About -

Tata Elxsi is amongst the world’s leading providers of design & technology services for product engineering & solutions across industries including Broadcast, Communications & Automotive sectors. The co provides product design & engineering services & systems

Tata Elxsi is amongst the world’s leading providers of design & technology services for product engineering & solutions across industries including Broadcast, Communications & Automotive sectors. The co provides product design & engineering services & systems

integration & support services in India, the US, Europe, & Rest of the World. The co also provides solutions & services for emerging technologies such as Internet of Things (IoT), big data analytics, cloud, mobility, virtual reality & artificial intelligence.

Financial Summary -

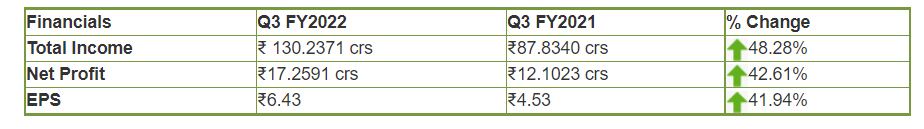

Q3FY22 (YoY)

Revenue at Rs 642cr ⬆️30%

PAT at Rs 151cr ⬆️43%

EPS at Rs 24.2⬆️ 44%

Q3FY22 (YoY)

Revenue at Rs 642cr ⬆️30%

PAT at Rs 151cr ⬆️43%

EPS at Rs 24.2⬆️ 44%

▪️ New collaborations to offer new opportunities:

Tata Elxsi has successfully collaborated with top auto sector players to develop sector-specific products & tools for OEMs & automotive suppliers. Co has collaborated with Hyundai Mobis to develop tools for accelerate

Tata Elxsi has successfully collaborated with top auto sector players to develop sector-specific products & tools for OEMs & automotive suppliers. Co has collaborated with Hyundai Mobis to develop tools for accelerate

testing of autonomous cars. It licenced the AUTOSAR adaptive platform to Great Wall Motors, China’s largest SUV manufacturer. Co has also partnered with Android & Blackberry for IP solutions with the help of this partnership; now co is one-stop shop for automotive solutions.

Co's in-house concept demonstrator vehicle has been developed using AEye’s iDAR™ platform & Tata Elxsi’s autonomous stack. iDAR is the first fully software-definable smart sensor that supports dynamic ROI & cueing of sensors, improving the reliability of detection.

▪️ Media & Communication is the new avenue for growth:

Co has made significant in-roads in the Media & Communication sector, which offers the company an attractive growth opportunity. The company develops the technology platform for FTH & DTH and OTT service providers in order

Co has made significant in-roads in the Media & Communication sector, which offers the company an attractive growth opportunity. The company develops the technology platform for FTH & DTH and OTT service providers in order

to improve the viewing experience for their customers. The company has tie-ups with different players such as OEMs, Digital Content Providers (DCPs), Software Vendors for addressing their needs to digitally connect consumers using DTH, IPTVs (Internet Protocol TVs),

& OTA (Over-the-Air) technology.

▪️ 5G - the new era of growth:

IHS has forecasted that the 5G market will grow to $19.3 bn by 2022 from $758.8 mn in 2018, at a CAGR of 124.6%. The market for 5G phones is likely to be quite small initially since large players like Samsung,

▪️ 5G - the new era of growth:

IHS has forecasted that the 5G market will grow to $19.3 bn by 2022 from $758.8 mn in 2018, at a CAGR of 124.6%. The market for 5G phones is likely to be quite small initially since large players like Samsung,

Oneplus, Huawei and LG have recently launched their flagship phones with 5G technology.5G will be the connective tissue for the Internet of Things (IoT), autonomous vehicles, and mobile media.

