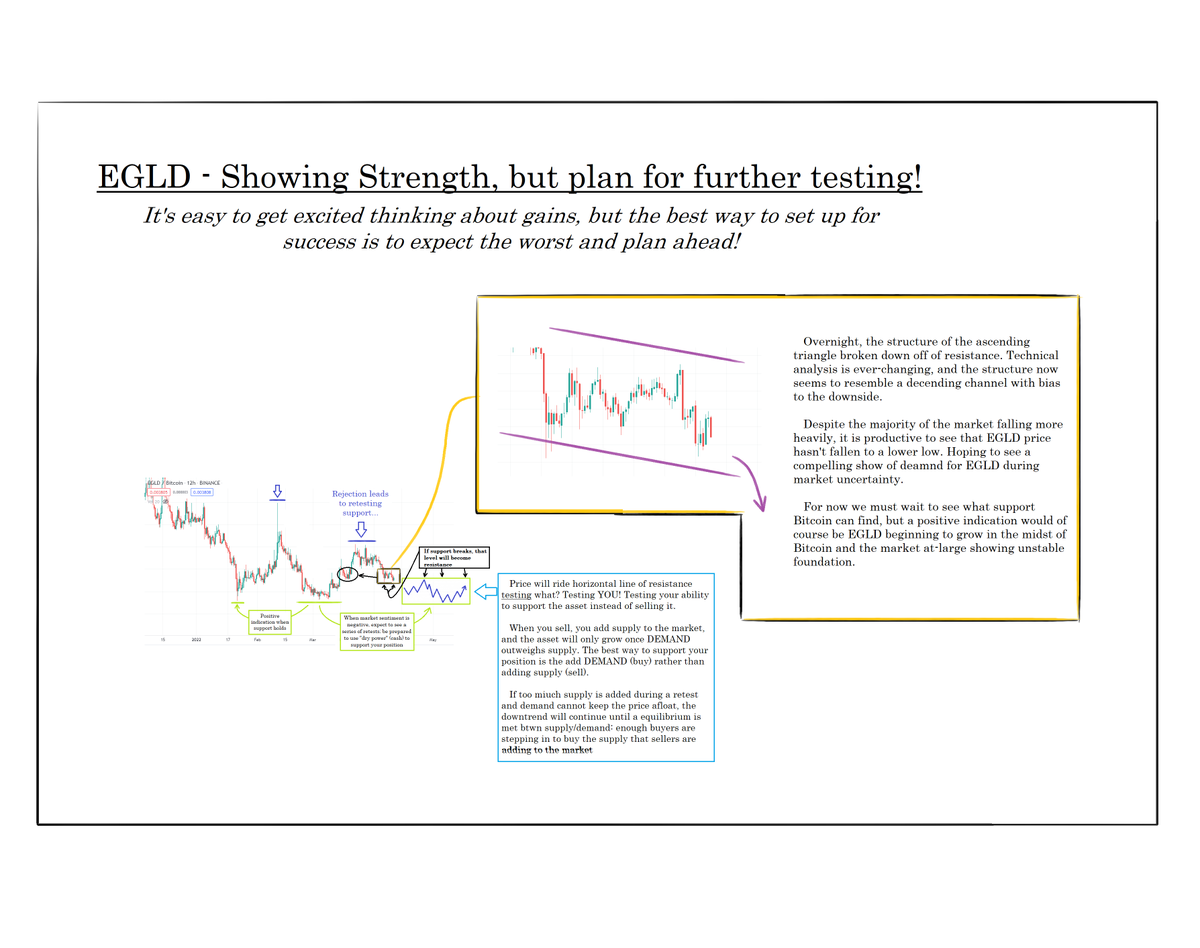

At this point it will take extreme demand for $lkmex to kill this uptrend in the EGLD/LKMEX chart via @LkmexExchange. People are trading $lkmex <> $egld like crazy and $egld is barely bullish. The exchange rate will only get worse, depending on which side of the trade you're on.

If you're not a trader, don't bother reading more because you're in for a shock...

Real-Life example:

28 days ago I traded ~11M $lkmex for 11 $egld...

Real-Life example:

28 days ago I traded ~11M $lkmex for 11 $egld...

