About -

Rupa is one of the leading Knitwear brands in India. They cover the entire range of knitted garments from comfort innerwear to cool casual wear. It all started as a dream of three farsighted visionary men who changed the face of the hosiery business in India.

Rupa is one of the leading Knitwear brands in India. They cover the entire range of knitted garments from comfort innerwear to cool casual wear. It all started as a dream of three farsighted visionary men who changed the face of the hosiery business in India.

Today, Rupa has evolved to become the frontrunner in the innerwear & outerwear business in India and also a leading brand in global markets with millions of satisfied customers.

Financial Summary -

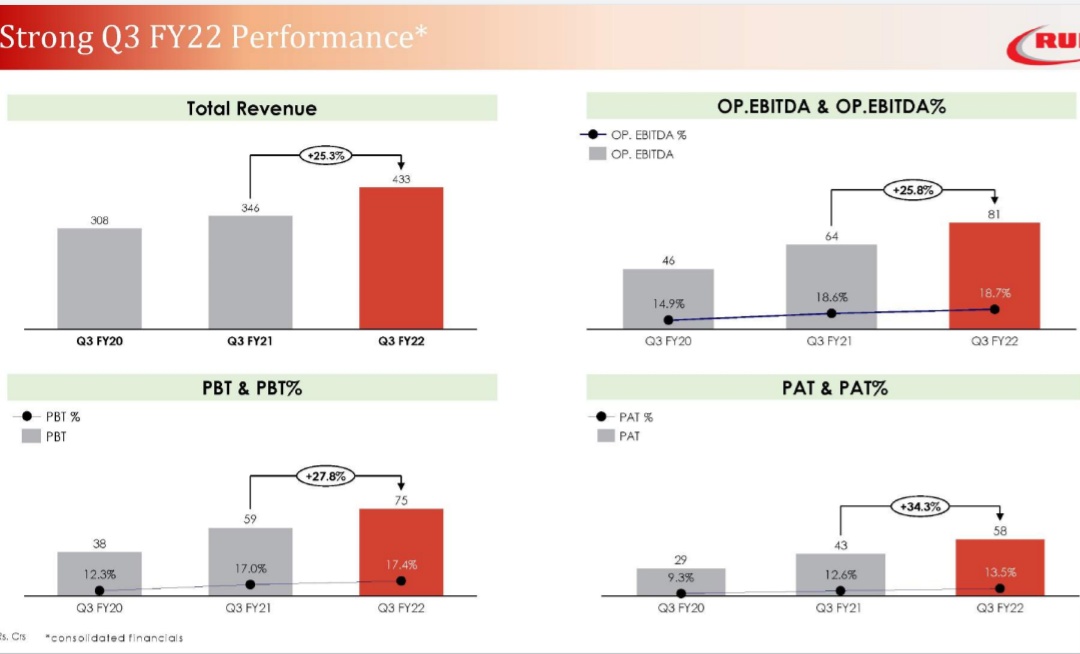

Q3 FY22 (YoY)

Revenue were at ₹433 Cr ⬆️25%

EBITDA at ₹81 Cr ⬆️ 26%

PAT at ₹58 Cr ⬆️ 34%

Q3 FY22 (YoY)

Revenue were at ₹433 Cr ⬆️25%

EBITDA at ₹81 Cr ⬆️ 26%

PAT at ₹58 Cr ⬆️ 34%

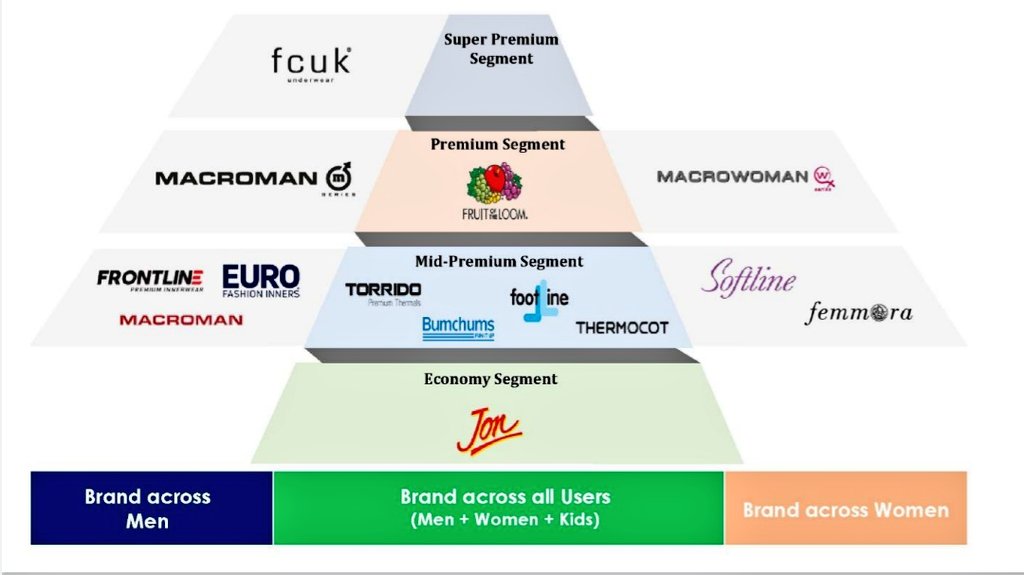

Acquired exclusive license from "FCUK" & "Fruit of the

Loom", to develop, manufacture, market & sale for

innerwear products of the respective brands in India.

