1) I've been asked about -ve growth

This is particularly relevant to GPs, but can apply to all

Previously shared a quick calc showing impact of CPI and potential for -ve growth👇

grid.is/@gdcuk/impact-…

This short thread explains the maths behind it

@nick_grundy

This is particularly relevant to GPs, but can apply to all

Previously shared a quick calc showing impact of CPI and potential for -ve growth👇

grid.is/@gdcuk/impact-…

This short thread explains the maths behind it

@nick_grundy

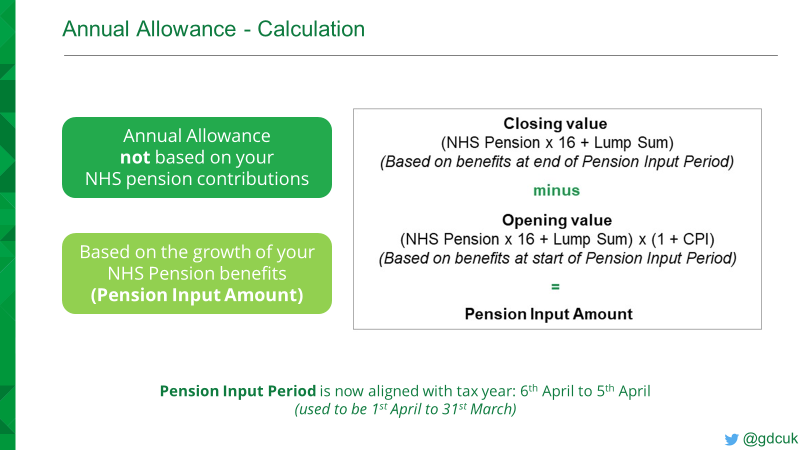

2) Quick reminder that Annual Allowance in #NHSpension is NOT based on contributions

AA is based on the growth of your NHS pension benefits over the tax year, called Pension Input Period

Calculation method👇

Important bit, you get an adjustment to Opening Value for inflation

AA is based on the growth of your NHS pension benefits over the tax year, called Pension Input Period

Calculation method👇

Important bit, you get an adjustment to Opening Value for inflation

3) If the CPI rate from the September BEFORE the tax year starts is particularly high, then the Opening Value can be higher than the Closing Value, which results in a negative growth figure🤯

Growth is then set to zero and can't be offset against 2015 scheme or previous years👇

Growth is then set to zero and can't be offset against 2015 scheme or previous years👇

4) Here's where it goes wrong

AA calcs use Sept CPI rate BEFORE the tax year starts

Increases in NHS pension benefits, to account for inflation, use Sept CPI rate AFTER the tax year starts

This CPI disconnect means you can be liable for AA charges just because of inflation🤦

AA calcs use Sept CPI rate BEFORE the tax year starts

Increases in NHS pension benefits, to account for inflation, use Sept CPI rate AFTER the tax year starts

This CPI disconnect means you can be liable for AA charges just because of inflation🤦

5) For example, you can see AA exceeded by £20,489, giving rise to a tax charge of £8,196

Next year, growth is -£22,100, so it seems logical to think you should be able to cover the previous year's excess?

Sadly not, you're stuck with the old tax bill

Next year, growth is -£22,100, so it seems logical to think you should be able to cover the previous year's excess?

Sadly not, you're stuck with the old tax bill

6) I'm quite certain they didn't realise the impact of this, or understand the interplay between public sector pension schemes and annual allowance calculations, when the legislation was created

This is yet another reason why the NHS Pension and Pension taxation needs reform

This is yet another reason why the NHS Pension and Pension taxation needs reform

• • •

Missing some Tweet in this thread? You can try to

force a refresh