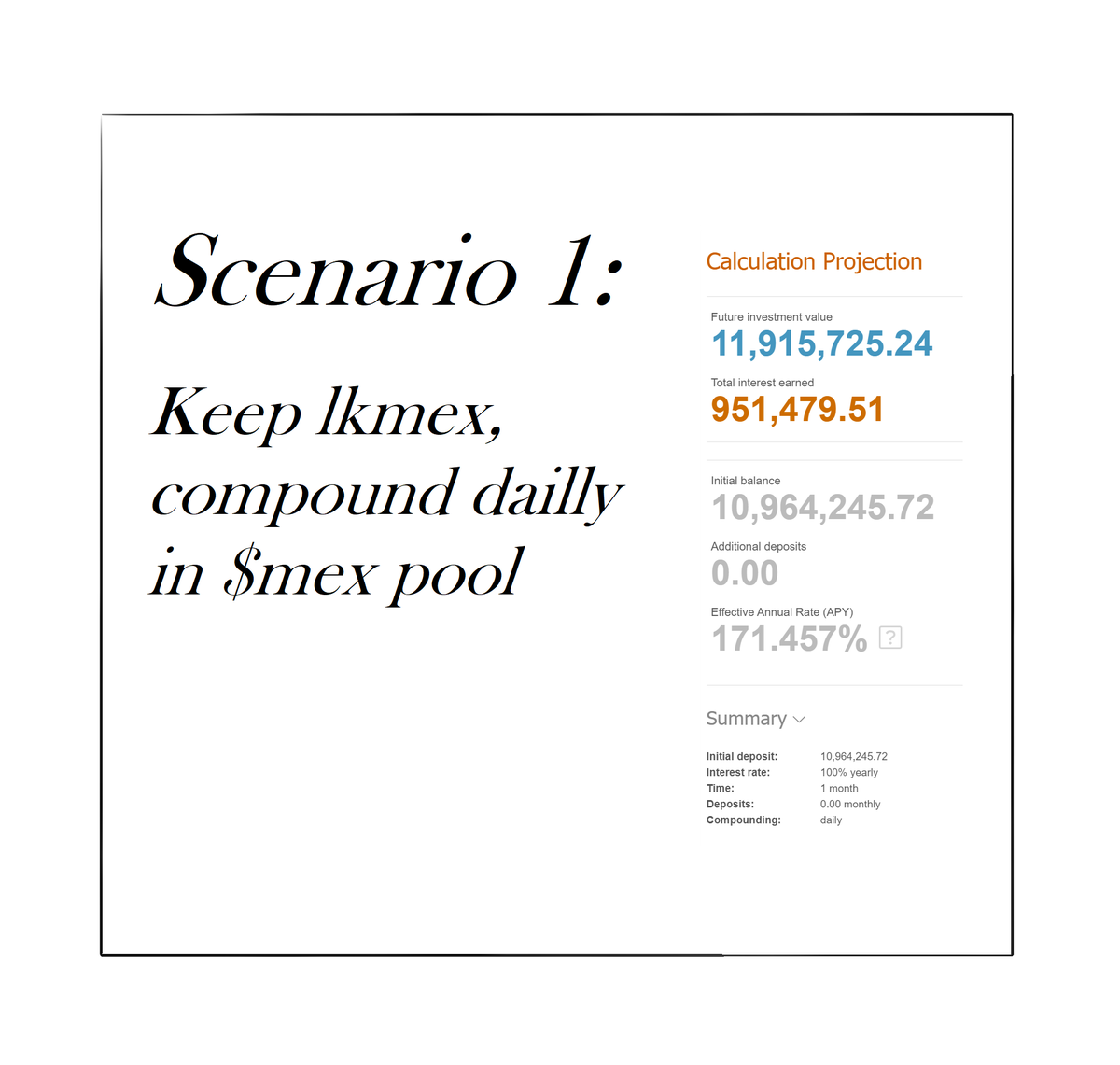

Scenario 1:

If I had only kept that ~11M $lkmex in the MEX pool earning 100% APR, that $lkmex would have earned me an addition 950k $lkmex with an APY of ~170%.

If I had only kept that ~11M $lkmex in the MEX pool earning 100% APR, that $lkmex would have earned me an addition 950k $lkmex with an APY of ~170%.

Scenario 2:

Instead, I utilized @LkmexExchange and traded my $lkmex "for a loss"...

Wake-up call! If I took those $egld and swapped them *back* to $lkmex, TODAY they would be worth over 19M $lkmex.

Scenario 1 end balance: 11.9M $lkmex vs.

Scenario 2 end balance: 19.2M $lkmex...

Instead, I utilized @LkmexExchange and traded my $lkmex "for a loss"...

Wake-up call! If I took those $egld and swapped them *back* to $lkmex, TODAY they would be worth over 19M $lkmex.

Scenario 1 end balance: 11.9M $lkmex vs.

Scenario 2 end balance: 19.2M $lkmex...

... That is a difference of exactly 7,337,805.76 ( 7.3 MILLION ) $lkmex that was generated by trading my $lkmex for $egld instead of just hodling and compounding. eek. 😬

Some might say that this is an unfair example because the exchange rate of $lkmex <> $egld is not as good as 30 days ago. You'd be right, but you're missing the point...

The idea I'm trying to convey is that traders are taking the value differential between $egld and $lkmex and they are capitalizing on it based on their expectation for $lkmex to continue to lose value against $egld.

You can hold and compound your $lkmex and hope that in 1 year your $lkmex paid-off well, OR you can swap your $lkmex "for a loss", which truly is a win-win in the eyes of a trader:

- Trade a locked asset ( $lkmex ) for liquidity ( $egld ) - cash is king = WIN ✅

- The liquidity you once traded "for a loss" appreciated 10, 20, 30%+ against the locked asset, so now you have liquidity AND the opportunity to trade BACK to $lkmex for 2X, 3X+ ✅

- The liquidity you once traded "for a loss" appreciated 10, 20, 30%+ against the locked asset, so now you have liquidity AND the opportunity to trade BACK to $lkmex for 2X, 3X+ ✅

So herein lies the issue: trading $lkmex for $egld not only reduces risk in the long term by putting liquidity in the investor's hands NOW, but it also hedges against $lkmex promise of "first class citizenship".

The objective of this post is NOT to convince YOU to swap your $lkmex for $egld. My posts are always NFA.

The objective of this post is to SHOW people one reason why it might be worth the "bad exchange rate" to swap your $lkmex for $egld.

The objective of this post is to SHOW people one reason why it might be worth the "bad exchange rate" to swap your $lkmex for $egld.

As much as I want $lkmex to succeed and perform well, I lost my faith in the team as I explain in this post. I trusted the team, but their actions during DEX launch led me to deny taking things at face value anymore.

https://twitter.com/the_economystic/status/1514660718653546517?s=20&t=Tvc70V_lVBrT_c-BlnszvA

As much as I wish to promise that $lkmex and $mex might be worth it in one year OR in the 1-5 year time horizon, $EGLD is the scarce Layer-1 asset with unprecedented use-case and value. $egld is the base-layer for all other value to grow. elrond.com/blog/egold-a-p…

• • •

Missing some Tweet in this thread? You can try to

force a refresh