Loom", to develop, manufacture, market & sale for

innerwear products of the respective brands in India.

Indian innerwear industry -

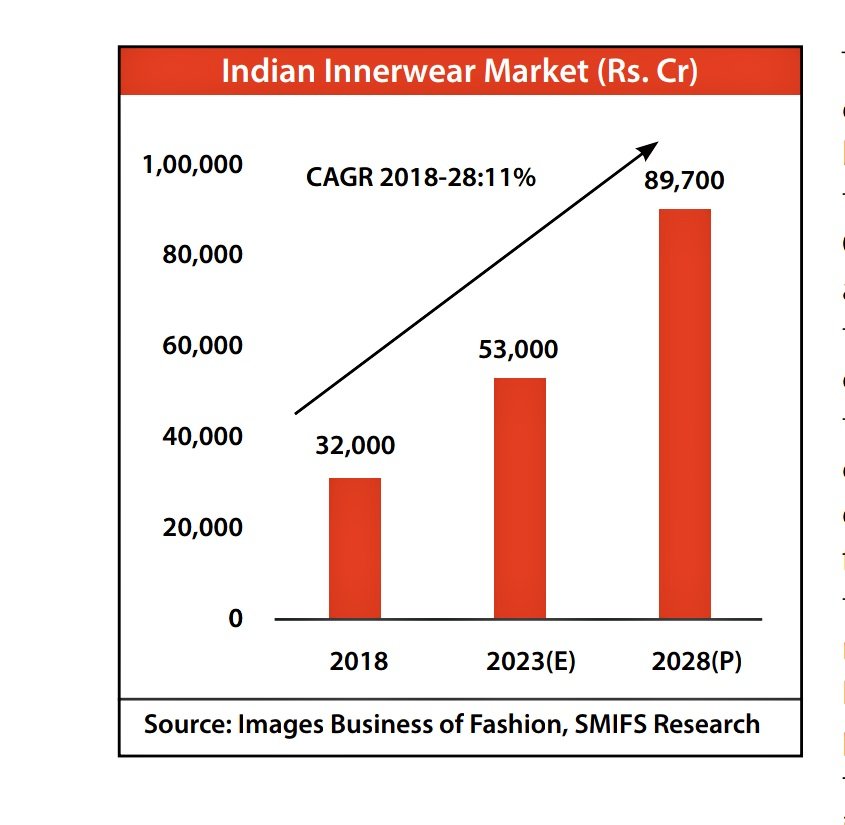

🇮🇳 Innerwear Market was valued at ₹320 billion in 2018 & expected to grow at 11% CAGR over the

next decade to reach ₹897 billion by 2028E. In the past, innerwear was depicted as a mere essential ‘commodity’ but now it turned into fashion statement.

🇮🇳 Innerwear Market was valued at ₹320 billion in 2018 & expected to grow at 11% CAGR over the

next decade to reach ₹897 billion by 2028E. In the past, innerwear was depicted as a mere essential ‘commodity’ but now it turned into fashion statement.

Men Innerwear Market was valued at ₹110 billion in 2018 is expected to grow at a CAGR of 7% over the next

decade to reach ₹218 billion by 2028.

Women Innerwear Market was valued at ₹210 billion in 2018 & expected to growth at 13% to reach ₹680 billion by 2028.

decade to reach ₹218 billion by 2028.

Women Innerwear Market was valued at ₹210 billion in 2018 & expected to growth at 13% to reach ₹680 billion by 2028.

Growth Triggers -

• Aim to increase share in premium & super premium category.

• Company is looking to increase revenue share in leggings segment which currently 20-25% of women’s wear revenue.

• Aim to increase share in premium & super premium category.

• Company is looking to increase revenue share in leggings segment which currently 20-25% of women’s wear revenue.

• Enhance brand visibility through increasing online presence through ‘Rupa online store’ & other e-players like Amazon, Flipkart & Myntra.

• Focus to double exports and tap new geographies in the next 2yrs.

• Focus to double exports and tap new geographies in the next 2yrs.

• Moving from wholesale distrioution

channel to direct for some products.

• Plan to cross ₹200 Cr of Thermal wear revenue in next 2yrs.

channel to direct for some products.

• Plan to cross ₹200 Cr of Thermal wear revenue in next 2yrs.

Risks -

• Significant increase in raw

material cost can negatively impacted

the margins.

• Inability to consistently expand.

• Changing consumer behavior.

• Emerging multi-national brands & their entry to the Indian market.

• Significant increase in raw

material cost can negatively impacted

the margins.

• Inability to consistently expand.

• Changing consumer behavior.

• Emerging multi-national brands & their entry to the Indian market.

Conclusion -

Going ahead, Rupa to report healthy revenue with margins likely to remain stable. Improving working capital cycle, asset light model augur well for strong balance sheet position

& with RoCE of 25%+, the re-rating looks certain.

Going ahead, Rupa to report healthy revenue with margins likely to remain stable. Improving working capital cycle, asset light model augur well for strong balance sheet position

& with RoCE of 25%+, the re-rating looks certain.

Please 🙏 like 👍, comment & retweet ♻️ if you find this useful.

@caniravkaria @DrdhimanBhatta1 @shubhfin @nid_rockz

@caniravkaria @DrdhimanBhatta1 @shubhfin @nid_rockz

• • •

Missing some Tweet in this thread? You can try to

force a refresh