▪️ Growth potential in healthcare business:

Typically, healthcare business contracts are long-term businesses with 1-3 year contracts having healthy total contract value (TCV). Currently, the US & Europe are driving robust growth in the healthcare segment. Margins too are better

Typically, healthcare business contracts are long-term businesses with 1-3 year contracts having healthy total contract value (TCV). Currently, the US & Europe are driving robust growth in the healthcare segment. Margins too are better

in this segment as compared to transportation and media & communication verticals. Though the healthcare business vertical is small in size currently, it offers tremendous opportunities going forward.

▪️ Growth in Automotive Vertical:

The automobile industry has witnessed several incredible technological advances over the last century. Right from the arrival of engines that used fossil fuels to power transportation, the impact of technology in shaping the automobiles over the

The automobile industry has witnessed several incredible technological advances over the last century. Right from the arrival of engines that used fossil fuels to power transportation, the impact of technology in shaping the automobiles over the

course has been enormous. Some of the greatest minds in the tech industry have joined forces with automotive companies in order to improve the way vehicles operate.

AI & machine learning play an important role in the future of the automotive industry as predictive capabilities

AI & machine learning play an important role in the future of the automotive industry as predictive capabilities

are becoming more prevalent in cars. Manufacturers are applying algorithms that use data to automate the process of setting up a vehicle, including infotainment system & its application preferences. Vehicles are becoming IoT devices which can connect to smartphones & take voice

commands, changing the user interface. The rise of self-driving vehicles and the potential of CaaS as a mobility service will save consumers greatly, while also increasing their safety.

▪️ Growth in Media & Broadcasting Industry:

Media broadcasting industry finds application in areas such as Broadcaster, Studios and Creators, Distributors, OTT, IPTV, among others. With the penetration of high-speed internet, smart devices & content flooding in the market,

Media broadcasting industry finds application in areas such as Broadcaster, Studios and Creators, Distributors, OTT, IPTV, among others. With the penetration of high-speed internet, smart devices & content flooding in the market,

the borders between entertainment, media, and telecommunications have dissolved. New services such as smart, connected homes & OTT are creating new revenue opportunities for operators and broadcasters.

▪️ Growth in Healthcare verticle:

Healthcare industry is also witnessing a new wave of AI-fuelled technology innovation, primarily due to the advancements in computing infrastructure & deep learning architectures, delivering reliable performance comparable to human experts.

Healthcare industry is also witnessing a new wave of AI-fuelled technology innovation, primarily due to the advancements in computing infrastructure & deep learning architectures, delivering reliable performance comparable to human experts.

The advancements in AI technologies have led the industry to explore AI for improving their internal processes, as well as adding value to their customer-facing products. This has resulted in an increase in the development of AI-based Software as a Medical Device (SaMD).

Key Risks:

▪️ Slowdown in the global economy & in the automotive industry might affect growth momentum.

▪️ Currency risks, geopolitical issues between countries can affect the revenues of the company.

▪️ Deferment of deals & slower addition of clients may impact the business.

▪️ Slowdown in the global economy & in the automotive industry might affect growth momentum.

▪️ Currency risks, geopolitical issues between countries can affect the revenues of the company.

▪️ Deferment of deals & slower addition of clients may impact the business.

Conclusion:

Tata Elxsi provides design & technology services for product engineering & solutions across industries including Broadcast, Communications & Automotive. Co has developed good presence in the Media & Communication space.

Tata Elxsi provides design & technology services for product engineering & solutions across industries including Broadcast, Communications & Automotive. Co has developed good presence in the Media & Communication space.

FTH & 5G have opened up new opportunities for service providers like Tata Elxsi. We also expect a revival in the auto sector which will lead to higher growth for Tata Elxsi going forward.

Please 🙏 like 👍, comment & retweet ♻️ if you find this useful.

@DrdhimanBhatta1 @caniravkaria @shubhfin @kuttrapali26 @DhanValue

@DrdhimanBhatta1 @caniravkaria @shubhfin @kuttrapali26 @DhanValue

• • •

Missing some Tweet in this thread? You can try to

force a refresh